In the digital age, with screens dominating our lives and the appeal of physical printed objects hasn't waned. If it's to aid in education or creative projects, or simply to add the personal touch to your area, Income Tax Deduction Under Section 80c 80ccc 80ccd can be an excellent resource. With this guide, you'll take a dive through the vast world of "Income Tax Deduction Under Section 80c 80ccc 80ccd," exploring what they are, how to find them, and ways they can help you improve many aspects of your life.

Get Latest Income Tax Deduction Under Section 80c 80ccc 80ccd Below

Income Tax Deduction Under Section 80c 80ccc 80ccd

Income Tax Deduction Under Section 80c 80ccc 80ccd -

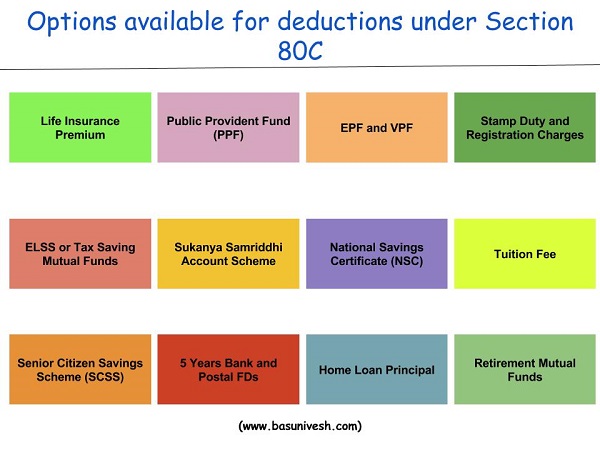

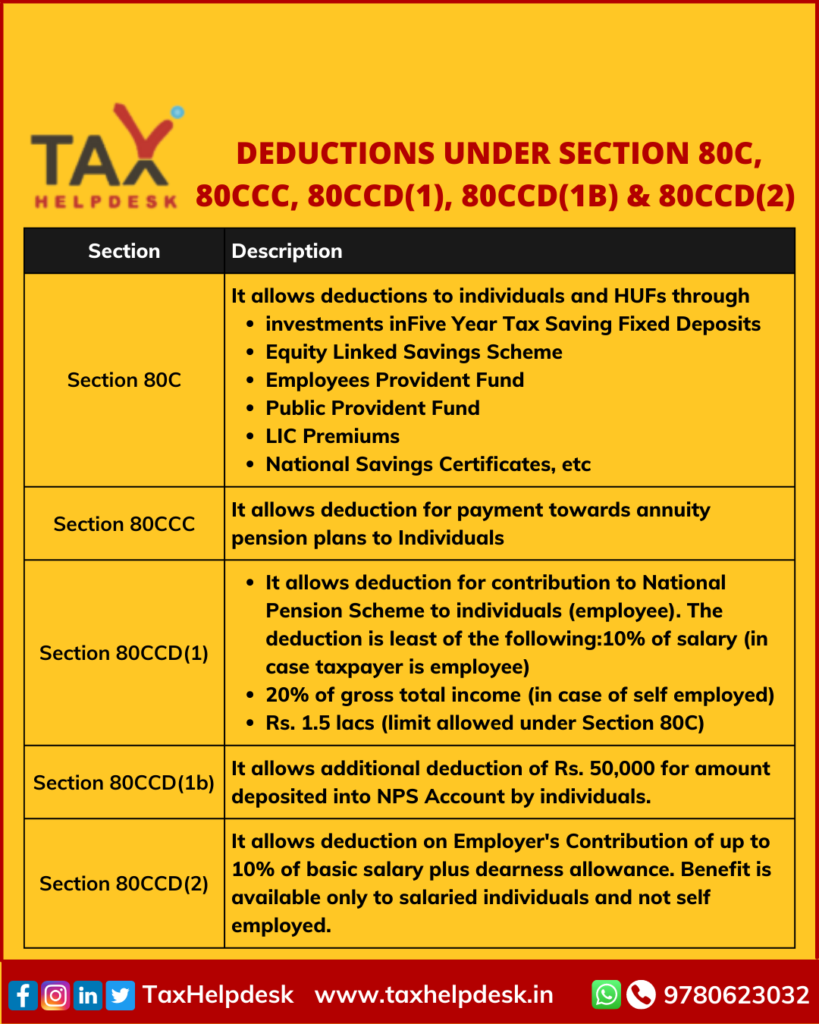

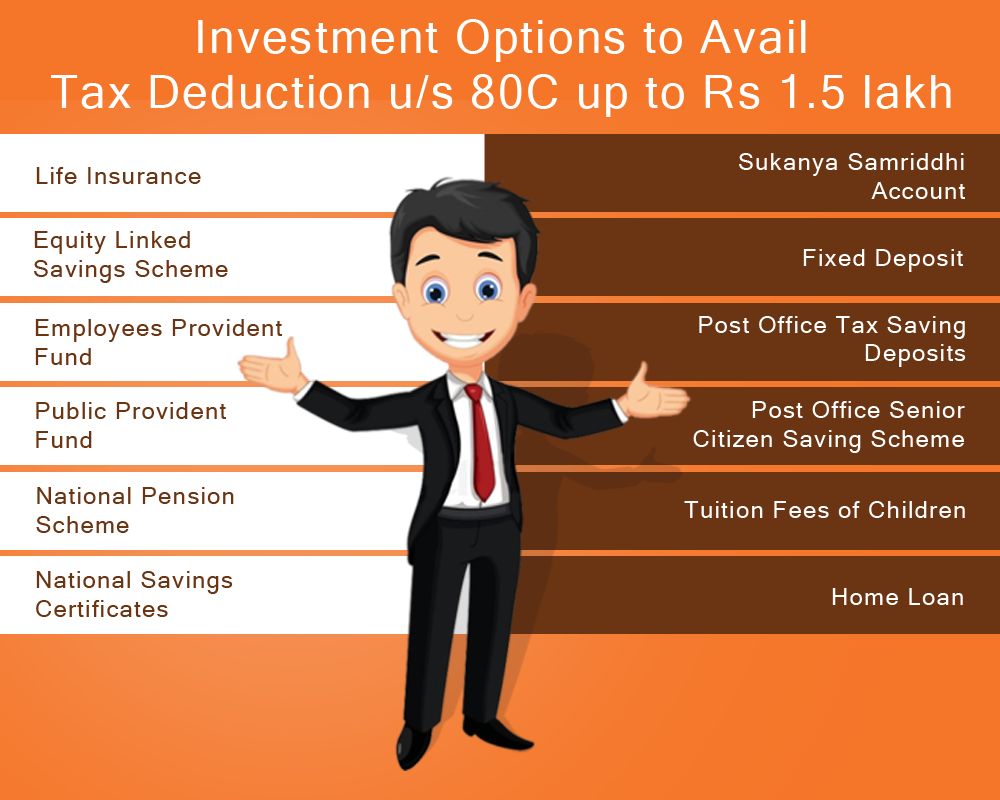

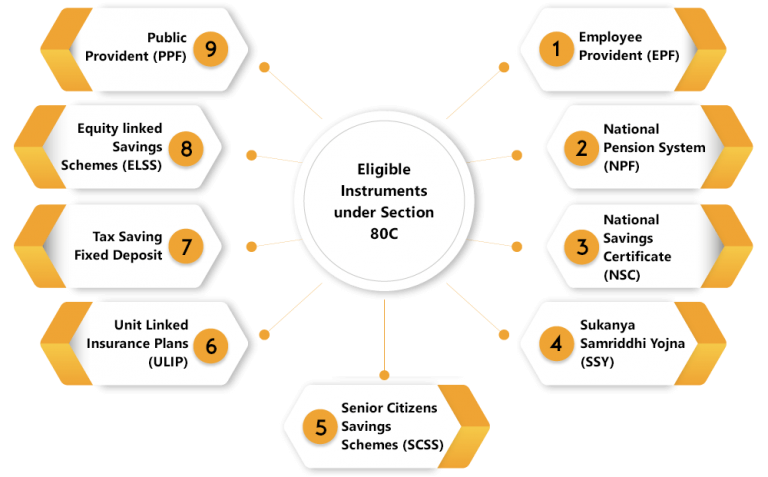

Section 80C provides tax deductions for individuals and Hindu Undivided Families HUFs through certain investments and expenses The maximum deduction is Rs 1 5 lakh per year Companies partnership firms and LLPs cannot use this deduction

Deduction under Section 80CCD According to this section deduction is available to individuals for contributions made to the National Pension Scheme NPS or The Atal Pension Yojna APY Mandatory to Central Government Employees Theses section has

Income Tax Deduction Under Section 80c 80ccc 80ccd cover a large assortment of printable material that is available online at no cost. The resources are offered in a variety designs, including worksheets templates, coloring pages, and more. The appeal of printables for free is in their versatility and accessibility.

More of Income Tax Deduction Under Section 80c 80ccc 80ccd

Deduction Under Section 80C Its Allied Sections

Deduction Under Section 80C Its Allied Sections

Section 80CCD allows deductions for contributions to the National Pension Scheme NPS or Atal Pension Yojana Understanding these 80C subsections can help taxpayers make informed

The maximum deduction under Section 80C is capped at INR 1 50 000 which also includes contributions under Sections 80CCC and 80CCD 1 However deductions under Section 80CCD 1B and 80CCD 2 for contributions to the National Pension Scheme NPS can be claimed over and above the INR 1 5 lakh limit

Income Tax Deduction Under Section 80c 80ccc 80ccd have garnered immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or costly software.

-

Flexible: The Customization feature lets you tailor the design to meet your needs such as designing invitations to organize your schedule or even decorating your home.

-

Educational Value Printables for education that are free provide for students of all ages. This makes the perfect source for educators and parents.

-

Simple: The instant accessibility to numerous designs and templates helps save time and effort.

Where to Find more Income Tax Deduction Under Section 80c 80ccc 80ccd

Section 80C 80CCC 80CCD And 80D Deduction Complete Guide

Section 80C 80CCC 80CCD And 80D Deduction Complete Guide

Section 80CCC of the Income Tax Act of 1961 is part of the larger 80C category which offers a cumulative tax deduction of up to Rs 1 5 lakh per year for investments in PPF EPF VPF life insurance recognized pension funds and other similar vehicles

What is Section 80C and its sub sections Get a complete guide on Income Tax deduction under sections 80C 80CCC 80CCD Learn how to take advantage of tax deductions under Income Tax Act 1961

If we've already piqued your interest in printables for free Let's look into where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of objectives.

- Explore categories like the home, decor, organization, and crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing including flashcards, learning tools.

- Great for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates at no cost.

- The blogs covered cover a wide array of topics, ranging ranging from DIY projects to planning a party.

Maximizing Income Tax Deduction Under Section 80c 80ccc 80ccd

Here are some fresh ways create the maximum value of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, or festive decorations to decorate your living areas.

2. Education

- Print free worksheets to build your knowledge at home either in the schoolroom or at home.

3. Event Planning

- Create invitations, banners, and decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Income Tax Deduction Under Section 80c 80ccc 80ccd are a treasure trove of practical and imaginative resources that satisfy a wide range of requirements and pursuits. Their accessibility and versatility make them an invaluable addition to every aspect of your life, both professional and personal. Explore the plethora of Income Tax Deduction Under Section 80c 80ccc 80ccd today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually absolutely free?

- Yes you can! You can download and print these materials for free.

-

Do I have the right to use free printing templates for commercial purposes?

- It's dependent on the particular usage guidelines. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Some printables could have limitations in their usage. Make sure to read the terms and conditions provided by the designer.

-

How do I print Income Tax Deduction Under Section 80c 80ccc 80ccd?

- You can print them at home using either a printer or go to any local print store for higher quality prints.

-

What program will I need to access printables for free?

- Most PDF-based printables are available in the format of PDF, which can be opened with free software such as Adobe Reader.

Deduction Under Section 80C A Complete List BasuNivesh

Tax Deduction Under Section 80C 80CCC 80CCD How To Earn Money Through

Check more sample of Income Tax Deduction Under Section 80c 80ccc 80ccd below

Income Tax Deduction Under Section 80C To 80U FY 2022 23

Deduction Under Section 80C

Deduction Under Section 80C 80CCC 80CCD 1 And 80CCE Under Chapter VI

Section 80C Income Tax Deduction Under Section 80C 80C Limit Tax2win

Deduction Under Section 80C 80CCC 80CCD 80D For AY 2019 20

Deductions From Gross Total Income Under Section 80C To 80 U Of Income

https://taxguru.in › income-tax

Deduction under Section 80CCD According to this section deduction is available to individuals for contributions made to the National Pension Scheme NPS or The Atal Pension Yojna APY Mandatory to Central Government Employees Theses section has

https://cleartax.in

In simple terms you can reduce up to Rs 1 50 000 from your total taxable income through section 80C This deduction is allowed to an Individual or a HUF A maximum of Rs 1 50 000 can be claimed for the FY 2021 22 2020 21 and FY 2019 20 each

Deduction under Section 80CCD According to this section deduction is available to individuals for contributions made to the National Pension Scheme NPS or The Atal Pension Yojna APY Mandatory to Central Government Employees Theses section has

In simple terms you can reduce up to Rs 1 50 000 from your total taxable income through section 80C This deduction is allowed to an Individual or a HUF A maximum of Rs 1 50 000 can be claimed for the FY 2021 22 2020 21 and FY 2019 20 each

Section 80C Income Tax Deduction Under Section 80C 80C Limit Tax2win

Deduction Under Section 80C

Deduction Under Section 80C 80CCC 80CCD 80D For AY 2019 20

Deductions From Gross Total Income Under Section 80C To 80 U Of Income

Investment Options To Avail Tax Deduction Under Section 80C

Section 80C Deduction Under Section 80C For Income Tax Paisabazaar

Section 80C Deduction Under Section 80C For Income Tax Paisabazaar

Deduction Of 80C 80CCC 80CCD Under Income Tax