In this digital age, where screens have become the dominant feature of our lives however, the attraction of tangible printed objects isn't diminished. Whether it's for educational purposes such as creative projects or simply to add a personal touch to your area, Income Tax Exemption For Partnership Firm can be an excellent source. In this article, we'll take a dive deep into the realm of "Income Tax Exemption For Partnership Firm," exploring what they are, where to find them, and the ways that they can benefit different aspects of your lives.

Get Latest Income Tax Exemption For Partnership Firm Below

Income Tax Exemption For Partnership Firm

Income Tax Exemption For Partnership Firm -

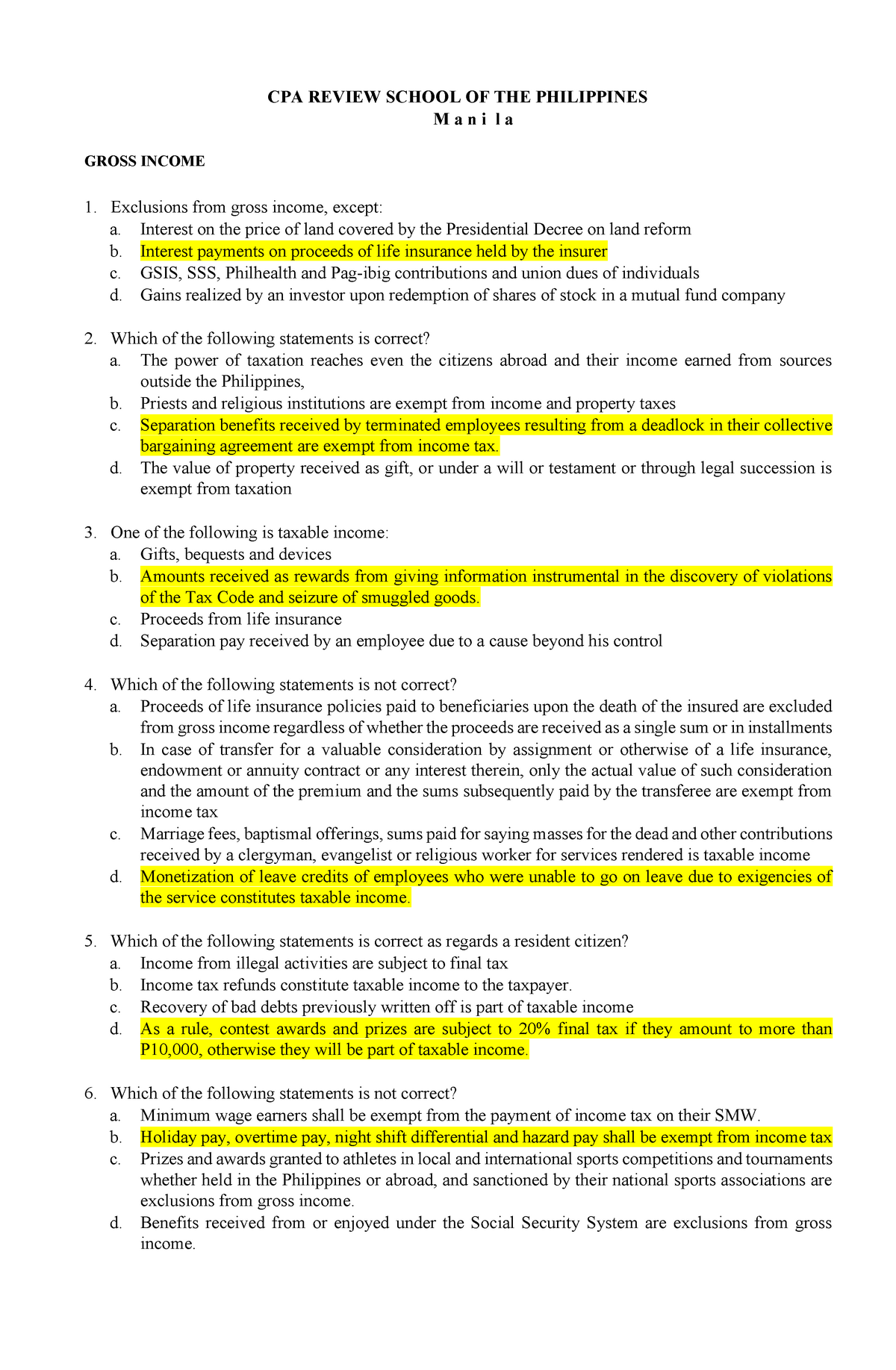

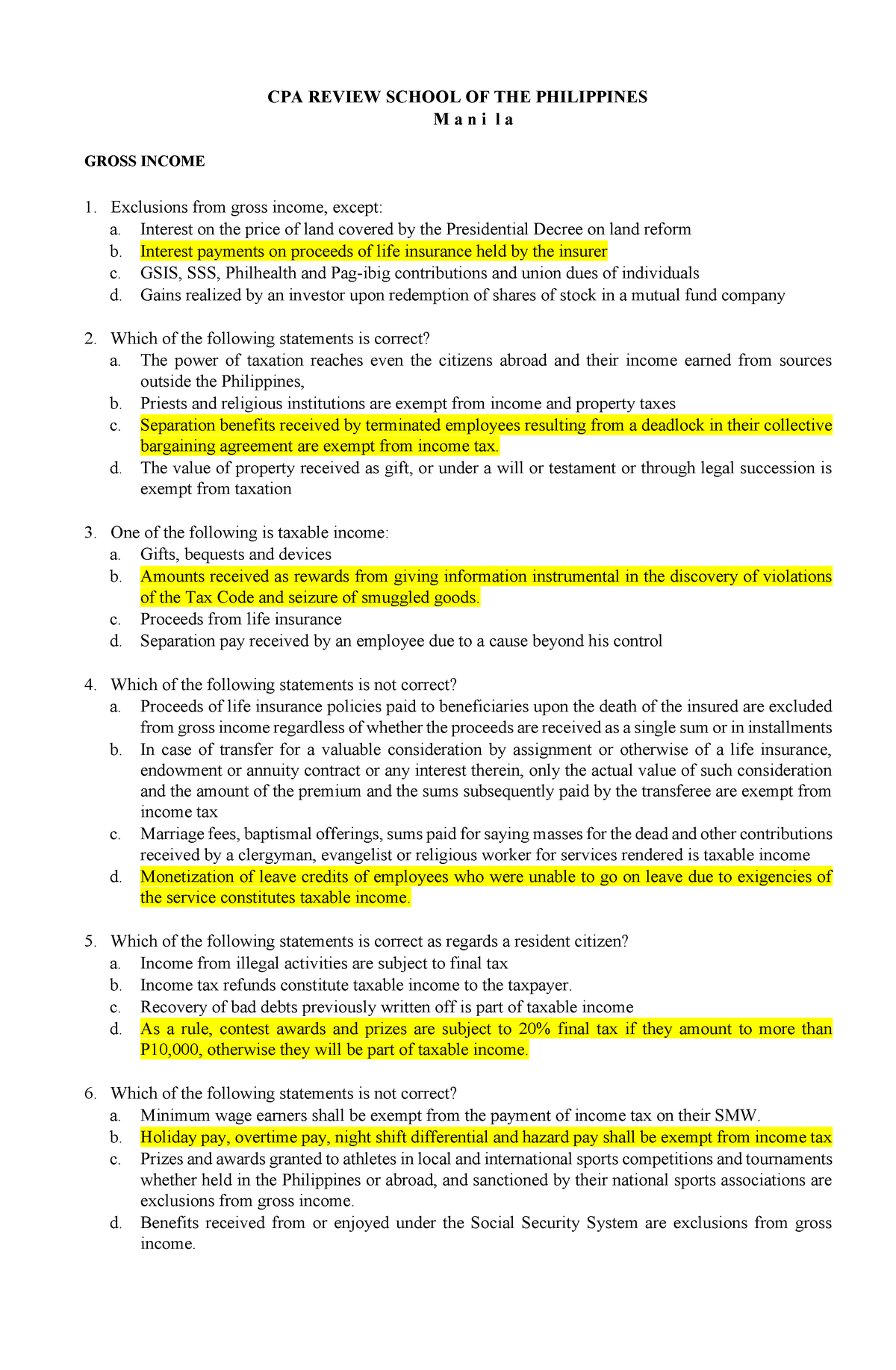

Section 26 of the Tax Code 1 as amended exempts a general professional partnership from income tax Persons who engage in business as partners in a general professional

Provisions of section 10 2A of the Income Tax Act exempts share of profit received by a partner in the total income of the partnership firm LLP The main

Income Tax Exemption For Partnership Firm offer a wide variety of printable, downloadable resources available online for download at no cost. They come in many forms, including worksheets, templates, coloring pages, and more. One of the advantages of Income Tax Exemption For Partnership Firm is in their variety and accessibility.

More of Income Tax Exemption For Partnership Firm

50 Income Tax Exemption For High Earners In Cyprus

50 Income Tax Exemption For High Earners In Cyprus

What is Partner s Remuneration A partner s remuneration is the salary bonus or commission paid to a partner by a partnership firm Similar to regular employees

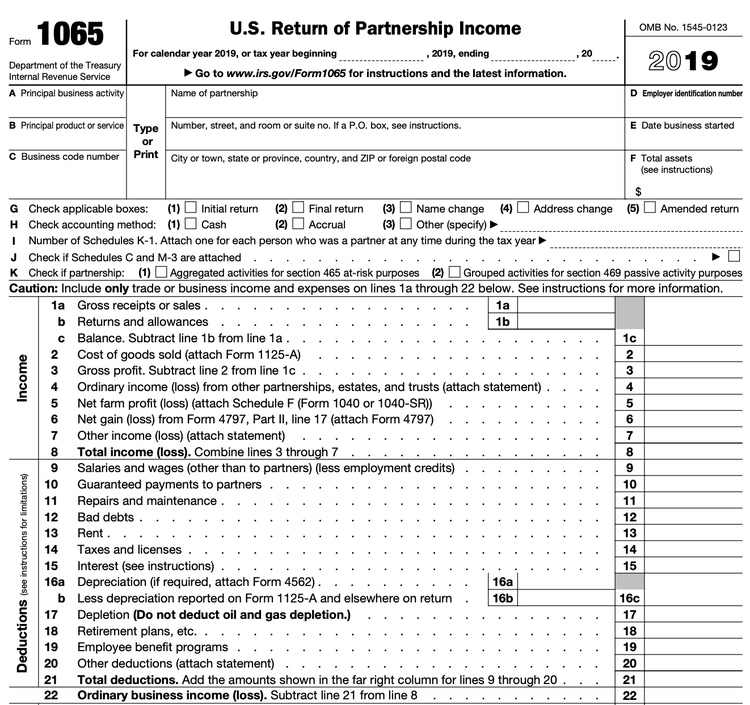

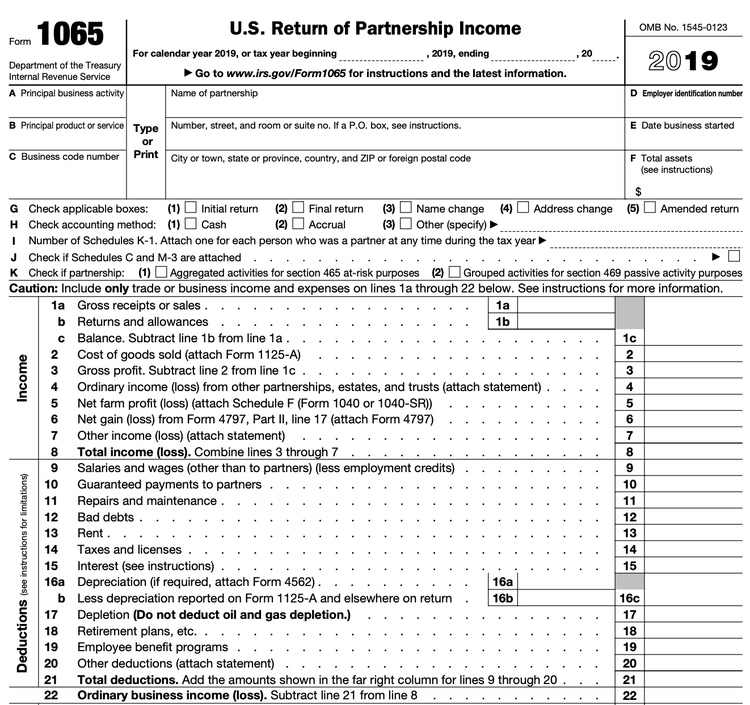

Income Tax at a flat rate of 30 is levied on Partnership Firms and LLP s Computation of taxes as per Income Tax Slab Rates is not allowed as the benefit of Slab Rates is only

Income Tax Exemption For Partnership Firm have gained immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

The ability to customize: Your HTML0 customization options allow you to customize the design to meet your needs for invitations, whether that's creating them or arranging your schedule or decorating your home.

-

Educational Value: Printables for education that are free offer a wide range of educational content for learners of all ages. This makes them a great device for teachers and parents.

-

An easy way to access HTML0: immediate access various designs and templates, which saves time as well as effort.

Where to Find more Income Tax Exemption For Partnership Firm

Income Tax Exemption For Gratuity Enhanced Up To Rs 20 Lakhs YouTube

Income Tax Exemption For Gratuity Enhanced Up To Rs 20 Lakhs YouTube

The appellant has claimed that income received as partner in a partnership firm shall be exempt u s 10 2A of the Income Tax Act Though it is correct that a

24 Jun 2023 Reading Time 12 Minutes Tax planning is an essential aspect of managing the finances of a partnership firm in India By

We hope we've stimulated your curiosity about Income Tax Exemption For Partnership Firm Let's take a look at where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Income Tax Exemption For Partnership Firm suitable for many applications.

- Explore categories like decorations for the home, education and organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets for flashcards, lessons, and worksheets. materials.

- It is ideal for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- The blogs covered cover a wide selection of subjects, including DIY projects to planning a party.

Maximizing Income Tax Exemption For Partnership Firm

Here are some unique ways of making the most use of printables for free:

1. Home Decor

- Print and frame gorgeous art, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Use printable worksheets from the internet to enhance learning at home as well as in the class.

3. Event Planning

- Design invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

Income Tax Exemption For Partnership Firm are a treasure trove with useful and creative ideas that can meet the needs of a variety of people and interest. Their availability and versatility make them a fantastic addition to every aspect of your life, both professional and personal. Explore the vast world that is Income Tax Exemption For Partnership Firm today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax Exemption For Partnership Firm really free?

- Yes they are! You can download and print these files for free.

-

Can I utilize free printables in commercial projects?

- It's determined by the specific usage guidelines. Always read the guidelines of the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Some printables could have limitations on their use. Be sure to read the terms of service and conditions provided by the designer.

-

How do I print Income Tax Exemption For Partnership Firm?

- Print them at home using printing equipment or visit any local print store for superior prints.

-

What program do I need in order to open printables free of charge?

- Most PDF-based printables are available in the format PDF. This can be opened using free software, such as Adobe Reader.

We Got 12A Exemption Registration Under Income Tax

Partnership Firm Income Tax Slab

Check more sample of Income Tax Exemption For Partnership Firm below

We Got 12A Exemption Registration Under Income Tax

Income Tax Exemption For Home Buyers No Tax On Making New House

Income Tax Calculator For Partnership Firm Guide 2023

House Of Representatives Files Bill Of Tax Exemption For Senior

Life Insurance Income Tax Exemption IndiaFilings

4 Steps To Filing Your Partnership Taxes

https://taxguru.in/income-tax/section-102a...

Provisions of section 10 2A of the Income Tax Act exempts share of profit received by a partner in the total income of the partnership firm LLP The main

https://tax2win.in/guide/tax-on-partner-renumeration

If the interest paid exceeds the permissible amount the firm cannot claim it as a deduction and will have to discharge tax on such excess amount However such

Provisions of section 10 2A of the Income Tax Act exempts share of profit received by a partner in the total income of the partnership firm LLP The main

If the interest paid exceeds the permissible amount the firm cannot claim it as a deduction and will have to discharge tax on such excess amount However such

House Of Representatives Files Bill Of Tax Exemption For Senior

Income Tax Exemption For Home Buyers No Tax On Making New House

Life Insurance Income Tax Exemption IndiaFilings

4 Steps To Filing Your Partnership Taxes

Income Tax Calculation Example 2 For Salary Employees 2023 24

Dissolution Of Partnership Firm And It s Income Tax Liablilty

Dissolution Of Partnership Firm And It s Income Tax Liablilty

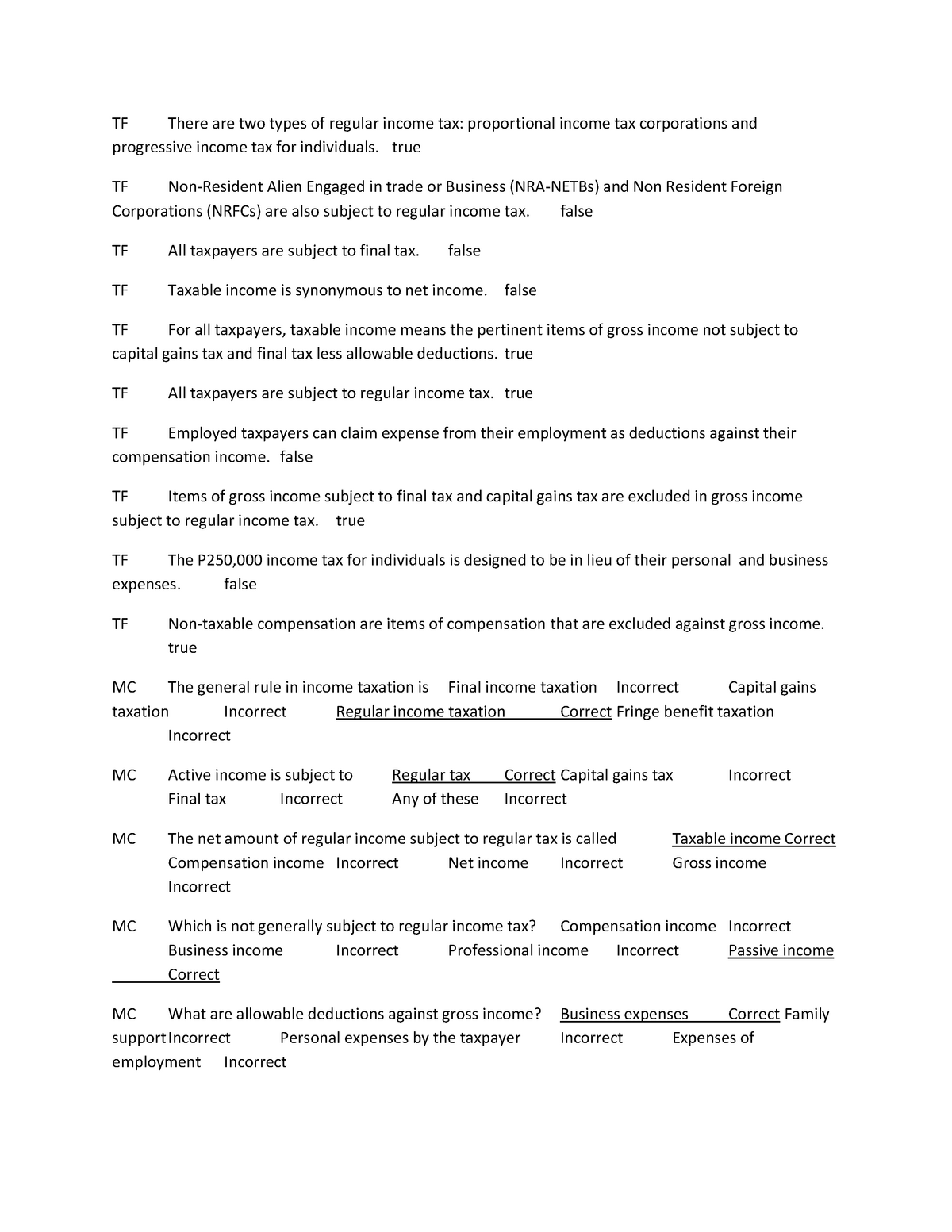

Introduction Of Income Taxation TF There Are Two Types Of Regular