In a world where screens rule our lives and the appeal of physical printed materials isn't diminishing. It doesn't matter if it's for educational reasons and creative work, or simply adding some personal flair to your home, printables for free are now a useful resource. With this guide, you'll dive to the depths of "Income Tax Rebate Under 80ccd," exploring the different types of printables, where to find them, and how they can be used to enhance different aspects of your daily life.

Get Latest Income Tax Rebate Under 80ccd Below

Income Tax Rebate Under 80ccd

Income Tax Rebate Under 80ccd -

Learn about tax benefits under the National Pension System NPS and deductions available under Section 80CCD 1B Discover how to maximize your savings with additional tax relief on NPS contributions

When filing your income tax returns as a salaried or self employed individual you can claim up to 1 50 000 jointly under Section 80CCD 1 for contributions made to NPS or APY individually and Section

Income Tax Rebate Under 80ccd include a broad collection of printable materials that are accessible online for free cost. These materials come in a variety of formats, such as worksheets, coloring pages, templates and many more. The beauty of Income Tax Rebate Under 80ccd is their flexibility and accessibility.

More of Income Tax Rebate Under 80ccd

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A

Section 80CCD1 allows every tax paying individual in India to get tax deduction benefits from the amount you deposit in your NPS account This tax benefit is open to both employed and self

Under Section 80CCD personal and employer contributions made to specific government pension schemes are eligible for income tax deductions This helps to promote retirement savings through pension schemes as well as

Income Tax Rebate Under 80ccd have gained immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

customization: You can tailor designs to suit your personal needs in designing invitations making your schedule, or even decorating your house.

-

Educational Benefits: Printables for education that are free can be used by students of all ages, which makes them an essential tool for teachers and parents.

-

Convenience: Access to various designs and templates reduces time and effort.

Where to Find more Income Tax Rebate Under 80ccd

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

It is to be noted that salaried individuals can claim two deductions under the new tax regime Standard Deduction and deduction under section 80CCD 2 for employer s contribution to NPS Here

For the purposes of deduction under section 80CCD salary includes dearness allowance if the terms of employment so provide but excludes all other allowances and

In the event that we've stirred your curiosity about Income Tax Rebate Under 80ccd Let's see where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety with Income Tax Rebate Under 80ccd for all purposes.

- Explore categories such as interior decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing along with flashcards, as well as other learning tools.

- Ideal for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for free.

- The blogs covered cover a wide spectrum of interests, that includes DIY projects to party planning.

Maximizing Income Tax Rebate Under 80ccd

Here are some ways of making the most use of Income Tax Rebate Under 80ccd:

1. Home Decor

- Print and frame beautiful artwork, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use free printable worksheets to aid in learning at your home for the classroom.

3. Event Planning

- Make invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Income Tax Rebate Under 80ccd are an abundance of fun and practical tools for a variety of needs and interests. Their access and versatility makes them a valuable addition to the professional and personal lives of both. Explore the world of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free cost-free?

- Yes they are! You can download and print these tools for free.

-

Can I utilize free printables in commercial projects?

- It's dependent on the particular usage guidelines. Always read the guidelines of the creator before using printables for commercial projects.

-

Are there any copyright issues with Income Tax Rebate Under 80ccd?

- Some printables could have limitations on usage. Be sure to read the terms and conditions offered by the creator.

-

How can I print printables for free?

- You can print them at home with printing equipment or visit any local print store for the highest quality prints.

-

What program do I need to run printables at no cost?

- The majority of printables are in the format PDF. This can be opened with free programs like Adobe Reader.

Section 87A Tax Rebate Under Section 87A Rebates Financial

Income Tax Rebate Under Section 87A Eligibility To Claim Rebate

Check more sample of Income Tax Rebate Under 80ccd below

Deduction Under Income Tax 80CCC And 80CCD

Anything To Everything Income Tax Guide For Individuals Including

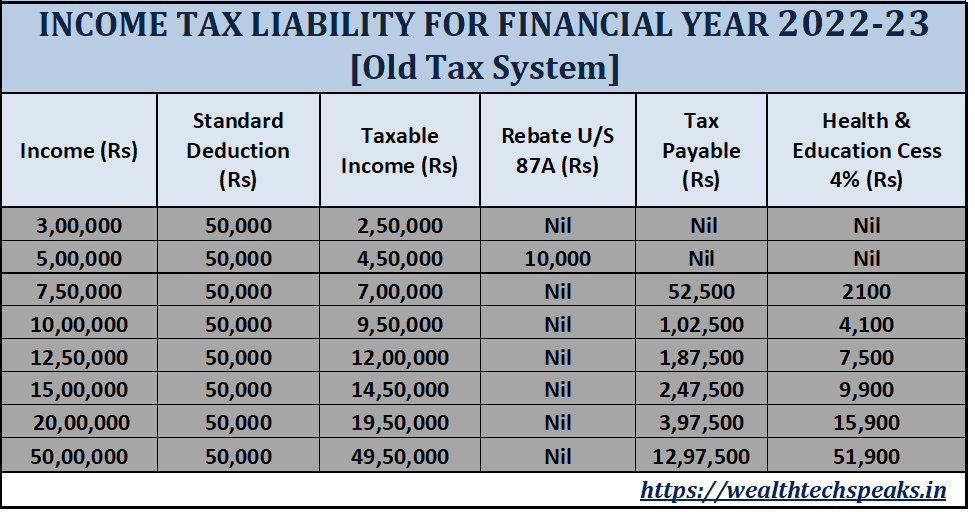

Income Tax Calculation Financial Year 2022 23 WealthTech Speaks

Exemptions Still Available In New Tax Regime with English Subtitles

How To Save Tax On Additional 50 000 Income Under Section 80CCD 1B

80CCD Income Tax Deduction Under Section 80CCD FY 20 21

https://www.etmoney.com › learn › inco…

When filing your income tax returns as a salaried or self employed individual you can claim up to 1 50 000 jointly under Section 80CCD 1 for contributions made to NPS or APY individually and Section

https://cleartax.in

Your total income after reducing the deductions under chapter VI A Section 80C 80D and so on does not exceed Rs 5 lakh in an FY The tax rebate is limited to Rs 12 500 This means if your total tax payable is less than Rs

When filing your income tax returns as a salaried or self employed individual you can claim up to 1 50 000 jointly under Section 80CCD 1 for contributions made to NPS or APY individually and Section

Your total income after reducing the deductions under chapter VI A Section 80C 80D and so on does not exceed Rs 5 lakh in an FY The tax rebate is limited to Rs 12 500 This means if your total tax payable is less than Rs

Exemptions Still Available In New Tax Regime with English Subtitles

Anything To Everything Income Tax Guide For Individuals Including

How To Save Tax On Additional 50 000 Income Under Section 80CCD 1B

80CCD Income Tax Deduction Under Section 80CCD FY 20 21

Save Income Tax Under 80C 80D 80DD 80CCD 1B 80DDB 80GG 80EE 80E

REBATE AND RELIEFS UNDER INCOME TAX

REBATE AND RELIEFS UNDER INCOME TAX

Income Tax Rebate Under Section 87A Rebate For Financial Year GST