In this day and age where screens dominate our lives it's no wonder that the appeal of tangible printed items hasn't gone away. Whether it's for educational purposes and creative work, or simply to add some personal flair to your home, printables for free are now a useful resource. Through this post, we'll take a dive through the vast world of "Income Tax Exemption Housing Loan Under Construction," exploring the different types of printables, where they can be found, and how they can enhance various aspects of your daily life.

Get Latest Income Tax Exemption Housing Loan Under Construction Below

Income Tax Exemption Housing Loan Under Construction

Income Tax Exemption Housing Loan Under Construction -

However Section 80EEA of the IT Act provides for claiming of interest paid on housing loan up to Rs 1 50 000 irrespective of the restriction imposed by S 24 on the

Can I claim tax benefits if the purchase a property with a home loan but the house is under construction You cannot claim tax deductions till the construction of

The Income Tax Exemption Housing Loan Under Construction are a huge array of printable resources available online for download at no cost. These printables come in different styles, from worksheets to templates, coloring pages, and much more. The great thing about Income Tax Exemption Housing Loan Under Construction lies in their versatility and accessibility.

More of Income Tax Exemption Housing Loan Under Construction

Section 24 Of Income Tax Act House Property Deduction

Section 24 Of Income Tax Act House Property Deduction

A home loan borrower can claim Income Tax exemption on interest payments of up to Rs 2 lakh and another Rs 1 5 lakh under Section 80 C towards the principal repayment However you cannot

Section 54 and Section 54F offer tax exemption on LTCG if the following conditions are met A new residential property is purchased within one year in case of

Printables that are free have gained enormous popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Customization: The Customization feature lets you tailor printables to fit your particular needs for invitations, whether that's creating them as well as organizing your calendar, or even decorating your house.

-

Education Value Printables for education that are free provide for students of all ages, making them a valuable aid for parents as well as educators.

-

An easy way to access HTML0: instant access a myriad of designs as well as templates saves time and effort.

Where to Find more Income Tax Exemption Housing Loan Under Construction

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

A home loan for under construction property can get tax deductions up to Rs 2 lakhs on interest paid in a year and up to 1 5 lakhs for principal paid under Section 80C of the

Section 24 of the Income Tax Act for Under Construction Property Under section 24B of the Income Tax Act 1961 homeowners can claim a tax deduction of up to

In the event that we've stirred your interest in Income Tax Exemption Housing Loan Under Construction Let's look into where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Income Tax Exemption Housing Loan Under Construction to suit a variety of reasons.

- Explore categories like decorations for the home, education and the arts, and more.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free as well as flashcards and other learning materials.

- This is a great resource for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs as well as templates for free.

- The blogs covered cover a wide variety of topics, that range from DIY projects to planning a party.

Maximizing Income Tax Exemption Housing Loan Under Construction

Here are some creative ways create the maximum value of Income Tax Exemption Housing Loan Under Construction:

1. Home Decor

- Print and frame beautiful art, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Print worksheets that are free to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable planners as well as to-do lists and meal planners.

Conclusion

Income Tax Exemption Housing Loan Under Construction are an abundance of useful and creative resources that can meet the needs of a variety of people and preferences. Their accessibility and versatility make them a valuable addition to your professional and personal life. Explore the vast world that is Income Tax Exemption Housing Loan Under Construction today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really cost-free?

- Yes they are! You can print and download these free resources for no cost.

-

Are there any free printouts for commercial usage?

- It depends on the specific rules of usage. Make sure you read the guidelines for the creator before utilizing their templates for commercial projects.

-

Do you have any copyright violations with Income Tax Exemption Housing Loan Under Construction?

- Some printables may come with restrictions regarding usage. Always read the terms and conditions provided by the author.

-

How do I print Income Tax Exemption Housing Loan Under Construction?

- You can print them at home with a printer or visit any local print store for more high-quality prints.

-

What program do I need to run printables that are free?

- A majority of printed materials are with PDF formats, which can be opened using free software, such as Adobe Reader.

Income Tax Exemption U s 80EEA Interest On Affordable Housing Loan

TIPS TO REMEMBER ABOUT HOME LOAN FOR UNDER CONSTRUCTION PROJECTS Home

Check more sample of Income Tax Exemption Housing Loan Under Construction below

Section 80EEA Exemption For Interest On Home Loan With Automated Income

Multifamily Tax Exemption Housing Seattle gov

Income Tax Benefits On Housing Loan Interest And Principal House Poster

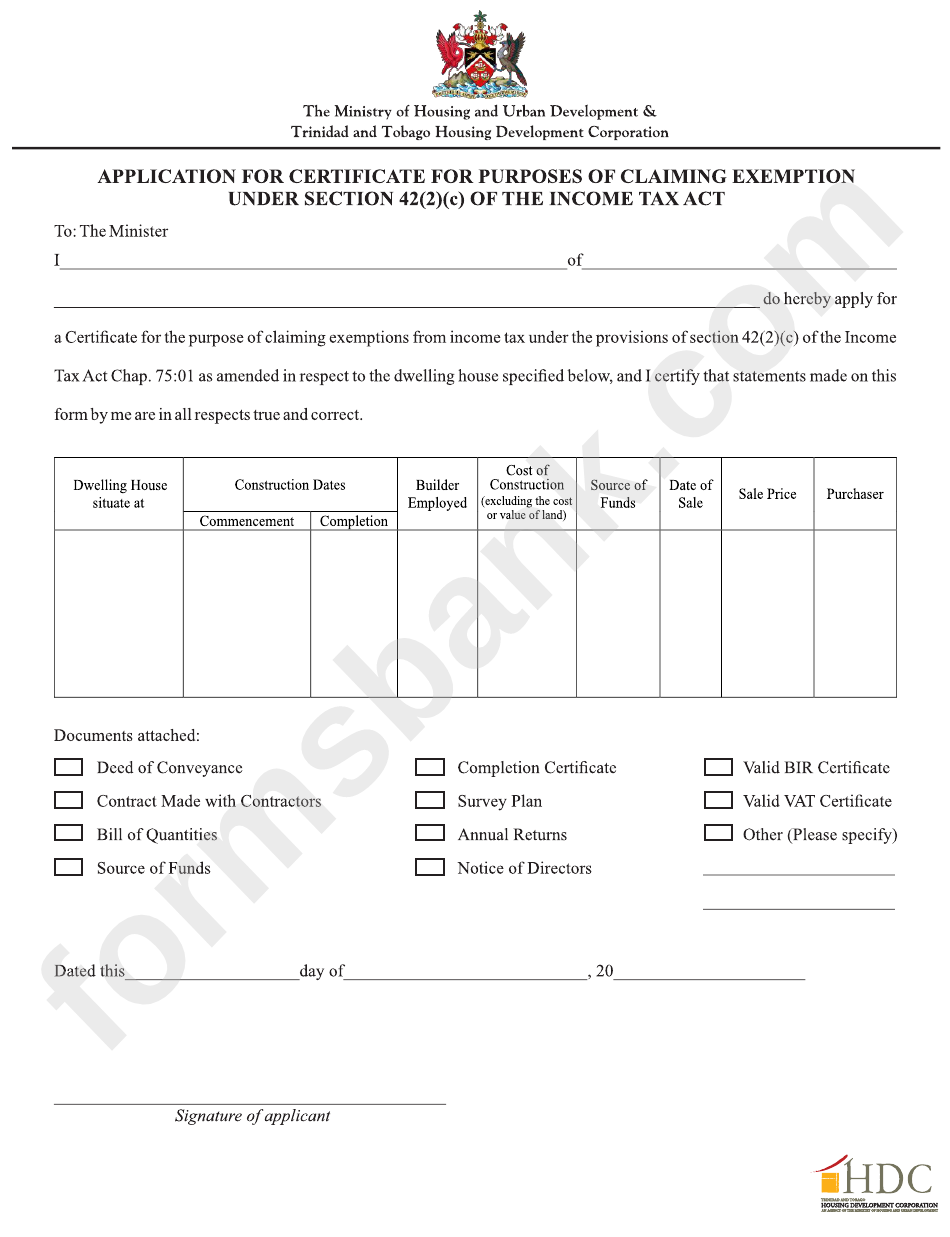

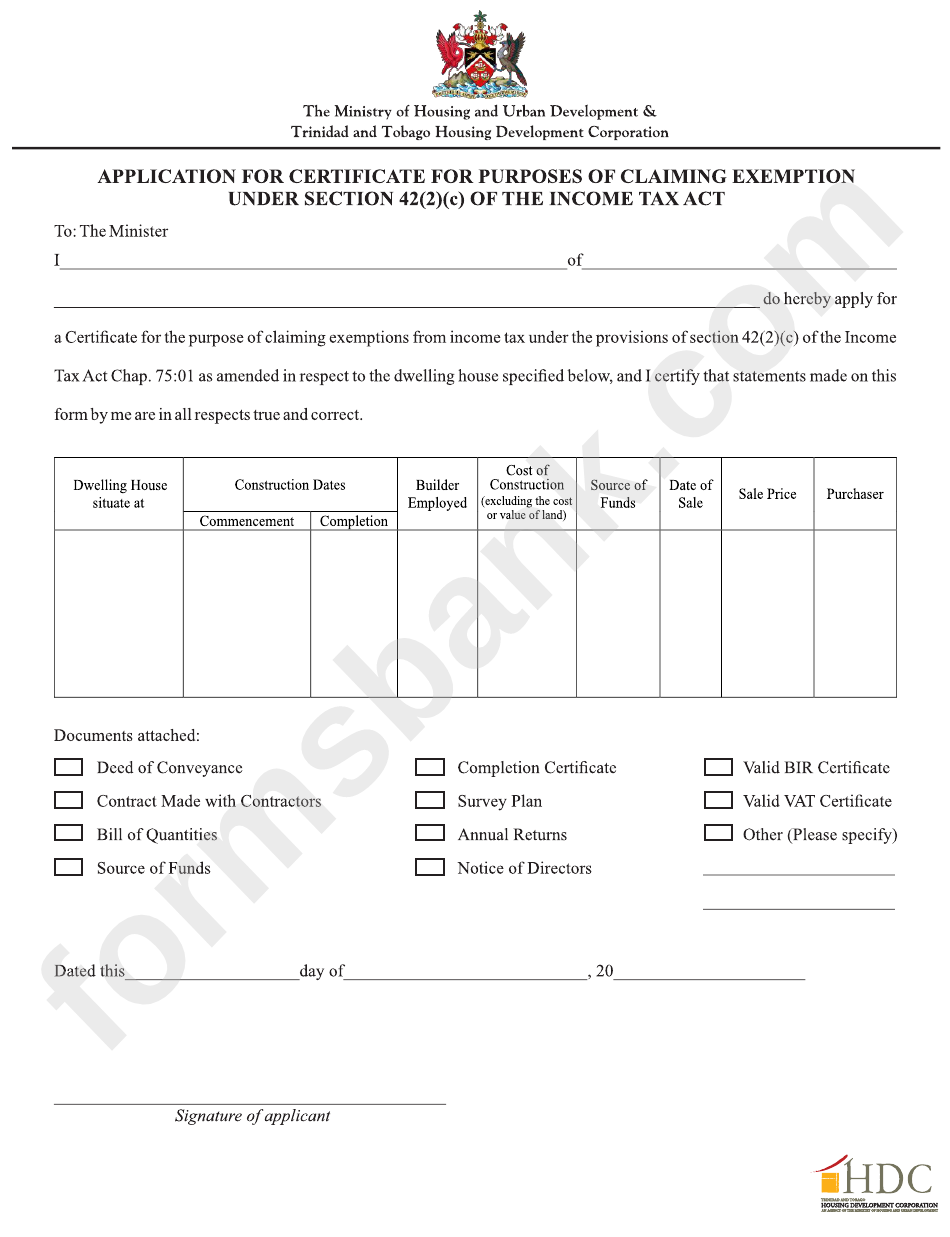

Application For Certificate For Purposes Of Claiming Exemption Under

Home Loan Interest Exemption In Income Tax Home Sweet Home

CBDT Notifies Income Tax Exemption To Karnataka State Building And

https://cleartax.in/s/home-loan-tax-benefit

Can I claim tax benefits if the purchase a property with a home loan but the house is under construction You cannot claim tax deductions till the construction of

https://taxguru.in/income-tax/claim-deduction...

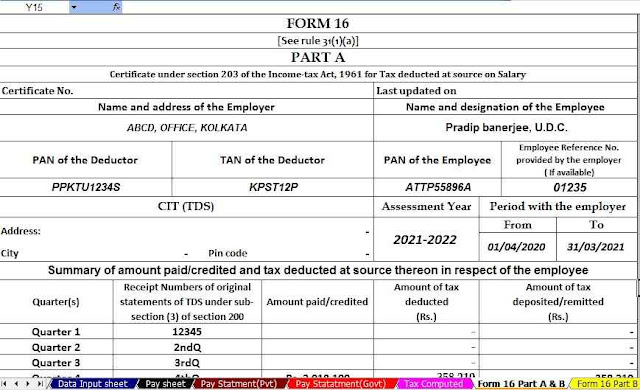

If you are paying EMI for the housing loan it has two components interest payment and principal repayment The interest portion of the EMI paid for the year can

Can I claim tax benefits if the purchase a property with a home loan but the house is under construction You cannot claim tax deductions till the construction of

If you are paying EMI for the housing loan it has two components interest payment and principal repayment The interest portion of the EMI paid for the year can

Application For Certificate For Purposes Of Claiming Exemption Under

Multifamily Tax Exemption Housing Seattle gov

Home Loan Interest Exemption In Income Tax Home Sweet Home

CBDT Notifies Income Tax Exemption To Karnataka State Building And

REVISED HOME LOAN BENEFITS U S 80EEA Deduction On Interest For Housing

Income Tax Exemption On HRA Vs Home Loan Savings And Calculation

Income Tax Exemption On HRA Vs Home Loan Savings And Calculation

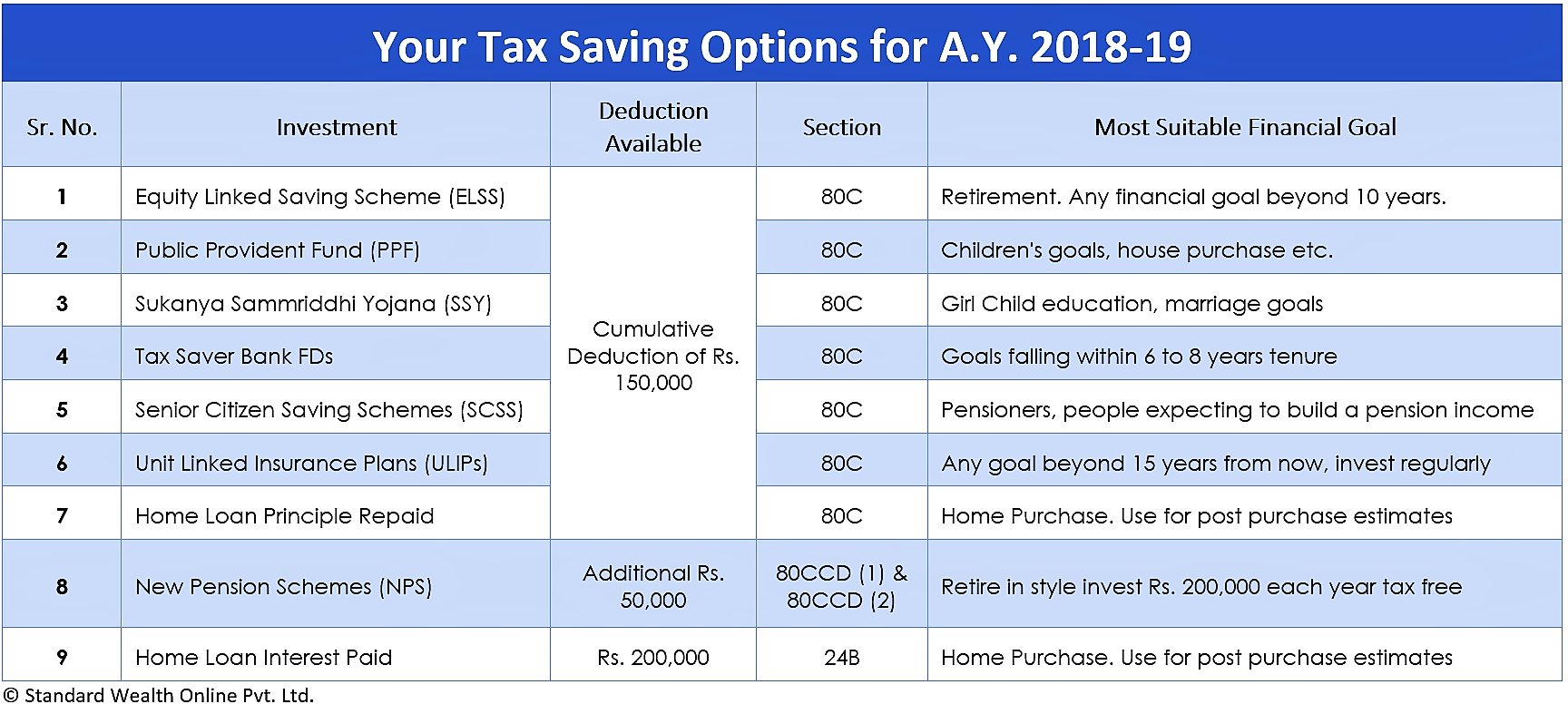

Housing Loan Tax Exemption Fy 2018 19 Tax Walls