In this age of electronic devices, where screens have become the dominant feature of our lives yet the appeal of tangible printed materials hasn't faded away. It doesn't matter if it's for educational reasons or creative projects, or just adding an element of personalization to your home, printables for free can be an excellent source. This article will take a dive into the sphere of "Income Tax Exemption On Home Loan Interest Before Possession," exploring what they are, where to find them, and what they can do to improve different aspects of your lives.

Get Latest Income Tax Exemption On Home Loan Interest Before Possession Below

Income Tax Exemption On Home Loan Interest Before Possession

Income Tax Exemption On Home Loan Interest Before Possession -

Verkko Yes you can claim deductions on the interest paid on the house loan before possession albeit after the construction is complete and the property is ready for occupancy If the construction is still underway or you use the loan to purchase a plot you cannot claim any exemption for interest on a housing loan

Verkko 16 toukok 2013 nbsp 0183 32 Principal component Section 80C provides that the principal component of the home loan is entitled to exemption up to Rs 100 000 along with all other permissible instruments like life insurance premium PPF ELSS NSC etc 80C deduction for principal repayment of home loan is allowed as soon as you start

Income Tax Exemption On Home Loan Interest Before Possession include a broad variety of printable, downloadable documents that can be downloaded online at no cost. These resources come in many kinds, including worksheets coloring pages, templates and much more. The value of Income Tax Exemption On Home Loan Interest Before Possession lies in their versatility and accessibility.

More of Income Tax Exemption On Home Loan Interest Before Possession

Income Tax Malaysia 2022 Deadline Extension Latest News Update

Income Tax Malaysia 2022 Deadline Extension Latest News Update

Verkko Total interest on home loan is Rs 72 000 for FY 2020 21 Since the property is rented out he can claim the entire interest as a deduction Also prakash can claim a deduction for principal repayment of Rs 1 50 000 Rs 1 68 000 or Rs 1 50 000 whichever is less under Section 80C from FY 2020 21

Verkko 4 elok 2021 nbsp 0183 32 Any interest paid before possession is tax deductible in 5 equal installments beginning from the financial year in which construction was completed So you get some tax deductions on interest payment but in a deferred manner and after completion of the house construction

Printables that are free have gained enormous popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

Flexible: Your HTML0 customization options allow you to customize printables to fit your particular needs whether it's making invitations and schedules, or even decorating your home.

-

Educational Value: These Income Tax Exemption On Home Loan Interest Before Possession offer a wide range of educational content for learners of all ages, which makes them a vital device for teachers and parents.

-

Simple: Quick access to a plethora of designs and templates saves time and effort.

Where to Find more Income Tax Exemption On Home Loan Interest Before Possession

Income Tax Exemption U s 80EEA Interest On Affordable Housing Loan

Income Tax Exemption U s 80EEA Interest On Affordable Housing Loan

Verkko 31 toukok 2022 nbsp 0183 32 Home Loans Tax Benefits Exemptions Under Section 80C 24 b 80EE amp 80EEA One of the primary benefits of home loans is that you get to enjoy substantial tax rebates which significantly reduce your tax outgo If you already have a home loan you can claim home loan tax benefits under various sections of the

Verkko In this video we have discussed about how to claim income tax deduction from interest paid on loan for a house or property before getting its possession Ta

If we've already piqued your interest in printables for free Let's find out where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Income Tax Exemption On Home Loan Interest Before Possession suitable for many applications.

- Explore categories such as decoration for your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free Flashcards, worksheets, and other educational materials.

- This is a great resource for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers post their original designs with templates and designs for free.

- These blogs cover a broad array of topics, ranging starting from DIY projects to party planning.

Maximizing Income Tax Exemption On Home Loan Interest Before Possession

Here are some new ways of making the most of Income Tax Exemption On Home Loan Interest Before Possession:

1. Home Decor

- Print and frame stunning art, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use printable worksheets from the internet for reinforcement of learning at home or in the classroom.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Income Tax Exemption On Home Loan Interest Before Possession are an abundance of creative and practical resources which cater to a wide range of needs and pursuits. Their access and versatility makes these printables a useful addition to your professional and personal life. Explore the wide world of Income Tax Exemption On Home Loan Interest Before Possession right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax Exemption On Home Loan Interest Before Possession really completely free?

- Yes you can! You can download and print the resources for free.

-

Does it allow me to use free printing templates for commercial purposes?

- It's based on specific rules of usage. Always verify the guidelines provided by the creator prior to using the printables in commercial projects.

-

Are there any copyright violations with Income Tax Exemption On Home Loan Interest Before Possession?

- Certain printables may be subject to restrictions in their usage. Check these terms and conditions as set out by the creator.

-

How do I print Income Tax Exemption On Home Loan Interest Before Possession?

- You can print them at home with an printer, or go to an area print shop for better quality prints.

-

What program do I need in order to open printables that are free?

- A majority of printed materials are in PDF format, which can be opened with free software such as Adobe Reader.

Under construction House How To Claim Tax Deduction On Home Loan

Home Loan Interest Tax Exemption Limit 2019 20 Home Sweet Home

Check more sample of Income Tax Exemption On Home Loan Interest Before Possession below

No Income Tax Exemption On Loan Interest From 2023

Gratuity Under Income Tax Act All You Need To Know

Income Tax Exemption On Gratuity Income Castuff

Home Loan Interest Exemption Limit Home Sweet Home Modern Livingroom

Auto Loan Calculator Surprise You Can Claim Income Tax Exemption If

CBDT Notifies Income Tax Exemption On California Public Employees

https://taxmantra.com/tax-benefit-on-home-loan-in-case-of-pre-and-post...

Verkko 16 toukok 2013 nbsp 0183 32 Principal component Section 80C provides that the principal component of the home loan is entitled to exemption up to Rs 100 000 along with all other permissible instruments like life insurance premium PPF ELSS NSC etc 80C deduction for principal repayment of home loan is allowed as soon as you start

https://cleartax.in/s/home-loan-tax-benefit

Verkko 5 helmik 2023 nbsp 0183 32 Principal repayment The interest portion of the EMI paid for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh

Verkko 16 toukok 2013 nbsp 0183 32 Principal component Section 80C provides that the principal component of the home loan is entitled to exemption up to Rs 100 000 along with all other permissible instruments like life insurance premium PPF ELSS NSC etc 80C deduction for principal repayment of home loan is allowed as soon as you start

Verkko 5 helmik 2023 nbsp 0183 32 Principal repayment The interest portion of the EMI paid for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh

Home Loan Interest Exemption Limit Home Sweet Home Modern Livingroom

Gratuity Under Income Tax Act All You Need To Know

Auto Loan Calculator Surprise You Can Claim Income Tax Exemption If

CBDT Notifies Income Tax Exemption On California Public Employees

Income Tax Exemption On Interest Of Education Loan YouTube

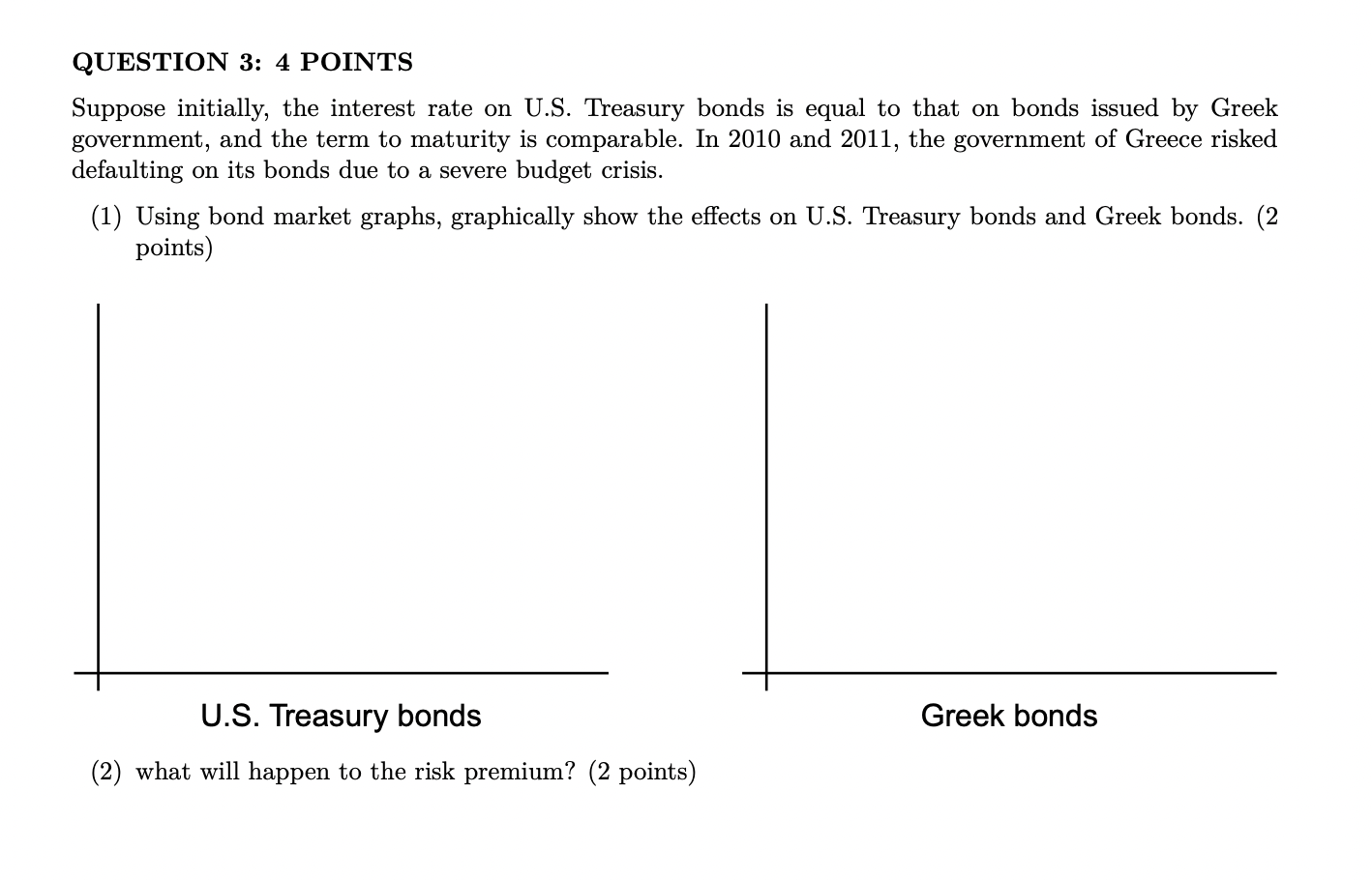

Solved QUESTION 2 4 POINTS Suppose The Income Tax Exemption Chegg

Solved QUESTION 2 4 POINTS Suppose The Income Tax Exemption Chegg

Income Tax Exemption On Electric Vehicle Deduction On Electric Vehicle