Today, in which screens are the norm it's no wonder that the appeal of tangible printed materials hasn't faded away. For educational purposes such as creative projects or just adding an individual touch to your space, Income Tax Exemption U S 87a are now an essential resource. For this piece, we'll dive through the vast world of "Income Tax Exemption U S 87a," exploring what they are, how they are available, and how they can enrich various aspects of your daily life.

Get Latest Income Tax Exemption U S 87a Below

Income Tax Exemption U S 87a

Income Tax Exemption U S 87a -

What are the conditions for claiming exemption under Section 87A Above all Income tax credit under Section 87A will be claimed automatically when you file your income tax return U s 87 Eligibility for exemption under

Discover the income tax rebate available under Section 87A of the Income Tax Act Learn how to claim the 87A rebate eligibility criteria and the applicable rebate

Printables for free cover a broad range of printable, free materials online, at no cost. They come in many types, like worksheets, templates, coloring pages and much more. One of the advantages of Income Tax Exemption U S 87a lies in their versatility and accessibility.

More of Income Tax Exemption U S 87a

Income Tax Exemption U s 80EEA Interest On Affordable Housing Loan

Income Tax Exemption U s 80EEA Interest On Affordable Housing Loan

What is tax rebate u s 87A A tax rebate is a type of discount offered on your tax liability If your annual income net of deductions and exemptions does not

Under the latest provisions of Section 87A any individual with an annual taxable income of up to Rs 5 lakhs is eligible for an income tax rebate of Rs12 500 This essentially

Income Tax Exemption U S 87a have gained a lot of popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

customization They can make printed materials to meet your requirements whether you're designing invitations and schedules, or even decorating your home.

-

Educational Value Printing educational materials for no cost can be used by students of all ages. This makes them a great aid for parents as well as educators.

-

Easy to use: The instant accessibility to a plethora of designs and templates reduces time and effort.

Where to Find more Income Tax Exemption U S 87a

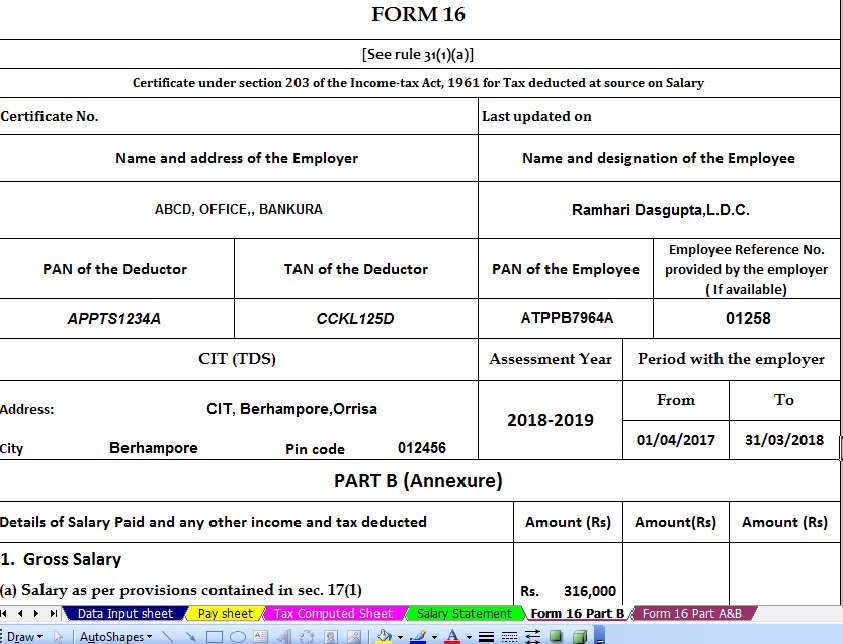

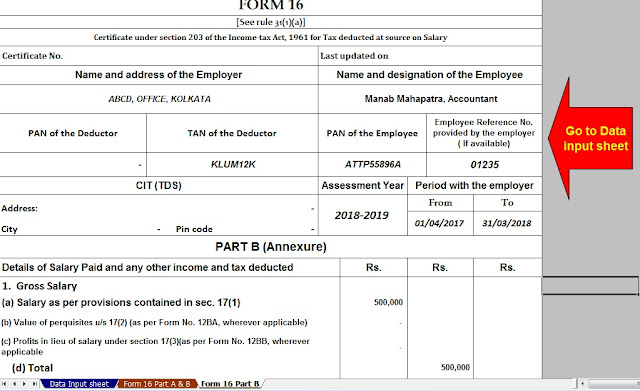

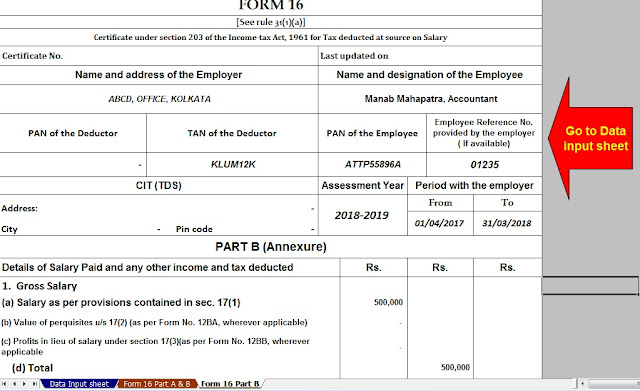

Income Tax Rebate Rs 2500 U s 87A Tdstaxindia

Income Tax Rebate Rs 2500 U s 87A Tdstaxindia

Section 87A of the Income Tax Act specifies eligibility guidelines and rebates for qualified taxpayers When the income exceeds the threshold limit the tax will

What is an Income Tax Rebate Under Section 87A Rebate under section 87A of the Income Tax Act helps taxpayers to reduce their tax liability Resident

Since we've got your interest in Income Tax Exemption U S 87a we'll explore the places you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection in Income Tax Exemption U S 87a for different motives.

- Explore categories like furniture, education, management, and craft.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets along with flashcards, as well as other learning materials.

- It is ideal for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their imaginative designs or templates for download.

- These blogs cover a wide variety of topics, ranging from DIY projects to planning a party.

Maximizing Income Tax Exemption U S 87a

Here are some fresh ways how you could make the most use of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Use printable worksheets from the internet for teaching at-home also in the classes.

3. Event Planning

- Design invitations and banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep your calendars organized by printing printable calendars checklists for tasks, as well as meal planners.

Conclusion

Income Tax Exemption U S 87a are a treasure trove of innovative and useful resources that meet a variety of needs and interest. Their availability and versatility make them a valuable addition to both professional and personal lives. Explore the many options of Income Tax Exemption U S 87a today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really are they free?

- Yes they are! You can print and download these documents for free.

-

Can I use free printouts for commercial usage?

- It is contingent on the specific conditions of use. Always read the guidelines of the creator before utilizing their templates for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Certain printables might have limitations in use. Be sure to check the terms and conditions set forth by the author.

-

How can I print printables for free?

- You can print them at home using any printer or head to a local print shop to purchase higher quality prints.

-

What program do I require to open printables at no cost?

- The majority of PDF documents are provided in PDF format. These is open with no cost software such as Adobe Reader.

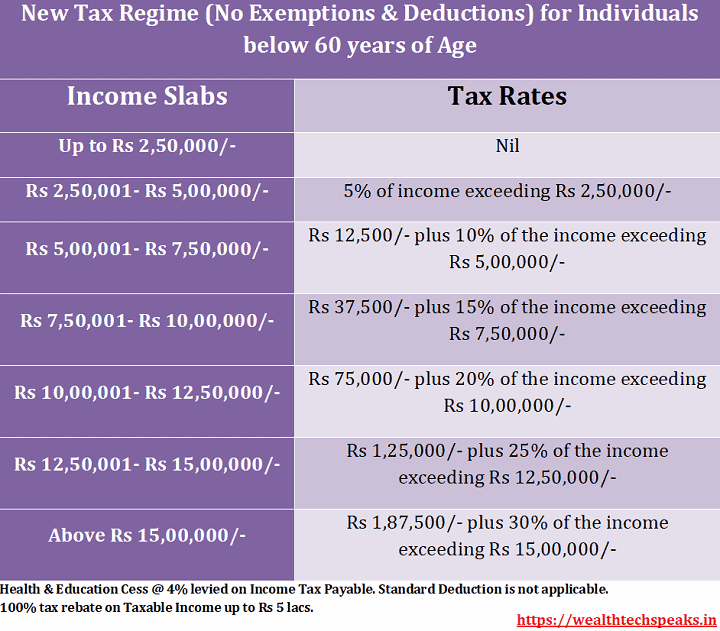

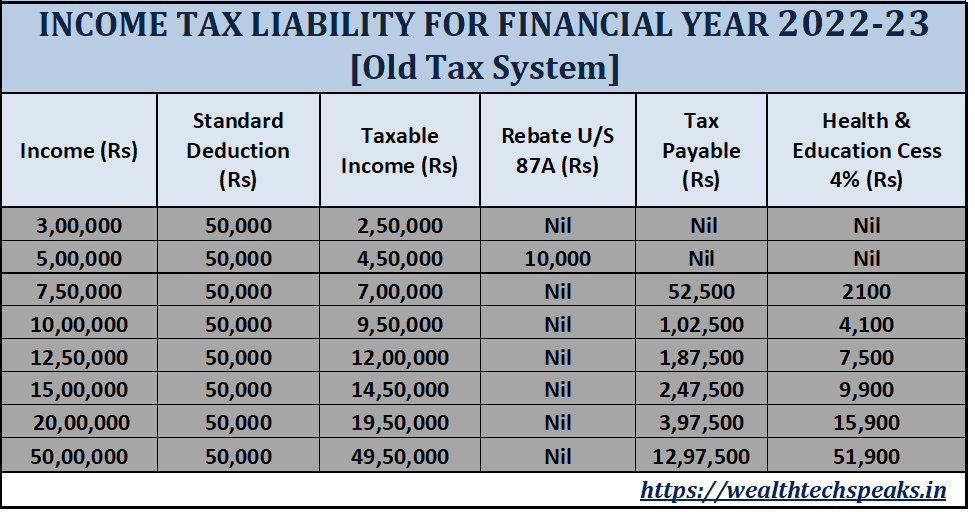

Income Tax Slabs Rates Financial Year 2022 23 WealthTech Speaks

Income Tax Rebate U s 87A For The Financial Year 2022 23

Check more sample of Income Tax Exemption U S 87a below

Income Tax Rebate Under Section 87A

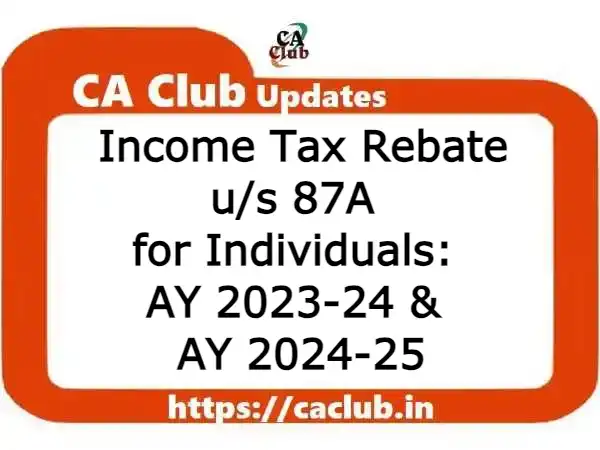

Income Tax Rebate U s 87A For Individuals AY 2023 24 2024 25 CA Club

Rebate U s 87A Of I Tax Act Income Tax

Income Tax Exemption U s 10 23C iiiac Allowable When 50 Of Total

ALL ABOUT REBATE 87A EXEMPTION OF TAX UP TO 5 LAKH SIMPLE TAX INDIA

Rebate U S 87A For FY 2017 18 AY 2018 19 All You Need To Know With

https://tax2win.in/guide/section-87a

Discover the income tax rebate available under Section 87A of the Income Tax Act Learn how to claim the 87A rebate eligibility criteria and the applicable rebate

https://m.economictimes.com/wealth/tax/who-is...

Story outline Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level

Discover the income tax rebate available under Section 87A of the Income Tax Act Learn how to claim the 87A rebate eligibility criteria and the applicable rebate

Story outline Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level

Income Tax Exemption U s 10 23C iiiac Allowable When 50 Of Total

Income Tax Rebate U s 87A For Individuals AY 2023 24 2024 25 CA Club

ALL ABOUT REBATE 87A EXEMPTION OF TAX UP TO 5 LAKH SIMPLE TAX INDIA

Rebate U S 87A For FY 2017 18 AY 2018 19 All You Need To Know With

Income Tax Calculation Financial Year 2022 23 WealthTech Speaks

Union Budget 2019 India Interim Budget News Expectations Tax

Union Budget 2019 India Interim Budget News Expectations Tax

Union Budget 2019 India Interim Budget News Expectations Tax