In this digital age, where screens dominate our lives The appeal of tangible printed objects isn't diminished. Whatever the reason, whether for education project ideas, artistic or just adding a personal touch to your space, Income Tax Exemption For Medical Expenditure can be an excellent resource. With this guide, you'll take a dive through the vast world of "Income Tax Exemption For Medical Expenditure," exploring the benefits of them, where to find them, and how they can improve various aspects of your lives.

Get Latest Income Tax Exemption For Medical Expenditure Below

Income Tax Exemption For Medical Expenditure

Income Tax Exemption For Medical Expenditure -

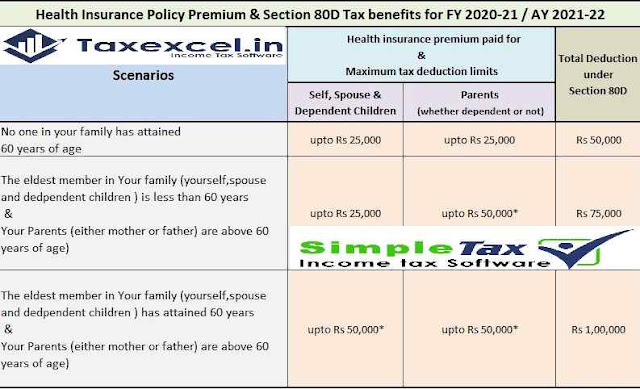

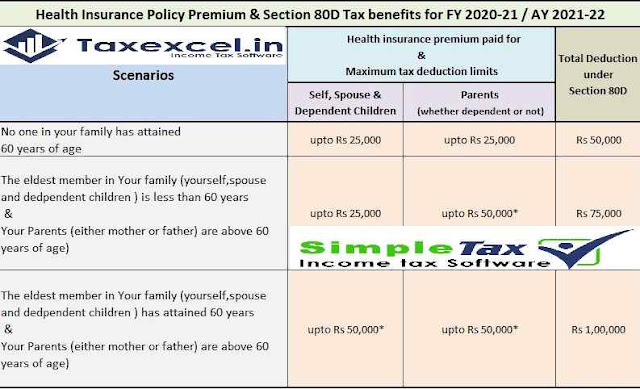

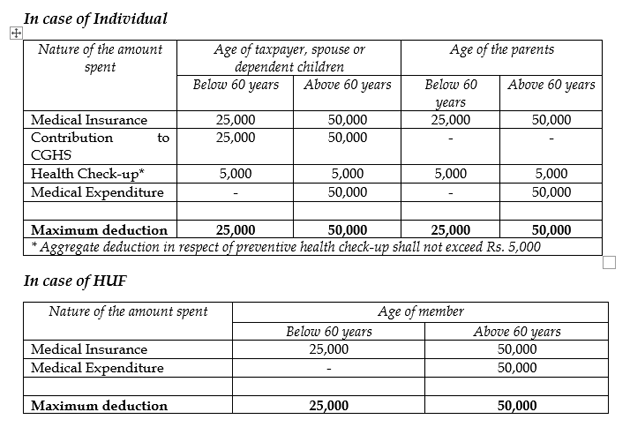

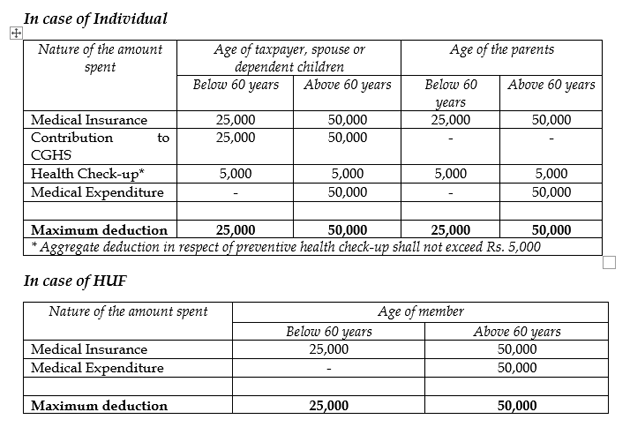

Section 80D allows the deduction for the Health Insurance premium or money spent on Medical Expenditure for self and parents

However if it is being claimed for a dependant then the person should be completely dependent on the individual claiming the deduction

Printables for free cover a broad collection of printable resources available online for download at no cost. These resources come in many forms, including worksheets, templates, coloring pages, and much more. The benefit of Income Tax Exemption For Medical Expenditure is their versatility and accessibility.

More of Income Tax Exemption For Medical Expenditure

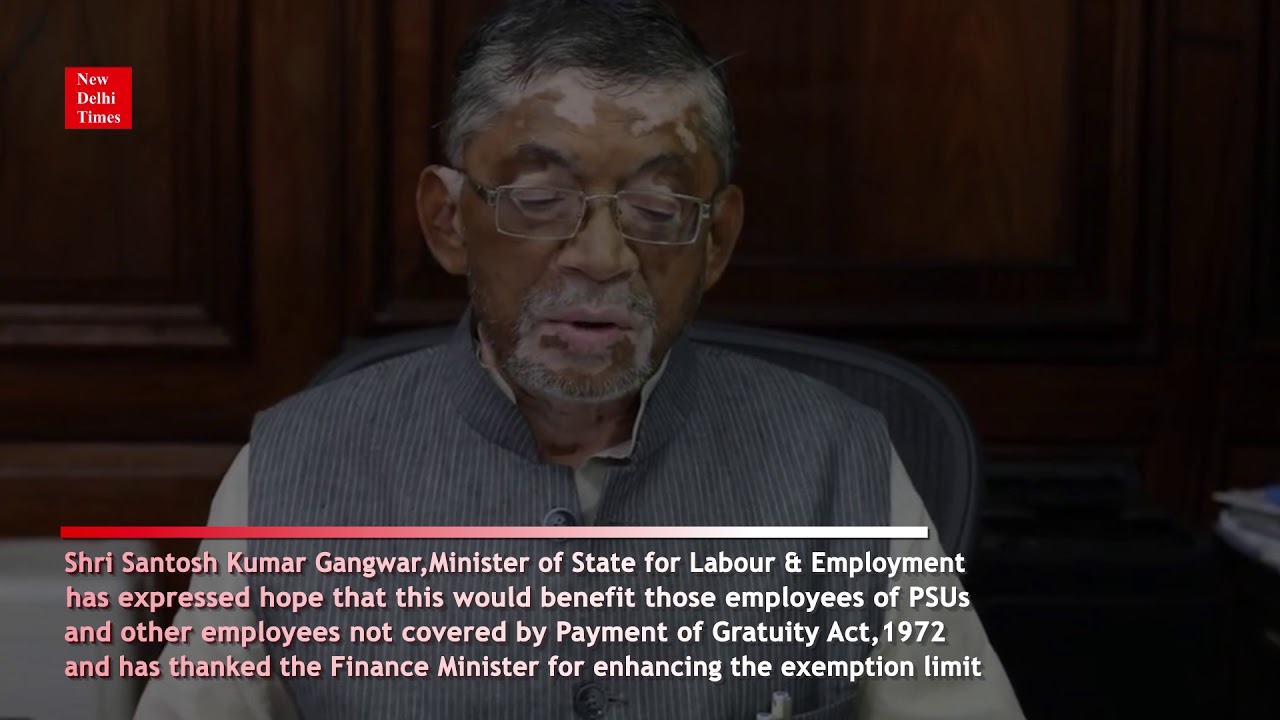

Income Tax Exemption For Gratuity Enhanced Up To Rs 20 Lakhs YouTube

Income Tax Exemption For Gratuity Enhanced Up To Rs 20 Lakhs YouTube

Section 80D allows senior citizens to claim deductions in their income tax filing It reduces their tax liabilities and increases tax savings A senior citizens who has incurred any

Deduction under Section 80DD of the income tax act is allowed to Resident Individuals or HUFs for a dependent who is differently abled and is wholly dependent on the

Income Tax Exemption For Medical Expenditure have garnered immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Customization: There is the possibility of tailoring printed materials to meet your requirements be it designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational Benefits: These Income Tax Exemption For Medical Expenditure are designed to appeal to students of all ages, making these printables a powerful source for educators and parents.

-

It's easy: Instant access to a variety of designs and templates saves time and effort.

Where to Find more Income Tax Exemption For Medical Expenditure

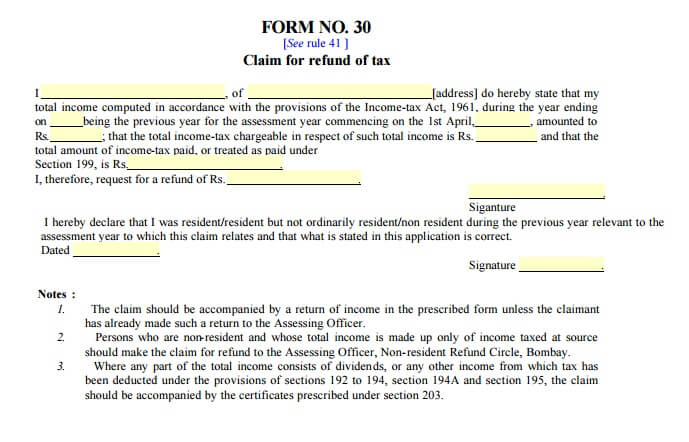

80DD FORM PDF

80DD FORM PDF

For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10

Can Medical Expenses Be Claimed Under Section 80D

Now that we've piqued your curiosity about Income Tax Exemption For Medical Expenditure We'll take a look around to see where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection in Income Tax Exemption For Medical Expenditure for different purposes.

- Explore categories like interior decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing as well as flashcards and other learning materials.

- Perfect for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs with templates and designs for free.

- The blogs are a vast array of topics, ranging ranging from DIY projects to party planning.

Maximizing Income Tax Exemption For Medical Expenditure

Here are some inventive ways create the maximum value of Income Tax Exemption For Medical Expenditure:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations to adorn your living spaces.

2. Education

- Print out free worksheets and activities to enhance your learning at home also in the classes.

3. Event Planning

- Design invitations, banners, and decorations for special events like weddings and birthdays.

4. Organization

- Get organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Income Tax Exemption For Medical Expenditure are an abundance of innovative and useful resources that meet a variety of needs and hobbies. Their access and versatility makes them a great addition to the professional and personal lives of both. Explore the endless world of Income Tax Exemption For Medical Expenditure right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really for free?

- Yes you can! You can download and print these items for free.

-

Can I download free templates for commercial use?

- It depends on the specific terms of use. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns with Income Tax Exemption For Medical Expenditure?

- Some printables may come with restrictions regarding their use. Be sure to review the terms and condition of use as provided by the creator.

-

How can I print Income Tax Exemption For Medical Expenditure?

- Print them at home with either a printer at home or in the local print shops for the highest quality prints.

-

What program will I need to access printables free of charge?

- Many printables are offered in PDF format. These can be opened using free software like Adobe Reader.

Louisiana Medical Tax Exemption For Medical Devices Agile

-1920w.jpg)

Preventive Check Up 80d Wkcn

Check more sample of Income Tax Exemption For Medical Expenditure below

We Got 12A Exemption Registration Under Income Tax

Medical Expenditure Of Women During Pregnancy Childbirth And

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Claim Deduction Under Section 80DD Learn By Quicko

Tax Exemption Of Health Insurance U s 80 D F Y 2020 21 With Automated

Download Auto Calculate And Auto Preparation Software In Excel For The

https://economictimes.indiatimes.com…

However if it is being claimed for a dependant then the person should be completely dependent on the individual claiming the deduction

https://tax2win.in/guide/section-80d-ded…

The expenditure is allowed for the deduction when no medical insurance premium is paid for the senior citizen The term medical expenditure has not been defined under the income tax act but generally it will include

However if it is being claimed for a dependant then the person should be completely dependent on the individual claiming the deduction

The expenditure is allowed for the deduction when no medical insurance premium is paid for the senior citizen The term medical expenditure has not been defined under the income tax act but generally it will include

Claim Deduction Under Section 80DD Learn By Quicko

Medical Expenditure Of Women During Pregnancy Childbirth And

Tax Exemption Of Health Insurance U s 80 D F Y 2020 21 With Automated

Download Auto Calculate And Auto Preparation Software In Excel For The

What Is Income Tax Limit For Property Tax And Insurance

Union Budget 2022 Why Budget 2022 Should Allow Tax Deduction For

Union Budget 2022 Why Budget 2022 Should Allow Tax Deduction For

Sample Letter Exemption Doc Template PdfFiller