In a world in which screens are the norm however, the attraction of tangible printed objects isn't diminished. For educational purposes project ideas, artistic or simply adding the personal touch to your space, Income Tax Exemption On House Rent Allowance are now a useful resource. In this article, we'll take a dive into the world of "Income Tax Exemption On House Rent Allowance," exploring the benefits of them, where to find them, and how they can improve various aspects of your daily life.

Get Latest Income Tax Exemption On House Rent Allowance Below

Income Tax Exemption On House Rent Allowance

Income Tax Exemption On House Rent Allowance -

If you rent a furnished or unfurnished place and do not receive House Rent Allowance as part of your salary you can claim a deduction for the rent paid under Section 80 GG of the Income tax Act To claim this

Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions for that rent on their taxes This benefit applies to both salaried individuals and

Printables for free cover a broad collection of printable content that can be downloaded from the internet at no cost. They come in many kinds, including worksheets templates, coloring pages, and more. The appeal of printables for free is in their variety and accessibility.

More of Income Tax Exemption On House Rent Allowance

HOUSE RENT ALLOWANCE Page 4 CENTRAL GOVERNMENT EMPLOYEES NEWS

HOUSE RENT ALLOWANCE Page 4 CENTRAL GOVERNMENT EMPLOYEES NEWS

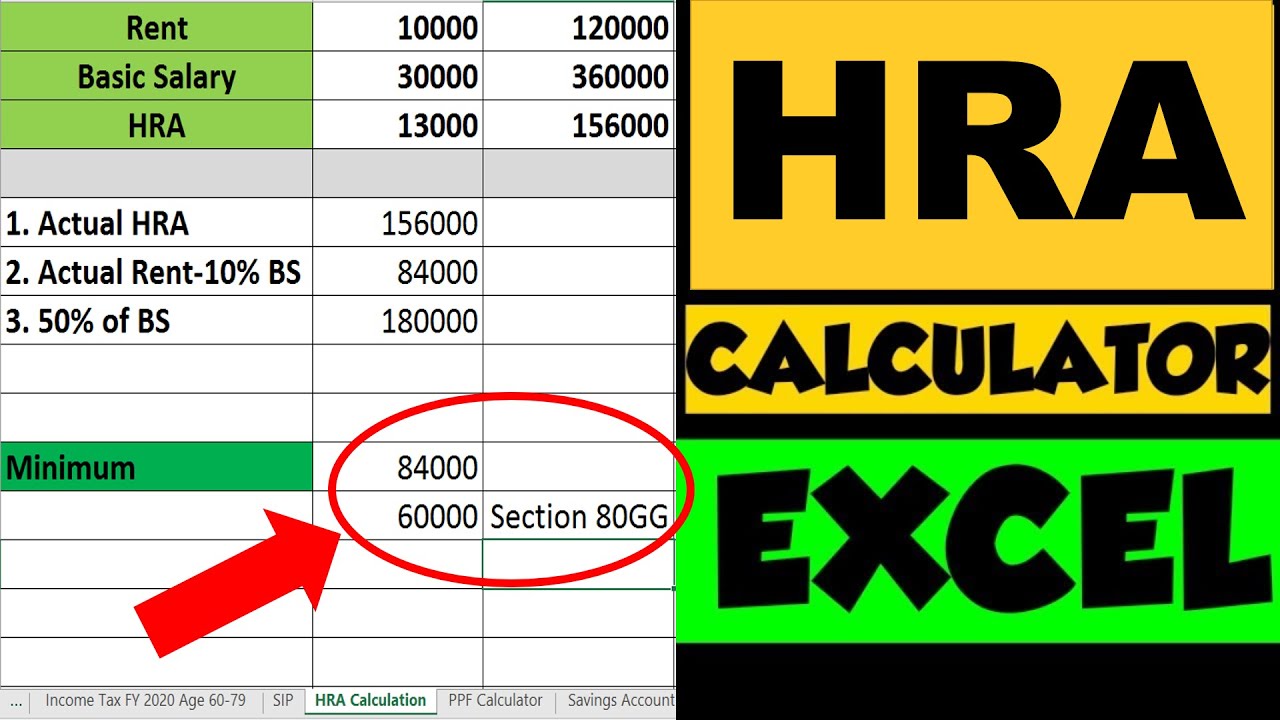

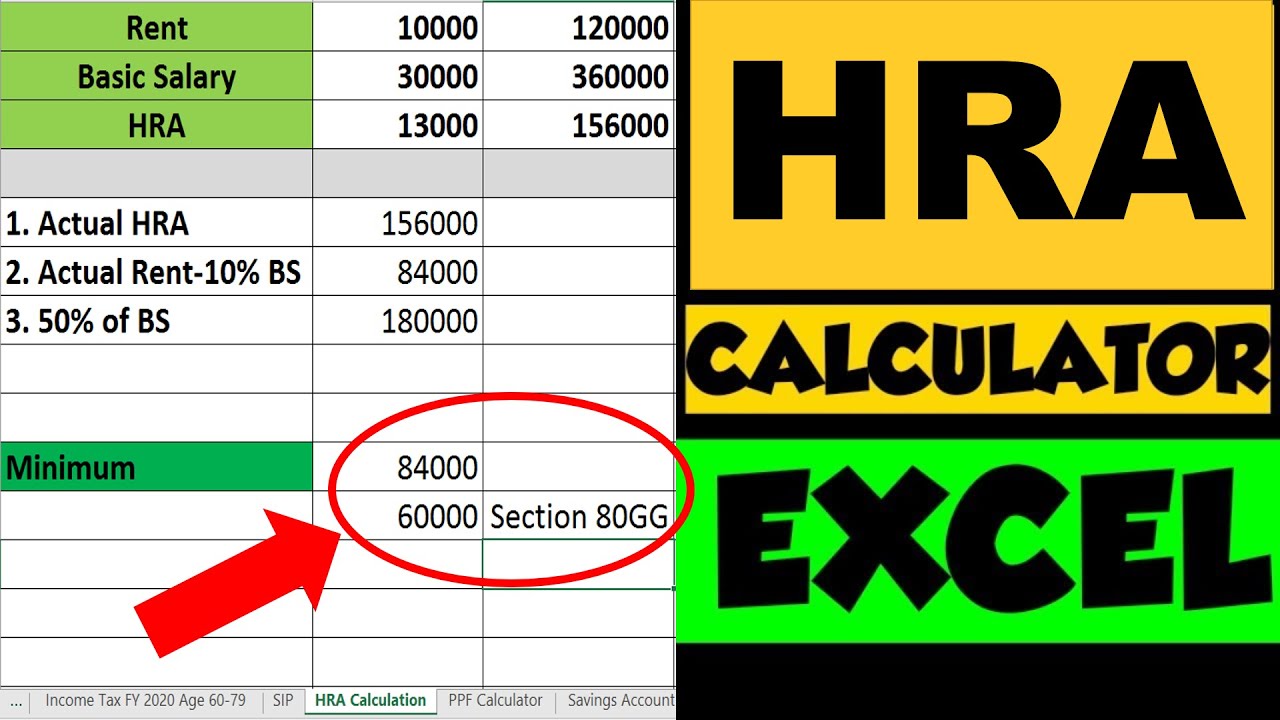

Our HRA exemption calculator will help you calculate what portion of the HRA you receive from your employer is exempt from tax and how much is taxable If you don t live in a rented accommodation but still get house rent allowance

An employee can claim exemption on his House Rent Allowance HRA under the Income Tax Act if he stays in a rented house and is in receipt of HRA from his employer In order to claim the deduction an employee must

Income Tax Exemption On House Rent Allowance have garnered immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Customization: We can customize the templates to meet your individual needs whether it's making invitations, organizing your schedule, or even decorating your home.

-

Educational Impact: Printing educational materials for no cost offer a wide range of educational content for learners of all ages, making them an invaluable source for educators and parents.

-

The convenience of You have instant access numerous designs and templates is time-saving and saves effort.

Where to Find more Income Tax Exemption On House Rent Allowance

CA Sumit Jain House Rent Allowance HRA Calculation Exemption

CA Sumit Jain House Rent Allowance HRA Calculation Exemption

Subject to certain conditions a part of HRA is exempted under Section 10 13A of the Income tax Act 1961 Amount of HRA tax exemption is deductible from the total salary income before arriving at a gross taxable

Salaried individuals who live in a rented house can claim House Rent Allowance or HRA to lower taxes This can be partially or completely exempt from taxes The allowance is for expenses

Now that we've ignited your curiosity about Income Tax Exemption On House Rent Allowance Let's take a look at where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Income Tax Exemption On House Rent Allowance suitable for many goals.

- Explore categories such as furniture, education, management, and craft.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing along with flashcards, as well as other learning tools.

- Great for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for no cost.

- These blogs cover a wide range of interests, starting from DIY projects to planning a party.

Maximizing Income Tax Exemption On House Rent Allowance

Here are some new ways create the maximum value of Income Tax Exemption On House Rent Allowance:

1. Home Decor

- Print and frame gorgeous artwork, quotes as well as seasonal decorations, to embellish your living areas.

2. Education

- Use printable worksheets from the internet to enhance learning at home for the classroom.

3. Event Planning

- Make invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Income Tax Exemption On House Rent Allowance are a treasure trove of innovative and useful resources that can meet the needs of a variety of people and interests. Their accessibility and versatility make them a fantastic addition to both professional and personal lives. Explore the vast collection of Income Tax Exemption On House Rent Allowance and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really absolutely free?

- Yes they are! You can print and download these free resources for no cost.

-

Are there any free printing templates for commercial purposes?

- It's based on specific usage guidelines. Always review the terms of use for the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright issues with printables that are free?

- Some printables may come with restrictions regarding their use. Make sure to read the terms and conditions offered by the creator.

-

How do I print printables for free?

- Print them at home using either a printer or go to an in-store print shop to get superior prints.

-

What software is required to open printables at no cost?

- The majority of PDF documents are provided in PDF format, which can be opened with free software, such as Adobe Reader.

How HRA Exemption Is Calculated Excel Examples FinCalC Blog

Income Tax EXPLAINED Check HRA Calculator Know Taxability Exemption

Check more sample of Income Tax Exemption On House Rent Allowance below

House Rent Allowance HRA Tax Exemption HRA Calculation Rules

HRA Exemption Rules How To Save Tax On House Rent Allowance House

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

Meaning Of House Rent Allowance And How Does It Cater To Tax Exemption

House Rent Allowance A Tax Planning Tool For Salaried Chandan

CBDT Notifies Income Tax Exemption On California Public Employees

https://tax2win.in/guide/hra-house-rent …

Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions for that rent on their taxes This benefit applies to both salaried individuals and

https://www.tankhapay.com/blog/house …

The exemption rules for House Rent Allowance HRA are governed by specific guidelines outlined in the Income Tax Act Here are some prominent rules related to HRA Percentage of Basic Salary The amount of

Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions for that rent on their taxes This benefit applies to both salaried individuals and

The exemption rules for House Rent Allowance HRA are governed by specific guidelines outlined in the Income Tax Act Here are some prominent rules related to HRA Percentage of Basic Salary The amount of

Meaning Of House Rent Allowance And How Does It Cater To Tax Exemption

HRA Exemption Rules How To Save Tax On House Rent Allowance House

House Rent Allowance A Tax Planning Tool For Salaried Chandan

CBDT Notifies Income Tax Exemption On California Public Employees

House Rent Allowance New HRA Exemption Rules Tax Deductions 2020

HRA House Rent Allowance Tax Exemption Rules Overview And Blog By

HRA House Rent Allowance Tax Exemption Rules Overview And Blog By

House Rent Allowance How To Calculate HRA Exemption TaxWinner