In this digital age, with screens dominating our lives it's no wonder that the appeal of tangible printed materials hasn't faded away. Whether it's for educational purposes, creative projects, or simply to add some personal flair to your area, Income Tax Rebate Home Loan Under Construction Property have become a valuable source. Here, we'll dive in the world of "Income Tax Rebate Home Loan Under Construction Property," exploring the benefits of them, where they are available, and ways they can help you improve many aspects of your life.

Get Latest Income Tax Rebate Home Loan Under Construction Property Below

Income Tax Rebate Home Loan Under Construction Property

Income Tax Rebate Home Loan Under Construction Property -

If the loan is taken jointly then each of the loan holders can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment u s 80C up to Rs 1 5 lakh

You can claim an income tax rebate on home loan on the amount paid towards stamp duty and registration charges under section 80C of the ITA However the benefit is only available after the construction has been completed and you

Printables for free include a vast collection of printable materials available online at no cost. These resources come in many types, such as worksheets coloring pages, templates and many more. The beauty of Income Tax Rebate Home Loan Under Construction Property is their versatility and accessibility.

More of Income Tax Rebate Home Loan Under Construction Property

Income Tax Rebate Astonishingceiyrs

Income Tax Rebate Astonishingceiyrs

A home loan borrower can claim Income Tax exemption on interest payments of up to Rs 2 lakh and another Rs 1 5 lakh under Section 80 C towards the principal repayment

First time homebuyers who have availed of a housing loan to purchase an under construction property between 1 April 2019 and 31 March 2022 can claim tax benefits on the

Printables for free have gained immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

The ability to customize: There is the possibility of tailoring designs to suit your personal needs such as designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational Benefits: Downloads of educational content for free offer a wide range of educational content for learners of all ages. This makes them a great resource for educators and parents.

-

The convenience of You have instant access various designs and templates helps save time and effort.

Where to Find more Income Tax Rebate Home Loan Under Construction Property

Federal Tax Rebate Home Improvement Window Treatments

Federal Tax Rebate Home Improvement Window Treatments

Claim Tax Benefits for Under Construction Property Section 80EEA was introduced in the Income Tax Act to provide relief to homebuyers by granting them deductions on the interest paid on home loans subject to a

Under Section 24 B a homebuyer can claim rebate on up to 2 lakh home loan interest paid in a financial year Income tax rebate on home loan Buying an under construction home is common

If we've already piqued your interest in Income Tax Rebate Home Loan Under Construction Property we'll explore the places you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of needs.

- Explore categories such as furniture, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free for flashcards, lessons, and worksheets. materials.

- This is a great resource for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- These blogs cover a broad selection of subjects, including DIY projects to party planning.

Maximizing Income Tax Rebate Home Loan Under Construction Property

Here are some fresh ways that you can make use use of Income Tax Rebate Home Loan Under Construction Property:

1. Home Decor

- Print and frame stunning artwork, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use printable worksheets from the internet to enhance learning at home (or in the learning environment).

3. Event Planning

- Make invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Income Tax Rebate Home Loan Under Construction Property are an abundance of practical and innovative resources that can meet the needs of a variety of people and desires. Their accessibility and flexibility make them a valuable addition to both personal and professional life. Explore the vast array that is Income Tax Rebate Home Loan Under Construction Property today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly available for download?

- Yes, they are! You can download and print these resources at no cost.

-

Are there any free printouts for commercial usage?

- It's determined by the specific conditions of use. Always read the guidelines of the creator prior to printing printables for commercial projects.

-

Do you have any copyright violations with printables that are free?

- Some printables may come with restrictions in their usage. Make sure to read the terms of service and conditions provided by the designer.

-

How do I print printables for free?

- You can print them at home using either a printer or go to a print shop in your area for higher quality prints.

-

What software do I require to view printables at no cost?

- A majority of printed materials are in the PDF format, and can be opened with free software like Adobe Reader.

Income Tax Rebate Up To 2 Lakhs On Home Loan The Viral News Live

Government Announces Council Tax Rebate

Check more sample of Income Tax Rebate Home Loan Under Construction Property below

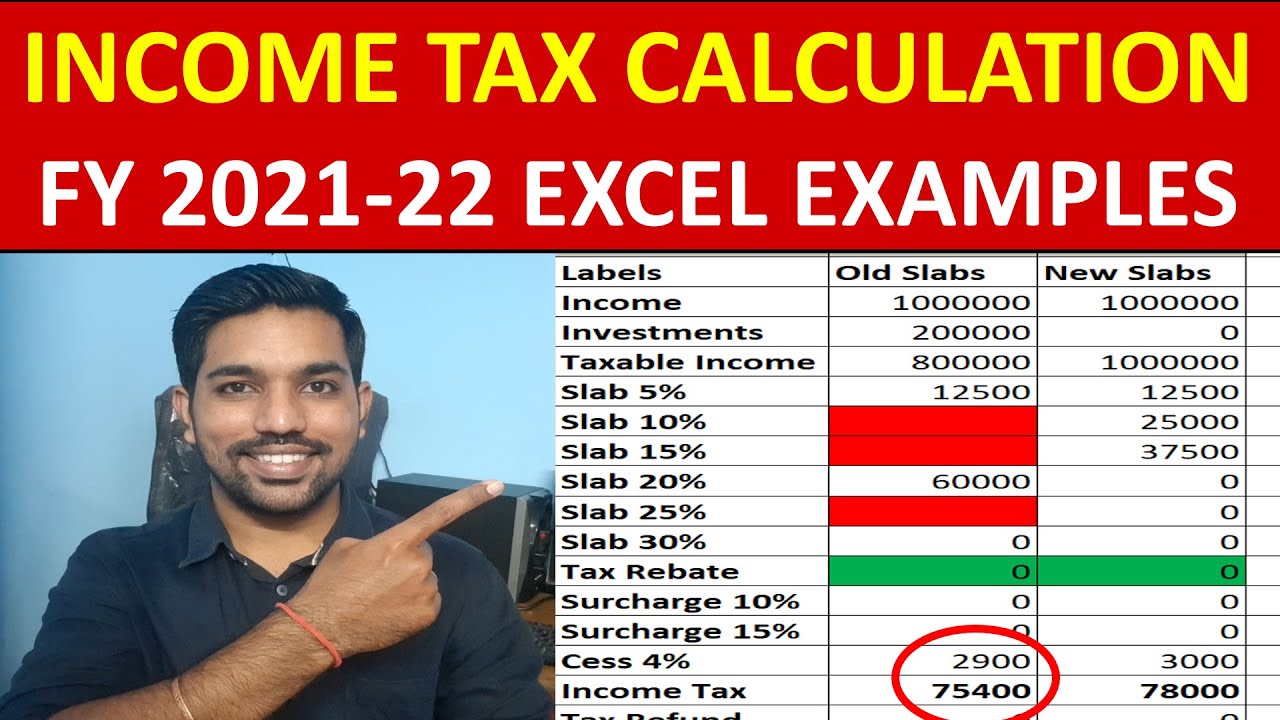

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Latest Income Tax Rebate On Home Loan 2023

Know How You Can Get Tax Benefits On Home Loan

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Income Tax Rebate Under Section 87A

Documents Required For Home Loan Under Construction Property Tata

https://www.tatacapital.com/blog/loan-fo…

You can claim an income tax rebate on home loan on the amount paid towards stamp duty and registration charges under section 80C of the ITA However the benefit is only available after the construction has been completed and you

https://cleartax.in/s/home-loan-tax-benefit

A loan must be taken for the purchase or construction of a house property to claim a tax deduction If it is taken for the construction of a house then construction must be

You can claim an income tax rebate on home loan on the amount paid towards stamp duty and registration charges under section 80C of the ITA However the benefit is only available after the construction has been completed and you

A loan must be taken for the purchase or construction of a house property to claim a tax deduction If it is taken for the construction of a house then construction must be

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Latest Income Tax Rebate On Home Loan 2023

Income Tax Rebate Under Section 87A

Documents Required For Home Loan Under Construction Property Tata

How To Rebate Home Loan Interest Income Tax Profit To Cash Salary

First WAVE Gets Home Loan Under GI Bill Of Rights April 1945 Ann

First WAVE Gets Home Loan Under GI Bill Of Rights April 1945 Ann

How To Claim Home Loan Interest For Under Construction Property