In the digital age, with screens dominating our lives The appeal of tangible printed items hasn't gone away. For educational purposes in creative or artistic projects, or just adding an individual touch to your home, printables for free have become an invaluable resource. In this article, we'll dive into the sphere of "Income Tax Exemption For Home Loan Under Construction," exploring what they are, how to find them, and how they can enrich various aspects of your daily life.

Get Latest Income Tax Exemption For Home Loan Under Construction Below

Income Tax Exemption For Home Loan Under Construction

Income Tax Exemption For Home Loan Under Construction -

A home loan borrower can claim Income Tax exemption on interest payments of up to Rs 2 lakh and another Rs 1 5 lakh under Section 80 C towards the principal repayment

Yes tax benefits on a home loan taken for the renovation of a property can be claimed under Section 24 of the Income Tax Act 1961 up to a maximum limit of Rs

Income Tax Exemption For Home Loan Under Construction provide a diverse assortment of printable material that is available online at no cost. They come in many styles, from worksheets to templates, coloring pages, and much more. The appealingness of Income Tax Exemption For Home Loan Under Construction is their flexibility and accessibility.

More of Income Tax Exemption For Home Loan Under Construction

We Got 12A Exemption Registration Under Income Tax

We Got 12A Exemption Registration Under Income Tax

The interest portion of the EMI paid for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 in case of self occupied

You can claim tax benefits on a Home Loan under construction property up to Rs 2 Lakh under Section 24B and up to 1 5 Lakh under Section 80C of the Income Tax Act Read

Income Tax Exemption For Home Loan Under Construction have gained a lot of popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Personalization This allows you to modify print-ready templates to your specific requirements be it designing invitations to organize your schedule or decorating your home.

-

Educational Use: Downloads of educational content for free offer a wide range of educational content for learners of all ages. This makes them a useful tool for parents and teachers.

-

An easy way to access HTML0: Access to many designs and templates can save you time and energy.

Where to Find more Income Tax Exemption For Home Loan Under Construction

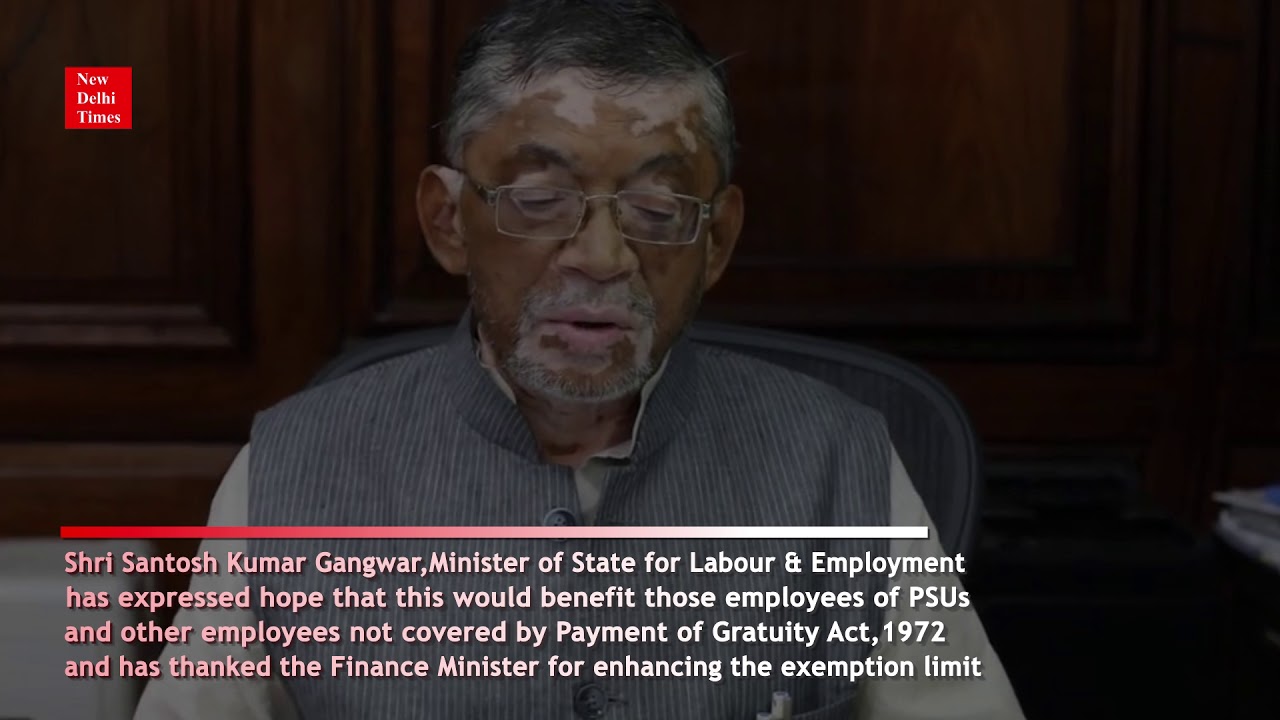

Income Tax Exemption For Gratuity Enhanced Up To Rs 20 Lakhs YouTube

Income Tax Exemption For Gratuity Enhanced Up To Rs 20 Lakhs YouTube

Irrespective of the property being under construction you could still be enjoying tax deductions under Section 80C on the principal component of your home loan However

As per the current income tax rules you cannot claim any tax benefits for the home loan till you get possession of the house i e during the pre construction phase Even if you

We've now piqued your curiosity about Income Tax Exemption For Home Loan Under Construction Let's take a look at where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection in Income Tax Exemption For Home Loan Under Construction for different applications.

- Explore categories such as the home, decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets Flashcards, worksheets, and other educational materials.

- Great for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- The blogs covered cover a wide array of topics, ranging that range from DIY projects to party planning.

Maximizing Income Tax Exemption For Home Loan Under Construction

Here are some creative ways of making the most of Income Tax Exemption For Home Loan Under Construction:

1. Home Decor

- Print and frame stunning images, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Utilize free printable worksheets to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep your calendars organized by printing printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Income Tax Exemption For Home Loan Under Construction are a treasure trove of practical and innovative resources which cater to a wide range of needs and needs and. Their availability and versatility make them a fantastic addition to both professional and personal lives. Explore the vast array of printables for free today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually completely free?

- Yes you can! You can print and download these tools for free.

-

Can I use the free printables for commercial uses?

- It depends on the specific rules of usage. Always consult the author's guidelines before using any printables on commercial projects.

-

Do you have any copyright issues in Income Tax Exemption For Home Loan Under Construction?

- Certain printables might have limitations in their usage. Check the terms and conditions provided by the designer.

-

How can I print printables for free?

- Print them at home with printing equipment or visit a local print shop for the highest quality prints.

-

What program do I require to open printables that are free?

- Most PDF-based printables are available with PDF formats, which can be opened with free software, such as Adobe Reader.

We Got 12A Exemption Registration Under Income Tax

Income Tax Exemption For Home Buyers No Tax On Making New House

Check more sample of Income Tax Exemption For Home Loan Under Construction below

Auto Loan Calculator Surprise You Can Claim Income Tax Exemption If

First WAVE Gets Home Loan Under GI Bill Of Rights April 1945 Ann

Know How You Can Get Tax Benefits On Home Loan

Herschel Walker Georgia Senate Candidate Gets Tax Exemption For Home

Resolved Home Loan Request For Non Liability Certificate From SBI

India Budget 2021 Tax Highlights Activpayroll

https://cleartax.in › home-loan-tax-benefit

Yes tax benefits on a home loan taken for the renovation of a property can be claimed under Section 24 of the Income Tax Act 1961 up to a maximum limit of Rs

https://cleartax.in › case-study-deduction-for-pre-construction-interest

Under section 24 of the Income Tax Act pre construction interest can be claimed for under construction residential property However this can be claimed only

Yes tax benefits on a home loan taken for the renovation of a property can be claimed under Section 24 of the Income Tax Act 1961 up to a maximum limit of Rs

Under section 24 of the Income Tax Act pre construction interest can be claimed for under construction residential property However this can be claimed only

Herschel Walker Georgia Senate Candidate Gets Tax Exemption For Home

First WAVE Gets Home Loan Under GI Bill Of Rights April 1945 Ann

Resolved Home Loan Request For Non Liability Certificate From SBI

India Budget 2021 Tax Highlights Activpayroll

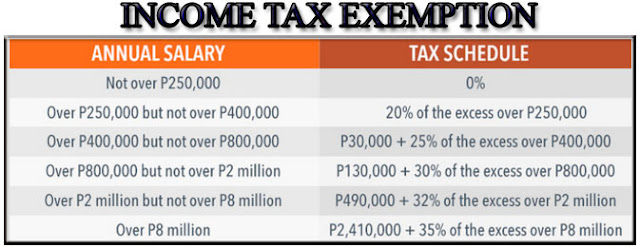

The Take home Pay Is Bigger As Senate Approved Higher Personal Income

Government Doubles Income Tax Exemption For Gratuity Updated You

Government Doubles Income Tax Exemption For Gratuity Updated You

House Of Representatives