In this digital age, where screens have become the dominant feature of our lives and the appeal of physical printed material hasn't diminished. For educational purposes for creative projects, simply to add an element of personalization to your space, Income Tax Deduction Under Section 80eea have proven to be a valuable resource. We'll dive into the sphere of "Income Tax Deduction Under Section 80eea," exploring what they are, where they are, and the ways that they can benefit different aspects of your lives.

Get Latest Income Tax Deduction Under Section 80eea Below

Income Tax Deduction Under Section 80eea

Income Tax Deduction Under Section 80eea -

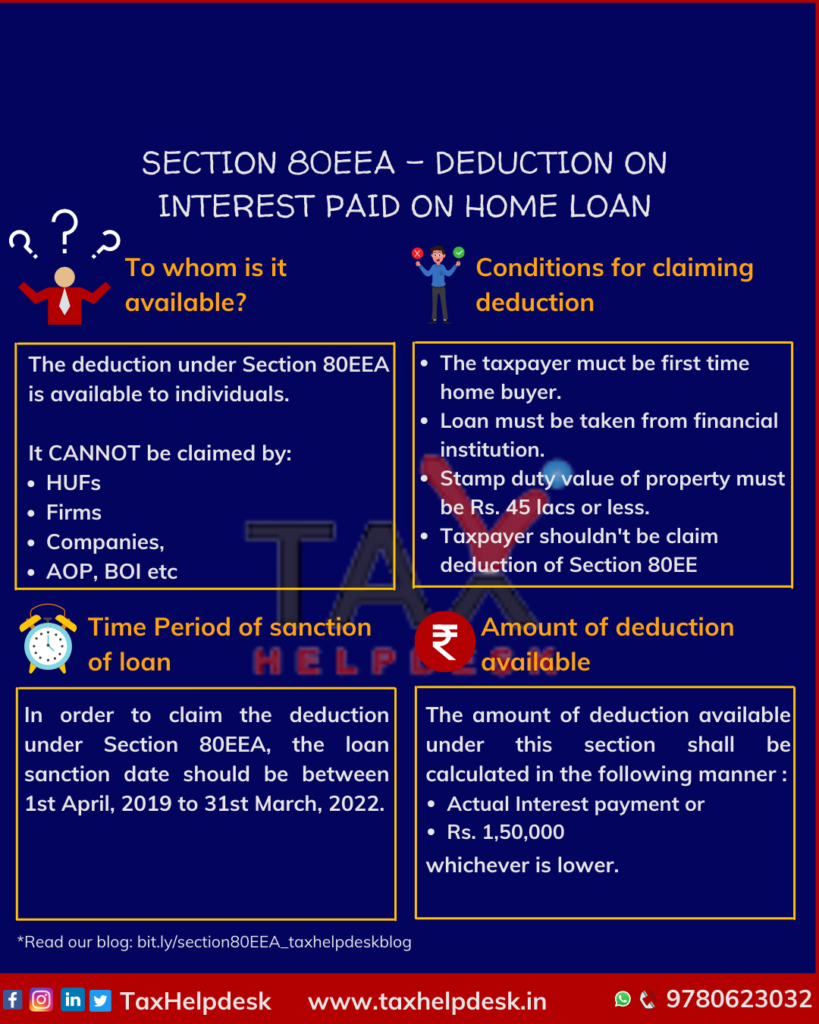

As per the Section 80EEA income tax act any first time home buyer in India can earn an additional tax deduction of up to Rs 1 5 lakh While buying a property that is affordable and needs the support of a

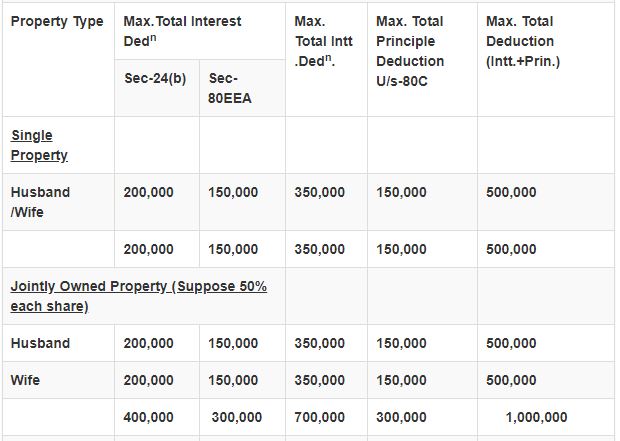

Calculation of Deduction under Section 80EEA with Examples The deductions under 80EEA are available over and above existing deductions under section 24 The deduction is limited to Rs

Income Tax Deduction Under Section 80eea cover a large array of printable content that can be downloaded from the internet at no cost. They come in many formats, such as worksheets, templates, coloring pages and more. The appealingness of Income Tax Deduction Under Section 80eea is in their variety and accessibility.

More of Income Tax Deduction Under Section 80eea

DEDUCTION UNDER CHAPTER VI A INCOME TAX SECTION 80EEA YouTube

DEDUCTION UNDER CHAPTER VI A INCOME TAX SECTION 80EEA YouTube

Under Section 80EEA deduction can be claimed on payment of interest on a Loan sanctioned between 01 04 2019 to 31 03 2022 Deduction under this section

The Income Tax 1961 under Section 80EE helps taxpayers to claim a deduction of up to Rs 50 000 per financial year This benefit is on the interest paid on the home loan and is not part of Section 80C of the

Income Tax Deduction Under Section 80eea have gained immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

customization: They can make the design to meet your needs whether you're designing invitations planning your schedule or even decorating your house.

-

Educational value: Downloads of educational content for free can be used by students from all ages, making the perfect device for teachers and parents.

-

An easy way to access HTML0: Access to the vast array of design and templates will save you time and effort.

Where to Find more Income Tax Deduction Under Section 80eea

Impact Of SECTION 80EEA 80EEB 194N AND 194M Under Tax Audit AY 20

Impact Of SECTION 80EEA 80EEB 194N AND 194M Under Tax Audit AY 20

This Section allows you to claim a deduction of up to Rs 50 000 per financial year You can claim this deduction until you have repaid the loan What are the Features of Section

Section 80EEA Deduction for interest on home loan Is there any benefit for a loan obtained towards buying a new house Read Section 80EEA in this article its terms

In the event that we've stirred your interest in Income Tax Deduction Under Section 80eea we'll explore the places you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Income Tax Deduction Under Section 80eea suitable for many reasons.

- Explore categories like decoration for your home, education, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free as well as flashcards and other learning tools.

- Ideal for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs as well as templates for free.

- These blogs cover a broad range of interests, ranging from DIY projects to party planning.

Maximizing Income Tax Deduction Under Section 80eea

Here are some fresh ways how you could make the most of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Use printable worksheets for free to reinforce learning at home or in the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Get organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Income Tax Deduction Under Section 80eea are an abundance of creative and practical resources designed to meet a range of needs and desires. Their accessibility and flexibility make them a great addition to the professional and personal lives of both. Explore the world of Income Tax Deduction Under Section 80eea to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free absolutely free?

- Yes, they are! You can print and download the resources for free.

-

Can I make use of free printouts for commercial usage?

- It's determined by the specific rules of usage. Make sure you read the guidelines for the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright violations with printables that are free?

- Some printables could have limitations in use. Be sure to read the terms and condition of use as provided by the designer.

-

How do I print Income Tax Deduction Under Section 80eea?

- You can print them at home with an printer, or go to a local print shop for top quality prints.

-

What program is required to open Income Tax Deduction Under Section 80eea?

- The majority are printed in the format PDF. This is open with no cost software like Adobe Reader.

Section 80EEA Eligibility And Deduction Amount

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

Check more sample of Income Tax Deduction Under Section 80eea below

Deduction Under Chapter 6A Of Income Tax Act Loan Deduction Under

Deduction Under Section 80D Ultimate Guide

Tax Benefits On Home Loan Know More At Taxhelpdesk

Income Tax Deduction Under Section 80U For Disabled Persons I e Autism

Section 80EEA Tax Deduction On Home Loan Interest Payment

Income Tax Deduction Under Section 80C Empowering The Society

https:// taxguru.in /income-tax/section-80eea...

Calculation of Deduction under Section 80EEA with Examples The deductions under 80EEA are available over and above existing deductions under section 24 The deduction is limited to Rs

https:// tax2win.in /guide/section-80eea-deduction...

Maximum Deduction The deduction under Section 80EEA is limited to a maximum amount of Rs 1 5 lakh per financial year

Calculation of Deduction under Section 80EEA with Examples The deductions under 80EEA are available over and above existing deductions under section 24 The deduction is limited to Rs

Maximum Deduction The deduction under Section 80EEA is limited to a maximum amount of Rs 1 5 lakh per financial year

Income Tax Deduction Under Section 80U For Disabled Persons I e Autism

Deduction Under Section 80D Ultimate Guide

Section 80EEA Tax Deduction On Home Loan Interest Payment

Income Tax Deduction Under Section 80C Empowering The Society

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Income Tax Deduction Under Section 80C To 80U FY 2022 23

Income Tax Deduction Under Section 80C To 80U FY 2022 23

Section 80EEA Deduction For Interest Paid On Home Loan For Affordable