In the digital age, when screens dominate our lives however, the attraction of tangible printed material hasn't diminished. In the case of educational materials, creative projects, or simply adding a personal touch to your area, Income Tax House Loan Interest Exemption India have become a valuable resource. For this piece, we'll dive to the depths of "Income Tax House Loan Interest Exemption India," exploring the different types of printables, where to find them and what they can do to improve different aspects of your daily life.

Get Latest Income Tax House Loan Interest Exemption India Below

Income Tax House Loan Interest Exemption India

Income Tax House Loan Interest Exemption India -

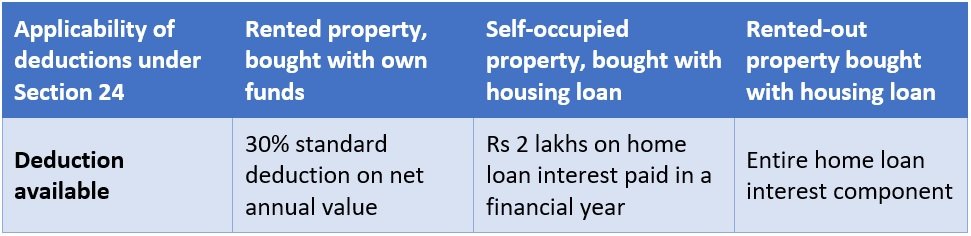

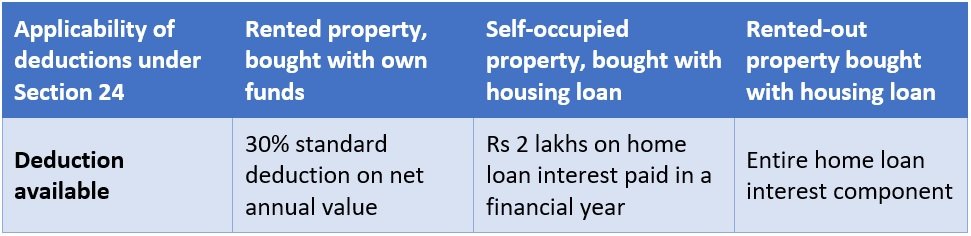

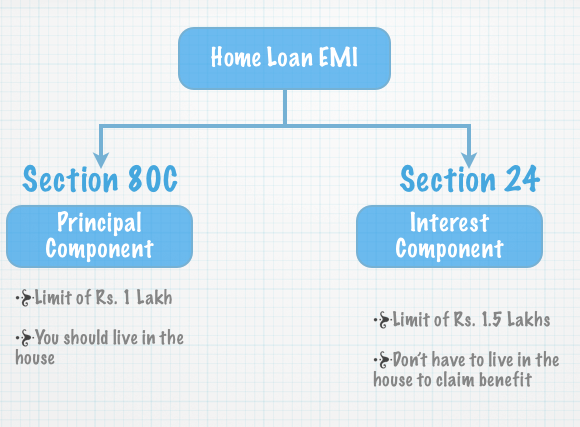

The maximum deduction on interest paid for self occupied houses is Rs 2 lakh This rule has been in effect from 2018 19 onwards However if your property is a let out then

Presently under Section 24 a home loan borrower who pays interest on the loan may deduct that interest from his or her gross annual income up to a maximum of

Printables for free include a vast assortment of printable, downloadable material that is available online at no cost. These resources come in various kinds, including worksheets templates, coloring pages, and much more. The benefit of Income Tax House Loan Interest Exemption India is in their versatility and accessibility.

More of Income Tax House Loan Interest Exemption India

Tax Benefits On Home Loan Know More At Taxhelpdesk

Tax Benefits On Home Loan Know More At Taxhelpdesk

Section 80EE allows Income Tax Benefits on Interest on Home Loan to first time buyers in the following events This deduction will be provided only if the cost of the property acquired is not more than

You can get home loan tax benefit under different sections like Section 80 EEA which provides income tax benefits of up to Rs 1 5 lakh on the home loan interests paid

Printables that are free have gained enormous recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

customization The Customization feature lets you tailor the design to meet your needs be it designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Worth: Education-related printables at no charge offer a wide range of educational content for learners of all ages, making these printables a powerful resource for educators and parents.

-

Simple: Quick access to numerous designs and templates saves time and effort.

Where to Find more Income Tax House Loan Interest Exemption India

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

One can claim tax exemption on the principal repayment for up to Rs 1 5 lakh Home loan interest deduction can be claimed in five equal instalments after the

80EE 1 In computing the total income of an assessee being an individual there shall be deducted in accordance with and subject to the provisions of this section interest

We've now piqued your curiosity about Income Tax House Loan Interest Exemption India Let's see where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection in Income Tax House Loan Interest Exemption India for different applications.

- Explore categories such as interior decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets Flashcards, worksheets, and other educational materials.

- It is ideal for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates, which are free.

- The blogs are a vast spectrum of interests, from DIY projects to party planning.

Maximizing Income Tax House Loan Interest Exemption India

Here are some new ways how you could make the most use of Income Tax House Loan Interest Exemption India:

1. Home Decor

- Print and frame stunning art, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use these printable worksheets free of charge to help reinforce your learning at home (or in the learning environment).

3. Event Planning

- Design invitations, banners, and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Income Tax House Loan Interest Exemption India are an abundance with useful and creative ideas which cater to a wide range of needs and pursuits. Their availability and versatility make them a valuable addition to the professional and personal lives of both. Explore the wide world of Income Tax House Loan Interest Exemption India right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax House Loan Interest Exemption India really are they free?

- Yes, they are! You can download and print these documents for free.

-

Can I make use of free printouts for commercial usage?

- It's determined by the specific usage guidelines. Always review the terms of use for the creator before utilizing printables for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Certain printables could be restricted on their use. Always read the conditions and terms of use provided by the author.

-

How do I print Income Tax House Loan Interest Exemption India?

- Print them at home with either a printer at home or in a print shop in your area for the highest quality prints.

-

What program do I need to run Income Tax House Loan Interest Exemption India?

- A majority of printed materials are in PDF format. They can be opened using free programs like Adobe Reader.

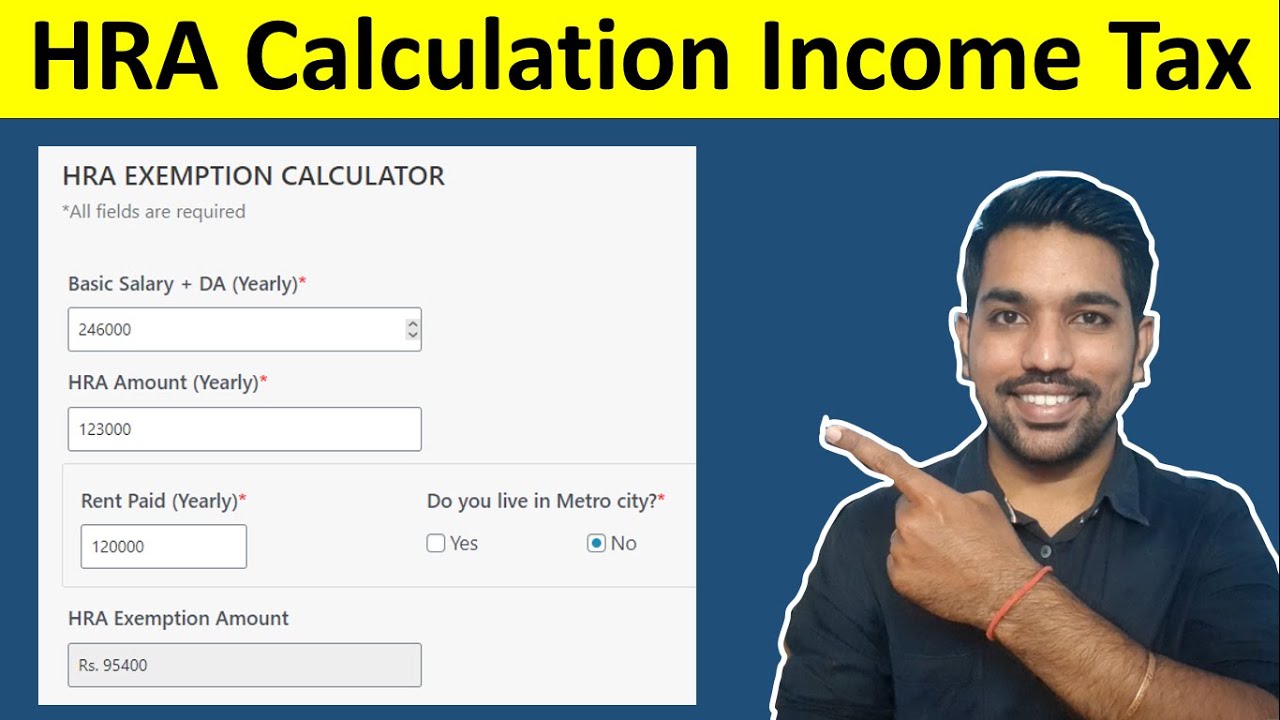

HRA Calculation In Income Tax House Rent Allowance Calculator

Tax Benefits On Home Loan Know More At Taxhelpdesk

Check more sample of Income Tax House Loan Interest Exemption India below

How HRA Exemption Is Calculated Excel Examples FinCalC Blog

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

Home Loan Tax Exemption Check Tax Benefits On Home Loan

National Interest Exemption Vs National Interest Waiver

24 Housing News

Patutkah Anda Bayar Baki Pinjaman Perumahan Lebih Awal Iproperty my

https://m.economictimes.com/wealth/tax/tax...

Presently under Section 24 a home loan borrower who pays interest on the loan may deduct that interest from his or her gross annual income up to a maximum of

https://www.paisabazaar.com/home-loan/home-loan-tax-benefits

The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Rs 1 5 lakh on principal repayment under Section 80C

Presently under Section 24 a home loan borrower who pays interest on the loan may deduct that interest from his or her gross annual income up to a maximum of

The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Rs 1 5 lakh on principal repayment under Section 80C

National Interest Exemption Vs National Interest Waiver

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

24 Housing News

Patutkah Anda Bayar Baki Pinjaman Perumahan Lebih Awal Iproperty my

Home Loan Interest Exemption Limit Home Sweet Home Modern Livingroom

The New Section 163 j Interest Limits And The Portfolio Interest Exemption

The New Section 163 j Interest Limits And The Portfolio Interest Exemption

How Will Your Home Loan Save Income Tax By Vinita Solanki Medium