In this age of electronic devices, in which screens are the norm yet the appeal of tangible printed items hasn't gone away. Whatever the reason, whether for education project ideas, artistic or simply to add an element of personalization to your space, Income Tax Exemption For Agriculture Income can be an excellent source. We'll take a dive deep into the realm of "Income Tax Exemption For Agriculture Income," exploring what they are, where they are available, and ways they can help you improve many aspects of your daily life.

Get Latest Income Tax Exemption For Agriculture Income Below

Income Tax Exemption For Agriculture Income

Income Tax Exemption For Agriculture Income -

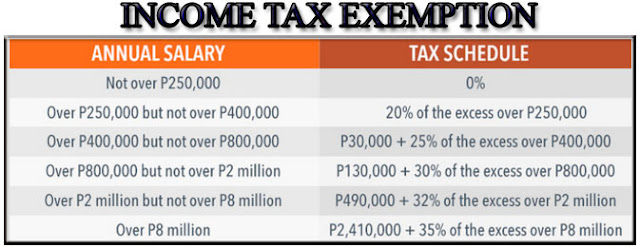

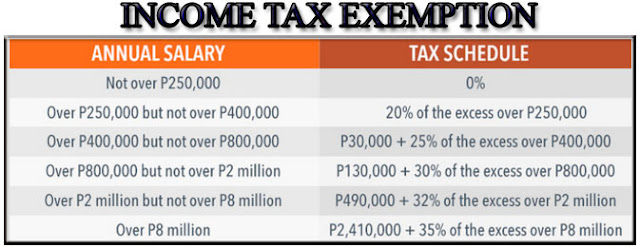

How much agricultural income is exempt from income tax How to calculate tax on agriculture income for AY 2023 24 But you might have to pay some

Agriculture income is exempt under section 10 1 of Income Tax Act 1961 if received in India Agriculture income from any other country will be taxable BUT for

Income Tax Exemption For Agriculture Income provide a diverse array of printable documents that can be downloaded online at no cost. These resources come in many forms, including worksheets, templates, coloring pages and more. The benefit of Income Tax Exemption For Agriculture Income lies in their versatility as well as accessibility.

More of Income Tax Exemption For Agriculture Income

We Got 12A Exemption Registration Under Income Tax

We Got 12A Exemption Registration Under Income Tax

FBR defines agricultural income for tax exemption May 2 2023 The Federal Board of Revenue FBR has provided an explanation of agricultural income to

Preferential taxes or exemptions are applied on income from agricultural cooperatives in the following countries Austria partial tax exemptions Israel tax holiday for five

Income Tax Exemption For Agriculture Income have gained a lot of popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

customization Your HTML0 customization options allow you to customize the design to meet your needs whether you're designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Value Downloads of educational content for free offer a wide range of educational content for learners from all ages, making the perfect instrument for parents and teachers.

-

Convenience: Instant access to many designs and templates, which saves time as well as effort.

Where to Find more Income Tax Exemption For Agriculture Income

How To File Agriculture Income Tax Return 2021 Tax Return For

How To File Agriculture Income Tax Return 2021 Tax Return For

Step 1 Add the net agricultural income to the non agricultural income Step 2 Add the exempted income as stated in the Income Tax Act 1961 to the

By default agricultural income is exempted from taxation and not included under total income The Central Government can t impose or levy tax on agricultural

After we've peaked your interest in Income Tax Exemption For Agriculture Income we'll explore the places they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of printables that are free for a variety of goals.

- Explore categories like decorating your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. materials.

- Great for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates at no cost.

- The blogs covered cover a wide range of topics, from DIY projects to party planning.

Maximizing Income Tax Exemption For Agriculture Income

Here are some unique ways in order to maximize the use of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print out free worksheets and activities to aid in learning at your home for the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Keep your calendars organized by printing printable calendars, to-do lists, and meal planners.

Conclusion

Income Tax Exemption For Agriculture Income are a treasure trove with useful and creative ideas that meet a variety of needs and desires. Their availability and versatility make them a great addition to any professional or personal life. Explore the wide world of Income Tax Exemption For Agriculture Income now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax Exemption For Agriculture Income truly gratis?

- Yes you can! You can download and print these resources at no cost.

-

Can I download free printing templates for commercial purposes?

- It's contingent upon the specific terms of use. Always consult the author's guidelines before utilizing their templates for commercial projects.

-

Are there any copyright problems with printables that are free?

- Certain printables may be subject to restrictions on use. Be sure to check the terms and conditions set forth by the designer.

-

How can I print printables for free?

- Print them at home using any printer or head to the local print shop for better quality prints.

-

What software do I need to run printables for free?

- Most PDF-based printables are available in the PDF format, and can be opened using free software, such as Adobe Reader.

Income Tax Exemption For Gratuity Enhanced Up To Rs 20 Lakhs YouTube

Missouri Sales Tax Exemption Form Agriculture ExemptForm

Check more sample of Income Tax Exemption For Agriculture Income below

We Got 12A Exemption Registration Under Income Tax

File Tax Return 2022 For Agriculture Income Tax Return For

Income Tax Legalversity

The Take home Pay Is Bigger As Senate Approved Higher Personal Income

Life Insurance Income Tax Exemption IndiaFilings

Government Doubles Income Tax Exemption For Gratuity Updated You

https://taxguru.in/income-tax/agriculture-income...

Agriculture income is exempt under section 10 1 of Income Tax Act 1961 if received in India Agriculture income from any other country will be taxable BUT for

https://taxguru.in/income-tax/understanding...

While the Income Tax Act provides comprehensive exemptions for agricultural income there are certain exclusions to be aware of Income from Land

Agriculture income is exempt under section 10 1 of Income Tax Act 1961 if received in India Agriculture income from any other country will be taxable BUT for

While the Income Tax Act provides comprehensive exemptions for agricultural income there are certain exclusions to be aware of Income from Land

The Take home Pay Is Bigger As Senate Approved Higher Personal Income

File Tax Return 2022 For Agriculture Income Tax Return For

Life Insurance Income Tax Exemption IndiaFilings

Government Doubles Income Tax Exemption For Gratuity Updated You

Income Tax Calculation Example 2 For Salary Employees 2023 24

Writing Religious Exemption Letters

Writing Religious Exemption Letters

India Budget 2021 Tax Highlights Activpayroll