In this age of technology, where screens dominate our lives however, the attraction of tangible printed objects hasn't waned. Whether it's for educational purposes for creative projects, just adding personal touches to your space, Income Tax Rebate Act have become an invaluable source. With this guide, you'll take a dive into the world of "Income Tax Rebate Act," exploring the different types of printables, where to locate them, and ways they can help you improve many aspects of your daily life.

Get Latest Income Tax Rebate Act Below

Income Tax Rebate Act

Income Tax Rebate Act - Income Tax Return Act, Income Tax Relief Act, Income Tax Deduction Act, Income Tax Exemption Act, Income Tax Act Rebate U/s 87a, Income Tax Act Exemption Under Section 10, Income Tax Act Return Filing, Income Tax Act Deduction Under Section 80c, Income Tax Act Refund, Income Tax Exemption Indian Act

Web 11 avr 2023 nbsp 0183 32 The Income Tax Act 1961 governs the provisions for income tax rebates in India According to this Act tax rebates are available for specific investments and

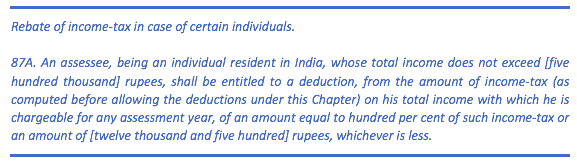

Web 3 f 233 vr 2023 nbsp 0183 32 Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level This tax

Income Tax Rebate Act cover a large variety of printable, downloadable materials online, at no cost. They are available in a variety of formats, such as worksheets, templates, coloring pages, and much more. One of the advantages of Income Tax Rebate Act is in their versatility and accessibility.

More of Income Tax Rebate Act

Rebate Under Section 87A Of Income Tax Act 1961 Section 87a Relief

Rebate Under Section 87A Of Income Tax Act 1961 Section 87a Relief

Web An assessee being an individual resident in India whose total income does not exceed 85 five hundred thousand rupees shall be entitled to a deduction from the amount of

Web An income tax rebate is a refund on taxes payable when the amount paid as income tax is less than the tax payable If you have paid more tax than you owe you will be entitled to

Income Tax Rebate Act have gained immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

Modifications: This allows you to modify printing templates to your own specific requirements, whether it's designing invitations making your schedule, or even decorating your house.

-

Educational Benefits: Printables for education that are free cater to learners of all ages, which makes the perfect resource for educators and parents.

-

The convenience of Fast access a variety of designs and templates saves time and effort.

Where to Find more Income Tax Rebate Act

Section 87A Rebate Income Tax Act Claim Rebate For FY 2019 20 AY

Section 87A Rebate Income Tax Act Claim Rebate For FY 2019 20 AY

Web 2 mai 2023 nbsp 0183 32 A resident individual with taxable income up to Rs 5 00 000 will be eligible for a tax rebate of Rs 12 500 or the amount of tax payable whichever is lower Under the new income tax regime the amount of

Web 23 lignes nbsp 0183 32 Tax rebate under Section 87A of the Income Tax Act 1961 is eligible for people whose

We've now piqued your interest in Income Tax Rebate Act Let's see where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Income Tax Rebate Act designed for a variety objectives.

- Explore categories like decorating your home, education, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free, flashcards, and learning tools.

- It is ideal for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for no cost.

- The blogs covered cover a wide range of topics, from DIY projects to party planning.

Maximizing Income Tax Rebate Act

Here are some inventive ways of making the most of Income Tax Rebate Act:

1. Home Decor

- Print and frame stunning images, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print worksheets that are free for reinforcement of learning at home also in the classes.

3. Event Planning

- Make invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Income Tax Rebate Act are a treasure trove of fun and practical tools that can meet the needs of a variety of people and preferences. Their accessibility and versatility make them an essential part of your professional and personal life. Explore the many options of Income Tax Rebate Act now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually completely free?

- Yes they are! You can print and download these free resources for no cost.

-

Are there any free printables for commercial purposes?

- It's based on specific rules of usage. Always verify the guidelines provided by the creator before utilizing printables for commercial projects.

-

Do you have any copyright issues in Income Tax Rebate Act?

- Certain printables may be subject to restrictions on use. Be sure to read the terms and conditions offered by the creator.

-

How can I print Income Tax Rebate Act?

- Print them at home using printing equipment or visit a print shop in your area for top quality prints.

-

What program do I require to open printables at no cost?

- The majority of printed documents are in the format PDF. This can be opened using free software like Adobe Reader.

INTERPRETATION NOTE 18 Issue 4 DATE 24 June 2020 ACT INCOME TAX

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Check more sample of Income Tax Rebate Act below

Rebate Under Section 87A Of Income Tax Act Insights From StairFirst

Income Tax Rebate Under Section 87A

Section 87a Of Income Tax Act Income Tax Taxact Income

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Income Tax Rebate Under Section 87A Eligibility To Claim Rebate

Section 87A Tax Rebate Under Section 87A

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Web 3 f 233 vr 2023 nbsp 0183 32 Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level This tax

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1

Web Rebate u s 87A Resident Individual whose Total Income is not more than 5 00 000 is also eligible for a Rebate of up to 100 of income tax or 12 500 whichever is less

Web 3 f 233 vr 2023 nbsp 0183 32 Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level This tax

Web Rebate u s 87A Resident Individual whose Total Income is not more than 5 00 000 is also eligible for a Rebate of up to 100 of income tax or 12 500 whichever is less

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A Eligibility To Claim Rebate

Section 87A Tax Rebate Under Section 87A

Rebate Under Section 87A Of Income Tax Act Section 87A

Rebate Under Section 87A Of Income Tax Act YouTube

Rebate Under Section 87A Of Income Tax Act YouTube

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh