In the digital age, in which screens are the norm yet the appeal of tangible printed items hasn't gone away. No matter whether it's for educational uses and creative work, or simply to add personal touches to your area, Income Tax Exemption On 2nd Home Loan have become an invaluable resource. The following article is a dive into the sphere of "Income Tax Exemption On 2nd Home Loan," exploring the different types of printables, where to get them, as well as how they can enhance various aspects of your lives.

Get Latest Income Tax Exemption On 2nd Home Loan Below

Income Tax Exemption On 2nd Home Loan

Income Tax Exemption On 2nd Home Loan -

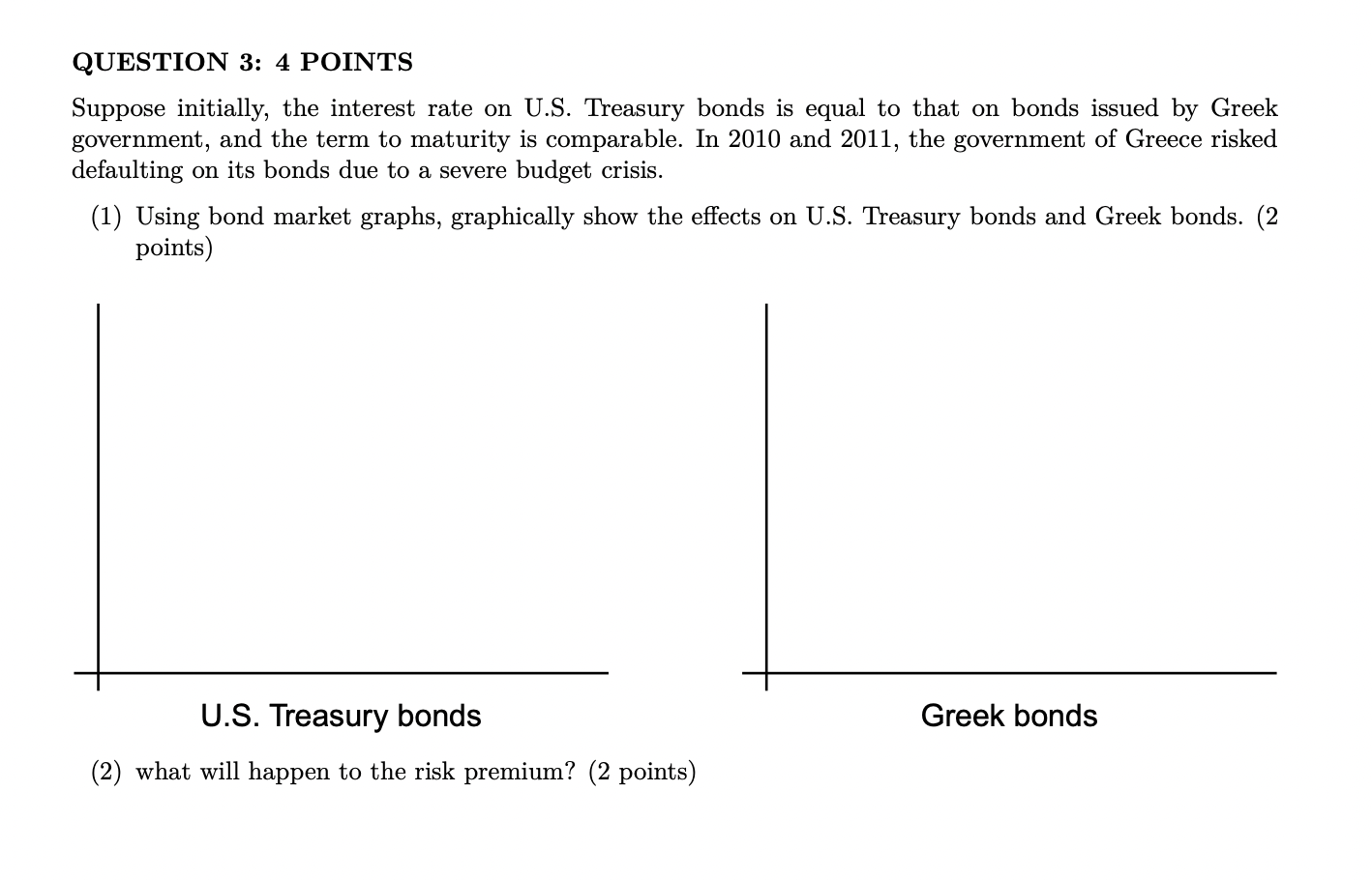

Tax benefits are subject to changes in tax laws Please contact your tax consultant for an exact calculation of your tax liabilities Check out the tax benefits on second home loans in India Avail of various deductions tax benefits on 2nd home loan when applying for a second home loan

1 One flat is given on rent of Rs 15000 per month For this flat home loan interest per annum is Rs 1 41 859 2 Second flat is also given on rent of Rs 15000 per month The approximate home loan interest for this flat is Rs 2 00 000 What maximum tax exemption can I get in above case

Printables for free cover a broad assortment of printable, downloadable materials that are accessible online for free cost. These resources come in many types, such as worksheets templates, coloring pages and more. The benefit of Income Tax Exemption On 2nd Home Loan is in their versatility and accessibility.

More of Income Tax Exemption On 2nd Home Loan

Tax Implications On A Second Home Loan A Must Read 50 Plus Finance

Tax Implications On A Second Home Loan A Must Read 50 Plus Finance

Whether you have one home loan or more the deduction allowable under Section 80 C for repayment of home loan is restricted to Rs 1 50 lakh together with various other eligible items

What is the maximum tax benefit on home loan The maximum tax deduction for a housing loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied home Up to Rs 1 5 lakh under Section 80C

Income Tax Exemption On 2nd Home Loan have garnered immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

Individualization It is possible to tailor printables to fit your particular needs whether you're designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Use: Printables for education that are free are designed to appeal to students from all ages, making the perfect resource for educators and parents.

-

An easy way to access HTML0: immediate access many designs and templates reduces time and effort.

Where to Find more Income Tax Exemption On 2nd Home Loan

Income Tax Malaysia 2022 Deadline Extension Latest News Update

Income Tax Malaysia 2022 Deadline Extension Latest News Update

Tax Deduction on second home loan principal amount Under section 80C of the Income Tax Act 1961 you get tax benefits on the home loan principal repayments made during a financial year You can claim a maximum amount of Rs 1 5 lakh as a deduction from your total income under this section

Under Section 80EEA first time homebuyers can claim additional tax benefits of up to Rs 1 5 lakh if their loan was sanctioned in FY 2019 20 extended to FY 2020 21 This exemption is over and above the existing tax rebate of Rs 2

If we've already piqued your interest in Income Tax Exemption On 2nd Home Loan and other printables, let's discover where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection with Income Tax Exemption On 2nd Home Loan for all purposes.

- Explore categories such as decoration for your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free including flashcards, learning materials.

- Perfect for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for free.

- The blogs covered cover a wide selection of subjects, that includes DIY projects to party planning.

Maximizing Income Tax Exemption On 2nd Home Loan

Here are some ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes or festive decorations to decorate your living spaces.

2. Education

- Print worksheets that are free to help reinforce your learning at home, or even in the classroom.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions like weddings and birthdays.

4. Organization

- Get organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Income Tax Exemption On 2nd Home Loan are an abundance filled with creative and practical information designed to meet a range of needs and passions. Their availability and versatility make them a valuable addition to the professional and personal lives of both. Explore the vast world of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax Exemption On 2nd Home Loan really gratis?

- Yes you can! You can print and download these documents for free.

-

Does it allow me to use free printing templates for commercial purposes?

- It's determined by the specific conditions of use. Always verify the guidelines of the creator before utilizing their templates for commercial projects.

-

Do you have any copyright issues with Income Tax Exemption On 2nd Home Loan?

- Some printables may contain restrictions regarding usage. You should read the terms and condition of use as provided by the author.

-

How do I print Income Tax Exemption On 2nd Home Loan?

- Print them at home with any printer or head to a print shop in your area for better quality prints.

-

What program do I need in order to open printables that are free?

- The majority of printables are with PDF formats, which is open with no cost software like Adobe Reader.

No Income Tax Exemption On Loan Interest From 2023

Income Tax Exemption On Gratuity Income Castuff

Check more sample of Income Tax Exemption On 2nd Home Loan below

Real Estate ReLakhs

2nd Home Loan Rochester Hills MI 2nd Home Loan Experts Michigan

CBDT Notifies Income Tax Exemption On California Public Employees

Auto Loan Calculator Surprise You Can Claim Income Tax Exemption If

Gratuity Under Income Tax Act All You Need To Know

Income Tax Exemption On Interest Of Education Loan YouTube

https://taxguru.in/income-tax/income-tax-benefits...

1 One flat is given on rent of Rs 15000 per month For this flat home loan interest per annum is Rs 1 41 859 2 Second flat is also given on rent of Rs 15000 per month The approximate home loan interest for this flat is Rs 2 00 000 What maximum tax exemption can I get in above case

https://cleartax.in/s/home-loan-tax-benefit

Know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan tax benefit Products

1 One flat is given on rent of Rs 15000 per month For this flat home loan interest per annum is Rs 1 41 859 2 Second flat is also given on rent of Rs 15000 per month The approximate home loan interest for this flat is Rs 2 00 000 What maximum tax exemption can I get in above case

Know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan tax benefit Products

Auto Loan Calculator Surprise You Can Claim Income Tax Exemption If

2nd Home Loan Rochester Hills MI 2nd Home Loan Experts Michigan

Gratuity Under Income Tax Act All You Need To Know

Income Tax Exemption On Interest Of Education Loan YouTube

Solved QUESTION 2 4 POINTS Suppose The Income Tax Exemption Chegg

Tax Benefits On Second Home Loan Tax Exemption On 2nd Home Loan PNB

Tax Benefits On Second Home Loan Tax Exemption On 2nd Home Loan PNB

Income Tax Exemption On Electric Vehicle Deduction On Electric Vehicle