In a world in which screens are the norm and the appeal of physical printed material hasn't diminished. It doesn't matter if it's for educational reasons or creative projects, or simply to add the personal touch to your home, printables for free are now an essential source. For this piece, we'll take a dive to the depths of "Income Tax Rebate On Home Loan Rules," exploring what they are, where to find them, and how they can enhance various aspects of your daily life.

Get Latest Income Tax Rebate On Home Loan Rules Below

Income Tax Rebate On Home Loan Rules

Income Tax Rebate On Home Loan Rules -

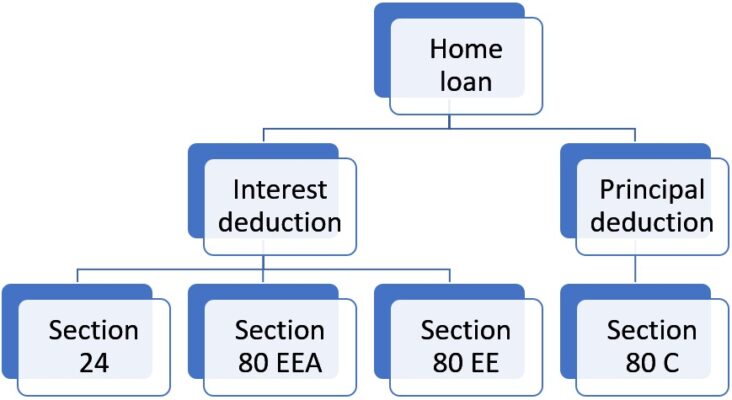

1 Home loan borrowers are entitled to tax benefits under Section 80C and Section 24 of the Income Tax Act These can be claimed by the property s owner 2 In the case of co owners all are entitled to tax benefits provided they are co borrowers for the home loan too The limit applies to each co owner 3

The change in tax rules came into force on 1 January 2023 No more deductions are available regarding home loans for purchasing a permanent dwelling and loans credits and other borrowing related to home repair The year s interest expenses are still shown on your pre completed tax return

Income Tax Rebate On Home Loan Rules provide a diverse variety of printable, downloadable materials online, at no cost. These resources come in many types, such as worksheets templates, coloring pages, and more. The great thing about Income Tax Rebate On Home Loan Rules is their flexibility and accessibility.

More of Income Tax Rebate On Home Loan Rules

ANOTHER Update To Home Loan Rules Blog BetterSaver

ANOTHER Update To Home Loan Rules Blog BetterSaver

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution The deduction is up to Rs 50 000 per financial year Taxpayers can claim 80EE if they had serviced a home loan between 1 April 2016 to 31 March 2017

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b Note that home loan borrowers opting for new tax regime cannot claim deductions under Sections 80C or 24 b

Income Tax Rebate On Home Loan Rules have gained immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Personalization The Customization feature lets you tailor the design to meet your needs whether it's making invitations or arranging your schedule or even decorating your house.

-

Educational Impact: Downloads of educational content for free provide for students of all ages, making them a useful instrument for parents and teachers.

-

Convenience: The instant accessibility to numerous designs and templates is time-saving and saves effort.

Where to Find more Income Tax Rebate On Home Loan Rules

SBS Language What Are The New Changes To Home Loan Rules

SBS Language What Are The New Changes To Home Loan Rules

The Union Minister of India announced in 2020 21 that all previous regimes of income tax rebates on home loans would be extended until 2024 The following are the advantages of a home loan Interest Deduction on Principal Repayment The principal amount and interest amount are two components of the EMI that you pay

An income tax rebate is allowed on both the principal and the interest throughout the repayment tenure of your home loan under the following sections Section 80C Section 80C Conditions Section 24 Section 24 Conditions Section 80EEA Section 80EE Section 80EE Conditions FAQs

After we've peaked your interest in printables for free Let's see where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Income Tax Rebate On Home Loan Rules for various needs.

- Explore categories like decorating your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets or flashcards as well as learning tools.

- Ideal for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for free.

- The blogs covered cover a wide variety of topics, ranging from DIY projects to party planning.

Maximizing Income Tax Rebate On Home Loan Rules

Here are some ways in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or even seasonal decorations to decorate your living areas.

2. Education

- Use printable worksheets from the internet to aid in learning at your home (or in the learning environment).

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners with to-do lists, planners, and meal planners.

Conclusion

Income Tax Rebate On Home Loan Rules are an abundance of creative and practical resources catering to different needs and interests. Their accessibility and versatility make them a wonderful addition to both personal and professional life. Explore the vast collection of Income Tax Rebate On Home Loan Rules to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax Rebate On Home Loan Rules truly for free?

- Yes they are! You can download and print these files for free.

-

Do I have the right to use free printing templates for commercial purposes?

- It's based on the terms of use. Make sure you read the guidelines for the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues when you download Income Tax Rebate On Home Loan Rules?

- Some printables may come with restrictions in use. Make sure you read the terms and conditions set forth by the designer.

-

How do I print printables for free?

- You can print them at home using printing equipment or visit an area print shop for premium prints.

-

What program do I need to run printables that are free?

- The majority of PDF documents are provided in PDF format. They can be opened using free software, such as Adobe Reader.

Budget 2023 India May Allow Income Tax Rebate On Electric Vehicles

Latest Income Tax Rebate On Home Loan 2023

Check more sample of Income Tax Rebate On Home Loan Rules below

Latest Income Tax Rebate On Home Loan 2023

Home Loan Rules Have Been Relaxed Here s What You Need To Know

The Less Known Rules For The First Home Loan Scheme

Home Loan Tips Income Tax Rebate On Home Loan By Section 80c And

Know About The Changes In Home Loan Rules SBS Malayalam

5 Home Loan Tax Exemptions Businesszag

https://www. vero.fi /en/individuals/tax-cards-and...

The change in tax rules came into force on 1 January 2023 No more deductions are available regarding home loans for purchasing a permanent dwelling and loans credits and other borrowing related to home repair The year s interest expenses are still shown on your pre completed tax return

https:// cleartax.in /s/home-loan-tax-benefit

From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh For let out property there is no upper limit for claiming interest However the overall loss one can claim under the head House Property is restricted to Rs 2 lakh only

The change in tax rules came into force on 1 January 2023 No more deductions are available regarding home loans for purchasing a permanent dwelling and loans credits and other borrowing related to home repair The year s interest expenses are still shown on your pre completed tax return

From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh For let out property there is no upper limit for claiming interest However the overall loss one can claim under the head House Property is restricted to Rs 2 lakh only

Home Loan Tips Income Tax Rebate On Home Loan By Section 80c And

Home Loan Rules Have Been Relaxed Here s What You Need To Know

Know About The Changes In Home Loan Rules SBS Malayalam

5 Home Loan Tax Exemptions Businesszag

Income Tax Rebate On Home Loan Tmdl edu vn

Income Tax Rebate Up To 2 Lakhs On Home Loan The Viral News Live

Income Tax Rebate Up To 2 Lakhs On Home Loan The Viral News Live

Latest Income Tax Rebate On Home Loan 2023