In a world where screens have become the dominant feature of our lives, the charm of tangible printed items hasn't gone away. Be it for educational use or creative projects, or simply to add an extra personal touch to your space, Income Tax Exemption For Solar Power are a great source. For this piece, we'll dive deeper into "Income Tax Exemption For Solar Power," exploring what they are, where you can find them, and how they can be used to enhance different aspects of your daily life.

Get Latest Income Tax Exemption For Solar Power Below

Income Tax Exemption For Solar Power

Income Tax Exemption For Solar Power -

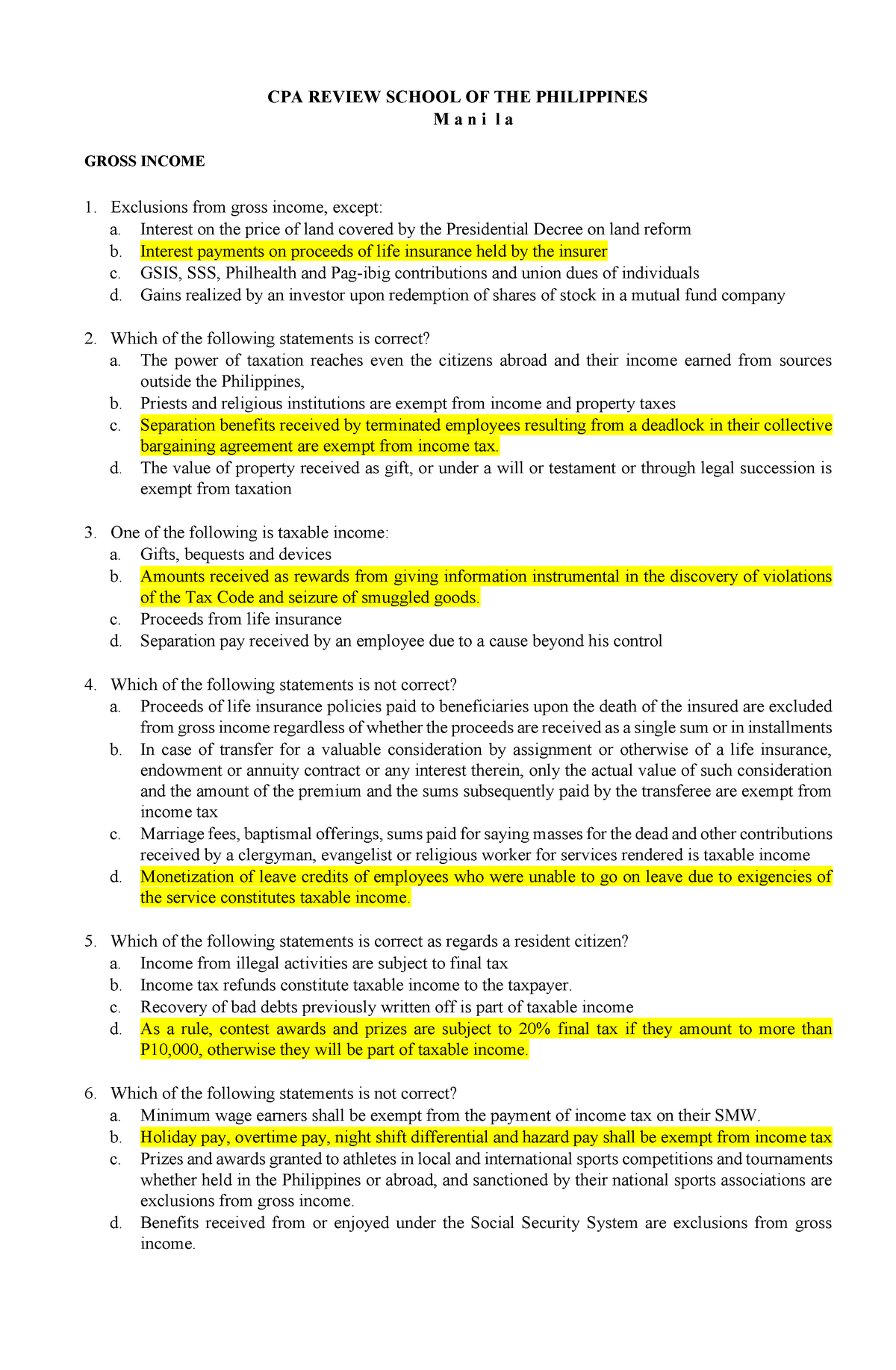

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit On this page How it works Who qualifies Qualified expenses Qualified clean energy property How to claim the credit Related resources How it works

The most common state level solar tax incentive is a property tax exemption This allows homeowners to exempt the value of their solar energy system from the overall value of their

Income Tax Exemption For Solar Power cover a large array of printable material that is available online at no cost. They are available in a variety of designs, including worksheets coloring pages, templates and more. The value of Income Tax Exemption For Solar Power lies in their versatility and accessibility.

More of Income Tax Exemption For Solar Power

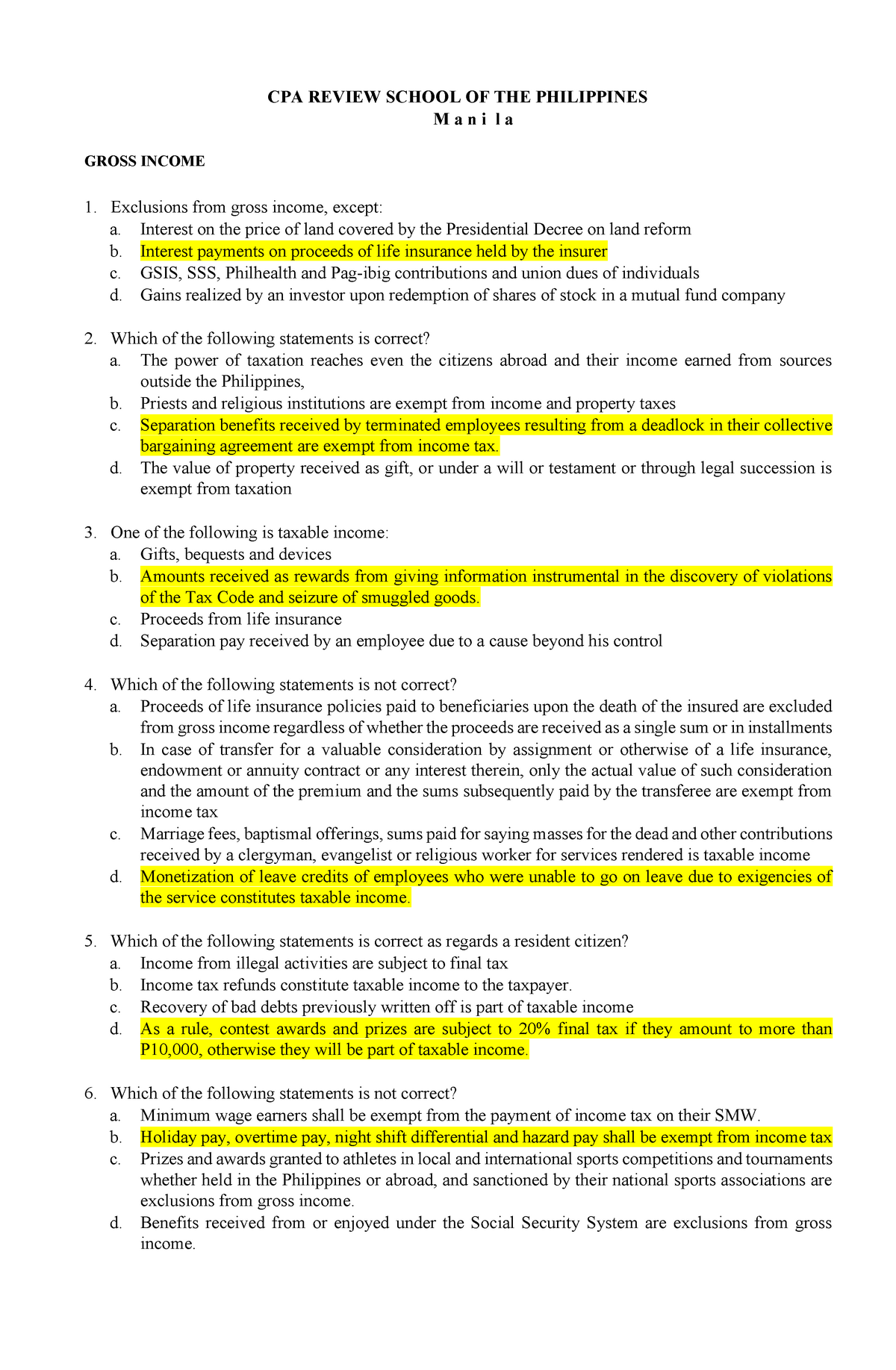

50 Income Tax Exemption For High Earners In Cyprus

50 Income Tax Exemption For High Earners In Cyprus

The Residential Clean Energy Credit also known as the solar investment tax credit or ITC is a tax credit for homeowners who invest in solar and or battery storage Thanks to the Inflation Reduction Act the 30 credit is available for homeowners that install solar from 2022 to 2032

WASHINGTON The Internal Revenue Service today updated frequently asked questions in Fact Sheet 2024 15 PDF to address the federal income tax treatment of amounts paid for the purchase of energy efficient property and improvements

The Income Tax Exemption For Solar Power have gained huge recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Flexible: It is possible to tailor printed materials to meet your requirements for invitations, whether that's creating them making your schedule, or decorating your home.

-

Educational Impact: Education-related printables at no charge are designed to appeal to students of all ages, which makes them an essential aid for parents as well as educators.

-

Simple: immediate access many designs and templates saves time and effort.

Where to Find more Income Tax Exemption For Solar Power

Canton Opts Out Of Property Tax Exemption For Solar Energy NCPR News

Canton Opts Out Of Property Tax Exemption For Solar Energy NCPR News

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide up to a 30 credit for qualifying investments in wind solar energy storage and other renewable energy projects that meet prevailing wage standards and employ a sufficient proportion of qualified apprentices from registered apprenticeship

The investment tax credit ITC is a tax credit that reduces the federal income tax liability for a percentage of the cost of a solar system that is installed during the tax year 1 The production tax credit PTC is a per kilowatt hour kWh tax credit for electricity generated by solar and other qualifying technologies for the first 10

We hope we've stimulated your curiosity about Income Tax Exemption For Solar Power, let's explore where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Income Tax Exemption For Solar Power designed for a variety goals.

- Explore categories such as decorations for the home, education and crafting, and organization.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free with flashcards and other teaching materials.

- This is a great resource for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- The blogs are a vast selection of subjects, that includes DIY projects to party planning.

Maximizing Income Tax Exemption For Solar Power

Here are some innovative ways create the maximum value of Income Tax Exemption For Solar Power:

1. Home Decor

- Print and frame stunning artwork, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use free printable worksheets to build your knowledge at home, or even in the classroom.

3. Event Planning

- Invitations, banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Get organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Income Tax Exemption For Solar Power are an abundance with useful and creative ideas for a variety of needs and pursuits. Their access and versatility makes them an essential part of both personal and professional life. Explore the world of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really are they free?

- Yes they are! You can print and download these documents for free.

-

Do I have the right to use free printables in commercial projects?

- It is contingent on the specific usage guidelines. Be sure to read the rules of the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright problems with Income Tax Exemption For Solar Power?

- Certain printables could be restricted regarding their use. Be sure to check the terms of service and conditions provided by the creator.

-

How do I print printables for free?

- You can print them at home using the printer, or go to a local print shop to purchase premium prints.

-

What program do I need to run printables that are free?

- Most printables come in PDF format, which can be opened using free programs like Adobe Reader.

Income Tax Exemption For Gratuity Enhanced Up To Rs 20 Lakhs YouTube

We Got 12A Exemption Registration Under Income Tax

Check more sample of Income Tax Exemption For Solar Power below

No Tax Exemption For Solar Panels

Bifacial Solar Panels Lose Their Section 201 Tariff Exemption

![]()

Solar Energy Generation Will Have Tax Exemption For Photovoltaic Panels

Oregon Solar Industry Calls For 10 Power From Solar In 10 Years

We Got 12A Exemption Registration Under Income Tax

Boscawen Considers Rare Step Of Removing A Tax Exemption For Solar Panels

https://www.cnet.com/home/energy-and-utilities/yes...

The most common state level solar tax incentive is a property tax exemption This allows homeowners to exempt the value of their solar energy system from the overall value of their

https://www.energy.gov/sites/default/files/2021/02...

Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax credit in other words you may claim the

The most common state level solar tax incentive is a property tax exemption This allows homeowners to exempt the value of their solar energy system from the overall value of their

Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax credit in other words you may claim the

Oregon Solar Industry Calls For 10 Power From Solar In 10 Years

Bifacial Solar Panels Lose Their Section 201 Tariff Exemption

We Got 12A Exemption Registration Under Income Tax

Boscawen Considers Rare Step Of Removing A Tax Exemption For Solar Panels

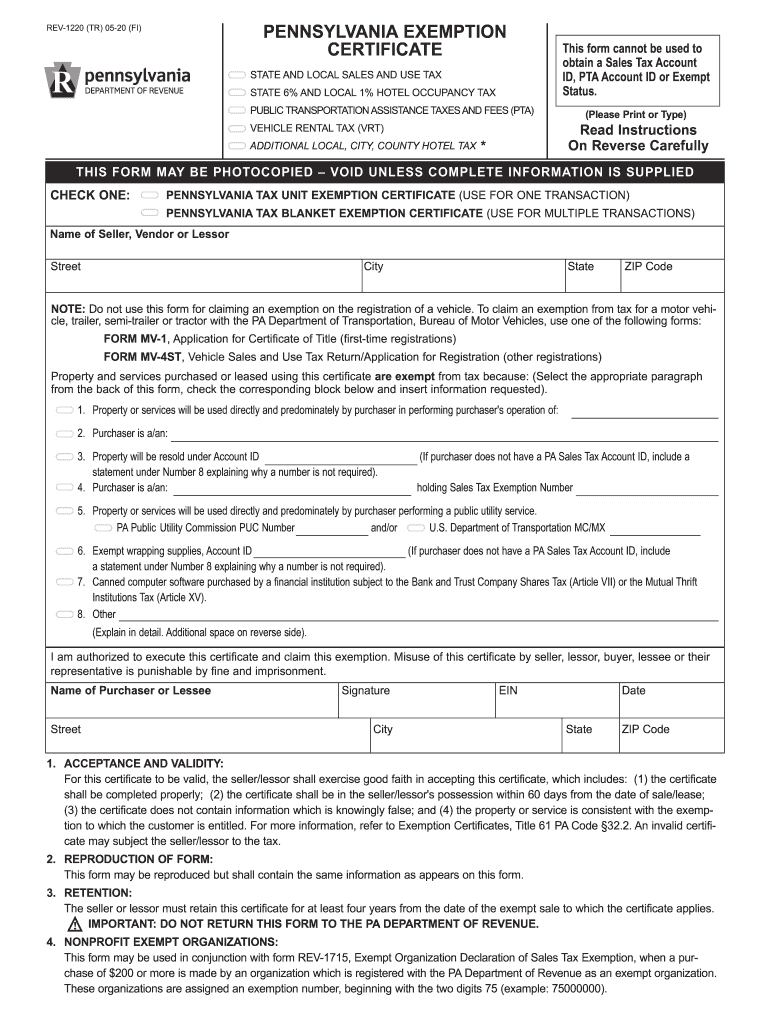

2020 Form PA DoR REV 1220 AS Fill Online Printable Fillable Blank

Life Insurance Income Tax Exemption IndiaFilings

Life Insurance Income Tax Exemption IndiaFilings

Tax Rebates For Solar Power Ineffective For Low income Americans But