In this age of electronic devices, in which screens are the norm however, the attraction of tangible printed products hasn't decreased. If it's to aid in education, creative projects, or simply to add an element of personalization to your space, Income Tax Exemption On House Rent Paid have become an invaluable source. For this piece, we'll take a dive through the vast world of "Income Tax Exemption On House Rent Paid," exploring the different types of printables, where to get them, as well as what they can do to improve different aspects of your life.

Get Latest Income Tax Exemption On House Rent Paid Below

Income Tax Exemption On House Rent Paid

Income Tax Exemption On House Rent Paid -

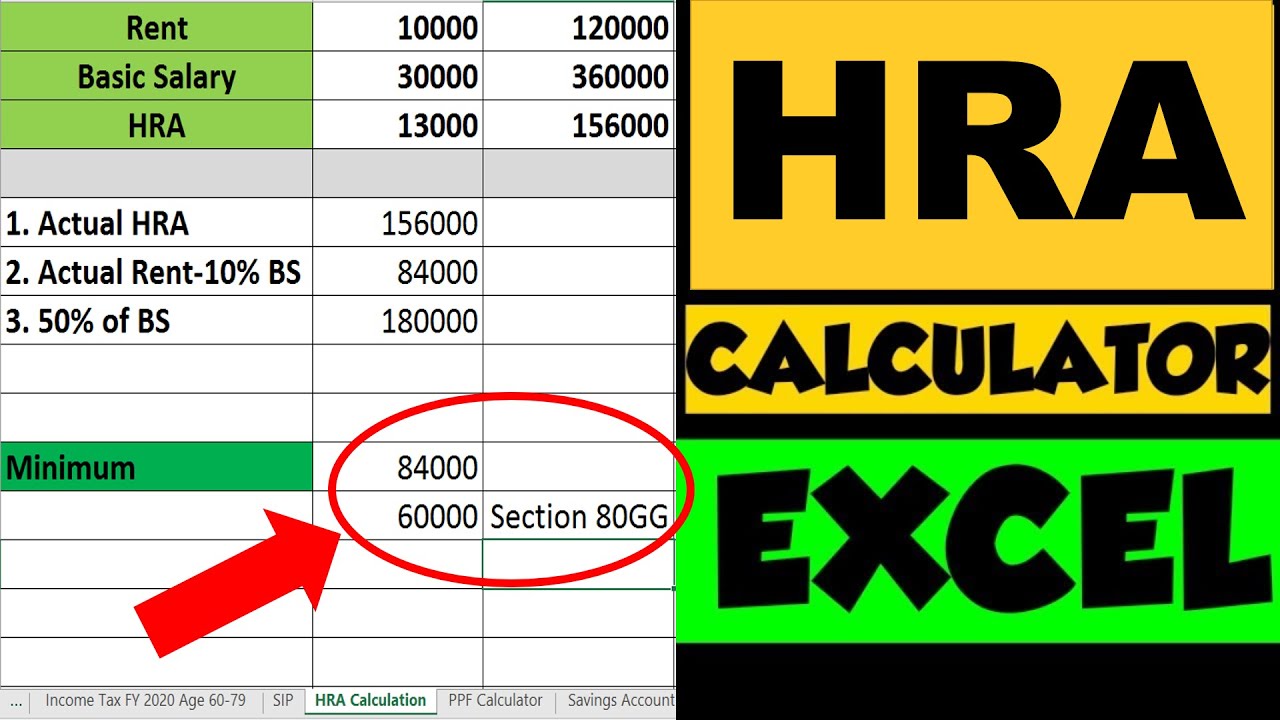

Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions for that rent on their taxes This benefit applies to both salaried individuals and self employed persons

Salaried employees who receive house rent allowance as a part of salary and pay rent can claim HRA exemption to reduce their taxable salary wholly or partially Which section of the income tax does HRA come under

Printables for free include a vast assortment of printable, downloadable materials online, at no cost. These materials come in a variety of kinds, including worksheets coloring pages, templates and more. The great thing about Income Tax Exemption On House Rent Paid is in their variety and accessibility.

More of Income Tax Exemption On House Rent Paid

Calculating Gratuity All About Gratuity Meaning And Gratuity Taxation

Calculating Gratuity All About Gratuity Meaning And Gratuity Taxation

If you rent a furnished or unfurnished place and do not receive House Rent Allowance as part of your salary you can claim a deduction for the rent paid under Section 80 GG of the Income tax Act To claim this deduction you need to submit Form 10B

By providing the rental agreement or rent receipts to your employer you can claim income tax HRA exemption without excess tax deduction at source In case the annual rent payment is over 1 00 000 per annum you will also need to

Printables that are free have gained enormous popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

Personalization We can customize printing templates to your own specific requirements for invitations, whether that's creating them to organize your schedule or decorating your home.

-

Educational value: Free educational printables offer a wide range of educational content for learners of all ages, making them a valuable tool for parents and teachers.

-

Simple: You have instant access a plethora of designs and templates cuts down on time and efforts.

Where to Find more Income Tax Exemption On House Rent Paid

HOUSE RENT ALLOWANCE Page 4 CENTRAL GOVERNMENT EMPLOYEES NEWS

HOUSE RENT ALLOWANCE Page 4 CENTRAL GOVERNMENT EMPLOYEES NEWS

From FY 2020 21 onwards House Rent Allowance Exemption is only available if an employee opts for the Old Tax Regime Exemption Rules and Calculation The amount of Exempt HRA will be the least of the following amounts Actual House Rent Allowance received Actual rent paid less 10 of salary

HRA exemption is calculated based on multiple things like the actual rent paid the base pay or salary of the individual and the location of the rental housing Individuals who are self employed may also qualify for the HRA exemption under Section 80GG of the Income Tax Act

After we've peaked your curiosity about Income Tax Exemption On House Rent Paid Let's see where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety and Income Tax Exemption On House Rent Paid for a variety objectives.

- Explore categories such as furniture, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets Flashcards, worksheets, and other educational materials.

- It is ideal for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- The blogs covered cover a wide range of interests, all the way from DIY projects to planning a party.

Maximizing Income Tax Exemption On House Rent Paid

Here are some new ways in order to maximize the use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or decorations for the holidays to beautify your living areas.

2. Education

- Use printable worksheets from the internet to aid in learning at your home and in class.

3. Event Planning

- Create invitations, banners, and decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized by using printable calendars or to-do lists. meal planners.

Conclusion

Income Tax Exemption On House Rent Paid are a treasure trove of practical and innovative resources that cater to various needs and pursuits. Their access and versatility makes them an essential part of every aspect of your life, both professional and personal. Explore the wide world of Income Tax Exemption On House Rent Paid to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly completely free?

- Yes you can! You can print and download these documents for free.

-

Does it allow me to use free printables for commercial purposes?

- It depends on the specific usage guidelines. Always verify the guidelines provided by the creator prior to printing printables for commercial projects.

-

Are there any copyright concerns with Income Tax Exemption On House Rent Paid?

- Certain printables may be subject to restrictions in their usage. Always read the terms and conditions set forth by the creator.

-

How do I print printables for free?

- Print them at home with either a printer or go to any local print store for high-quality prints.

-

What software do I need to open printables free of charge?

- Many printables are offered in the format of PDF, which is open with no cost software such as Adobe Reader.

CA Sumit Jain House Rent Allowance HRA Calculation Exemption

Income Tax Malaysia 2022 Deadline Extension Latest News Update

Check more sample of Income Tax Exemption On House Rent Paid below

Gratuity Under Income Tax Act All You Need To Know

Rent In HER Purse HRA In HIS Wallet

CBDT Notifies Income Tax Exemption On California Public Employees

Can The Rent Paid To Parents Or Spouses Be Eligible For HRA Exemption

ITR Filing 2023 How To Claim Exemption On HRA In Tax Return

Sample Letter Exemption Doc Template PdfFiller

https://cleartax.in › hra-house-rent-allowance

Salaried employees who receive house rent allowance as a part of salary and pay rent can claim HRA exemption to reduce their taxable salary wholly or partially Which section of the income tax does HRA come under

https://taxguru.in › income-tax › house-rent-allowance...

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer Part of Salary is apportioned to HRA 1 CONDITIONS FOR CLAIMING HRA EXEMPTION

Salaried employees who receive house rent allowance as a part of salary and pay rent can claim HRA exemption to reduce their taxable salary wholly or partially Which section of the income tax does HRA come under

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer Part of Salary is apportioned to HRA 1 CONDITIONS FOR CLAIMING HRA EXEMPTION

Can The Rent Paid To Parents Or Spouses Be Eligible For HRA Exemption

Rent In HER Purse HRA In HIS Wallet

ITR Filing 2023 How To Claim Exemption On HRA In Tax Return

Sample Letter Exemption Doc Template PdfFiller

Tax Bd 2015 VAT Exemption On House Rent For IT ITES Company

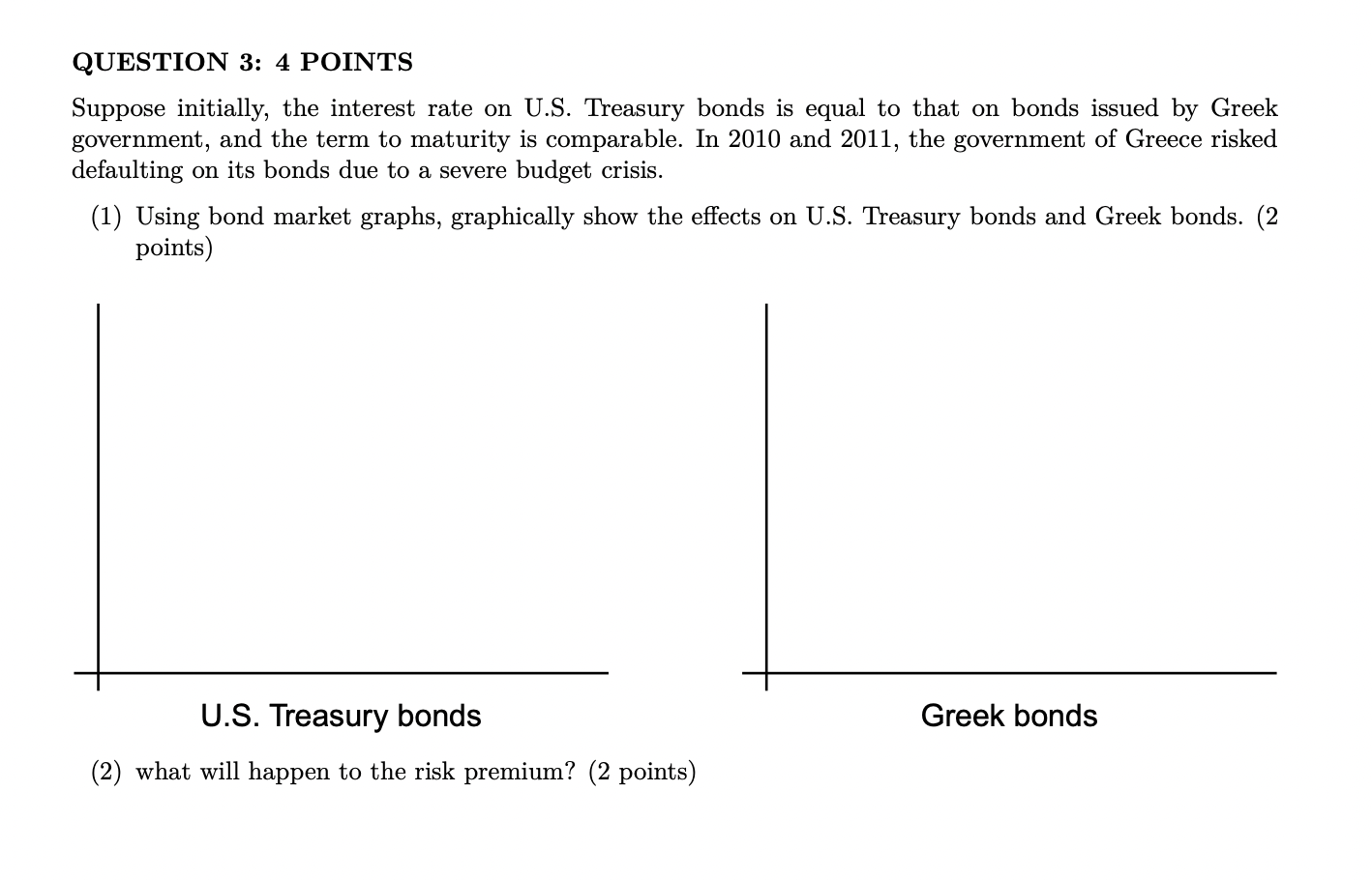

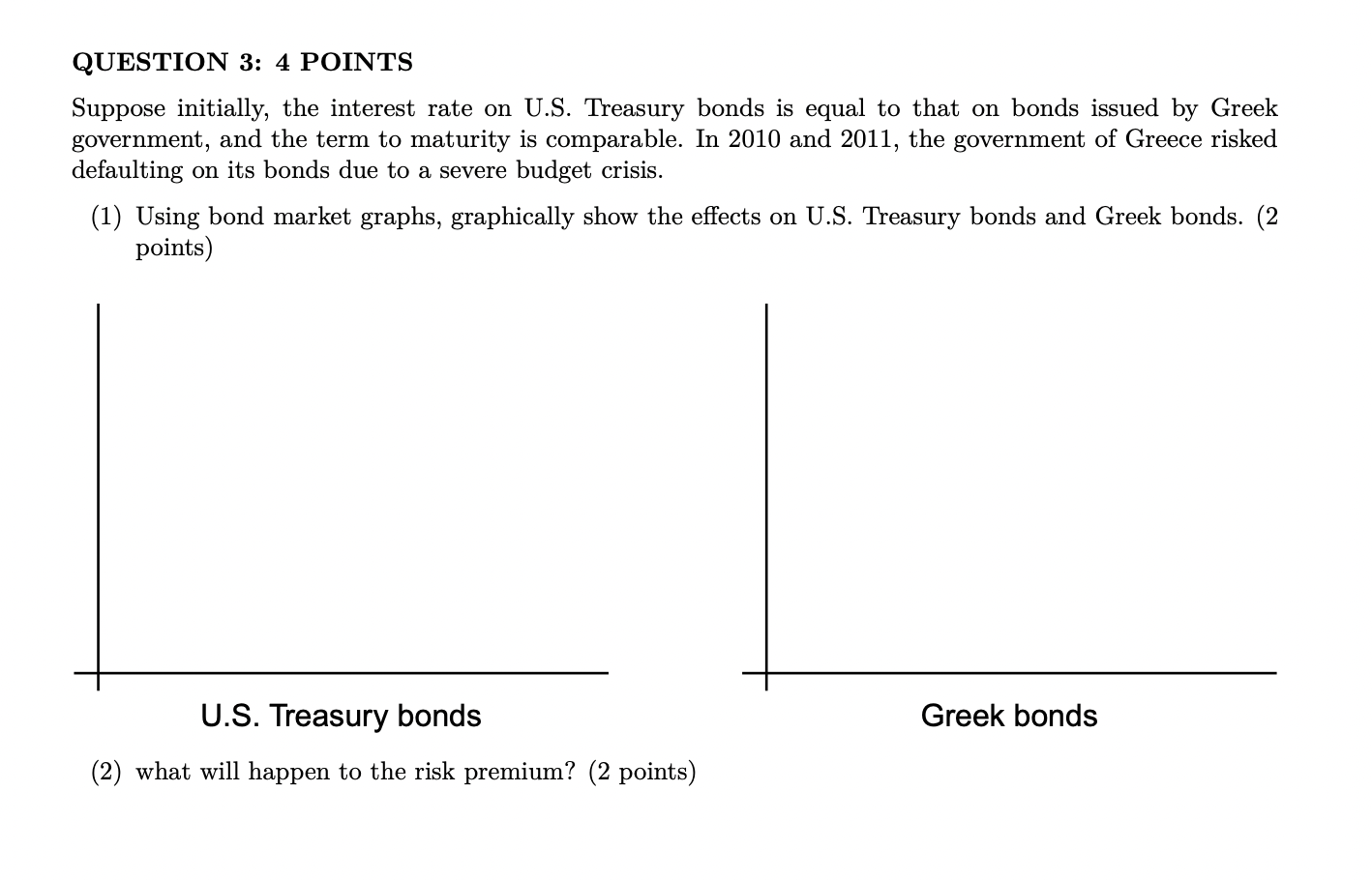

Solved QUESTION 2 4 POINTS Suppose The Income Tax Exemption Chegg

Solved QUESTION 2 4 POINTS Suppose The Income Tax Exemption Chegg

Income Tax Exemption On Electric Vehicle Deduction On Electric Vehicle