In this age of technology, where screens rule our lives but the value of tangible printed materials hasn't faded away. No matter whether it's for educational uses or creative projects, or simply adding an extra personal touch to your home, printables for free have become an invaluable source. Through this post, we'll dive in the world of "Income Tax Rebate Under 80ccd 1b," exploring the benefits of them, where to find them, and the ways that they can benefit different aspects of your life.

Get Latest Income Tax Rebate Under 80ccd 1b Below

Income Tax Rebate Under 80ccd 1b

Income Tax Rebate Under 80ccd 1b -

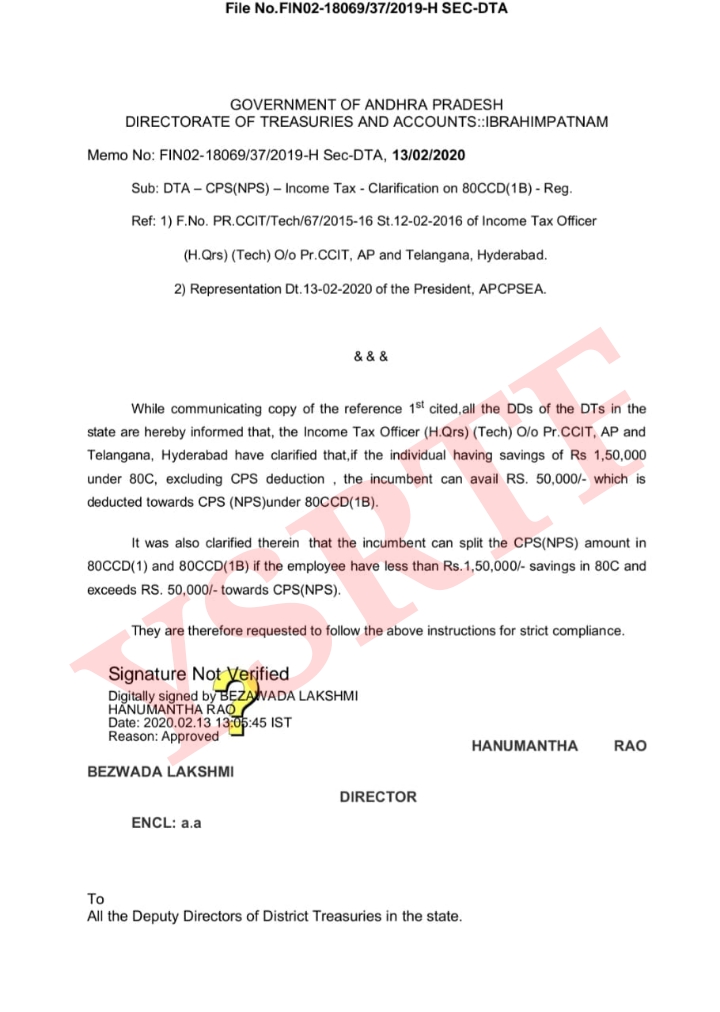

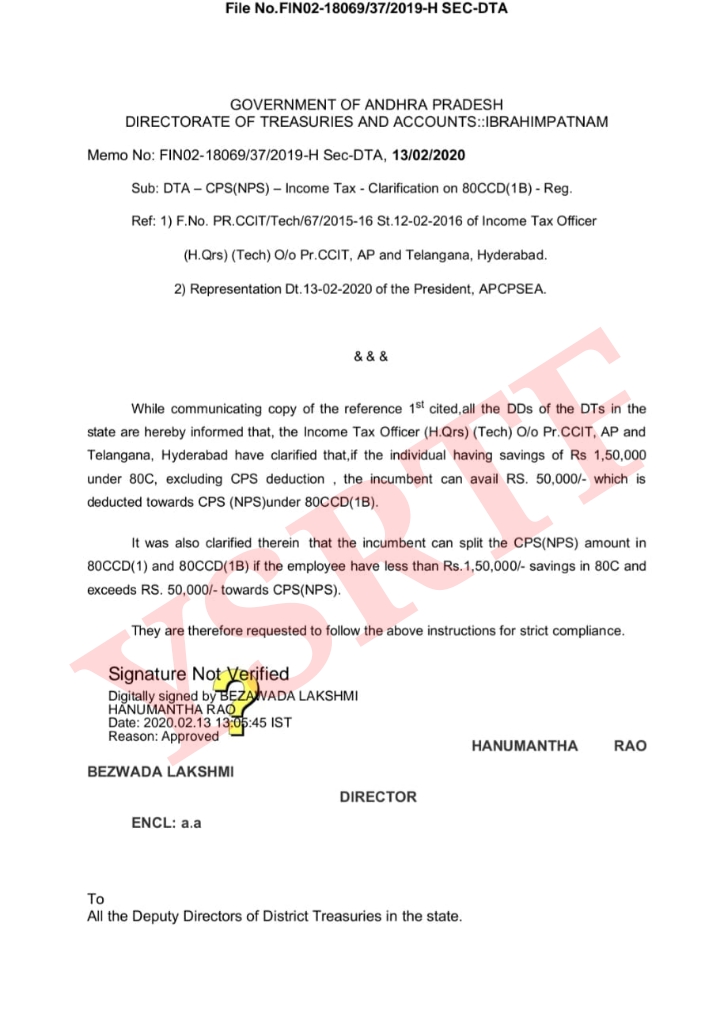

In essence by investing in NPS you can claim tax deductions of up to Rs 2 lakhs in total Rs 1 5 lakhs under Section 80C and an additional Rs 50 000 under Section 80CCD 1B This means

The deduction under Section 80CCD 1B is over and above the combined limit of Rs 1 5 lakh Under Section 80C 80CCC 80CCD 1 If your employer is also

Income Tax Rebate Under 80ccd 1b include a broad selection of printable and downloadable materials available online at no cost. These resources come in various styles, from worksheets to templates, coloring pages and more. The great thing about Income Tax Rebate Under 80ccd 1b is in their variety and accessibility.

More of Income Tax Rebate Under 80ccd 1b

Section 80CCD 1B Deduction NPS Scheme Tax Benefits Alankit

Section 80CCD 1B Deduction NPS Scheme Tax Benefits Alankit

Rs 50 000 under Section 80CCD 1B is in addition to the overall limit of Rs 1 50 lakh Thus the maximum deduction available under Section 80CCD is Rs 2 lakhs

Contributions made towards this account are tax deductible and qualify for deductions u s 80CCD 1 80CCD 1B You can deposit a sum of Rs 2 lakhs in a tier 1 National Pension Scheme account and

Income Tax Rebate Under 80ccd 1b have gained immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Personalization They can make designs to suit your personal needs such as designing invitations or arranging your schedule or even decorating your house.

-

Educational Value: Printing educational materials for no cost cater to learners of all ages, making the perfect source for educators and parents.

-

Convenience: immediate access a plethora of designs and templates saves time and effort.

Where to Find more Income Tax Rebate Under 80ccd 1b

What Is Dcps Nps Yojana Login Pages Info

What Is Dcps Nps Yojana Login Pages Info

The contributions made to this account are eligible for tax deductions under Section 80CCD 1 and 80CCD 1B of the Income Tax Act Tier II account This is a withdrawable account linked to the Tier I

Income Tax Deductions List Deductions on Section 80C 80CCC 80CCD 80D FY 2023 24 AY 2024 25 Updated on 22 Jan

Now that we've ignited your curiosity about Income Tax Rebate Under 80ccd 1b and other printables, let's discover where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Income Tax Rebate Under 80ccd 1b for various objectives.

- Explore categories such as decorations for the home, education and organizing, and crafts.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free or flashcards as well as learning materials.

- It is ideal for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for no cost.

- The blogs are a vast spectrum of interests, from DIY projects to planning a party.

Maximizing Income Tax Rebate Under 80ccd 1b

Here are some ideas to make the most use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Print out free worksheets and activities for reinforcement of learning at home also in the classes.

3. Event Planning

- Designs invitations, banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable calendars, to-do lists, and meal planners.

Conclusion

Income Tax Rebate Under 80ccd 1b are a treasure trove with useful and creative ideas that cater to various needs and preferences. Their accessibility and flexibility make them an essential part of both personal and professional life. Explore the vast world of Income Tax Rebate Under 80ccd 1b and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really absolutely free?

- Yes, they are! You can print and download these materials for free.

-

Are there any free printouts for commercial usage?

- It's dependent on the particular conditions of use. Always consult the author's guidelines prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Certain printables might have limitations concerning their use. Make sure to read the terms and conditions offered by the creator.

-

How do I print printables for free?

- You can print them at home using printing equipment or visit the local print shops for high-quality prints.

-

What program do I need to run printables for free?

- Most printables come as PDF files, which can be opened using free programs like Adobe Reader.

NPS Tax Benefit Under Sec 80CCD 1b Of Rs 50 000 Business HimSky

-50000.jpg)

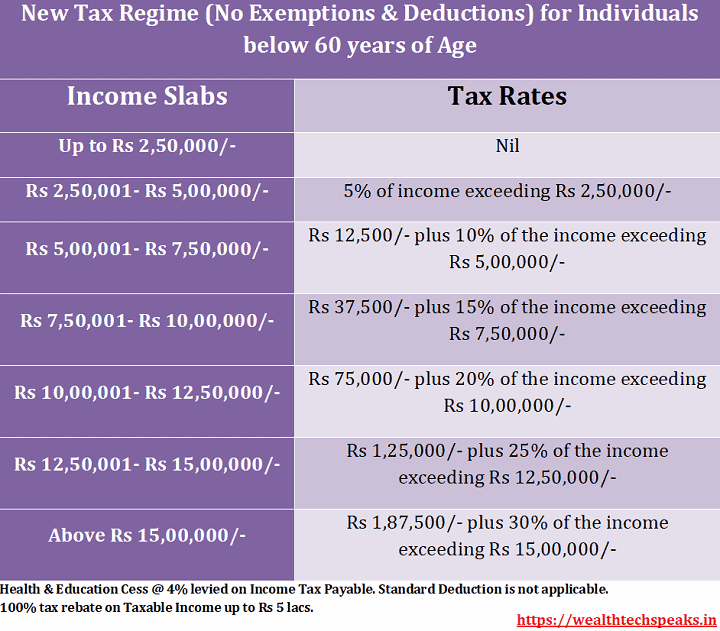

Income Tax Slabs Rates Financial Year 2022 23 WealthTech Speaks

Check more sample of Income Tax Rebate Under 80ccd 1b below

How To Claim Section 80CCD 1B TaxHelpdesk

Do We Need To Invest Extra For Claiming Deduction Under Section 80CCD

Section 80GGC Of Income Tax Act Tax Deduction IndiaFilings

NPS 80CCD 1B Proof NPS Tax Benefits Sec 80C And Additional Tax

NPS Deduction Under Income Tax Act NPS Tax Benefit U s 80ccd 1 80ccd

Income Tax Deduction Under Section 80CCD 1B FilingLounge

https://www.etmoney.com/learn/income-tax/section-80ccd-deductions

The deduction under Section 80CCD 1B is over and above the combined limit of Rs 1 5 lakh Under Section 80C 80CCC 80CCD 1 If your employer is also

https://taxguru.in/income-tax/section-80ccd1b...

Contributions to Tier II accounts are not eligible to claim the deduction under Section 80CCD 1B There are a quite a few Pension fund managers offering to open

The deduction under Section 80CCD 1B is over and above the combined limit of Rs 1 5 lakh Under Section 80C 80CCC 80CCD 1 If your employer is also

Contributions to Tier II accounts are not eligible to claim the deduction under Section 80CCD 1B There are a quite a few Pension fund managers offering to open

NPS 80CCD 1B Proof NPS Tax Benefits Sec 80C And Additional Tax

Do We Need To Invest Extra For Claiming Deduction Under Section 80CCD

NPS Deduction Under Income Tax Act NPS Tax Benefit U s 80ccd 1 80ccd

Income Tax Deduction Under Section 80CCD 1B FilingLounge

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

Save Income Tax Under 80C 80D 80DD 80CCD 1B 80DDB 80GG 80EE 80E

Save Income Tax Under 80C 80D 80DD 80CCD 1B 80DDB 80GG 80EE 80E

How To Save Tax On Additional 50 000 Income Under Section 80CCD 1B