In the age of digital, in which screens are the norm yet the appeal of tangible printed material hasn't diminished. If it's to aid in education or creative projects, or just adding personal touches to your home, printables for free are a great resource. For this piece, we'll dive into the sphere of "Income Tax Deduction Under Section 80d," exploring what they are, where to get them, as well as ways they can help you improve many aspects of your life.

Get Latest Income Tax Deduction Under Section 80d Below

Income Tax Deduction Under Section 80d

Income Tax Deduction Under Section 80d -

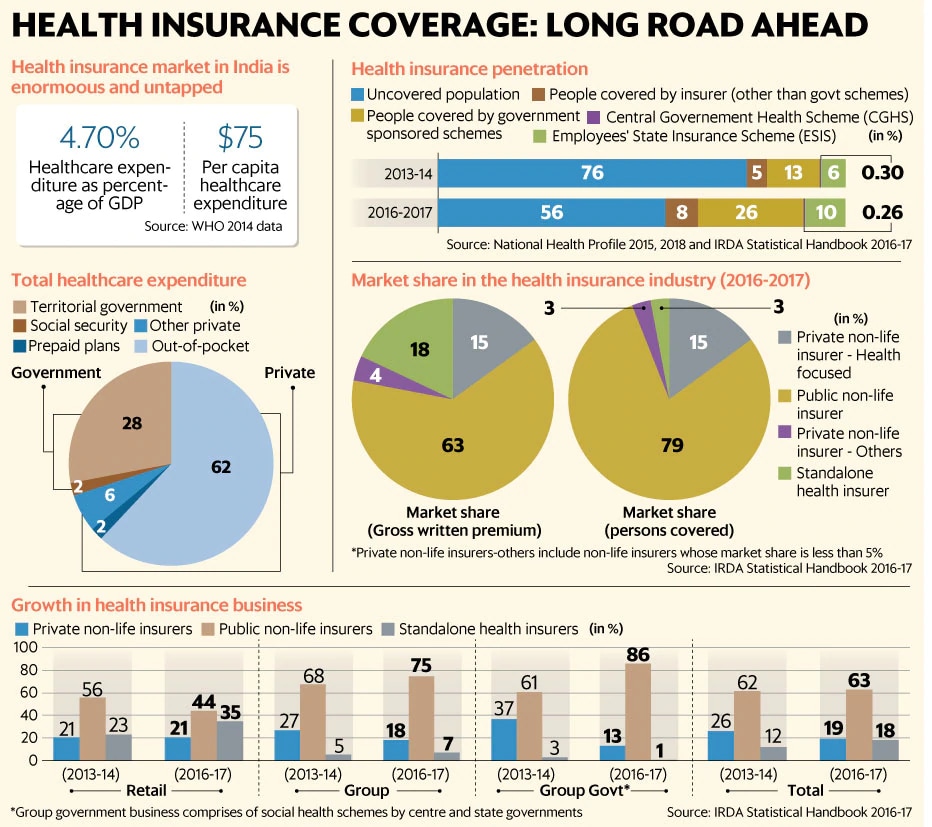

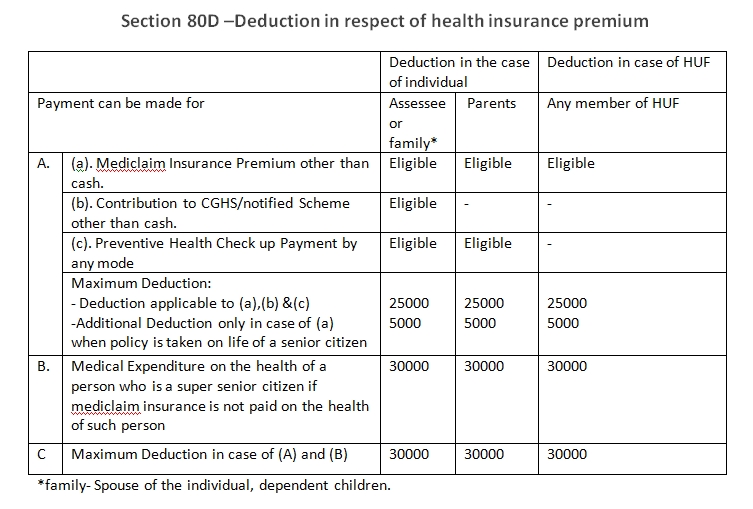

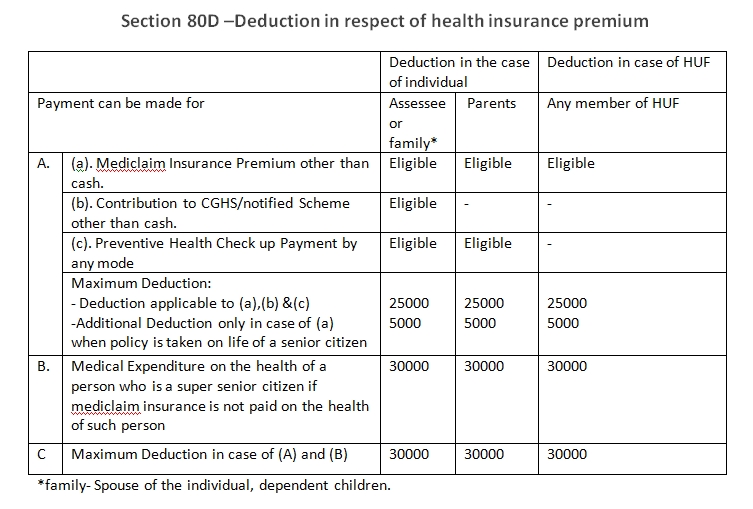

Deduction under section 80D is allowable in respect of premium paid to insure the health of any member of the family The maximum deduction available to a HUF would be 25 000 and in case

Deduction Under Section 80D Assessment Year Status Assessee Spouse dependent Children Assesee s parents Payment for medical insurance premium mode other than

The Income Tax Deduction Under Section 80d are a huge range of downloadable, printable documents that can be downloaded online at no cost. They are available in numerous types, such as worksheets templates, coloring pages, and more. The great thing about Income Tax Deduction Under Section 80d lies in their versatility and accessibility.

More of Income Tax Deduction Under Section 80d

Income Tax Act For Medical Bills Under Section 80D

Income Tax Act For Medical Bills Under Section 80D

Q What is the limit of income tax deduction under section 80D The maximum limit u s 80D is Rs 25000 in case senior

Section 80D permits a deduction of 25 000 for self spouse and dependent children However for parents it is dependent on their age If they are 60

Income Tax Deduction Under Section 80d have gained immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

Customization: We can customize printables to your specific needs whether it's making invitations and schedules, or even decorating your house.

-

Educational Worth: Printing educational materials for no cost can be used by students of all ages, making them a useful tool for parents and teachers.

-

The convenience of Fast access a variety of designs and templates can save you time and energy.

Where to Find more Income Tax Deduction Under Section 80d

Section 80D Deduction In Respect Of Health Or Medical Insurance

Section 80D Deduction In Respect Of Health Or Medical Insurance

Section 80D of the income tax act allows an individual to avail tax deduction for medical insurance Know about when is section 80d applicable the deductions under it Keep

Eligibility and Deduction Limits According to Chapter VI A of the Income Tax Act individuals and HUFs are eligible to claim deductions under Section 80D The maximum deduction limit for

Now that we've ignited your interest in Income Tax Deduction Under Section 80d Let's find out where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection and Income Tax Deduction Under Section 80d for a variety objectives.

- Explore categories like design, home decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free along with flashcards, as well as other learning materials.

- Great for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their creative designs with templates and designs for free.

- These blogs cover a wide range of interests, including DIY projects to planning a party.

Maximizing Income Tax Deduction Under Section 80d

Here are some unique ways create the maximum value use of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use printable worksheets for free to help reinforce your learning at home, or even in the classroom.

3. Event Planning

- Invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Income Tax Deduction Under Section 80d are a treasure trove of fun and practical tools for a variety of needs and preferences. Their availability and versatility make them a fantastic addition to both professional and personal lives. Explore the vast array of Income Tax Deduction Under Section 80d today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax Deduction Under Section 80d truly gratis?

- Yes you can! You can download and print these free resources for no cost.

-

Can I utilize free printables for commercial uses?

- It depends on the specific usage guidelines. Always verify the guidelines of the creator before using printables for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Some printables may have restrictions on usage. Make sure you read these terms and conditions as set out by the designer.

-

How do I print printables for free?

- You can print them at home using any printer or head to a local print shop to purchase more high-quality prints.

-

What software will I need to access printables at no cost?

- The majority of printables are in the format PDF. This can be opened with free software like Adobe Reader.

80D Tax Deduction Under Section 80D On Medical Insurance

Deduction Available Under Section 80D

Check more sample of Income Tax Deduction Under Section 80d below

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

80D Tax Deduction Under Section 80D On Medical Insurance

Income Tax Deductions Under Section 80C 80CCC 80CCD 80D 100Utils

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

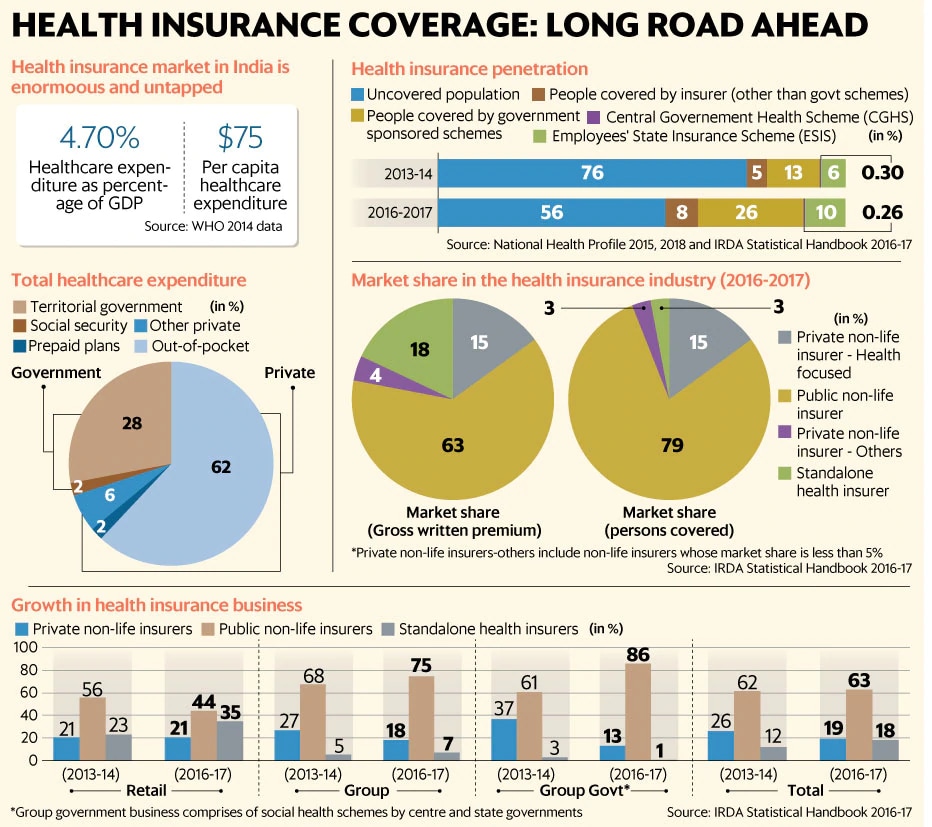

Income Tax Deductions Available For The Financial Year 2017 18

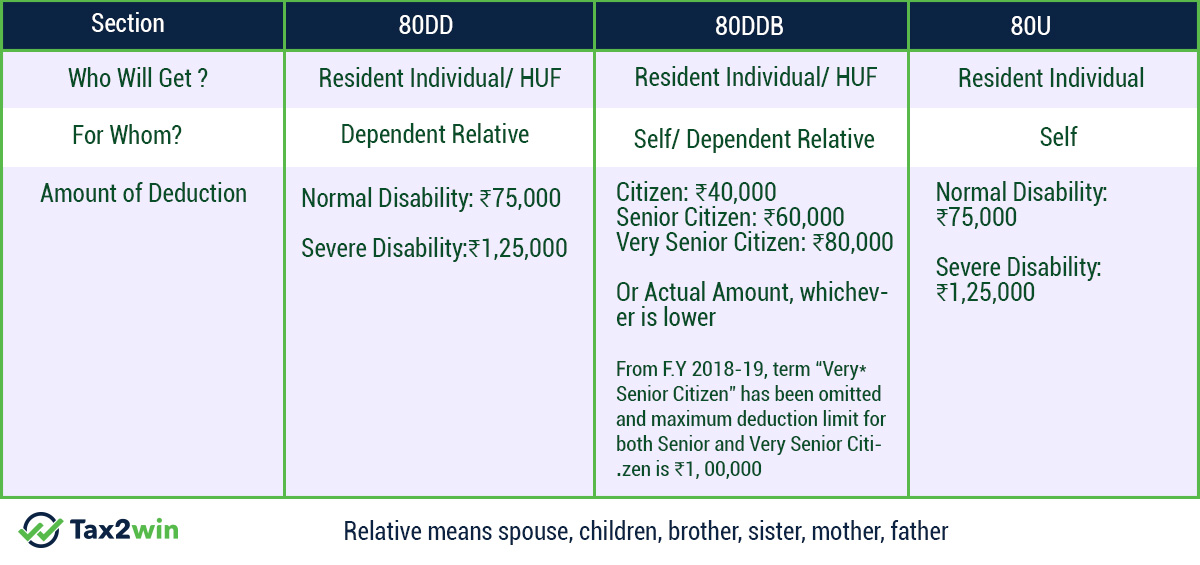

Section 80U Tax Deductions For Disabled Individuals Tax2win

https://incometaxindia.gov.in/Pages/tools/...

Deduction Under Section 80D Assessment Year Status Assessee Spouse dependent Children Assesee s parents Payment for medical insurance premium mode other than

https://www.forbes.com/advisor/in/tax/sectio…

The total tax deduction that can be claimed under Section 80D is based on members insured and their age criterion which ranges from INR

Deduction Under Section 80D Assessment Year Status Assessee Spouse dependent Children Assesee s parents Payment for medical insurance premium mode other than

The total tax deduction that can be claimed under Section 80D is based on members insured and their age criterion which ranges from INR

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

80D Tax Deduction Under Section 80D On Medical Insurance

Income Tax Deductions Available For The Financial Year 2017 18

Section 80U Tax Deductions For Disabled Individuals Tax2win

Section 80D Guide Tax Deductions For Health Insurance Medical

Section 80D Income Tax Act Dialabank Best Offers

Section 80D Income Tax Act Dialabank Best Offers

Section 80D Deductions For Medical Health Insurance For Fy 2021 22