Today, in which screens are the norm, the charm of tangible, printed materials hasn't diminished. It doesn't matter if it's for educational reasons as well as creative projects or simply to add the personal touch to your space, Income Tax Exemption For Housing Loan can be an excellent resource. Through this post, we'll dive into the sphere of "Income Tax Exemption For Housing Loan," exploring what they are, how they are, and how they can enhance various aspects of your life.

Get Latest Income Tax Exemption For Housing Loan Below

Income Tax Exemption For Housing Loan

Income Tax Exemption For Housing Loan -

Section 24 b of the Income Tax Act allows for a deduction of up to Rs 2 lakh on the interest paid towards your home loan in a financial year To avail of this deduction you need to make

Understand tax savings on a home loan under sections 24 80EE and 80C Home loan customers should be aware of the EMI or interest rate tax benefits as they could reduce taxable income for income tax calculations under home loan tax benefit 80c section

Income Tax Exemption For Housing Loan encompass a wide range of downloadable, printable content that can be downloaded from the internet at no cost. These printables come in different formats, such as worksheets, templates, coloring pages and much more. The appeal of printables for free is their versatility and accessibility.

More of Income Tax Exemption For Housing Loan

Toaz Tax Multiple Choice CPA REVIEW SCHOOL OF THE PHILIPPINES M A N I

Toaz Tax Multiple Choice CPA REVIEW SCHOOL OF THE PHILIPPINES M A N I

To encourage citizens to invest in property the government provides a range of home loan tax exemptions and deductions under the Income Tax Act of 1961 All home loan borrowers should be informed of all income tax refunds available on home loans since doing so can drastically lower their tax payments

Home renovation If you take a personal loan to renovate or repair your home then you will be eligible for a tax deduction under Section 24 b of the Income Tax Act You can claim deductions of up to Rs 30 000 per year on the interest paid on a personal loan

Income Tax Exemption For Housing Loan have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

The ability to customize: They can make the design to meet your needs in designing invitations, organizing your schedule, or even decorating your house.

-

Educational Benefits: Printing educational materials for no cost offer a wide range of educational content for learners of all ages. This makes them a great tool for parents and teachers.

-

Simple: Instant access to various designs and templates will save you time and effort.

Where to Find more Income Tax Exemption For Housing Loan

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Individuals who apply for a home loan can receive home loan tax benefits under several sections such as Section 80 EEA and Section 24b of the Income Tax Act 1961 which grants income tax benefits of up to Rs 1 5 lakh In this article we will look at the various tax benefits for home loans

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b

We hope we've stimulated your interest in printables for free We'll take a look around to see where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Income Tax Exemption For Housing Loan to suit a variety of motives.

- Explore categories like decoration for your home, education, management, and craft.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets including flashcards, learning tools.

- Great for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates at no cost.

- The blogs covered cover a wide range of interests, from DIY projects to planning a party.

Maximizing Income Tax Exemption For Housing Loan

Here are some inventive ways that you can make use of Income Tax Exemption For Housing Loan:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations that will adorn your living spaces.

2. Education

- Print worksheets that are free to enhance your learning at home, or even in the classroom.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Income Tax Exemption For Housing Loan are a treasure trove of fun and practical tools that can meet the needs of a variety of people and interest. Their accessibility and versatility make them a fantastic addition to the professional and personal lives of both. Explore the vast world of Income Tax Exemption For Housing Loan now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes you can! You can download and print the resources for free.

-

Do I have the right to use free printables to make commercial products?

- It's determined by the specific usage guidelines. Always verify the guidelines provided by the creator before using any printables on commercial projects.

-

Are there any copyright concerns when using Income Tax Exemption For Housing Loan?

- Some printables could have limitations regarding their use. Be sure to review the terms and regulations provided by the creator.

-

How do I print Income Tax Exemption For Housing Loan?

- Print them at home using printing equipment or visit a local print shop to purchase higher quality prints.

-

What program do I need in order to open printables that are free?

- A majority of printed materials are with PDF formats, which can be opened with free programs like Adobe Reader.

50 Income Tax Exemption For High Earners In Cyprus

Income Tax Exemption For Gratuity Enhanced Up To Rs 20 Lakhs YouTube

Check more sample of Income Tax Exemption For Housing Loan below

We Got 12A Exemption Registration Under Income Tax

Sales Tax Exemption Certificate Wisconsin

Housing Loan Tax Exemption Revision In Fiscal 2022 PLAZA HOMES

We Got 12A Exemption Registration Under Income Tax

Auto Loan Calculator Surprise You Can Claim Income Tax Exemption If

Life Insurance Income Tax Exemption IndiaFilings

https://www.hdfc.com › blog › home-finance › home-loan-tax-benefit

Understand tax savings on a home loan under sections 24 80EE and 80C Home loan customers should be aware of the EMI or interest rate tax benefits as they could reduce taxable income for income tax calculations under home loan tax benefit 80c section

https://housing.com › news › home-loans-guide-claiming-tax-benefits

On purchase of property with home loans borrowers enjoy a variety of deductions on their income tax liability These deductions against the tax could be claimed under four sections of the income tax act namely Section 80C

Understand tax savings on a home loan under sections 24 80EE and 80C Home loan customers should be aware of the EMI or interest rate tax benefits as they could reduce taxable income for income tax calculations under home loan tax benefit 80c section

On purchase of property with home loans borrowers enjoy a variety of deductions on their income tax liability These deductions against the tax could be claimed under four sections of the income tax act namely Section 80C

We Got 12A Exemption Registration Under Income Tax

Sales Tax Exemption Certificate Wisconsin

Auto Loan Calculator Surprise You Can Claim Income Tax Exemption If

Life Insurance Income Tax Exemption IndiaFilings

Pit The Tax Office Confirms The Tax Exemption for Housing Purposes

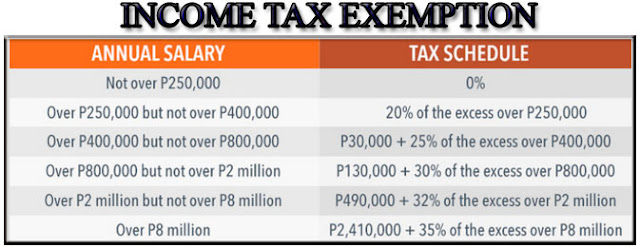

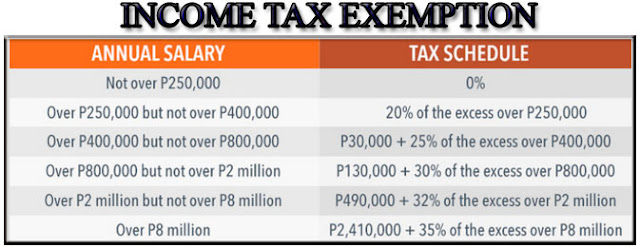

The Take home Pay Is Bigger As Senate Approved Higher Personal Income

The Take home Pay Is Bigger As Senate Approved Higher Personal Income

Income Tax Calculation Example 2 For Salary Employees 2023 24