Today, where screens rule our lives, the charm of tangible printed products hasn't decreased. Whether it's for educational purposes or creative projects, or simply adding an individual touch to the space, Income Tax Exemption For Salaried Employees 2021 22 are now an essential resource. In this article, we'll dive in the world of "Income Tax Exemption For Salaried Employees 2021 22," exploring what they are, where you can find them, and how they can be used to enhance different aspects of your lives.

Get Latest Income Tax Exemption For Salaried Employees 2021 22 Below

Income Tax Exemption For Salaried Employees 2021 22

Income Tax Exemption For Salaried Employees 2021 22 -

Under this salaried employees can get exemption by depositing up to 10 of their salary in pension account which is a maximum of Rs 1 5 lakh Through the new section 80CCD 1B the salaried person can get additional

Returns and Forms Applicable for Salaried Individuals for AY 2024 25 Disclaimer The content on this page is only to give an overview and general guidance and is not exhaustive For

Income Tax Exemption For Salaried Employees 2021 22 provide a diverse variety of printable, downloadable content that can be downloaded from the internet at no cost. They are available in a variety of forms, like worksheets templates, coloring pages, and more. The value of Income Tax Exemption For Salaried Employees 2021 22 is their flexibility and accessibility.

More of Income Tax Exemption For Salaried Employees 2021 22

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

The income tax exemption limit is up to Rs 2 50 000 for Individuals HUF below 60 years aged and NRIs Surcharge and cess will be applicable Income tax slab for individuals aged above 60 years to 80 years

These instructions are guidelines for filling the particulars in Income tax Return Form 2 for the Assessment Year 2021 22 relating to the Financial Year 2020 21 In case of any doubt please

Income Tax Exemption For Salaried Employees 2021 22 have gained a lot of popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Personalization Your HTML0 customization options allow you to customize printables to your specific needs, whether it's designing invitations making your schedule, or decorating your home.

-

Educational Value: Printing educational materials for no cost are designed to appeal to students of all ages. This makes them an essential tool for parents and teachers.

-

The convenience of Fast access various designs and templates can save you time and energy.

Where to Find more Income Tax Exemption For Salaried Employees 2021 22

How To File Income Tax Return ITR Online For Salaried Employees

How To File Income Tax Return ITR Online For Salaried Employees

The Income Tax Department has started issuance of Income Tax Notices seeking evidence in support of deductions claimed in Assessment Years 2021 22 2022 23

The income tax notices being sent now are for the ITRs filed for last year for assessment year 2022 23 FY 2021 22 If you are filing your ITR now and claiming certain

Now that we've ignited your curiosity about Income Tax Exemption For Salaried Employees 2021 22 Let's see where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection with Income Tax Exemption For Salaried Employees 2021 22 for all purposes.

- Explore categories like design, home decor, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free including flashcards, learning materials.

- Ideal for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- These blogs cover a broad variety of topics, including DIY projects to planning a party.

Maximizing Income Tax Exemption For Salaried Employees 2021 22

Here are some fresh ways for you to get the best use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Print worksheets that are free for reinforcement of learning at home (or in the learning environment).

3. Event Planning

- Make invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Be organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Income Tax Exemption For Salaried Employees 2021 22 are an abundance with useful and creative ideas that cater to various needs and passions. Their availability and versatility make these printables a useful addition to any professional or personal life. Explore the world of Income Tax Exemption For Salaried Employees 2021 22 to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really cost-free?

- Yes you can! You can download and print these resources at no cost.

-

Can I download free printables in commercial projects?

- It's based on specific conditions of use. Always verify the guidelines of the creator prior to printing printables for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Certain printables might have limitations on use. Check the conditions and terms of use provided by the designer.

-

How can I print printables for free?

- Print them at home with either a printer at home or in the local print shops for the highest quality prints.

-

What program do I need to open printables for free?

- The majority of PDF documents are provided in the PDF format, and can be opened with free software like Adobe Reader.

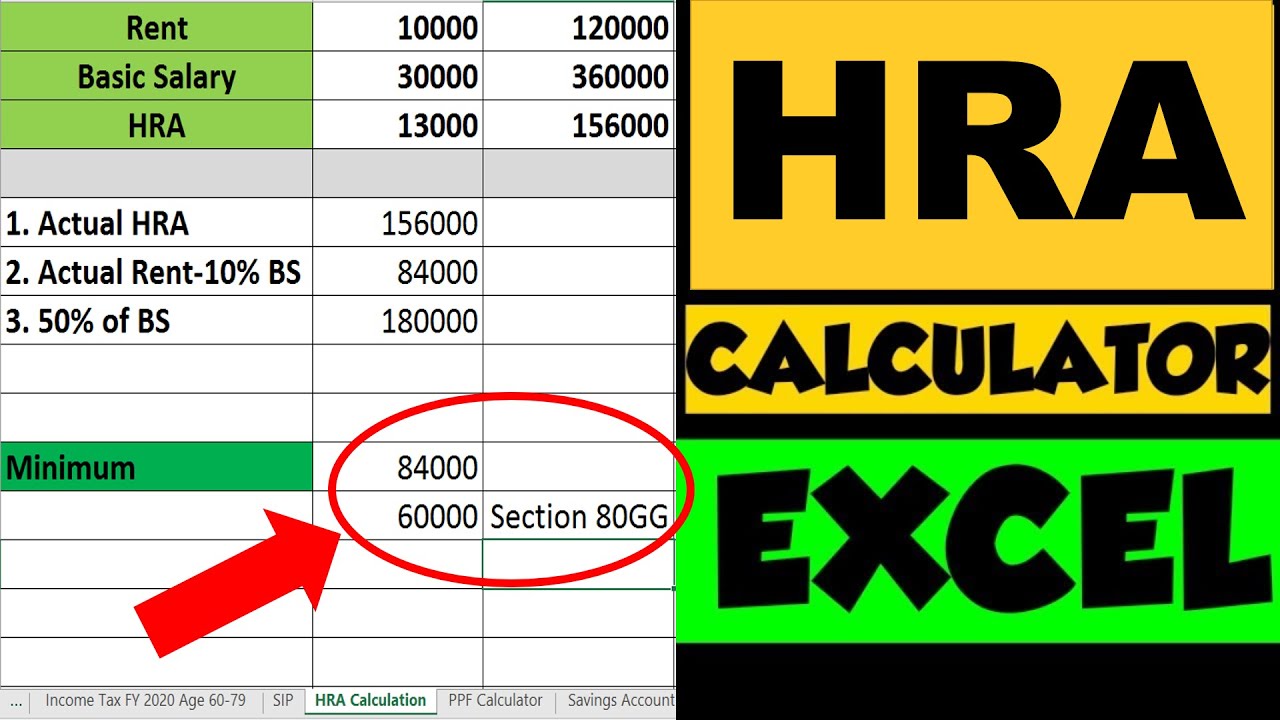

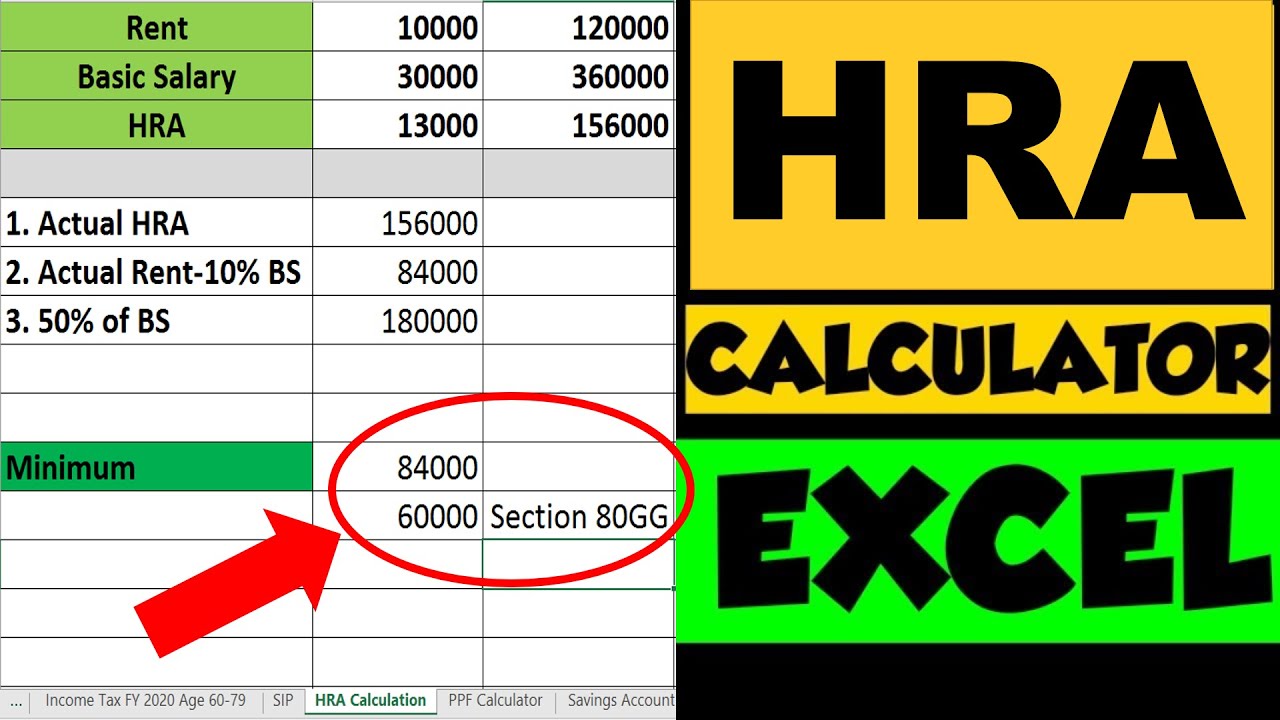

Income Tax Allowances For Salaried Employees For F Y 2021 22 A Y 2022 23

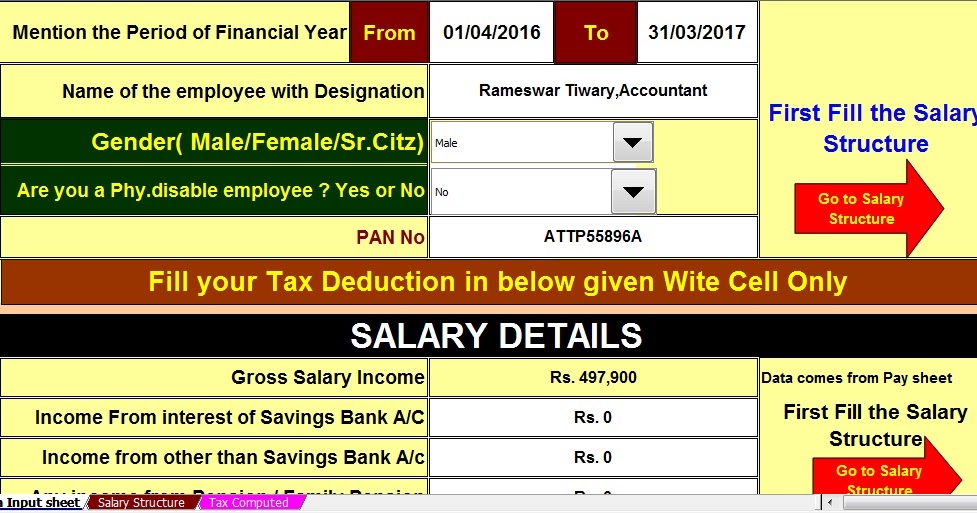

I Tax Calculator For Ay 2020 21 Games overviews

Check more sample of Income Tax Exemption For Salaried Employees 2021 22 below

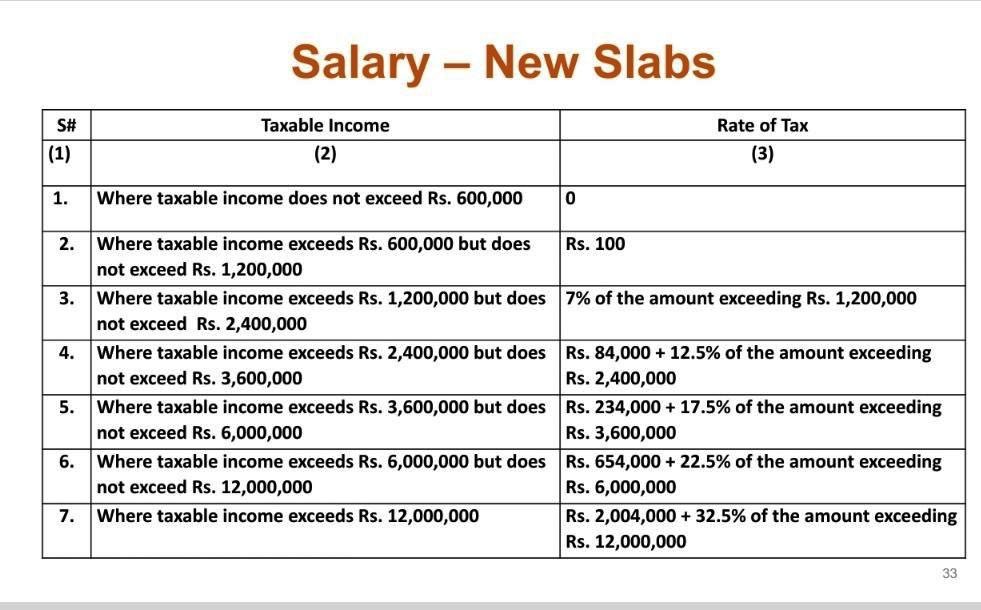

Income Tax Slabs Year 2022 23 Info Ghar Educational News

Income Tax Return Filing For Salaried Employees AY 2022 23 Section 80C

How To File Income Tax Return Online For Salaried Employees 2022 2023

CBDT Increases Income Tax Exemption Limit On Leave Encashment For Non

Salaried Employees Alert Income Tax Exemption Limit Likely To Be

Budget 2023 Income Tax Slab Change Expectations Salaried Employees

https://www.incometax.gov.in/iec/foportal/help/...

Returns and Forms Applicable for Salaried Individuals for AY 2024 25 Disclaimer The content on this page is only to give an overview and general guidance and is not exhaustive For

https://cleartax.in/s/standard-deduction-…

The Income Tax Act allows deductions like standard deduction for salaried individuals From FY 2024 25 the standard deduction is Rs 75 000 in the new tax regime No supporting documents are needed Old regime s

Returns and Forms Applicable for Salaried Individuals for AY 2024 25 Disclaimer The content on this page is only to give an overview and general guidance and is not exhaustive For

The Income Tax Act allows deductions like standard deduction for salaried individuals From FY 2024 25 the standard deduction is Rs 75 000 in the new tax regime No supporting documents are needed Old regime s

CBDT Increases Income Tax Exemption Limit On Leave Encashment For Non

Income Tax Return Filing For Salaried Employees AY 2022 23 Section 80C

Salaried Employees Alert Income Tax Exemption Limit Likely To Be

Budget 2023 Income Tax Slab Change Expectations Salaried Employees

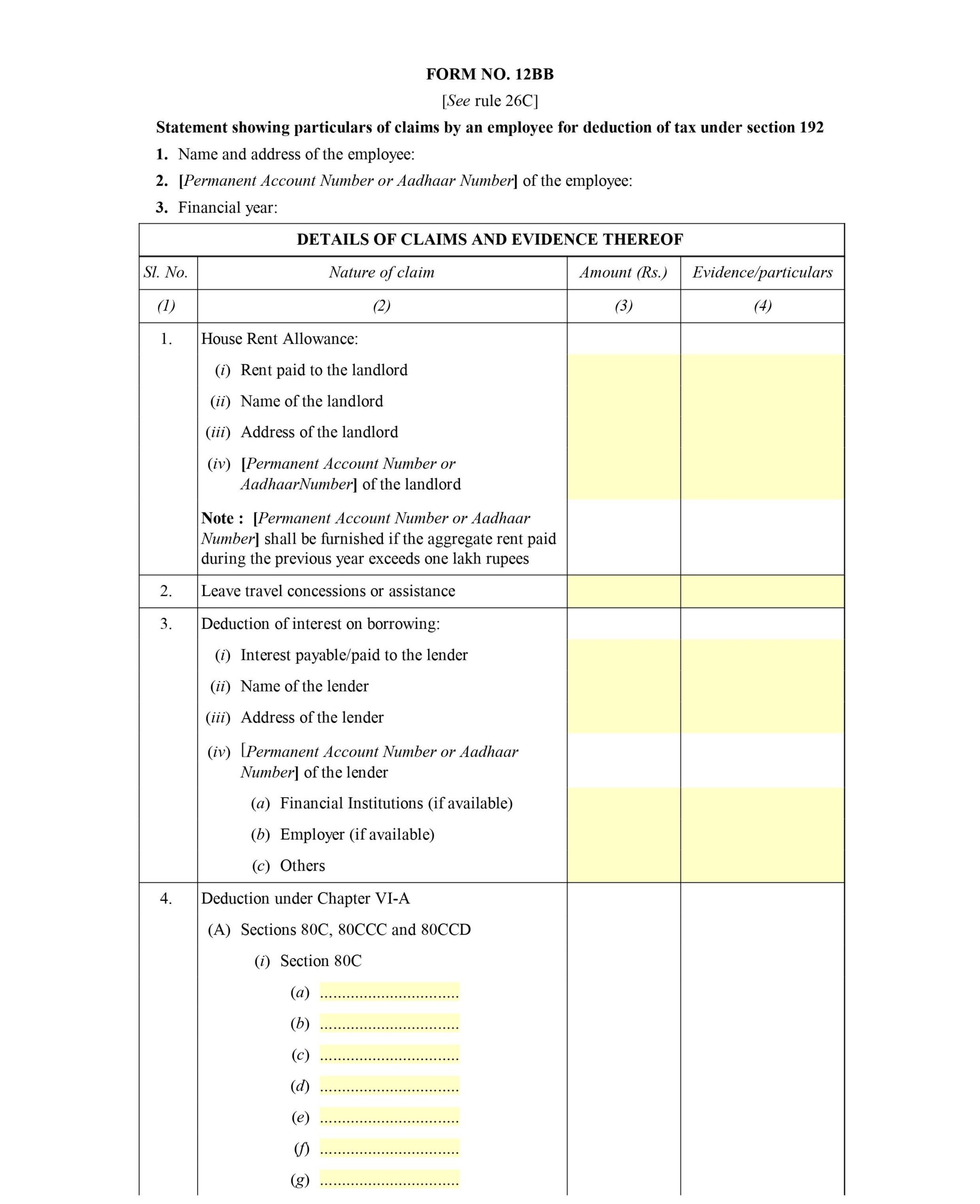

PDF Investment Declaration Form PDF Download

Income Tax Calculator Fy 2021 22 Income Tax Calculator For FY 2020 21

Income Tax Calculator Fy 2021 22 Income Tax Calculator For FY 2020 21

6 Income Tax Exemption For Salaried Persons As Per Budget 2016 With