In the age of digital, in which screens are the norm The appeal of tangible, printed materials hasn't diminished. It doesn't matter if it's for educational reasons in creative or artistic projects, or simply to add an individual touch to your home, printables for free are now a useful source. For this piece, we'll take a dive into the world "Income Tax Rebate Limit On Education Loan," exploring what they are, where to find them, and what they can do to improve different aspects of your life.

Get Latest Income Tax Rebate Limit On Education Loan Below

Income Tax Rebate Limit On Education Loan

Income Tax Rebate Limit On Education Loan - Income Tax Exemption Limit For Education Loan, Education Loan Tax Exemption Limit, Can I Get Tax Benefit On Education Loan, Limit Of Education Loan Interest In Income Tax, Education Loan Tax Benefit Limit, Income Tax Relief On Education Loan

Web This deduction is available for a maximum of 8 years or till the interest is repaid whichever is earlier To claim a deduction for an education loan you must receive a certificate from the financial institution showing the

Web If any tax free educational assistance for the qualified education expenses paid in 2022 or any refund of your qualified education expenses paid in 2022 is received after you file

Printables for free include a vast variety of printable, downloadable material that is available online at no cost. These resources come in various types, like worksheets, coloring pages, templates and much more. One of the advantages of Income Tax Rebate Limit On Education Loan is their versatility and accessibility.

More of Income Tax Rebate Limit On Education Loan

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Web If you ve taken an Education Loan and are repaying the same you can always claim deduction under Section 80E of the Income Tax Act for the Repayment of Interest on Education Loan However this deduction is

Web 25 ao 251 t 2022 nbsp 0183 32 The income tax rebate on education loan is available only for the repayment of the interest component of the loan No tax benefits are available for the

Printables for free have gained immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Personalization They can make the templates to meet your individual needs, whether it's designing invitations making your schedule, or even decorating your home.

-

Educational Use: Educational printables that can be downloaded for free can be used by students of all ages, which makes them an essential aid for parents as well as educators.

-

An easy way to access HTML0: Instant access to a plethora of designs and templates reduces time and effort.

Where to Find more Income Tax Rebate Limit On Education Loan

Education Tax Credit 2020 Income Limits TIEDUN

Education Tax Credit 2020 Income Limits TIEDUN

Web Any individual who has applied for a loan for higher education can avail the benefits of tax saving provided by Section 80E of the Income Tax Act 1961 Even if an individual has

Web 23 f 233 vr 2018 nbsp 0183 32 The income tax deduction on education loan is only available for up to eight years or until the payment of interest in full whichever is earlier Business Written by

Since we've got your curiosity about Income Tax Rebate Limit On Education Loan and other printables, let's discover where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Income Tax Rebate Limit On Education Loan designed for a variety objectives.

- Explore categories like decorating your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets Flashcards, worksheets, and other educational materials.

- Ideal for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- The blogs covered cover a wide array of topics, ranging including DIY projects to party planning.

Maximizing Income Tax Rebate Limit On Education Loan

Here are some unique ways of making the most use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Print worksheets that are free to enhance your learning at home also in the classes.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Income Tax Rebate Limit On Education Loan are a treasure trove of practical and imaginative resources for a variety of needs and hobbies. Their accessibility and flexibility make them an essential part of both professional and personal life. Explore the wide world of Income Tax Rebate Limit On Education Loan today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax Rebate Limit On Education Loan truly absolutely free?

- Yes, they are! You can download and print these tools for free.

-

Does it allow me to use free printables for commercial use?

- It's determined by the specific usage guidelines. Always verify the guidelines provided by the creator before utilizing printables for commercial projects.

-

Are there any copyright issues with printables that are free?

- Certain printables might have limitations on their use. Always read these terms and conditions as set out by the designer.

-

How do I print Income Tax Rebate Limit On Education Loan?

- You can print them at home with the printer, or go to a print shop in your area for top quality prints.

-

What software will I need to access Income Tax Rebate Limit On Education Loan?

- A majority of printed materials are in the format PDF. This can be opened using free software like Adobe Reader.

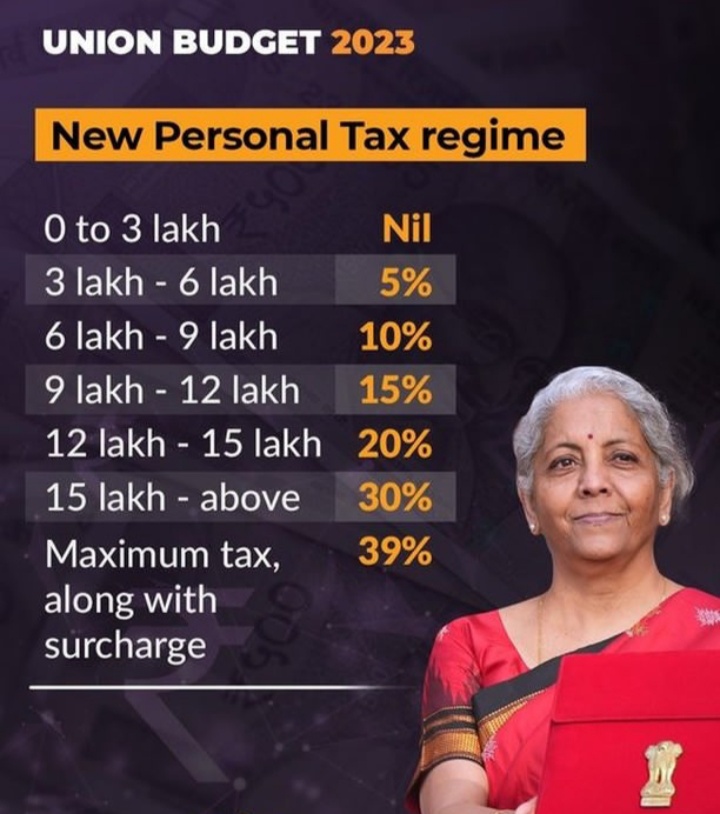

Indian Budget 2023 Income Tax Rebate Limit Increased No Tax On Income

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

Check more sample of Income Tax Rebate Limit On Education Loan below

Union Budget 2023 Live Income Tax Rebate Limit Increased To Rs 7 Lakh

Income Tax Slabs Overhauled Under New Regime Rebate Limit Up Check

Individual Income Tax Rebate

Budget 2023 Income Tax Rebate Limit FM Nirmala Sitharaman

Income Tax Rebate Under Section 87A

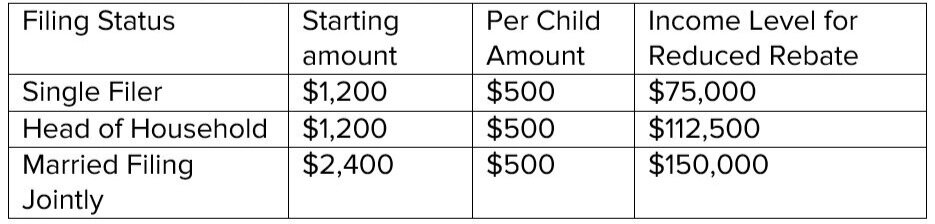

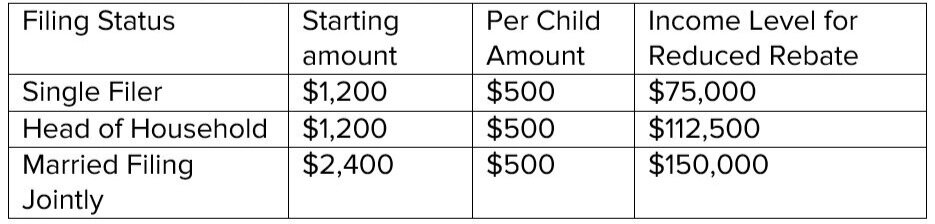

CARES Act Q A About Recovery Rebates Student Loans Health Care

https://www.irs.gov/publications/p970

Web If any tax free educational assistance for the qualified education expenses paid in 2022 or any refund of your qualified education expenses paid in 2022 is received after you file

https://cleartax.in/s/tax-benefits-on-education-loan

Web 30 mars 2023 nbsp 0183 32 There is no maximum deduction amount that can be claimed against an education loan according to Section 80 E of income tax The interest you pay on an

Web If any tax free educational assistance for the qualified education expenses paid in 2022 or any refund of your qualified education expenses paid in 2022 is received after you file

Web 30 mars 2023 nbsp 0183 32 There is no maximum deduction amount that can be claimed against an education loan according to Section 80 E of income tax The interest you pay on an

Budget 2023 Income Tax Rebate Limit FM Nirmala Sitharaman

Income Tax Slabs Overhauled Under New Regime Rebate Limit Up Check

Income Tax Rebate Under Section 87A

CARES Act Q A About Recovery Rebates Student Loans Health Care

More Tax Credits More Rebates Education Magazine

How To Calculate Tax Rebate On Home Loan Grizzbye

How To Calculate Tax Rebate On Home Loan Grizzbye

Exemption Of Up To 2 Lacks In Tax From These Schemes The Viral News