In this digital age, in which screens are the norm but the value of tangible printed products hasn't decreased. Be it for educational use in creative or artistic projects, or just adding personal touches to your space, Income Tax Exemptions For Salaried Employees 2020 21 have become an invaluable resource. Through this post, we'll take a dive into the sphere of "Income Tax Exemptions For Salaried Employees 2020 21," exploring what they are, where they are, and how they can improve various aspects of your life.

Get Latest Income Tax Exemptions For Salaried Employees 2020 21 Below

Income Tax Exemptions For Salaried Employees 2020 21

Income Tax Exemptions For Salaried Employees 2020 21 -

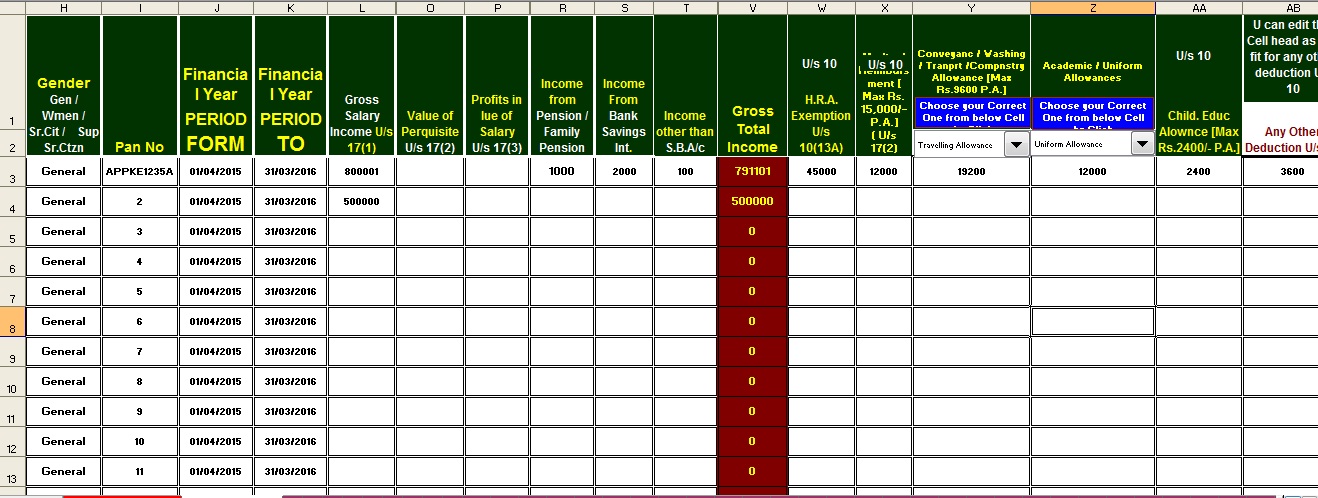

Salient features of Income tax calculator for salaried employees F Y 2020 21 1 Useful for the salaried employees of government and private sector 2 Private sector

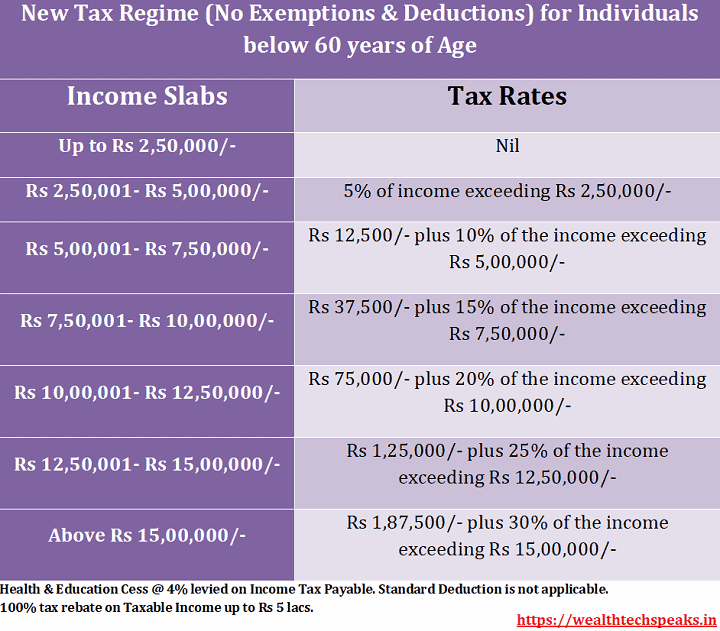

In this article we will learn about Income Tax Slabs under the old regime Income Tax Slabs under the new regime Comparison of Tax slabs under both the regimes How to calculate income tax under both tax regimes

Income Tax Exemptions For Salaried Employees 2020 21 provide a diverse variety of printable, downloadable materials available online at no cost. These printables come in different forms, including worksheets, coloring pages, templates and much more. The value of Income Tax Exemptions For Salaried Employees 2020 21 is in their variety and accessibility.

More of Income Tax Exemptions For Salaried Employees 2020 21

Income Tax Exemptions For 2015 16 For Salaried With Automated Master

Income Tax Exemptions For 2015 16 For Salaried With Automated Master

Salaried employees can avail a standard tax exemption of Rs 50 000 in the old tax regime in the financial year 2022 23 Starting from 2023 24 the new regime also offers the same standard deduction to salaried

Returns and Forms Applicable for Salaried Individuals for AY 2024 25 Disclaimer The content on this page is only to give an overview and general guidance and is not exhaustive For

Income Tax Exemptions For Salaried Employees 2020 21 have gained immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Personalization We can customize the templates to meet your individual needs, whether it's designing invitations and schedules, or decorating your home.

-

Educational Impact: Printing educational materials for no cost provide for students of all ages, which makes the perfect resource for educators and parents.

-

Affordability: Fast access a variety of designs and templates can save you time and energy.

Where to Find more Income Tax Exemptions For Salaried Employees 2020 21

Income Tax Slabs Rates Financial Year 2022 23 WealthTech Speaks

Income Tax Slabs Rates Financial Year 2022 23 WealthTech Speaks

As per the Budget 2017 18 the self employed individual other than the salaried class can contribute up to 20 of their gross income and the same can be deducted from the taxable income under Section 80CCD 1 of the Income

Basic income threshold exempt from tax for senior citizen aged 60 to 80 years and super senior citizens aged above 80 years is 3 lakh and 5 lakh respectively 2

We hope we've stimulated your interest in printables for free We'll take a look around to see where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Income Tax Exemptions For Salaried Employees 2020 21 designed for a variety reasons.

- Explore categories such as design, home decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets with flashcards and other teaching materials.

- This is a great resource for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- These blogs cover a broad spectrum of interests, from DIY projects to party planning.

Maximizing Income Tax Exemptions For Salaried Employees 2020 21

Here are some innovative ways of making the most of Income Tax Exemptions For Salaried Employees 2020 21:

1. Home Decor

- Print and frame stunning art, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print worksheets that are free for reinforcement of learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Be organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

Income Tax Exemptions For Salaried Employees 2020 21 are a treasure trove of practical and innovative resources catering to different needs and desires. Their accessibility and flexibility make these printables a useful addition to any professional or personal life. Explore the plethora of Income Tax Exemptions For Salaried Employees 2020 21 today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really for free?

- Yes you can! You can print and download these documents for free.

-

Are there any free printing templates for commercial purposes?

- It's contingent upon the specific conditions of use. Always verify the guidelines of the creator prior to printing printables for commercial projects.

-

Do you have any copyright issues when you download Income Tax Exemptions For Salaried Employees 2020 21?

- Some printables may come with restrictions in their usage. You should read the terms and conditions set forth by the designer.

-

How do I print Income Tax Exemptions For Salaried Employees 2020 21?

- Print them at home using your printer or visit any local print store for higher quality prints.

-

What software do I need to run printables free of charge?

- A majority of printed materials are in PDF format, which can be opened using free programs like Adobe Reader.

Income Tax Exemptions For Salaried Employees F Y 2022 23

How To File Income Tax Return Online For Salaried Employees 2022 2023

Check more sample of Income Tax Exemptions For Salaried Employees 2020 21 below

Income Tax Slab 2020 21 Pakistan Tax Rates For Salaried Non

List Of Allowances Exemptions Relevant To Salaried Employees TAXCONCEPT

Income Tax Calculator FY 2021 22 AY 2022 23 Excel Download 2023

Salaried Employees Get Tax Relief On Rent Free Accommodation INDToday

Income Tax Return Filing Know How To File Income Tax Return Online For

Income Tax Exemptions For Salaried Employees

https://cleartax.in › income-tax-slabs

In this article we will learn about Income Tax Slabs under the old regime Income Tax Slabs under the new regime Comparison of Tax slabs under both the regimes How to calculate income tax under both tax regimes

https://cleartax.in › income-tax-allowan…

Salaried employees have significant income tax deduction opportunities Major deductions include HRA standard deduction LTA books and periodicals and gratuity Other savings avenues include section 80C for

In this article we will learn about Income Tax Slabs under the old regime Income Tax Slabs under the new regime Comparison of Tax slabs under both the regimes How to calculate income tax under both tax regimes

Salaried employees have significant income tax deduction opportunities Major deductions include HRA standard deduction LTA books and periodicals and gratuity Other savings avenues include section 80C for

Salaried Employees Get Tax Relief On Rent Free Accommodation INDToday

List Of Allowances Exemptions Relevant To Salaried Employees TAXCONCEPT

Income Tax Return Filing Know How To File Income Tax Return Online For

Income Tax Exemptions For Salaried Employees

Income Tax Deductions List FY 2020 21 Blog De Livros

How To File Income Tax Return Online For Salaried Employee Alankit

How To File Income Tax Return Online For Salaried Employee Alankit

Tax Exemption Salaried Employees Can Save Tax Via Section 10