In this age of technology, where screens dominate our lives but the value of tangible printed material hasn't diminished. For educational purposes, creative projects, or simply adding an extra personal touch to your space, Income Tax Exemption For Higher Education have become a valuable resource. The following article is a dive deep into the realm of "Income Tax Exemption For Higher Education," exploring what they are, where they can be found, and ways they can help you improve many aspects of your daily life.

Get Latest Income Tax Exemption For Higher Education Below

Income Tax Exemption For Higher Education

Income Tax Exemption For Higher Education -

Maximize your tax savings by understanding Section 80E deduction and how it helps you claim tax benefits on the interest paid on your education loan Explore our comprehensive guide at Tax2Win Read about Sec 80E Deduction for ineterst paid on education loan for 8 years

Section 80E of the Income Tax Act 1961 deals with the terms and conditions of availing income tax deductions if you have an ongoing education loan A set of criteria is given under this section mentioning who is eligible to get the deductions and under what conditions Let s discuss them in detail

Printables for free include a vast variety of printable, downloadable materials online, at no cost. They are available in a variety of kinds, including worksheets coloring pages, templates and much more. The appealingness of Income Tax Exemption For Higher Education is in their versatility and accessibility.

More of Income Tax Exemption For Higher Education

50 Income Tax Exemption For High Earners In Cyprus

50 Income Tax Exemption For High Earners In Cyprus

The taxpayer Only Individuals assessee can claim income tax exemption under Section 80C Partnership firms HUF s and Companies are not eligible to avail tax benefits on tuition fees Children The income tax exemption can be claimed only when the parent is paying for two children s education

An education credit helps with the cost of higher education by reducing the amount of tax owed on your tax return If the credit reduces your tax to less than zero you may get a refund There are two education credits available the American Opportunity Tax Credit and the Lifetime Learning Credit

Income Tax Exemption For Higher Education have gained a lot of popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

customization: They can make printables to fit your particular needs for invitations, whether that's creating them as well as organizing your calendar, or even decorating your house.

-

Educational Benefits: These Income Tax Exemption For Higher Education can be used by students of all ages. This makes them a useful resource for educators and parents.

-

Simple: You have instant access a plethora of designs and templates helps save time and effort.

Where to Find more Income Tax Exemption For Higher Education

Income Tax Exemption For Gratuity Enhanced Up To Rs 20 Lakhs YouTube

Income Tax Exemption For Gratuity Enhanced Up To Rs 20 Lakhs YouTube

Education is the cornerstone of personal and professional growth Pursuing higher studies not only enhances knowledge but also opens doors to numerous opportunities However the cost of education especially for advanced degrees or courses abroad can be substantial To alleviate the financial burden the Indian government

IRS Tax Tip 2021 106 July 22 2021 As a new school year approaches students are considering what classes they need to take and how much the classes will cost Whether it s community college a trade school a four year university or an advanced degree higher education is expensive The good news is tax credits can help offset these costs

Now that we've piqued your interest in printables for free we'll explore the places you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Income Tax Exemption For Higher Education to suit a variety of purposes.

- Explore categories such as furniture, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets, flashcards, and learning tools.

- The perfect resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates free of charge.

- The blogs covered cover a wide spectrum of interests, starting from DIY projects to planning a party.

Maximizing Income Tax Exemption For Higher Education

Here are some inventive ways of making the most use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Print free worksheets to help reinforce your learning at home (or in the learning environment).

3. Event Planning

- Invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Get organized with printable calendars, to-do lists, and meal planners.

Conclusion

Income Tax Exemption For Higher Education are a treasure trove of creative and practical resources catering to different needs and needs and. Their access and versatility makes them an invaluable addition to both professional and personal life. Explore the wide world of Income Tax Exemption For Higher Education now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually are they free?

- Yes you can! You can print and download the resources for free.

-

Can I make use of free printing templates for commercial purposes?

- It's based on the usage guidelines. Always review the terms of use for the creator before utilizing printables for commercial projects.

-

Are there any copyright issues when you download Income Tax Exemption For Higher Education?

- Certain printables might have limitations concerning their use. You should read the terms and conditions provided by the creator.

-

How can I print printables for free?

- You can print them at home with either a printer at home or in a print shop in your area for high-quality prints.

-

What software will I need to access printables at no cost?

- Many printables are offered in the format PDF. This can be opened using free programs like Adobe Reader.

We Got 12A Exemption Registration Under Income Tax

We Got 12A Exemption Registration Under Income Tax

Check more sample of Income Tax Exemption For Higher Education below

House Of Representatives Files Bill Of Tax Exemption For Senior

If You re Already Looking Ahead To April 15 2020 Here Are The Income

House Of Representatives

Life Insurance Income Tax Exemption IndiaFilings

The Take home Pay Is Bigger As Senate Approved Higher Personal Income

Tax Exemption On Education Loan Who Is Eligible To Claim Tax Benefits

https://cleartax.in/s/tax-benefits-on-education-loan

Section 80E of the Income Tax Act 1961 deals with the terms and conditions of availing income tax deductions if you have an ongoing education loan A set of criteria is given under this section mentioning who is eligible to get the deductions and under what conditions Let s discuss them in detail

https://www.vero.fi/en/detailed-guidance/guidance/...

The tax relief concerning the income from work performed in the country of study only applies if the student is studying in a university or other institute of higher education in the student s home country

Section 80E of the Income Tax Act 1961 deals with the terms and conditions of availing income tax deductions if you have an ongoing education loan A set of criteria is given under this section mentioning who is eligible to get the deductions and under what conditions Let s discuss them in detail

The tax relief concerning the income from work performed in the country of study only applies if the student is studying in a university or other institute of higher education in the student s home country

Life Insurance Income Tax Exemption IndiaFilings

If You re Already Looking Ahead To April 15 2020 Here Are The Income

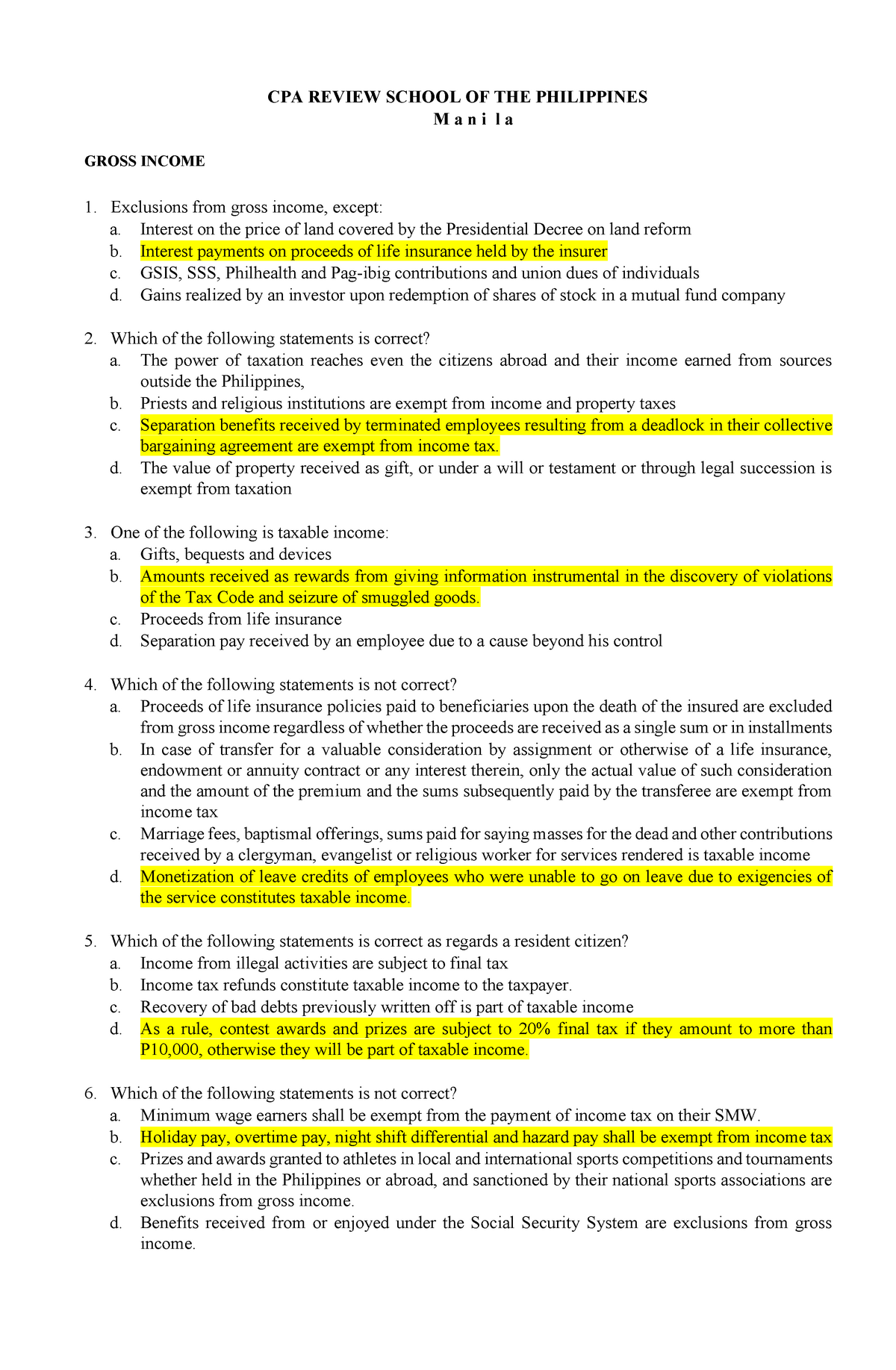

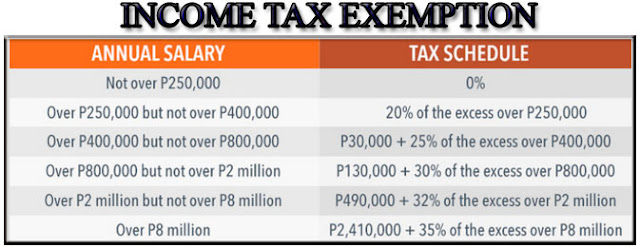

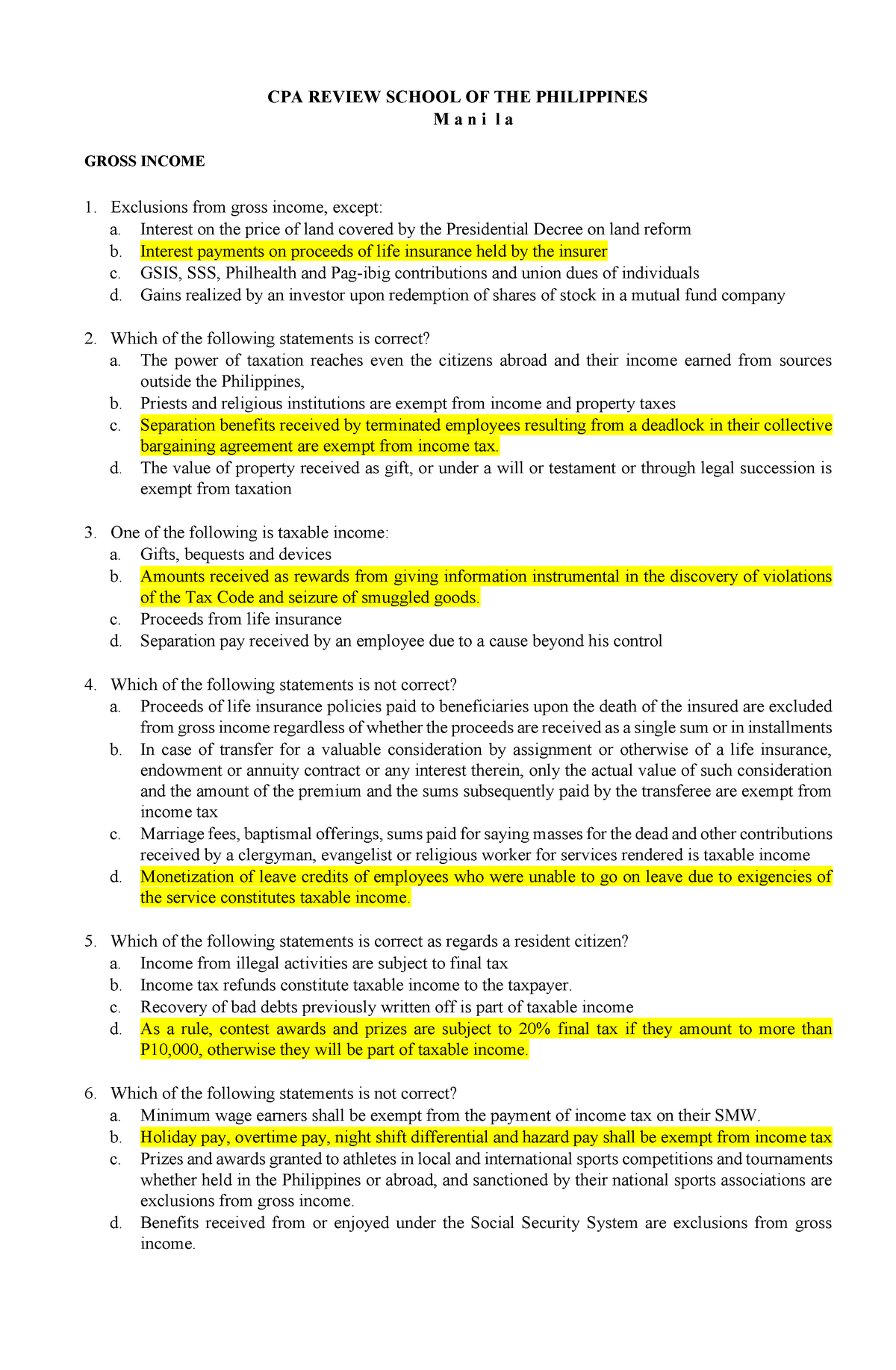

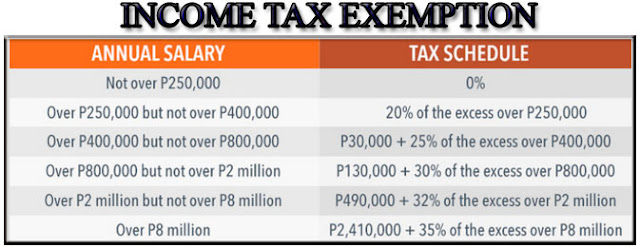

The Take home Pay Is Bigger As Senate Approved Higher Personal Income

Tax Exemption On Education Loan Who Is Eligible To Claim Tax Benefits

Income Tax Calculation Example 2 For Salary Employees 2023 24

Tax Archives CA CLUB

Tax Archives CA CLUB

Tax Exemption On Loan For Abroad Education U S 80E SAG Infotech Tax