In a world when screens dominate our lives, the charm of tangible printed material hasn't diminished. Be it for educational use or creative projects, or simply adding some personal flair to your home, printables for free have become a valuable source. In this article, we'll dive deeper into "Income Tax Exemption For Physically Handicapped Dependent Pdf," exploring the benefits of them, where to find them, and what they can do to improve different aspects of your daily life.

Get Latest Income Tax Exemption For Physically Handicapped Dependent Pdf Below

Income Tax Exemption For Physically Handicapped Dependent Pdf

Income Tax Exemption For Physically Handicapped Dependent Pdf -

Government of India has in order to provide some relief to those who have a dependent with disability or sever disability provided some relief s from Income tax under section 80DD of the Income Tax Act 1961 Deduction allowed under this section is Rs 75 000 if disabled dependant is not suffering from severe disability

Section 80DD Here we explains everything about Section 80DD of income tax act including eligibility criteria deductions available and how to claim them Section 80DD is the deduction for the medical maintenance of a dependant who is a person with a major disability

The Income Tax Exemption For Physically Handicapped Dependent Pdf are a huge assortment of printable resources available online for download at no cost. They come in many designs, including worksheets templates, coloring pages and more. The appealingness of Income Tax Exemption For Physically Handicapped Dependent Pdf is in their versatility and accessibility.

More of Income Tax Exemption For Physically Handicapped Dependent Pdf

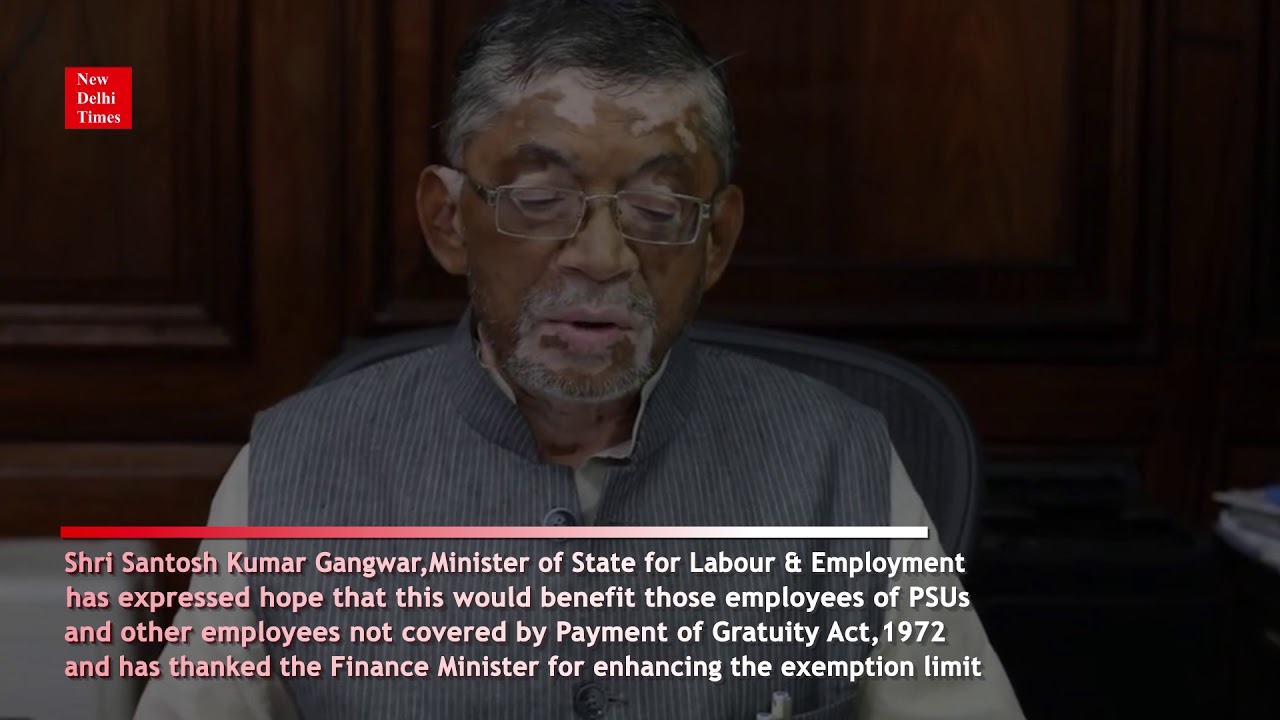

Income Tax Exemption For Gratuity Enhanced Up To Rs 20 Lakhs YouTube

Income Tax Exemption For Gratuity Enhanced Up To Rs 20 Lakhs YouTube

Section 80DD of the income tax act allows deductions for a dependent differently abled person conditions and documents required for claiming deductions including differences from Section 80U explained

What is Section 80DD Section 80DD deduction can be claimed by individuals who are resident in India and HUFs for maintenance and medical treatment of a disabled dependant The maximum deduction under section 80DD is

Print-friendly freebies have gained tremendous popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Flexible: Your HTML0 customization options allow you to customize printing templates to your own specific requirements in designing invitations, organizing your schedule, or even decorating your house.

-

Educational Worth: These Income Tax Exemption For Physically Handicapped Dependent Pdf cater to learners from all ages, making them an invaluable instrument for parents and teachers.

-

Affordability: You have instant access the vast array of design and templates helps save time and effort.

Where to Find more Income Tax Exemption For Physically Handicapped Dependent Pdf

I Tax Calculator For Ay 2020 21 Games overviews

I Tax Calculator For Ay 2020 21 Games overviews

While under Section 80DD dependent family members of the individual suffering from the disability can claim the tax deduction Here dependent family members include spouse children parents siblings of the disabled person Source Link https www paisabazaar tax section 80u

Section 80U Tax Deduction for the Disabled Persons Updated on 16 Jan 2024 05 49 PM Check the eligibility deduction amount how to claim documents and definitions for FY 2022 23 AY 2023 24 and what diseases are covered

After we've peaked your curiosity about Income Tax Exemption For Physically Handicapped Dependent Pdf Let's look into where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Income Tax Exemption For Physically Handicapped Dependent Pdf suitable for many objectives.

- Explore categories like interior decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets Flashcards, worksheets, and other educational materials.

- Perfect for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers post their original designs and templates for no cost.

- These blogs cover a broad range of topics, that range from DIY projects to party planning.

Maximizing Income Tax Exemption For Physically Handicapped Dependent Pdf

Here are some fresh ways of making the most of Income Tax Exemption For Physically Handicapped Dependent Pdf:

1. Home Decor

- Print and frame gorgeous art, quotes, or festive decorations to decorate your living areas.

2. Education

- Print out free worksheets and activities to build your knowledge at home (or in the learning environment).

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Get organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Income Tax Exemption For Physically Handicapped Dependent Pdf are a treasure trove of practical and imaginative resources which cater to a wide range of needs and needs and. Their accessibility and versatility make them a fantastic addition to both personal and professional life. Explore the world of Income Tax Exemption For Physically Handicapped Dependent Pdf today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly cost-free?

- Yes, they are! You can download and print these items for free.

-

Do I have the right to use free templates for commercial use?

- It's dependent on the particular conditions of use. Always verify the guidelines of the creator before utilizing their templates for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Some printables may come with restrictions in their usage. Always read the terms and conditions provided by the designer.

-

How do I print printables for free?

- You can print them at home using the printer, or go to an in-store print shop to get high-quality prints.

-

What program will I need to access printables at no cost?

- The majority of PDF documents are provided as PDF files, which can be opened using free software, such as Adobe Reader.

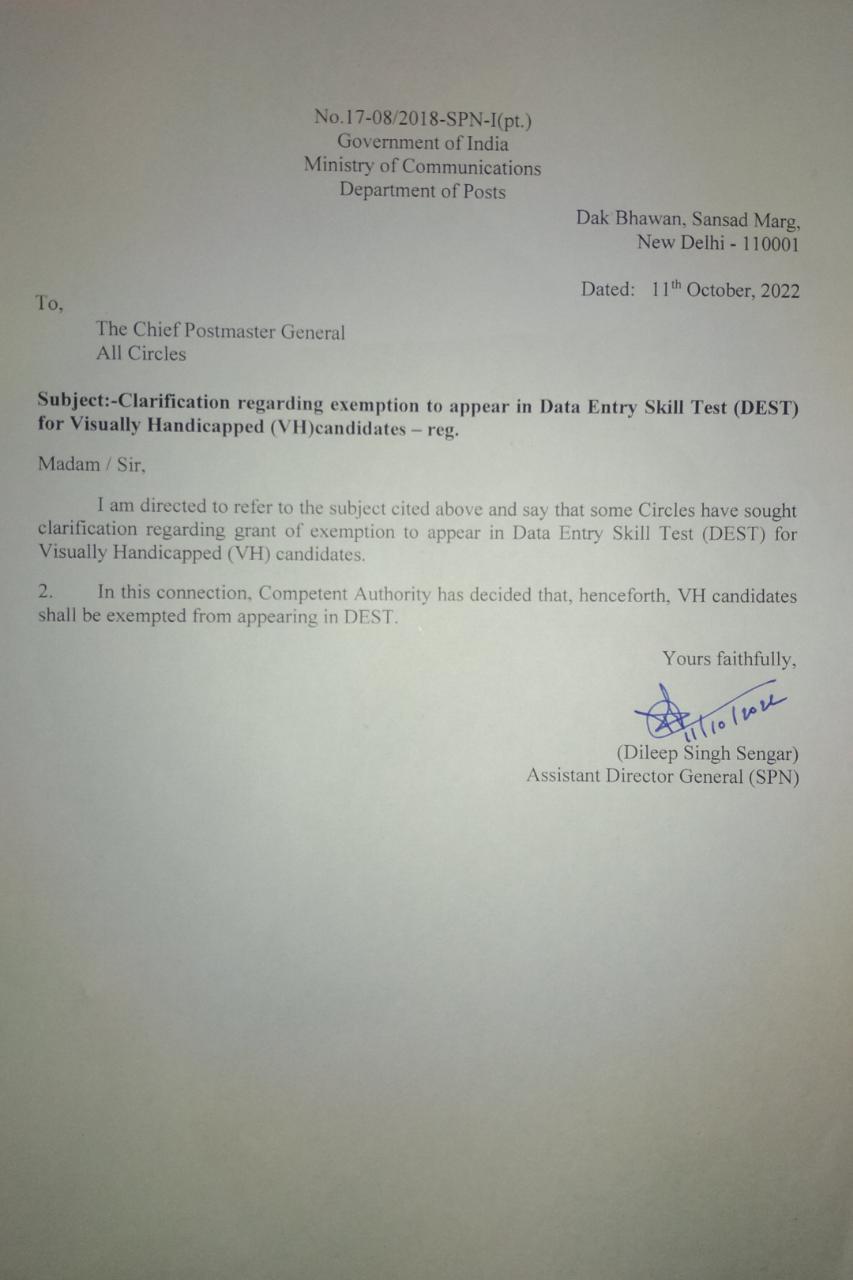

Clarification Regarding Exemption To Appear In Data Entry Skill Test

Income Tax Exemption For Physically Handicapped A Complete Guideline

Check more sample of Income Tax Exemption For Physically Handicapped Dependent Pdf below

FASTag For Handicapped Vehicle Exemption For Disabled NETC FASTag

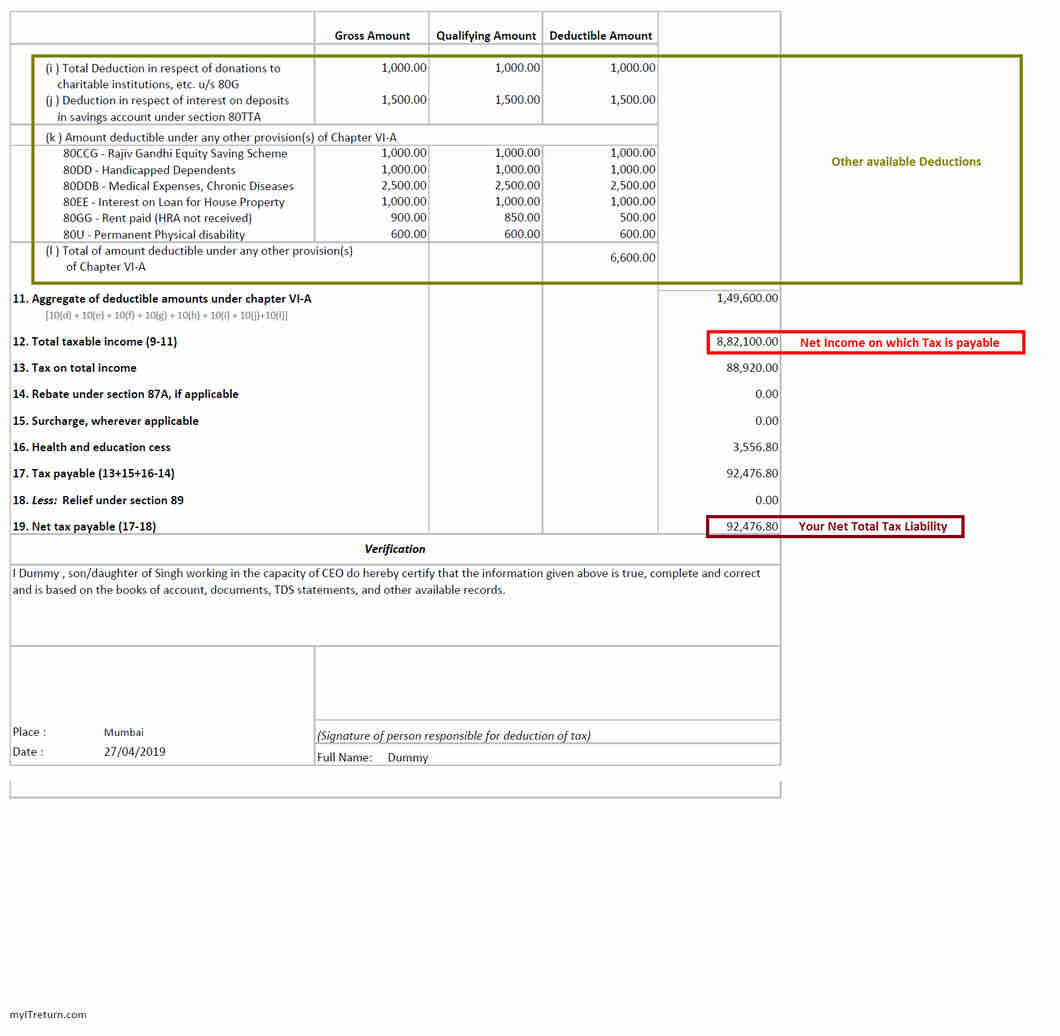

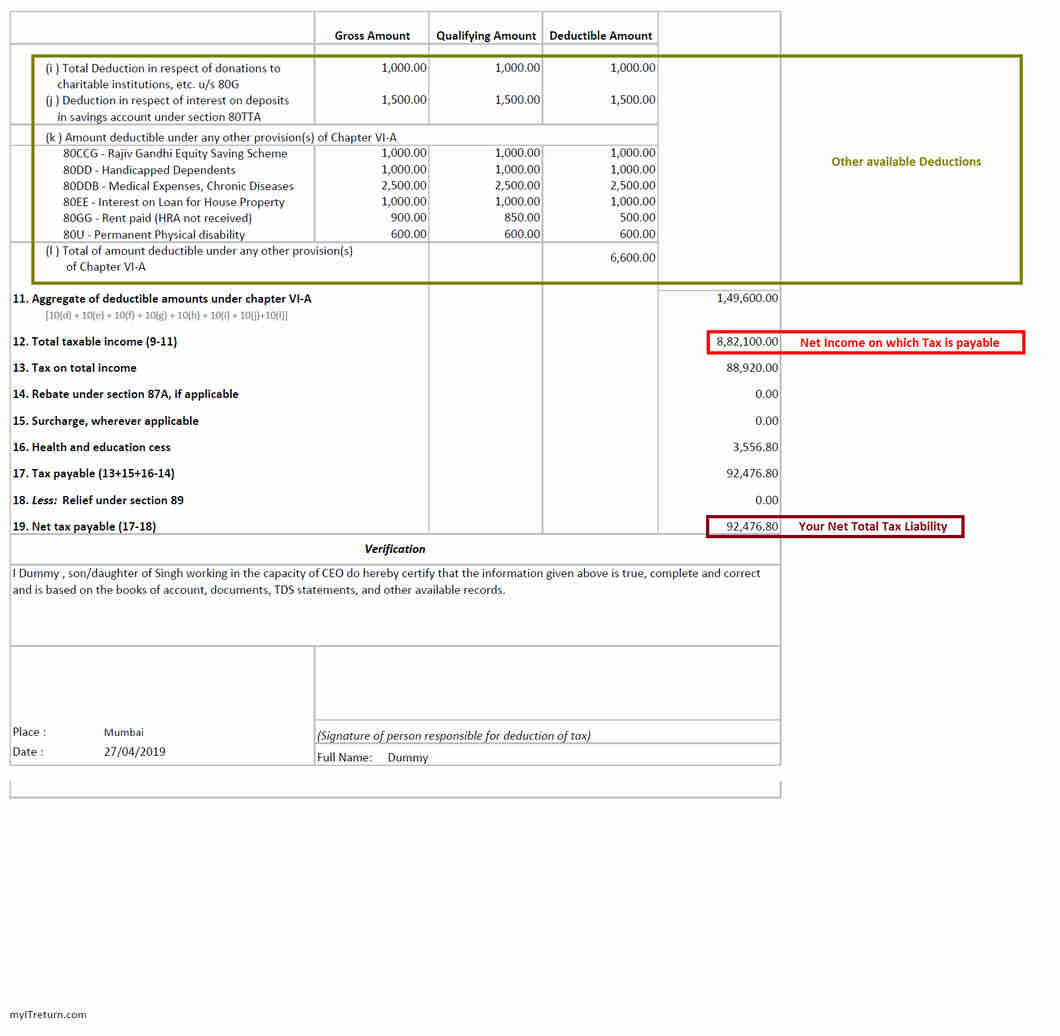

Claim Deduction Under Section 80DD Learn By Quicko

Vehicle Belongs To Persons With Disability Get Tax Exemption INDIAN

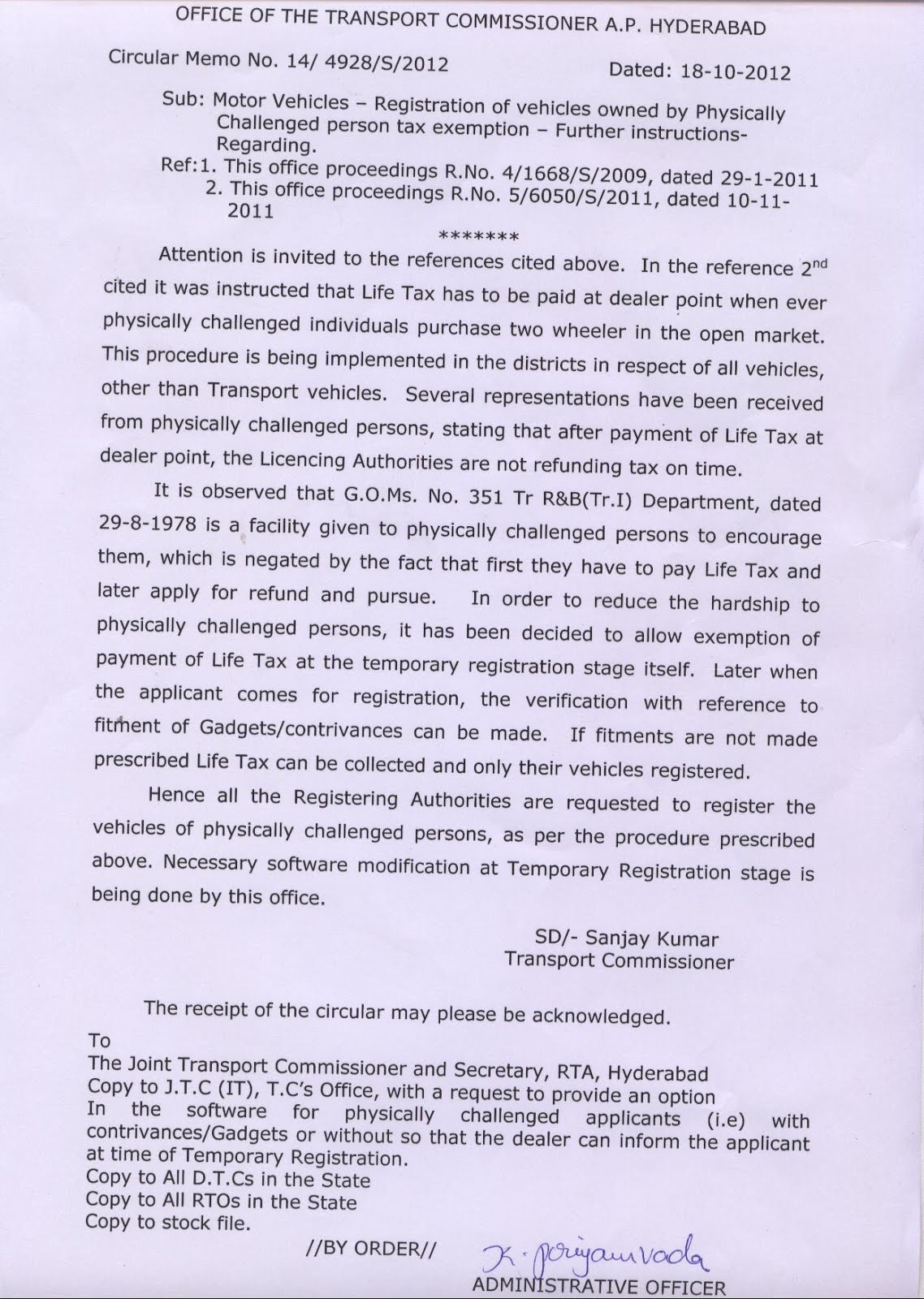

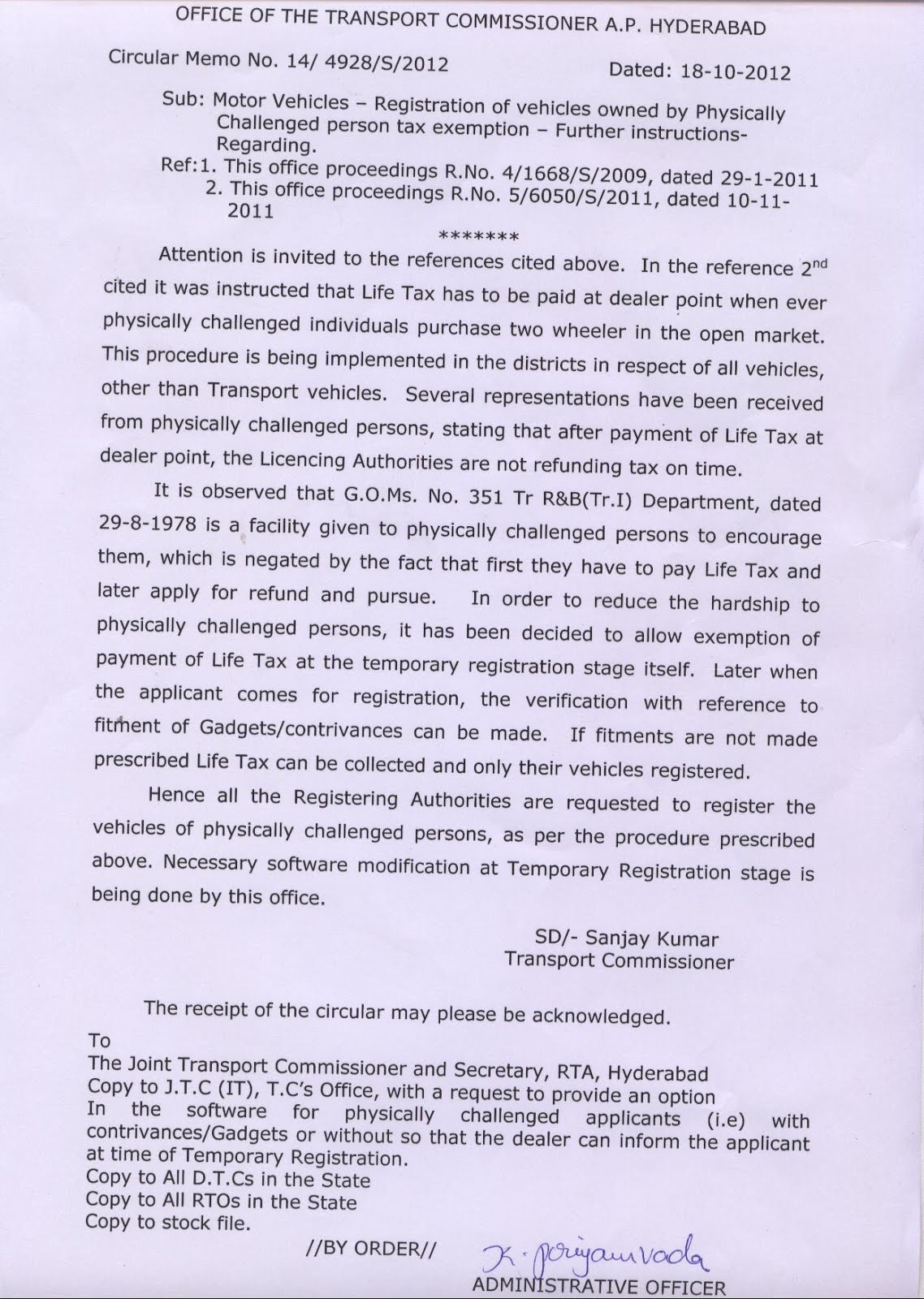

Andhra Pradesh Employees With Disabilities M V TAX EXMPTION FURTHR

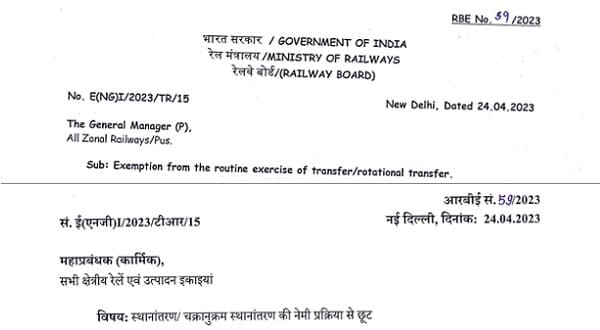

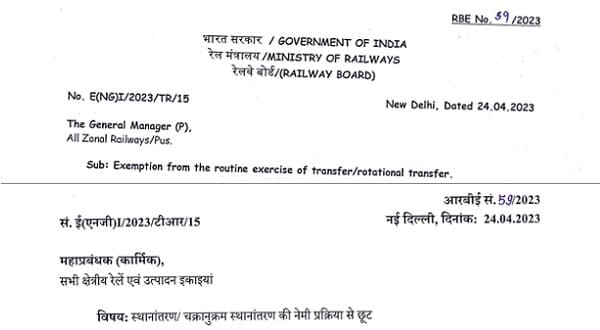

Exemption From Routine Transfers For Physically Handicapped Railway

Income Tax Form 16 What Is Form 16 Eligibility Benefits And Exemptions

https://tax2win.in/guide/section-80dd

Section 80DD Here we explains everything about Section 80DD of income tax act including eligibility criteria deductions available and how to claim them Section 80DD is the deduction for the medical maintenance of a dependant who is a person with a major disability

https://www.irs.gov/pub/irs-pdf/p3966.pdf

AS A PERSON WITH A DISABILITY you may qualify for some of the following tax deductions income exclusions and credits More detailed information may be found in the IRS publications referenced Standard Deduction If you are legally blind you may be entitled to a higher standard deduction on your tax return

Section 80DD Here we explains everything about Section 80DD of income tax act including eligibility criteria deductions available and how to claim them Section 80DD is the deduction for the medical maintenance of a dependant who is a person with a major disability

AS A PERSON WITH A DISABILITY you may qualify for some of the following tax deductions income exclusions and credits More detailed information may be found in the IRS publications referenced Standard Deduction If you are legally blind you may be entitled to a higher standard deduction on your tax return

Andhra Pradesh Employees With Disabilities M V TAX EXMPTION FURTHR

Claim Deduction Under Section 80DD Learn By Quicko

Exemption From Routine Transfers For Physically Handicapped Railway

Income Tax Form 16 What Is Form 16 Eligibility Benefits And Exemptions

Rahul Gandhi Why Tax Products For Physically Handicapped People

Exemption From The Routine Train Of Switch rotational Switch Railway

Exemption From The Routine Train Of Switch rotational Switch Railway

Income Tax Calculation Example 2 For Salary Employees 2023 24