In this age of technology, with screens dominating our lives however, the attraction of tangible, printed materials hasn't diminished. Whether it's for educational purposes and creative work, or simply adding a personal touch to your area, Income Tax Rebate On Investment In Infrastructure Bonds are now an essential resource. Through this post, we'll take a dive through the vast world of "Income Tax Rebate On Investment In Infrastructure Bonds," exploring the different types of printables, where to get them, as well as how they can improve various aspects of your life.

Get Latest Income Tax Rebate On Investment In Infrastructure Bonds Below

Income Tax Rebate On Investment In Infrastructure Bonds

Income Tax Rebate On Investment In Infrastructure Bonds -

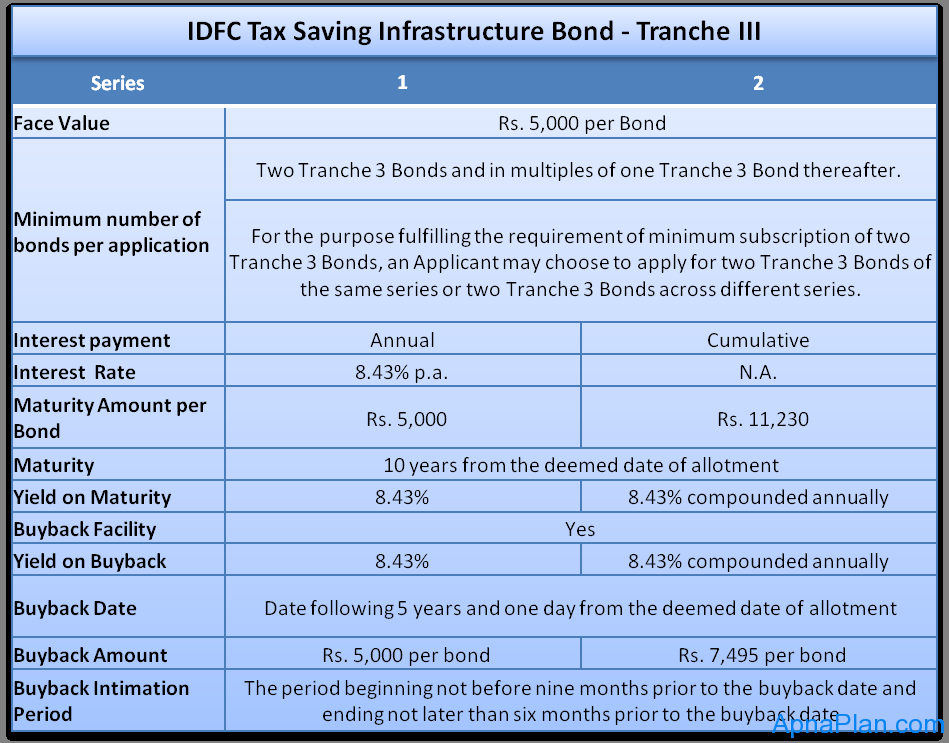

Web The maximum amount of deduction that can be availed by an individual under this section is INR 20 000 per annum A deduction shall be for specified infrastructure bonds and

Web 23 oct 2021 nbsp 0183 32 The long term infrastructure bonds that were issued in the Financial Year 2011 12 to offer deductions of up to Rs 20 000 from taxable income under section

The Income Tax Rebate On Investment In Infrastructure Bonds are a huge range of downloadable, printable content that can be downloaded from the internet at no cost. They come in many forms, including worksheets, coloring pages, templates and many more. The appeal of printables for free is in their variety and accessibility.

More of Income Tax Rebate On Investment In Infrastructure Bonds

Stock And Number REC Long Term Infrastructure Bonds Are Tax Rebate U s

Stock And Number REC Long Term Infrastructure Bonds Are Tax Rebate U s

Web 27 mars 2021 nbsp 0183 32 It will result in a total tax liability of Rs 6 960 excluding cess on maturity while he availed tax benefit of Rs 2 000 by investing in the tax saving long term

Web 9 juil 2010 nbsp 0183 32 The government today notified one more avenue for saving tax investment in infrastructure bonds

Printables for free have gained immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Personalization Your HTML0 customization options allow you to customize the templates to meet your individual needs in designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Value Educational printables that can be downloaded for free offer a wide range of educational content for learners of all ages, making them a useful instrument for parents and teachers.

-

It's easy: Instant access to numerous designs and templates can save you time and energy.

Where to Find more Income Tax Rebate On Investment In Infrastructure Bonds

Tax Rebate RM20 000 X 3 Years On Investment Holding Company Apr 20

Tax Rebate RM20 000 X 3 Years On Investment Holding Company Apr 20

Web 30 janv 2020 nbsp 0183 32 As per this section deduction from income would be available to individuals for investing in notified long term infrastructure bonds up to a sum of Rs 20 000 This

Web 24 janv 2017 nbsp 0183 32 The federal government incurs a cost from these bonds in terms of foregone tax revenue Advantages These bonds can be used for all types of publicly owned infrastructure The tax exempt bond market

Now that we've piqued your interest in Income Tax Rebate On Investment In Infrastructure Bonds Let's look into where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection in Income Tax Rebate On Investment In Infrastructure Bonds for different needs.

- Explore categories such as interior decor, education, organization, and crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets including flashcards, learning tools.

- The perfect resource for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates at no cost.

- The blogs covered cover a wide selection of subjects, ranging from DIY projects to planning a party.

Maximizing Income Tax Rebate On Investment In Infrastructure Bonds

Here are some creative ways that you can make use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print free worksheets to build your knowledge at home and in class.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Income Tax Rebate On Investment In Infrastructure Bonds are a treasure trove of creative and practical resources which cater to a wide range of needs and preferences. Their accessibility and flexibility make them a valuable addition to every aspect of your life, both professional and personal. Explore the vast collection of Income Tax Rebate On Investment In Infrastructure Bonds to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly for free?

- Yes you can! You can download and print these files for free.

-

Can I use the free printing templates for commercial purposes?

- It's based on specific terms of use. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Do you have any copyright issues when you download Income Tax Rebate On Investment In Infrastructure Bonds?

- Certain printables may be subject to restrictions concerning their use. Check the terms and conditions offered by the creator.

-

How do I print Income Tax Rebate On Investment In Infrastructure Bonds?

- You can print them at home with the printer, or go to any local print store for high-quality prints.

-

What software will I need to access Income Tax Rebate On Investment In Infrastructure Bonds?

- Most PDF-based printables are available in the format of PDF, which is open with no cost software, such as Adobe Reader.

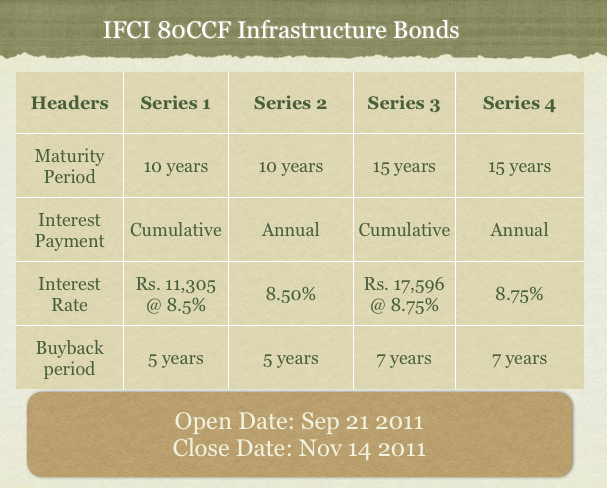

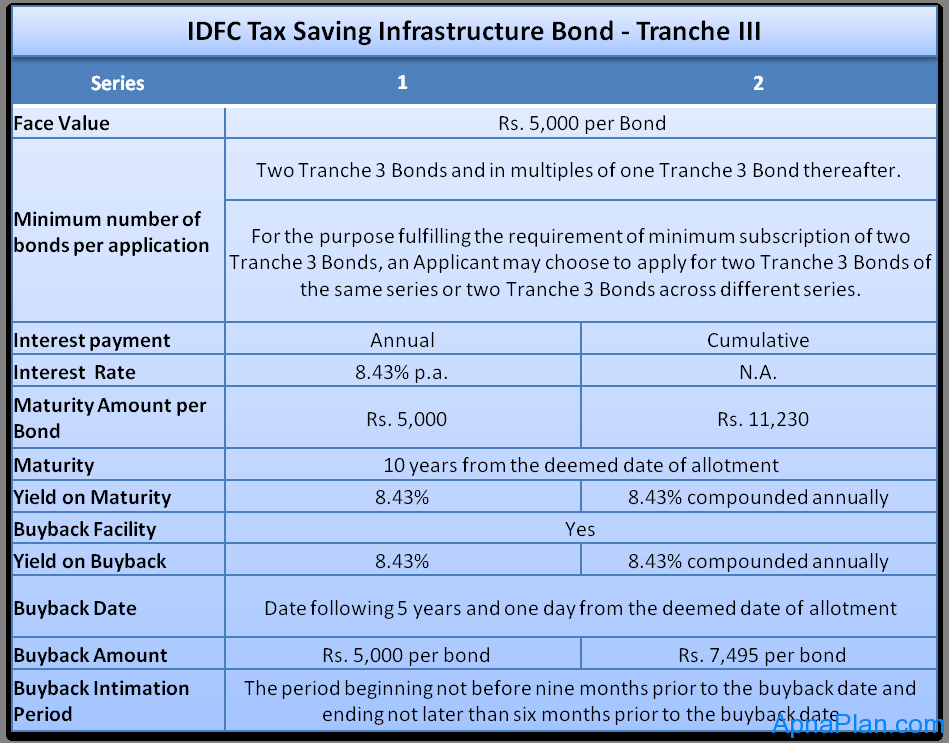

IFCI 80CCF Tax Saving Infrastructure Bonds Review OneMint

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Check more sample of Income Tax Rebate On Investment In Infrastructure Bonds below

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

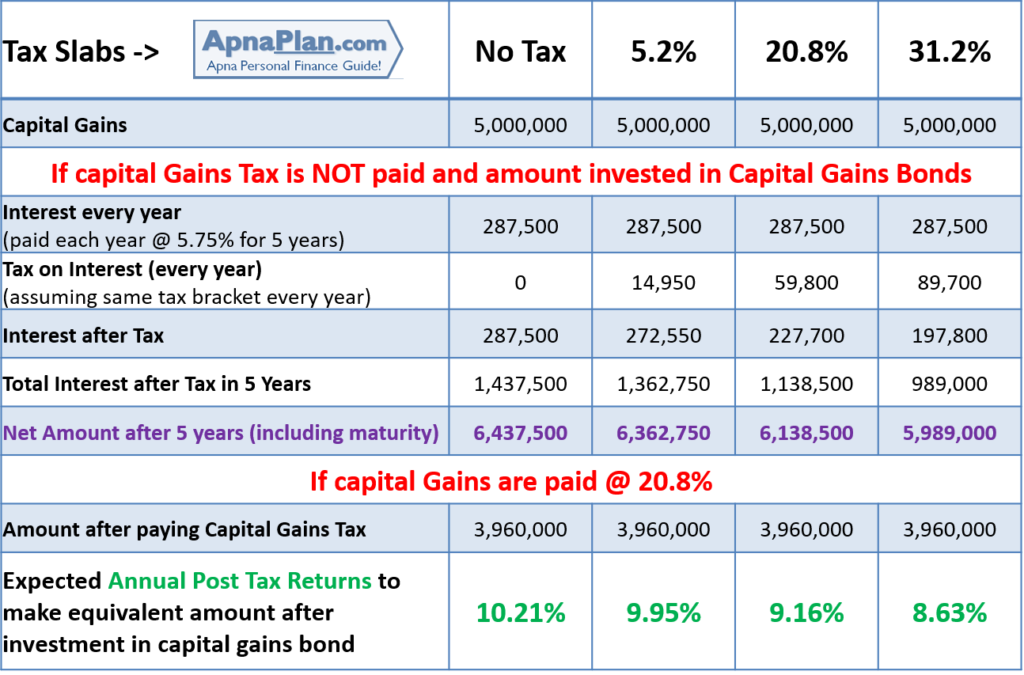

Should You Invest In Capital Gains Bond To Save Taxes

Income Tax Rebate Under Section 87A Eligibility To Claim Rebate

2007 Tax Rebate Tax Deduction Rebates

Where Invest Money For Return Income Tax

https://certicom.in/tax-saving-infrastructure-bonds-tax-you-have-to...

Web 23 oct 2021 nbsp 0183 32 The long term infrastructure bonds that were issued in the Financial Year 2011 12 to offer deductions of up to Rs 20 000 from taxable income under section

https://www.valueresearchonline.com/stories/51139/what-is-the-tax...

Web 5 ao 251 t 2022 nbsp 0183 32 05 Aug 2022 The government of India in a bid to attract investors money into the infrastructure sector introduced section 80CCF of the Income tax Act more than a

Web 23 oct 2021 nbsp 0183 32 The long term infrastructure bonds that were issued in the Financial Year 2011 12 to offer deductions of up to Rs 20 000 from taxable income under section

Web 5 ao 251 t 2022 nbsp 0183 32 05 Aug 2022 The government of India in a bid to attract investors money into the infrastructure sector introduced section 80CCF of the Income tax Act more than a

Income Tax Rebate Under Section 87A Eligibility To Claim Rebate

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

2007 Tax Rebate Tax Deduction Rebates

Where Invest Money For Return Income Tax

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate