In this day and age where screens rule our lives yet the appeal of tangible printed products hasn't decreased. Be it for educational use for creative projects, simply to add an individual touch to the area, Income Tax Rebate U S 87 A have become an invaluable source. This article will dive in the world of "Income Tax Rebate U S 87 A," exploring what they are, where you can find them, and how they can add value to various aspects of your daily life.

Get Latest Income Tax Rebate U S 87 A Below

Income Tax Rebate U S 87 A

Income Tax Rebate U S 87 A - Income Tax Rebate U/s 87a, Less Income Tax Rebate U/s 87a, Income Tax After Rebate (u/s 87a), Income Tax After Relief U/s 87a In Hindi, Rebate U/s 87a Of Income Tax Act 1961, Rebate U/s 87a As Per Income Tax Act, Income Tax Rebate U/s 87a With Example, How To Fill Rebate U/s 87a, How To Claim Rebate Under Section 87a

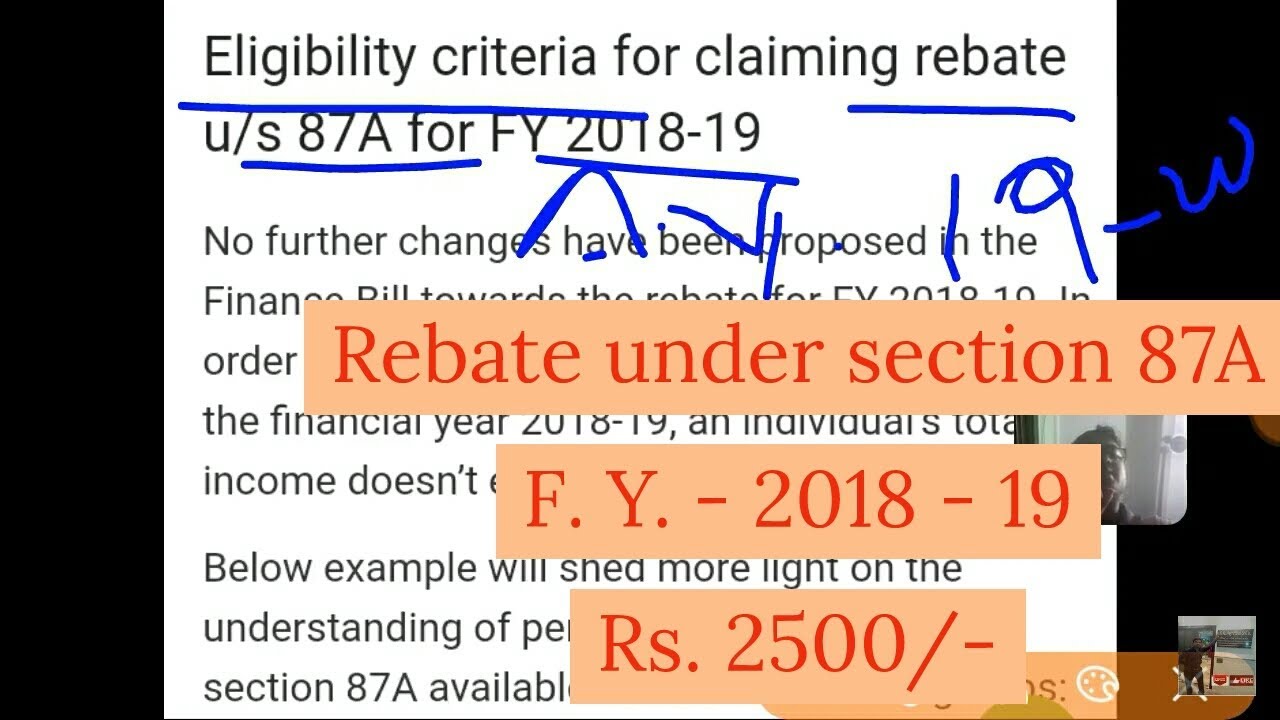

Web 28 mars 2023 nbsp 0183 32 What is the rebate u s 87A for AY 2022 23 The rebate for the financial year 2022 23 is the same in both old and new tax regimes A taxpayer whose annual

Web 14 sept 2019 nbsp 0183 32 For the FY 2023 24 AY 2024 25 the rebate limit has been increased to Rs 7 00 000 under the new tax regime This means a resident individual with taxable

Printables for free cover a broad range of downloadable, printable materials online, at no cost. They are available in numerous types, such as worksheets templates, coloring pages, and more. The appeal of printables for free is in their versatility and accessibility.

More of Income Tax Rebate U S 87 A

Income Tax Rebate U s 87A For The Financial Year 2022 23

Income Tax Rebate U s 87A For The Financial Year 2022 23

Web 25 janv 2022 nbsp 0183 32 Section 87A of the Income Tax Act allows taxpayers to claim a rebate on the payable income tax and reduce tax liability You can claim the tax rebate if your

Web 28 d 233 c 2019 nbsp 0183 32 Certain basic conditions for availing rebate U s 87A a Assessee must be a Resident Individual and b His Total Income after Deductions under Chapter VIA

Income Tax Rebate U S 87 A have risen to immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

customization: They can make designs to suit your personal needs in designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Value: Printing educational materials for no cost provide for students of all ages, making these printables a powerful tool for parents and teachers.

-

Simple: Fast access many designs and templates will save you time and effort.

Where to Find more Income Tax Rebate U S 87 A

Income Tax Rebate U s 87 A Increased By 500 From FY 2019 20

Income Tax Rebate U s 87 A Increased By 500 From FY 2019 20

Web 2 The rates of Surcharge and Health amp Education cess are same under both the tax regimes 3 Rebate u s 87 A Resident individual whose Total Income is not more than

Web The income tax rebate under Section 87A offers some relief to the taxpayers who fall under the tax slab of 10 Any individual whose annual net income is not more than Rs 5

We hope we've stimulated your interest in Income Tax Rebate U S 87 A Let's look into where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Income Tax Rebate U S 87 A for various reasons.

- Explore categories like decoration for your home, education, management, and craft.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets, flashcards, and learning tools.

- Ideal for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- The blogs are a vast range of interests, that range from DIY projects to party planning.

Maximizing Income Tax Rebate U S 87 A

Here are some creative ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Utilize free printable worksheets for reinforcement of learning at home as well as in the class.

3. Event Planning

- Make invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars along with lists of tasks, and meal planners.

Conclusion

Income Tax Rebate U S 87 A are an abundance of useful and creative resources that can meet the needs of a variety of people and needs and. Their accessibility and versatility make them a fantastic addition to your professional and personal life. Explore the many options of Income Tax Rebate U S 87 A and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really cost-free?

- Yes, they are! You can print and download these materials for free.

-

Can I use the free printables for commercial purposes?

- It's based on specific rules of usage. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Do you have any copyright violations with printables that are free?

- Certain printables could be restricted on their use. Always read the terms and conditions set forth by the author.

-

How do I print printables for free?

- Print them at home using printing equipment or visit an area print shop for higher quality prints.

-

What software do I require to open printables at no cost?

- A majority of printed materials are in PDF format. They can be opened with free software, such as Adobe Reader.

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Rebate U s 87A For F Y 2018 2019 Taxable Income Not Exceed 3 5

Check more sample of Income Tax Rebate U S 87 A below

What Is TAX REBATE U s 87A EXAMPLES Of Tax Rebate Budget 2019 New

Rebate U s 87A A Y 2019 20 Section 87A Of Income Tax How To Claim

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

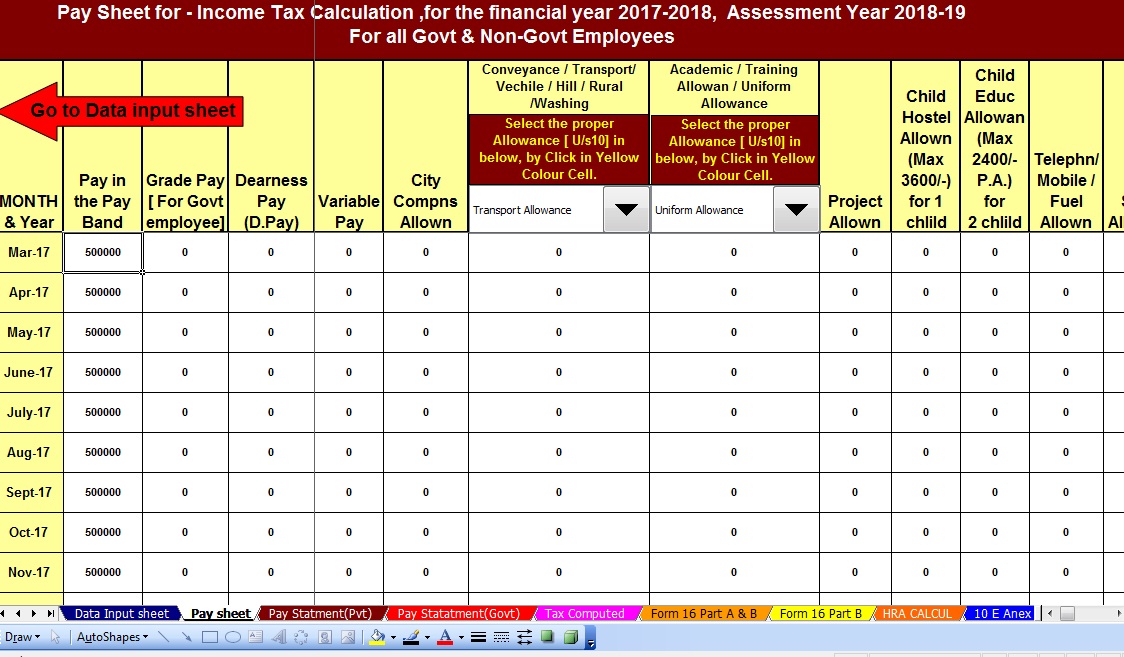

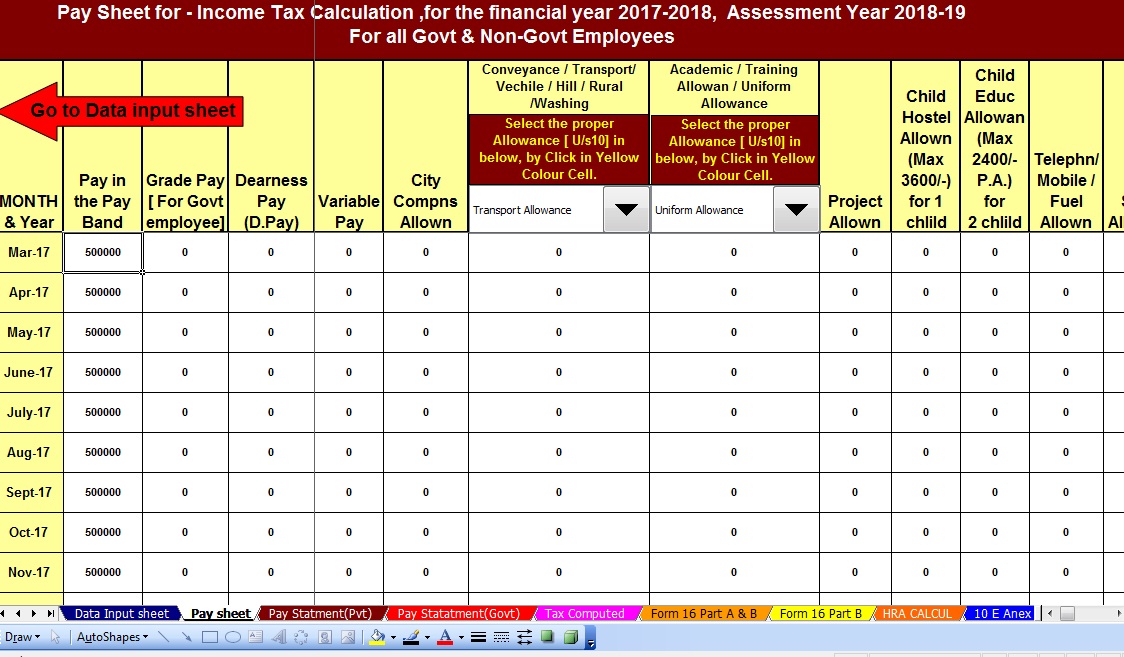

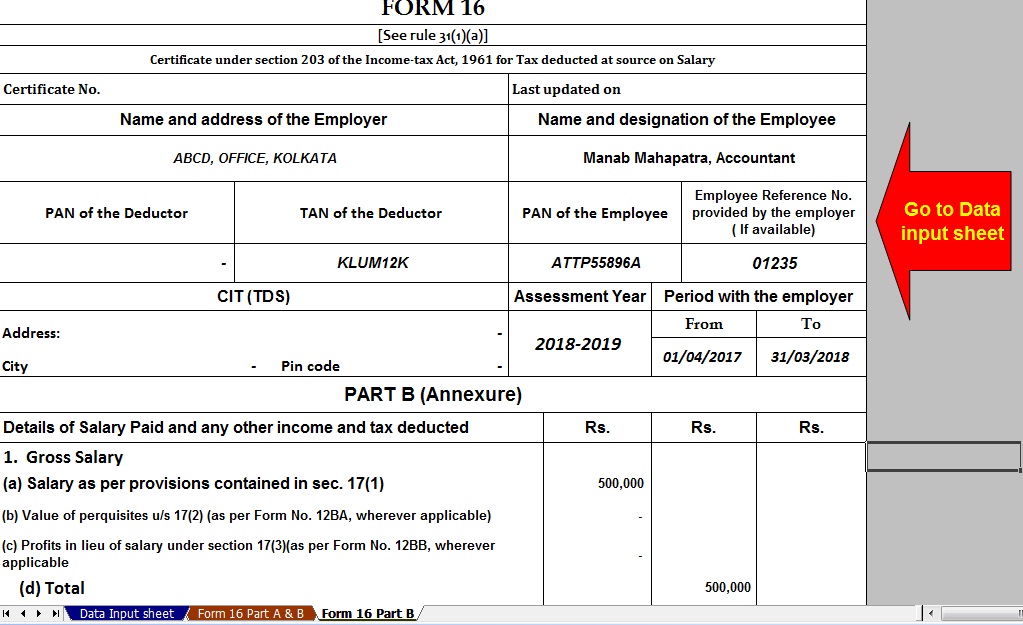

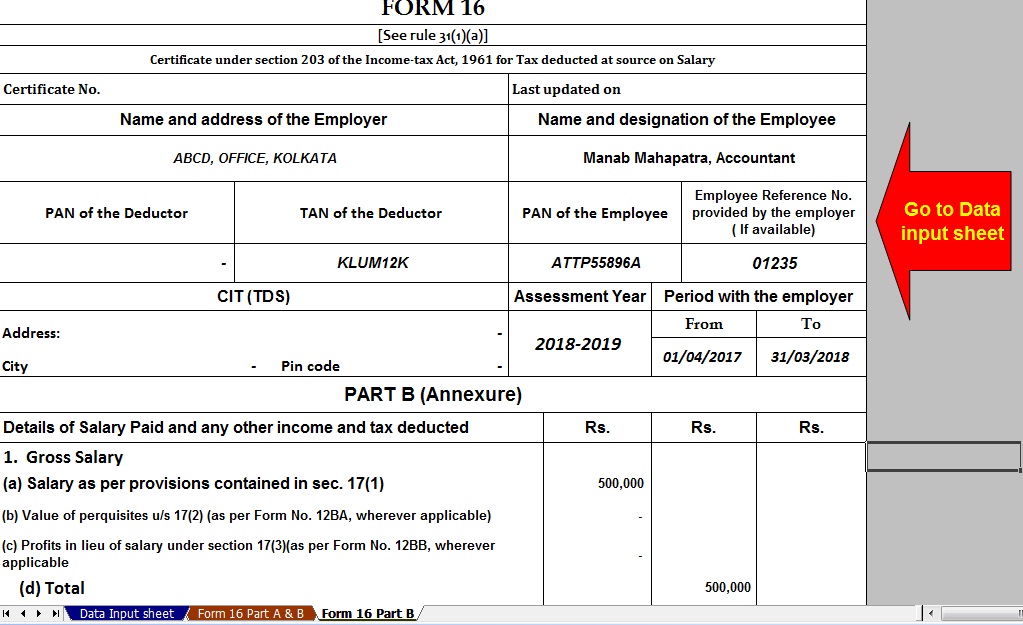

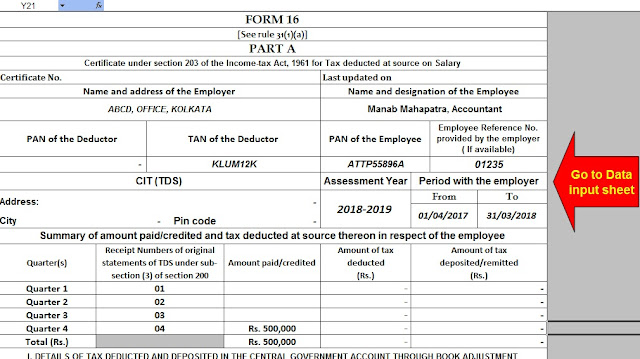

Rebate U s 87A Of The Income Tax As Per Budget 2017 Plus Automated TDS

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

https://tax2win.in/guide/section-87a

Web 14 sept 2019 nbsp 0183 32 For the FY 2023 24 AY 2024 25 the rebate limit has been increased to Rs 7 00 000 under the new tax regime This means a resident individual with taxable

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Web 3 f 233 vr 2023 nbsp 0183 32 Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level This tax

Web 14 sept 2019 nbsp 0183 32 For the FY 2023 24 AY 2024 25 the rebate limit has been increased to Rs 7 00 000 under the new tax regime This means a resident individual with taxable

Web 3 f 233 vr 2023 nbsp 0183 32 Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level This tax

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Rebate U s 87A A Y 2019 20 Section 87A Of Income Tax How To Claim

Rebate U s 87A Of The Income Tax As Per Budget 2017 Plus Automated TDS

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Rebate U s 87A Of The Income Tax As Per Budget 2017 Plus Automated TDS

Rebate U s 87A Of The Income Tax As Per Budget 2017 Plus Automated TDS

Rebate U s 87A Of The Income Tax As Per Budget 2017 Plus Automated TDS