In the digital age, with screens dominating our lives however, the attraction of tangible printed materials hasn't faded away. For educational purposes as well as creative projects or simply to add an individual touch to the area, Income Tax Deductions For Working From Home can be an excellent source. In this article, we'll dive through the vast world of "Income Tax Deductions For Working From Home," exploring what they are, how to get them, as well as what they can do to improve different aspects of your life.

Get Latest Income Tax Deductions For Working From Home Below

Income Tax Deductions For Working From Home

Income Tax Deductions For Working From Home -

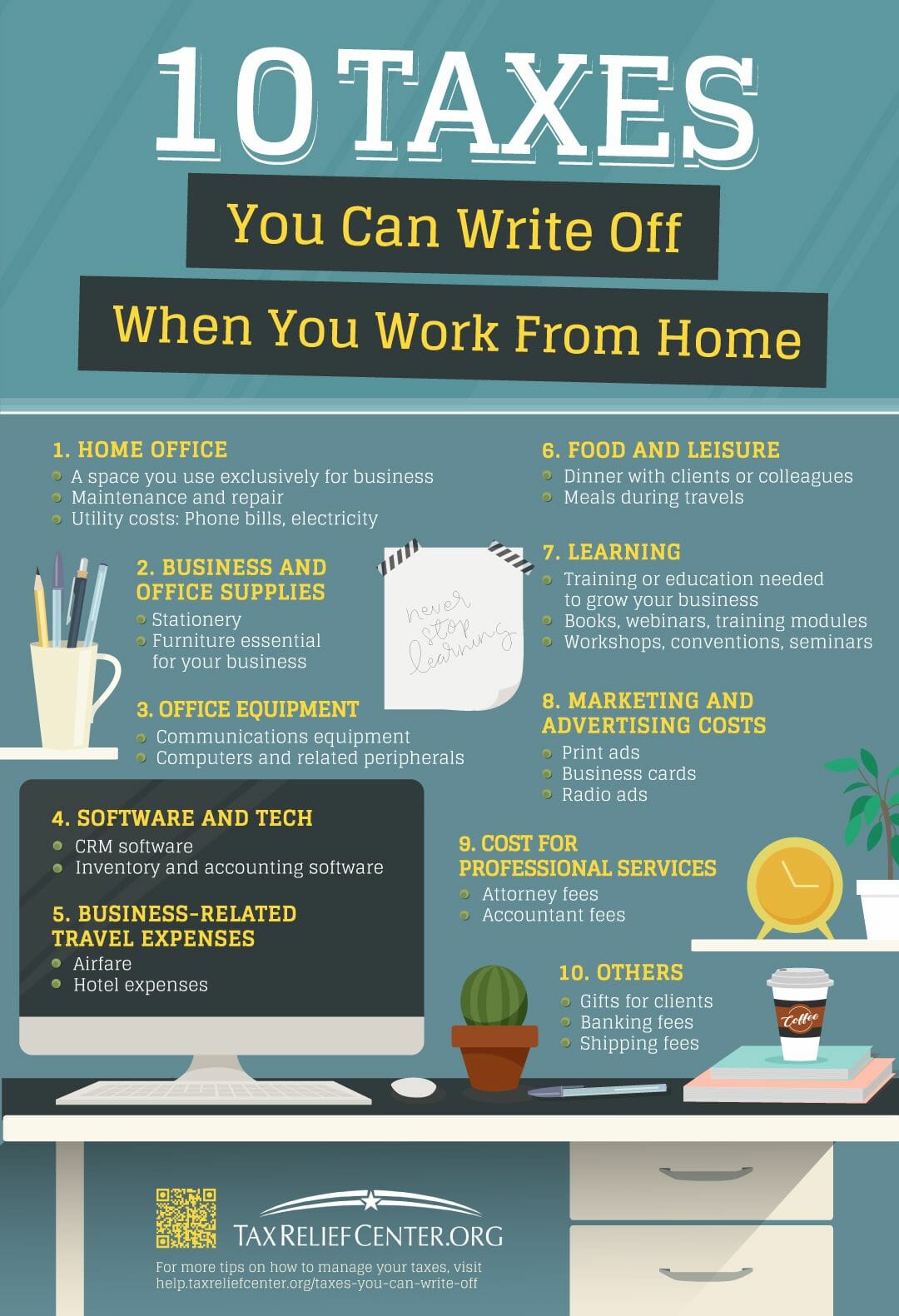

You can either claim tax relief on 6 a week from 6 April 2020 for previous tax years the rate is 4 a week you will not need to keep evidence of your extra costs the exact

Number of days of remote work Standard workspace deduction in 2023 tax assessment If you work from home more than 50 of the total number of work days in

Income Tax Deductions For Working From Home cover a large range of downloadable, printable documents that can be downloaded online at no cost. They are available in a variety of designs, including worksheets templates, coloring pages, and much more. The attraction of printables that are free lies in their versatility and accessibility.

More of Income Tax Deductions For Working From Home

The Deductions You Can Claim Hra Tax Vrogue

The Deductions You Can Claim Hra Tax Vrogue

Tax deductions for expenses needed to work from home are only available to taxpayers who itemize their deductions Also work from home expenses can only

Work from home WFH tax deductions are business expenses that you can subtracted from revenue to lower your tax bill But these deductions almost exclusively

Income Tax Deductions For Working From Home have gained immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Individualization They can make printables to fit your particular needs for invitations, whether that's creating them as well as organizing your calendar, or even decorating your house.

-

Educational Benefits: Printing educational materials for no cost provide for students from all ages, making them a valuable tool for parents and teachers.

-

Easy to use: Quick access to a plethora of designs and templates helps save time and effort.

Where to Find more Income Tax Deductions For Working From Home

6 Working From Home Deductions You Can Claim BOX Advisory Services

6 Working From Home Deductions You Can Claim BOX Advisory Services

Deductions for expenses you incur to work from home such as stationery energy and office equipment Fixed rate method 67 cents Check your eligibility to

For instance if your home office takes up the maximum 300 square feet of your home the maximum you can deduct is 1 500 under the simplified home office deduction but if you use up to 300 square

If we've already piqued your interest in Income Tax Deductions For Working From Home Let's look into where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection in Income Tax Deductions For Working From Home for different applications.

- Explore categories such as design, home decor, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free as well as flashcards and other learning materials.

- Perfect for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- The blogs covered cover a wide range of topics, including DIY projects to party planning.

Maximizing Income Tax Deductions For Working From Home

Here are some creative ways of making the most use of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use free printable worksheets to build your knowledge at home or in the classroom.

3. Event Planning

- Design invitations, banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars, to-do lists, and meal planners.

Conclusion

Income Tax Deductions For Working From Home are an abundance of practical and innovative resources that cater to various needs and desires. Their availability and versatility make them a fantastic addition to both professional and personal lives. Explore the vast array of Income Tax Deductions For Working From Home today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax Deductions For Working From Home really free?

- Yes, they are! You can print and download these items for free.

-

Can I use free printables for commercial use?

- It's determined by the specific terms of use. Always check the creator's guidelines prior to using the printables in commercial projects.

-

Do you have any copyright concerns when using Income Tax Deductions For Working From Home?

- Certain printables may be subject to restrictions in their usage. Check the terms of service and conditions provided by the creator.

-

How do I print Income Tax Deductions For Working From Home?

- Print them at home using either a printer at home or in any local print store for better quality prints.

-

What program do I need to run printables that are free?

- The majority are printed as PDF files, which can be opened with free software, such as Adobe Reader.

2023 Working From Home Tax Deductions

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

Check more sample of Income Tax Deductions For Working From Home below

Working From Home Tax Deductions Who Is Eligible And How To Apply

Tax Deductions For Food Bloggers Blog Taxes Tax Deductions Working

Tax Deductions For Working From Home 2023 KMT Partners

Tax Deductions For Working From Home 2023 KMT Partners

Income Tax Deductions For The FY 2019 20 ComparePolicy

Tax Deductions For Working From Home MileIQ

https://www.vero.fi/.../remote-working-and-deductions

Number of days of remote work Standard workspace deduction in 2023 tax assessment If you work from home more than 50 of the total number of work days in

https://www.ramseysolutions.com/taxes/work-from-home-tax-deductions

So who gets to take work from home tax deductions Well the IRS reserves them for self employed independent contractors In other words if you work

Number of days of remote work Standard workspace deduction in 2023 tax assessment If you work from home more than 50 of the total number of work days in

So who gets to take work from home tax deductions Well the IRS reserves them for self employed independent contractors In other words if you work

Tax Deductions For Working From Home 2023 KMT Partners

Tax Deductions For Food Bloggers Blog Taxes Tax Deductions Working

Income Tax Deductions For The FY 2019 20 ComparePolicy

Tax Deductions For Working From Home MileIQ

Printable Itemized Deductions Worksheet

Income Tax 80c Deduction Fy 2021 22 TAX

Income Tax 80c Deduction Fy 2021 22 TAX

Deductions Allowed Under The New Income Tax Regime Paisabazaar Com