Today, where screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed material hasn't diminished. If it's to aid in education and creative work, or just adding an individual touch to your home, printables for free have proven to be a valuable resource. Here, we'll take a dive into the world "Income Tax Deductions Slab For Salaried Employees," exploring the benefits of them, where to locate them, and how they can be used to enhance different aspects of your daily life.

Get Latest Income Tax Deductions Slab For Salaried Employees Below

Income Tax Deductions Slab For Salaried Employees

Income Tax Deductions Slab For Salaried Employees -

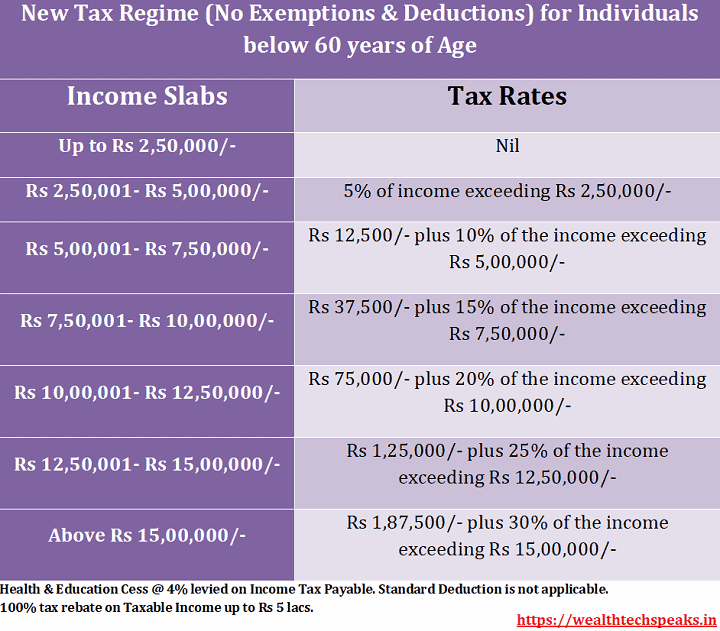

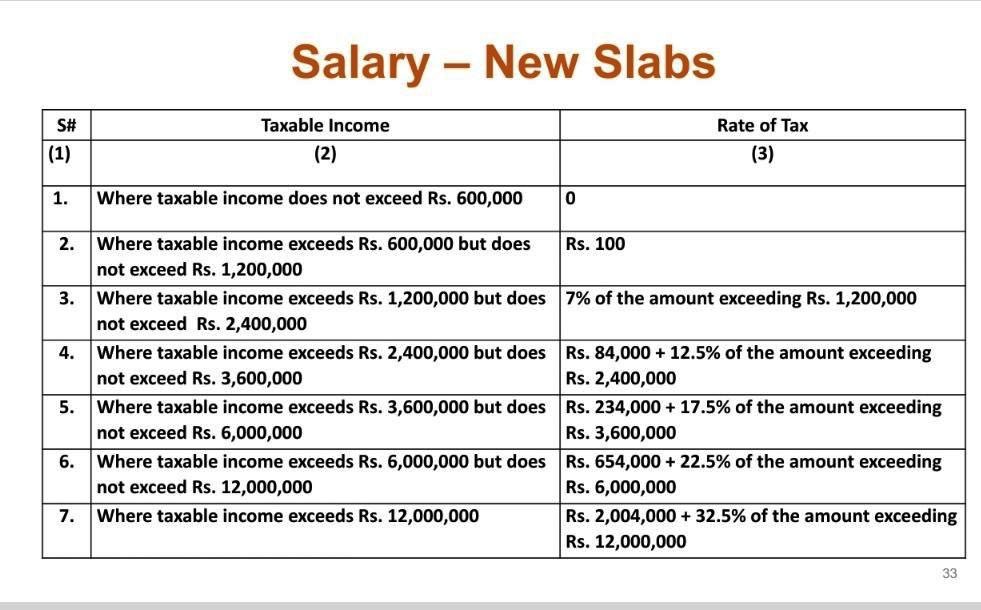

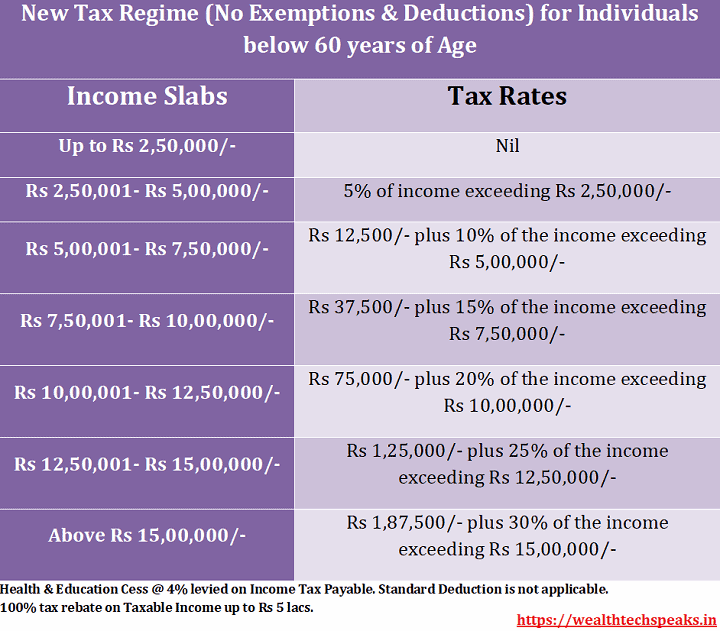

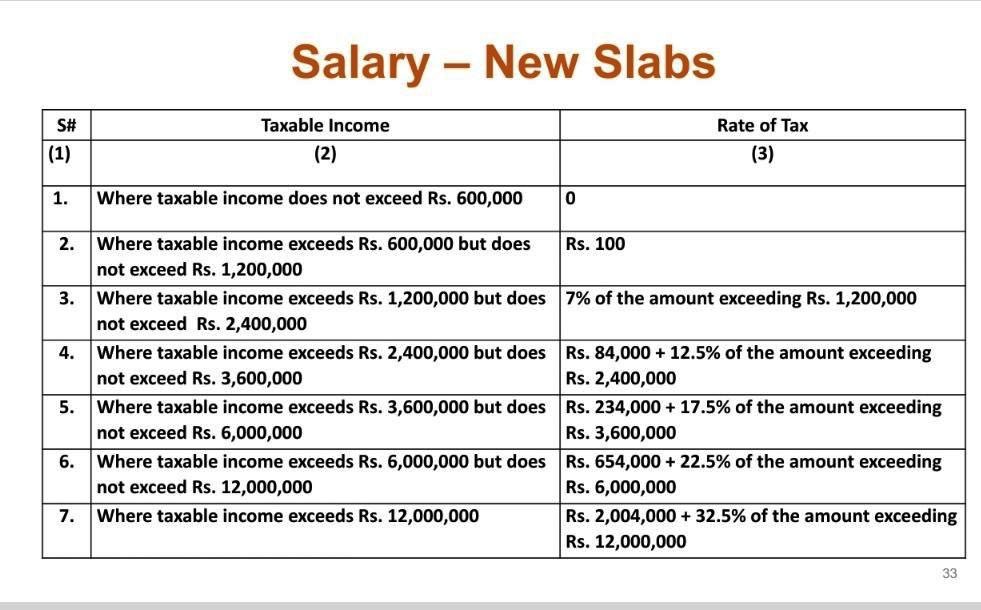

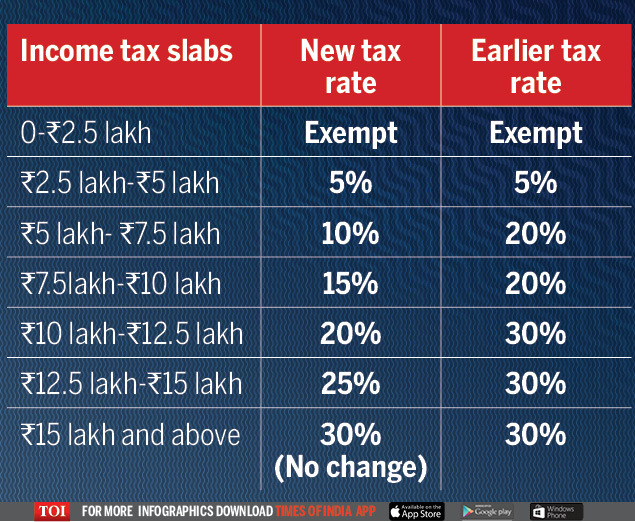

Income tax on salary is calculated based on the income earned and the applicable tax rates The tax rates are determined by the government and are based on income slabs

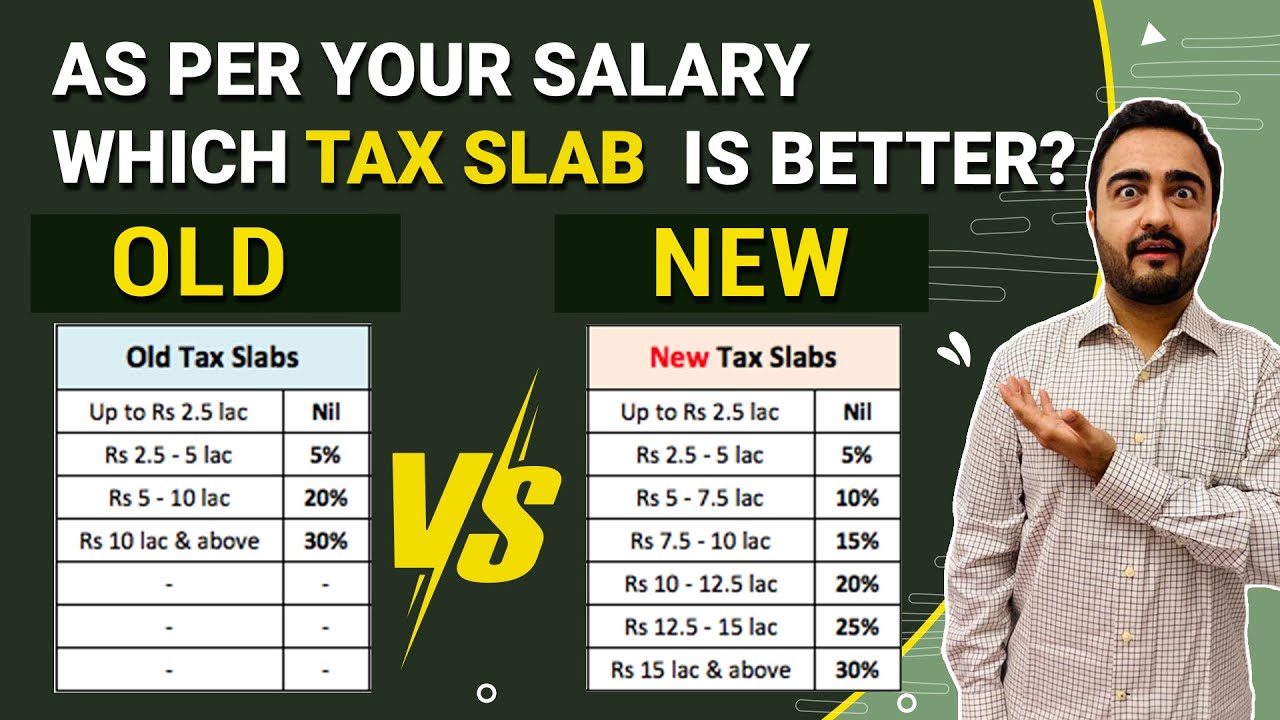

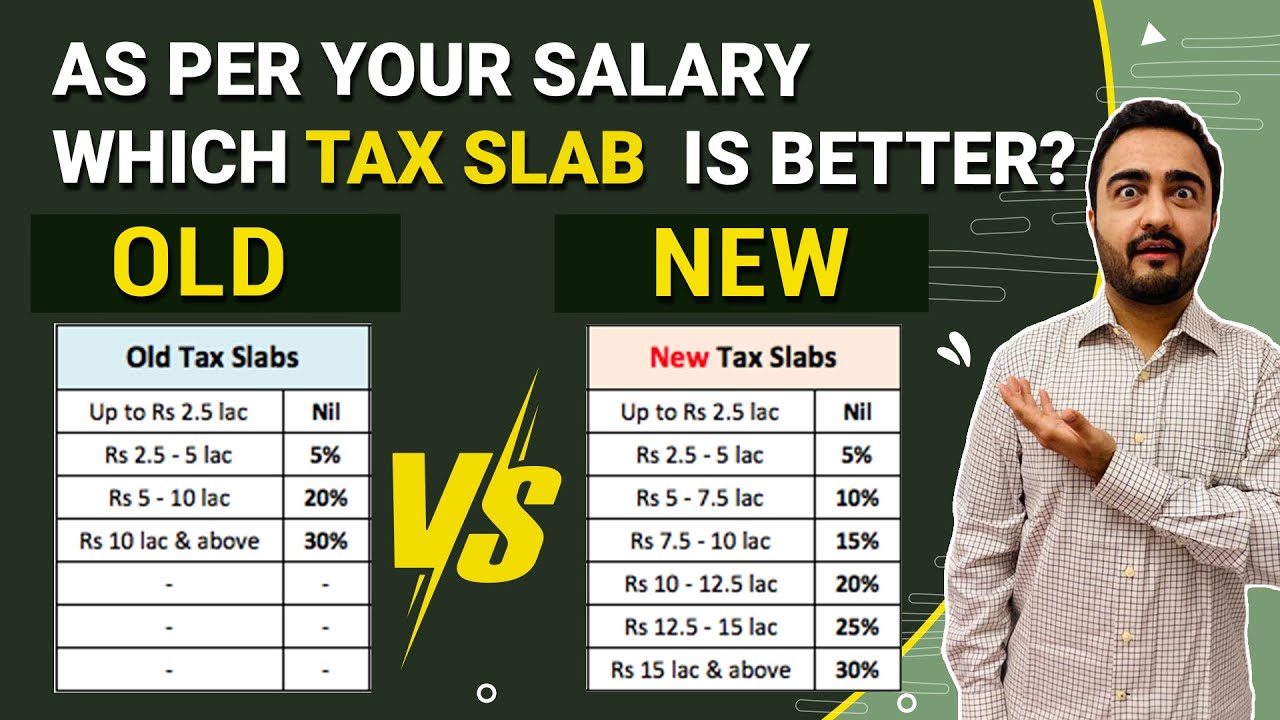

Tax Slabs for AY 2024 25 The Finance Act 2023 has amended the provisions of Section 115BAC w e f AY 2024 25 to make new tax regime the default tax regime for the assessee

Income Tax Deductions Slab For Salaried Employees provide a diverse collection of printable materials that are accessible online for free cost. These printables come in different forms, like worksheets coloring pages, templates and much more. The value of Income Tax Deductions Slab For Salaried Employees is in their versatility and accessibility.

More of Income Tax Deductions Slab For Salaried Employees

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

Income tax calculation for the Salaried Income from salary Basic salary HRA Special Allowance Transport Allowance any other allowance Some components of your salary are exempt from tax such as telephone bill

Government employees can claim up to 14 of salary as a deduction under section 80 CCD 2 There is also another condition which is employer s contribution to NPS EPF and a superannuation fund is eligible for

Printables for free have gained immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Personalization You can tailor print-ready templates to your specific requirements in designing invitations planning your schedule or even decorating your home.

-

Educational Value Education-related printables at no charge offer a wide range of educational content for learners of all ages. This makes them a valuable device for teachers and parents.

-

Simple: Fast access the vast array of design and templates helps save time and effort.

Where to Find more Income Tax Deductions Slab For Salaried Employees

Income Tax Slab 2022 Live Updates Big Tax Relief For Salaried

Income Tax Slab 2022 Live Updates Big Tax Relief For Salaried

The taxable income on which you have to calculate tax will be Rs 9 9 lakh Rs 12 lakh Rs 2 10 lakh Your income tax slab in the old tax regime will be between Rs 5 lakh and Rs 10 lakh

Use our income tax calculator to calculate tax payable on your income for FY 2024 25 old tax regime vs new tax regime as per Union Budget 2024 FY 2023 24 and FY 2022 23 in a few simple steps Check how much income tax you

Since we've got your interest in printables for free We'll take a look around to see where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Income Tax Deductions Slab For Salaried Employees for various objectives.

- Explore categories such as home decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free or flashcards as well as learning tools.

- Ideal for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs or templates for download.

- The blogs are a vast range of topics, including DIY projects to planning a party.

Maximizing Income Tax Deductions Slab For Salaried Employees

Here are some creative ways how you could make the most of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, or festive decorations to decorate your living areas.

2. Education

- Print free worksheets for teaching at-home and in class.

3. Event Planning

- Invitations, banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable planners as well as to-do lists and meal planners.

Conclusion

Income Tax Deductions Slab For Salaried Employees are an abundance of fun and practical tools which cater to a wide range of needs and desires. Their availability and versatility make them a wonderful addition to any professional or personal life. Explore the wide world of Income Tax Deductions Slab For Salaried Employees to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really available for download?

- Yes they are! You can download and print these resources at no cost.

-

Can I use the free templates for commercial use?

- It's all dependent on the conditions of use. Always consult the author's guidelines prior to printing printables for commercial projects.

-

Are there any copyright issues with Income Tax Deductions Slab For Salaried Employees?

- Some printables could have limitations regarding usage. Make sure to read the terms of service and conditions provided by the author.

-

How do I print printables for free?

- You can print them at home using printing equipment or visit the local print shop for more high-quality prints.

-

What software do I need to open Income Tax Deductions Slab For Salaried Employees?

- The majority of printed documents are as PDF files, which can be opened using free software like Adobe Reader.

Income Tax Return Filing For Salaried Employees AY 2022 23 Section 80C

Budget 2023 Income Tax Slab Change Expectations Salaried Employees

Check more sample of Income Tax Deductions Slab For Salaried Employees below

Summary Of Slab Deductions Under Income Tax AY 2020 21

Income Tax Slabs Year 2022 23 Info Ghar Educational News

Income Tax Slab 2020 21 Pakistan Tax Rates For Salaried Non

Income Tax Slab For Ay 2023 24 For Salaried Person New Regime

Latest Income Tax Slab Rates For FY 2021 22 AY 2022 23 If You Are

New Income Tax Slab For Salaried Employees 2023 24 Which Slabs Will

https://www.incometax.gov.in/iec/foportal/help/...

Tax Slabs for AY 2024 25 The Finance Act 2023 has amended the provisions of Section 115BAC w e f AY 2024 25 to make new tax regime the default tax regime for the assessee

https://www.godigit.com/income-tax/income-tax-slab...

Here are some of the important income tax benefits in the form of allowances and deductions under the old tax regime that can help reduce the tax liability for salaried individuals for

Tax Slabs for AY 2024 25 The Finance Act 2023 has amended the provisions of Section 115BAC w e f AY 2024 25 to make new tax regime the default tax regime for the assessee

Here are some of the important income tax benefits in the form of allowances and deductions under the old tax regime that can help reduce the tax liability for salaried individuals for

Income Tax Slab For Ay 2023 24 For Salaried Person New Regime

Income Tax Slabs Year 2022 23 Info Ghar Educational News

Latest Income Tax Slab Rates For FY 2021 22 AY 2022 23 If You Are

New Income Tax Slab For Salaried Employees 2023 24 Which Slabs Will

Tax Slab Rate For Salaried Individuals Be Taxfiler

Income Tax Slab Rate 2021 2022 Tax Calculation For Salaried Person

Income Tax Slab Rate 2021 2022 Tax Calculation For Salaried Person

Income Tax Slab Income Tax Slab Revision Latest News New Slab