Today, when screens dominate our lives but the value of tangible printed items hasn't gone away. It doesn't matter if it's for educational reasons project ideas, artistic or simply to add a personal touch to your space, Income Tax Deductions Chart 2023 have become a valuable source. The following article is a take a dive through the vast world of "Income Tax Deductions Chart 2023," exploring the benefits of them, where they are, and what they can do to improve different aspects of your lives.

Get Latest Income Tax Deductions Chart 2023 Below

Income Tax Deductions Chart 2023

Income Tax Deductions Chart 2023 -

Eral income tax return It answers some basic questions who must file who should file what filing status to use and the amount of the stand ard deduction Who Must File explains who must file an in come tax return If you have little or no gross in come reading this section will help you decide if you have to file a return

For the 2023 tax year for forms you file in 2024 the standard deduction is 13 850 for single filers and married couples filing separately 27 700 for married couples filing jointly and

The Income Tax Deductions Chart 2023 are a huge range of printable, free content that can be downloaded from the internet at no cost. These resources come in various formats, such as worksheets, coloring pages, templates and much more. The benefit of Income Tax Deductions Chart 2023 lies in their versatility as well as accessibility.

More of Income Tax Deductions Chart 2023

Federal Income Tax Deduction Chart My XXX Hot Girl

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

The IRS has released the standard deduction amounts for 2024 which increase the amounts that will be available on 2023 tax returns

This publication discusses some tax rules that affect every person who may have to file a federal income tax return It answers some basic questions who must file who should file what filing status to use and the amount of the standard deduction Who Must File explains who must file an income tax return If you have little or no gross

The Income Tax Deductions Chart 2023 have gained huge popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

The ability to customize: The Customization feature lets you tailor the design to meet your needs whether you're designing invitations and schedules, or even decorating your house.

-

Educational Value: Downloads of educational content for free can be used by students from all ages, making the perfect source for educators and parents.

-

Accessibility: Instant access to an array of designs and templates reduces time and effort.

Where to Find more Income Tax Deductions Chart 2023

IRS Tax Brackets For 2023 Taxed Right

IRS Tax Brackets For 2023 Taxed Right

Tax Tables 2023 Edition 2023 Tax Rate Schedule TAXABLE INCOME BASE MARGINAL OF THE AMOUNT OF TAX AMOUNT Standard Deductions Personal Exemption STANDARD PERSONAL PHASEOUTS FILING STATUS DEDUCTION EXEMPTION BEGIN AT AGI OF HEAD OF HOUSEHOLD

These tax brackets determine how much you ll pay on your taxable income for that year Each year tax brackets are adjusted based on inflation In many countries including the United States tax brackets are progressive which

Since we've got your interest in Income Tax Deductions Chart 2023 and other printables, let's discover where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection with Income Tax Deductions Chart 2023 for all objectives.

- Explore categories such as interior decor, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free for flashcards, lessons, and worksheets. materials.

- This is a great resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for free.

- The blogs are a vast range of topics, ranging from DIY projects to party planning.

Maximizing Income Tax Deductions Chart 2023

Here are some innovative ways create the maximum value use of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Use printable worksheets for free for reinforcement of learning at home or in the classroom.

3. Event Planning

- Invitations, banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners for to-do list, lists of chores, and meal planners.

Conclusion

Income Tax Deductions Chart 2023 are a treasure trove of practical and imaginative resources designed to meet a range of needs and interest. Their accessibility and versatility make them a fantastic addition to both personal and professional life. Explore the endless world of Income Tax Deductions Chart 2023 to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly free?

- Yes they are! You can download and print the resources for free.

-

Can I download free printables for commercial purposes?

- It's dependent on the particular conditions of use. Always consult the author's guidelines prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Some printables may contain restrictions in their usage. Always read the terms of service and conditions provided by the designer.

-

How do I print Income Tax Deductions Chart 2023?

- Print them at home using a printer or visit the local print shops for top quality prints.

-

What program must I use to open printables at no cost?

- The majority of PDF documents are provided in PDF format. These is open with no cost software such as Adobe Reader.

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

2022 Federal Tax Brackets And Standard Deduction Printable Form

Check more sample of Income Tax Deductions Chart 2023 below

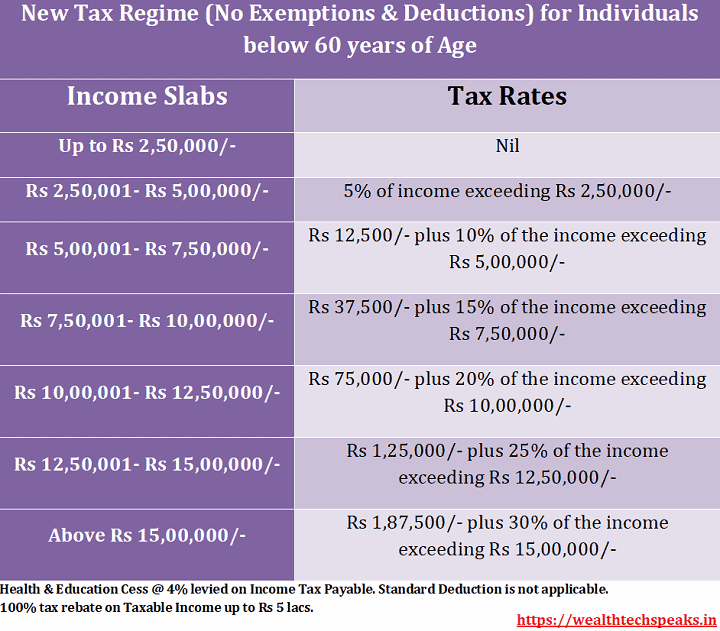

Income Tax Slabs Rates Financial Year 2022 23 WealthTech Speaks

How Much Do You Need To Donate For Tax Deduction

IDR 2020 Interest Rates Standard Deductions And Income Tax Brackets

Section Wise Income Tax Deductions For AY 2022 23 FY 2021 22

Printable Itemized Deductions Worksheet

Tax Return 2023 Chart Printable Forms Free Online

https://www.usatoday.com › money › blueprint › taxes

For the 2023 tax year for forms you file in 2024 the standard deduction is 13 850 for single filers and married couples filing separately 27 700 for married couples filing jointly and

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg?w=186)

https://www.irs.gov › pub › irs-pdf

Standard deduction amount in creased For 2023 the standard deduction amount has been in creased for all filers The amounts are Single or Married filing sepa rately 13 850 Married filing jointly or Qualify ing surviving spouse 27 700 and Head of household 20 800 See chapter 10 later New lines on Schedule 3 Form 1040

For the 2023 tax year for forms you file in 2024 the standard deduction is 13 850 for single filers and married couples filing separately 27 700 for married couples filing jointly and

Standard deduction amount in creased For 2023 the standard deduction amount has been in creased for all filers The amounts are Single or Married filing sepa rately 13 850 Married filing jointly or Qualify ing surviving spouse 27 700 and Head of household 20 800 See chapter 10 later New lines on Schedule 3 Form 1040

Section Wise Income Tax Deductions For AY 2022 23 FY 2021 22

How Much Do You Need To Donate For Tax Deduction

Printable Itemized Deductions Worksheet

Tax Return 2023 Chart Printable Forms Free Online

School Toilet Bag Moos Negro Padded Black 23 X 12 8 Cm

What Can I Deduct Freelance Tax Deductions Flowchart Rags To Reasonable

What Can I Deduct Freelance Tax Deductions Flowchart Rags To Reasonable

IRS Announces 2022 Tax Rates Standard Deduction