In the age of digital, where screens dominate our lives, the charm of tangible printed material hasn't diminished. If it's to aid in education or creative projects, or just adding some personal flair to your area, Income Tax Exemption Singapore are a great resource. In this article, we'll take a dive deep into the realm of "Income Tax Exemption Singapore," exploring the benefits of them, where they are, and the ways that they can benefit different aspects of your lives.

Get Latest Income Tax Exemption Singapore Below

Income Tax Exemption Singapore

Income Tax Exemption Singapore -

Corporate income tax CIT 17 Partial tax exemption 75 of first S 10 000 and 50 of next S 190 000 of chargeable income are exempt from tax from YA 2020 No CIT rebate for YA 2022

A resident individual s taxable income after setoff of personal reliefs and deductions is subject to income tax at progressive rates Current rates from the year of assessment 2024 income year 2023 are shown below

Income Tax Exemption Singapore provide a diverse selection of printable and downloadable material that is available online at no cost. These materials come in a variety of types, such as worksheets templates, coloring pages, and many more. The beauty of Income Tax Exemption Singapore lies in their versatility and accessibility.

More of Income Tax Exemption Singapore

What Are Corporate Tax Exemptions In Singapore

What Are Corporate Tax Exemptions In Singapore

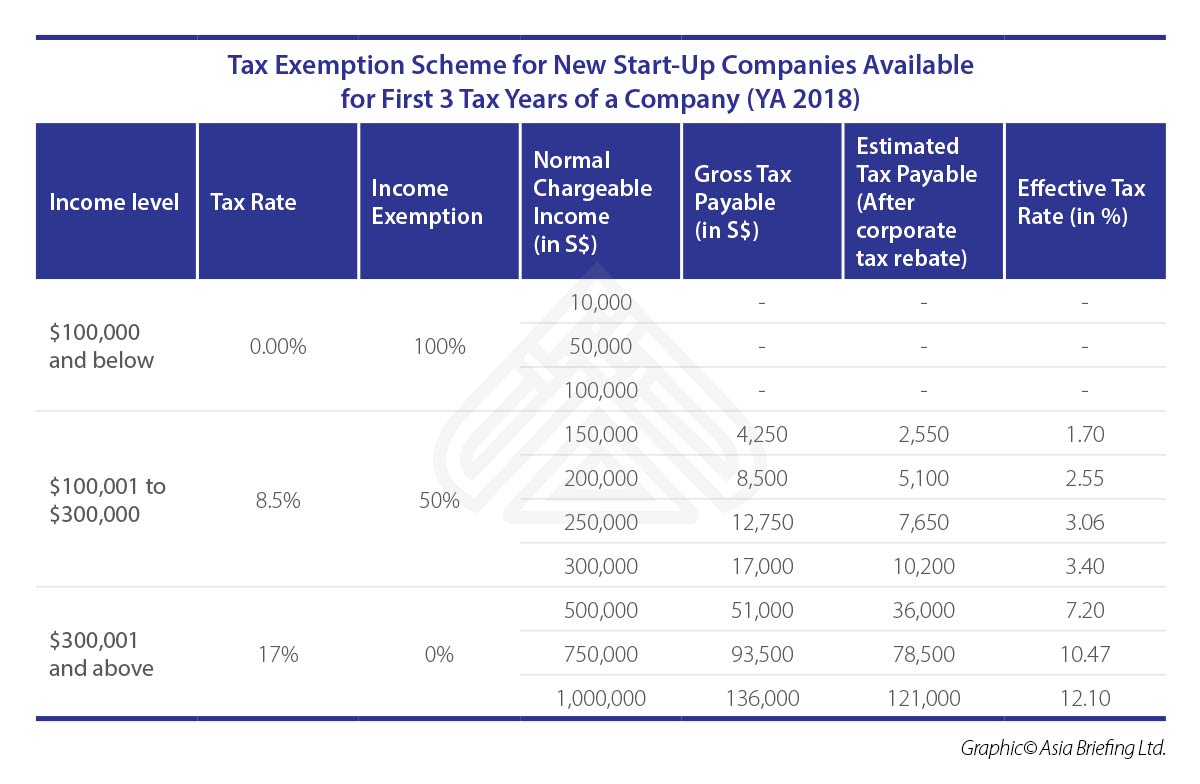

This article will explain what is the Start Up Tax Exemption SUTE scheme the amount of tax exemption and which companies qualify for it

Otherwise 17 for non individuals or 22 for individuals applies From YA2024 the withholding tax rate of 22 for individuals will be increased to 24 Tax exemption applies for interest payments made by banks finance companies and

Income Tax Exemption Singapore have gained a lot of popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

Individualization Your HTML0 customization options allow you to customize print-ready templates to your specific requirements whether it's making invitations making your schedule, or even decorating your home.

-

Educational Value Education-related printables at no charge are designed to appeal to students of all ages, making the perfect tool for teachers and parents.

-

An easy way to access HTML0: immediate access the vast array of design and templates is time-saving and saves effort.

Where to Find more Income Tax Exemption Singapore

Tax Exemption In Singapore How To Be Exempt From Corporate Taxes

Tax Exemption In Singapore How To Be Exempt From Corporate Taxes

Singapore tax exemption for individuals refers to the entitlements of taxpayers in Singapore to various exemptions which would reduce their taxable income The Singapore

Singapore s corporate income tax rate has been maintained at a flat 17 over the last 10 years A company s chargeable income is reduced by the tax exemption rates set by IRAS for each respective Year of Assessment

Now that we've piqued your interest in printables for free we'll explore the places you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of printables that are free for a variety of goals.

- Explore categories such as home decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets as well as flashcards and other learning tools.

- Ideal for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates free of charge.

- These blogs cover a broad variety of topics, that includes DIY projects to party planning.

Maximizing Income Tax Exemption Singapore

Here are some creative ways that you can make use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Use free printable worksheets to enhance learning at home as well as in the class.

3. Event Planning

- Invitations, banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Be organized by using printable calendars or to-do lists. meal planners.

Conclusion

Income Tax Exemption Singapore are an abundance of innovative and useful resources that satisfy a wide range of requirements and pursuits. Their availability and versatility make them an essential part of every aspect of your life, both professional and personal. Explore the vast array of Income Tax Exemption Singapore right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really absolutely free?

- Yes, they are! You can print and download these free resources for no cost.

-

Can I download free printables to make commercial products?

- It's all dependent on the rules of usage. Always review the terms of use for the creator before using their printables for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Certain printables might have limitations in use. You should read the terms and conditions set forth by the creator.

-

How can I print printables for free?

- You can print them at home using the printer, or go to the local print shops for premium prints.

-

What program must I use to open printables for free?

- The majority of printed documents are as PDF files, which can be opened using free programs like Adobe Reader.

Singapore Income Tax Calculator To Calculate Foreigner s Income Tax In

All Income Earned In Singapore Is Subject To Tax However Singapore

Check more sample of Income Tax Exemption Singapore below

Withholding Tax Singapore

Corporate Income Tax Exemption Schemes In Singapore Paul Wan Co

5 Tips To Reduce Your 2022 Income Tax In Singapore Seedly

Corporate Tax In Singapore Singapore Taxation

Corporate Income Tax In Singapore

Iran s Income Tax Exemption Determined Financial Tribune

https://taxsummaries.pwc.com/singapo…

A resident individual s taxable income after setoff of personal reliefs and deductions is subject to income tax at progressive rates Current rates from the year of assessment 2024 income year 2023 are shown below

https://taxsummaries.pwc.com/singapo…

Tax on corporate income is imposed at a flat rate of 17 A partial tax exemption and a three year start up tax exemption for qualifying start up companies are available Partial tax exemption income taxable at

A resident individual s taxable income after setoff of personal reliefs and deductions is subject to income tax at progressive rates Current rates from the year of assessment 2024 income year 2023 are shown below

Tax on corporate income is imposed at a flat rate of 17 A partial tax exemption and a three year start up tax exemption for qualifying start up companies are available Partial tax exemption income taxable at

Corporate Tax In Singapore Singapore Taxation

Corporate Income Tax Exemption Schemes In Singapore Paul Wan Co

Corporate Income Tax In Singapore

Iran s Income Tax Exemption Determined Financial Tribune

Singapore s Corporate Income Tax Quick Facts Dezan Shira Associates

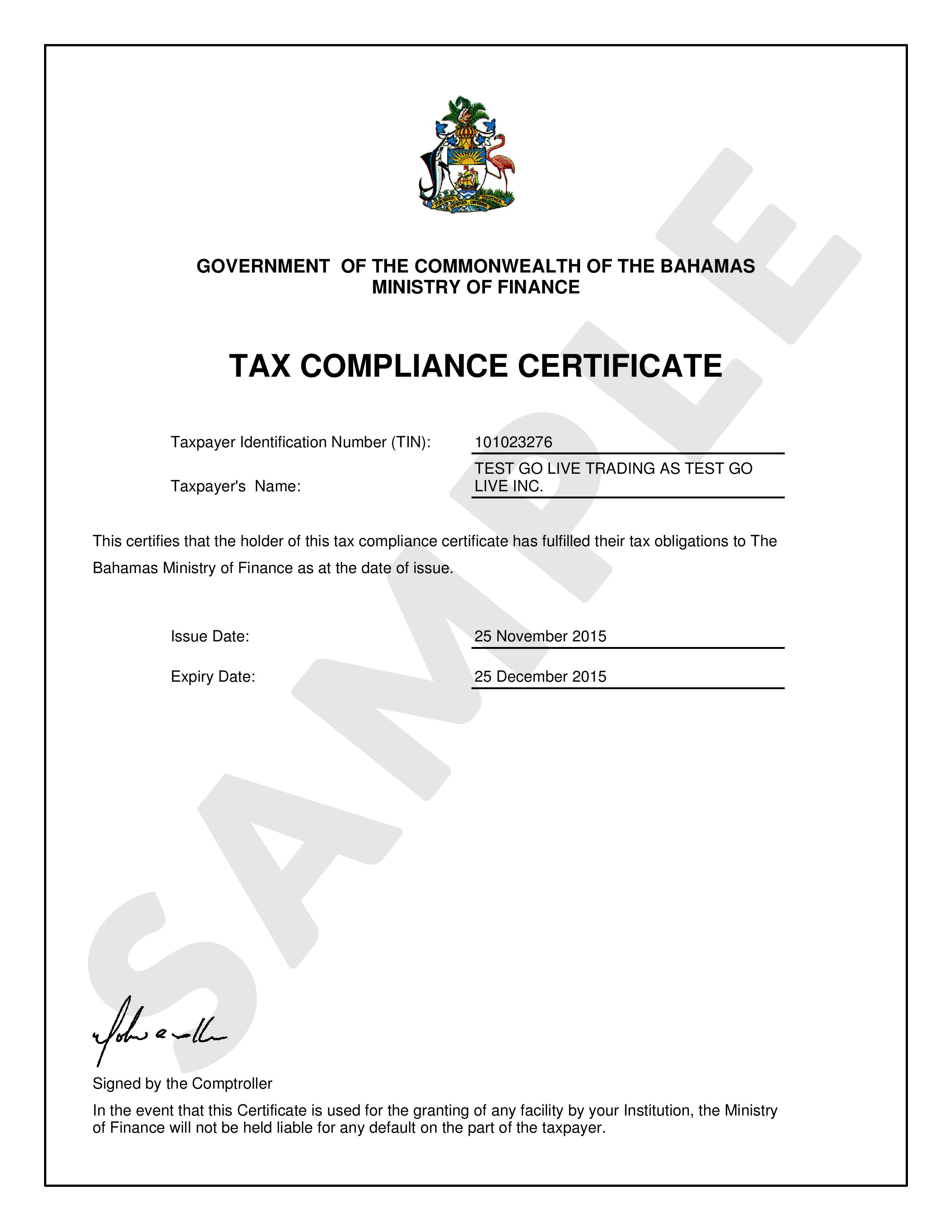

Tax Compliance Certificate Sample Hq Printable Documents CLOUD HOT GIRL

Tax Compliance Certificate Sample Hq Printable Documents CLOUD HOT GIRL

Corporate Tax Singapore Filing Rate At 400 year