In the digital age, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible, printed materials hasn't diminished. Whether it's for educational purposes as well as creative projects or just adding some personal flair to your area, Income Tax Exemption For Home Loan 2022 23 are now a vital resource. This article will take a dive deep into the realm of "Income Tax Exemption For Home Loan 2022 23," exploring the benefits of them, where they are available, and how they can enhance various aspects of your life.

Get Latest Income Tax Exemption For Home Loan 2022 23 Below

Income Tax Exemption For Home Loan 2022 23

Income Tax Exemption For Home Loan 2022 23 -

Home loan tax benefits include deductions on principal interest payments under sections 80C 24 b of Income Tax Act reducing overall tax liability for owners

Asit Manohar New income tax rules from April 2022 On new home loans sanctioned in FY23 first time home buyers won t be able to claim tax benefit under Section 80EEA as this special

Income Tax Exemption For Home Loan 2022 23 offer a wide variety of printable, downloadable resources available online for download at no cost. These resources come in various types, like worksheets, templates, coloring pages, and more. One of the advantages of Income Tax Exemption For Home Loan 2022 23 lies in their versatility as well as accessibility.

More of Income Tax Exemption For Home Loan 2022 23

Georgia Sales Tax Exemption Form St 5 ExemptForm

Georgia Sales Tax Exemption Form St 5 ExemptForm

31 May 2022 Home Loan One of the primary benefits of home loans is that you get to enjoy substantial tax rebates which significantly reduce your tax outgo If you already have a home loan you can claim home loan tax benefits under various sections of the Income Tax Act including Section 24 b 80C 80EE and 80EEA

Income Tax Benefit on Home Loan FY 2023 24 Assessment Year 2024 25 Home Home Loan Home Loan Tax Benefit Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section

Printables that are free have gained enormous popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

Modifications: You can tailor the design to meet your needs in designing invitations planning your schedule or even decorating your house.

-

Educational Impact: Downloads of educational content for free can be used by students of all ages. This makes the perfect tool for parents and educators.

-

It's easy: Instant access to a myriad of designs as well as templates helps save time and effort.

Where to Find more Income Tax Exemption For Home Loan 2022 23

We Got 12A Exemption Registration Under Income Tax

We Got 12A Exemption Registration Under Income Tax

A tax payer can deduct both the interest paid on a house loan as well as the principal amount that was repaid on the loan In the case of self occupied property section 24 allows a deduction on the interest paid on a house loan up to a maximum of Rs 2 lakh in a given fiscal year

Updated on Mar 14th 2024 7 min read Section 80EE allows benefits on the interest portion of the residential house property loan availed from any financial institution As per this section you can claim a deduction of up to Rs 50 000 per financial year You can continue to claim this deduction until you have fully repaid the loan

We hope we've stimulated your curiosity about Income Tax Exemption For Home Loan 2022 23 Let's find out where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection and Income Tax Exemption For Home Loan 2022 23 for a variety goals.

- Explore categories like home decor, education, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets Flashcards, worksheets, and other educational materials.

- Perfect for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs or templates for download.

- The blogs are a vast array of topics, ranging everything from DIY projects to party planning.

Maximizing Income Tax Exemption For Home Loan 2022 23

Here are some unique ways to make the most of Income Tax Exemption For Home Loan 2022 23:

1. Home Decor

- Print and frame beautiful art, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use printable worksheets from the internet to reinforce learning at home (or in the learning environment).

3. Event Planning

- Invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Income Tax Exemption For Home Loan 2022 23 are an abundance filled with creative and practical information that satisfy a wide range of requirements and pursuits. Their access and versatility makes them a fantastic addition to both professional and personal lives. Explore the plethora of Income Tax Exemption For Home Loan 2022 23 now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free completely free?

- Yes, they are! You can print and download these documents for free.

-

Can I use the free printouts for commercial usage?

- It depends on the specific terms of use. Always consult the author's guidelines prior to using the printables in commercial projects.

-

Are there any copyright violations with printables that are free?

- Certain printables might have limitations on usage. Make sure you read the terms and conditions offered by the creator.

-

How can I print printables for free?

- Print them at home using printing equipment or visit the local print shops for top quality prints.

-

What software do I need in order to open printables at no cost?

- A majority of printed materials are in PDF format, which can be opened with free software such as Adobe Reader.

50 Income Tax Exemption For High Earners In Cyprus

Income Tax Exemption For Gratuity Enhanced Up To Rs 20 Lakhs YouTube

Check more sample of Income Tax Exemption For Home Loan 2022 23 below

Home Loan Interest Tax Exemption Limit 2019 20 Home Sweet Home

We Got 12A Exemption Registration Under Income Tax

Auto Loan Calculator Surprise You Can Claim Income Tax Exemption If

Income Tax Exemption For Home Buyers No Tax On Making New House

Zenman1550 On Twitter RT Safelanding Herschel Walker Georgia

Income Tax Calculation Example 2 For Salary Employees 2023 24

https://www.livemint.com/money/personal-finance/...

Asit Manohar New income tax rules from April 2022 On new home loans sanctioned in FY23 first time home buyers won t be able to claim tax benefit under Section 80EEA as this special

https://www.livemint.com/money/personal-finance/...

4 min read 20 Mar 2023 06 18 PM IST Vipul Das A Home Loan is a financial source for your dream come true along with making a better deal for tax savers A home loan provides a number

Asit Manohar New income tax rules from April 2022 On new home loans sanctioned in FY23 first time home buyers won t be able to claim tax benefit under Section 80EEA as this special

4 min read 20 Mar 2023 06 18 PM IST Vipul Das A Home Loan is a financial source for your dream come true along with making a better deal for tax savers A home loan provides a number

Income Tax Exemption For Home Buyers No Tax On Making New House

We Got 12A Exemption Registration Under Income Tax

Zenman1550 On Twitter RT Safelanding Herschel Walker Georgia

Income Tax Calculation Example 2 For Salary Employees 2023 24

Life Insurance Income Tax Exemption IndiaFilings

Herschel Walker Georgia Senate Candidate Gets Tax Exemption For Home

Herschel Walker Georgia Senate Candidate Gets Tax Exemption For Home

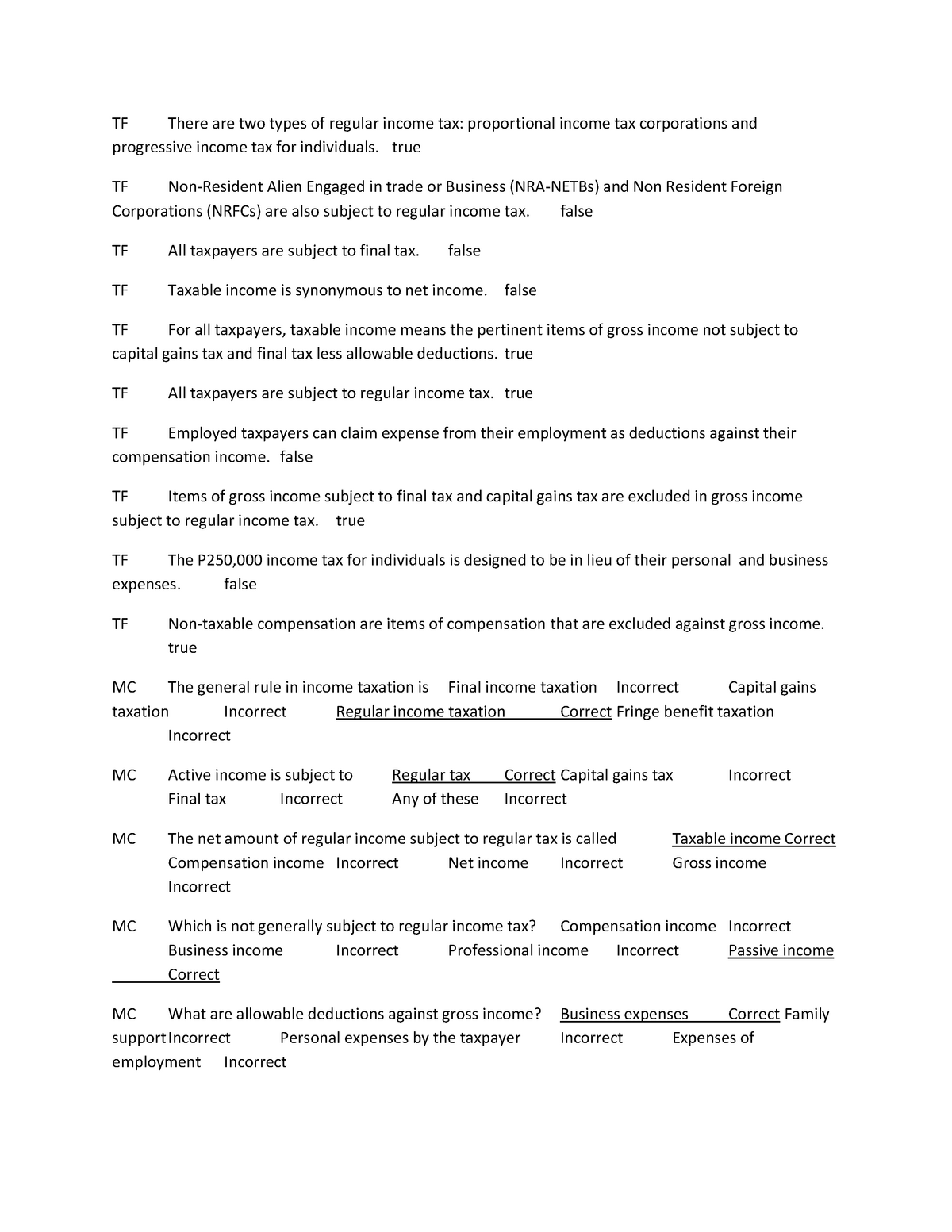

Introduction Of Income Taxation TF There Are Two Types Of Regular