In a world where screens dominate our lives but the value of tangible printed objects hasn't waned. Be it for educational use in creative or artistic projects, or simply adding the personal touch to your home, printables for free are a great resource. This article will take a dive to the depths of "Income Tax Relief For Education Loan," exploring what they are, how to locate them, and what they can do to improve different aspects of your life.

Get Latest Income Tax Relief For Education Loan Below

Income Tax Relief For Education Loan

Income Tax Relief For Education Loan -

Education loan income tax benefits can be claimed for 8 years from when you start repaying the EMIs of your loan When you pay the EMI it has an interest and a principal

Maximize your tax savings by understanding Section 80E deduction and how it helps you claim tax benefits on the interest paid on

Printables for free cover a broad variety of printable, downloadable material that is available online at no cost. These materials come in a variety of forms, including worksheets, coloring pages, templates and much more. The appealingness of Income Tax Relief For Education Loan is in their variety and accessibility.

More of Income Tax Relief For Education Loan

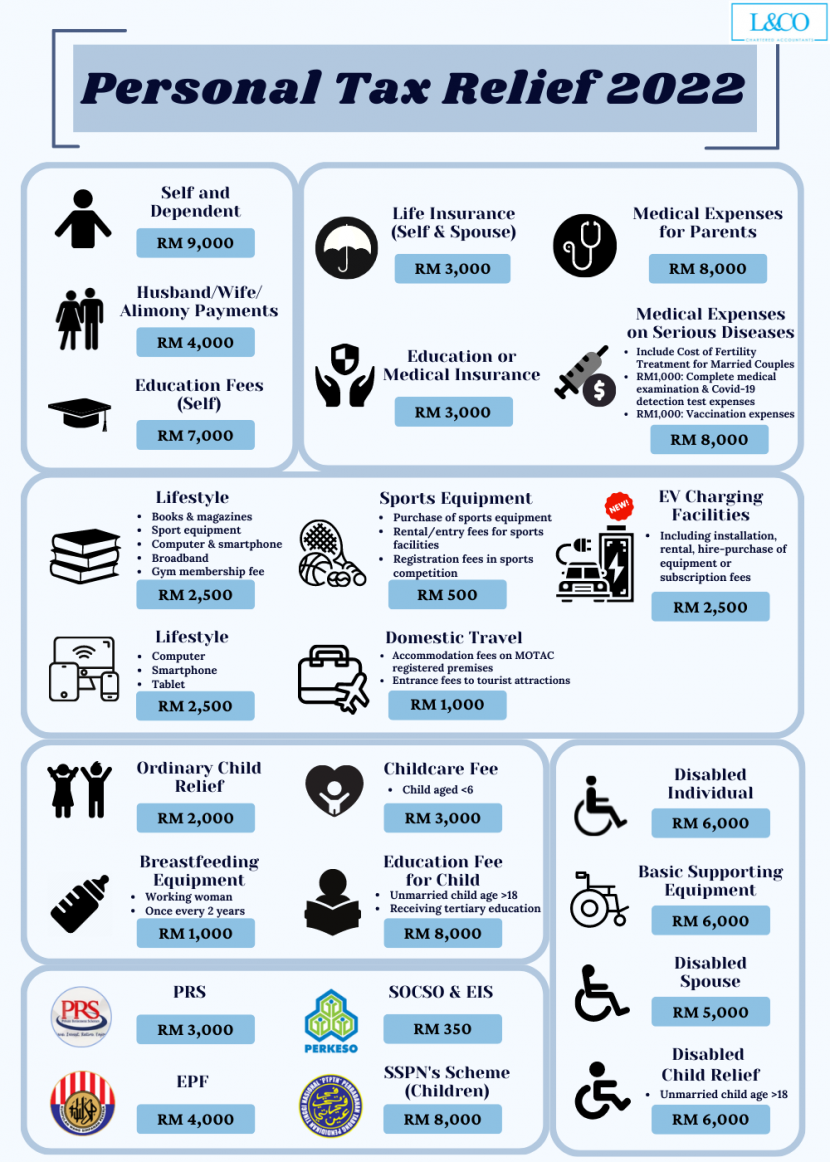

Personal Tax Relief 2022 L Co Accountants

Personal Tax Relief 2022 L Co Accountants

Kindly guide on whether the interest paid on such educational loan taken for the purpose of daughter s education can be claimed as tax deduction in my tax return

Describing the provisions u s 80E and how one can take advantage of it Ankit Mehra CEO and Founder GyanDhan said Section 80E of the Income Tax Act

Income Tax Relief For Education Loan have garnered immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

The ability to customize: It is possible to tailor printing templates to your own specific requirements, whether it's designing invitations to organize your schedule or even decorating your home.

-

Educational Value The free educational worksheets provide for students of all ages, making these printables a powerful source for educators and parents.

-

It's easy: Fast access numerous designs and templates reduces time and effort.

Where to Find more Income Tax Relief For Education Loan

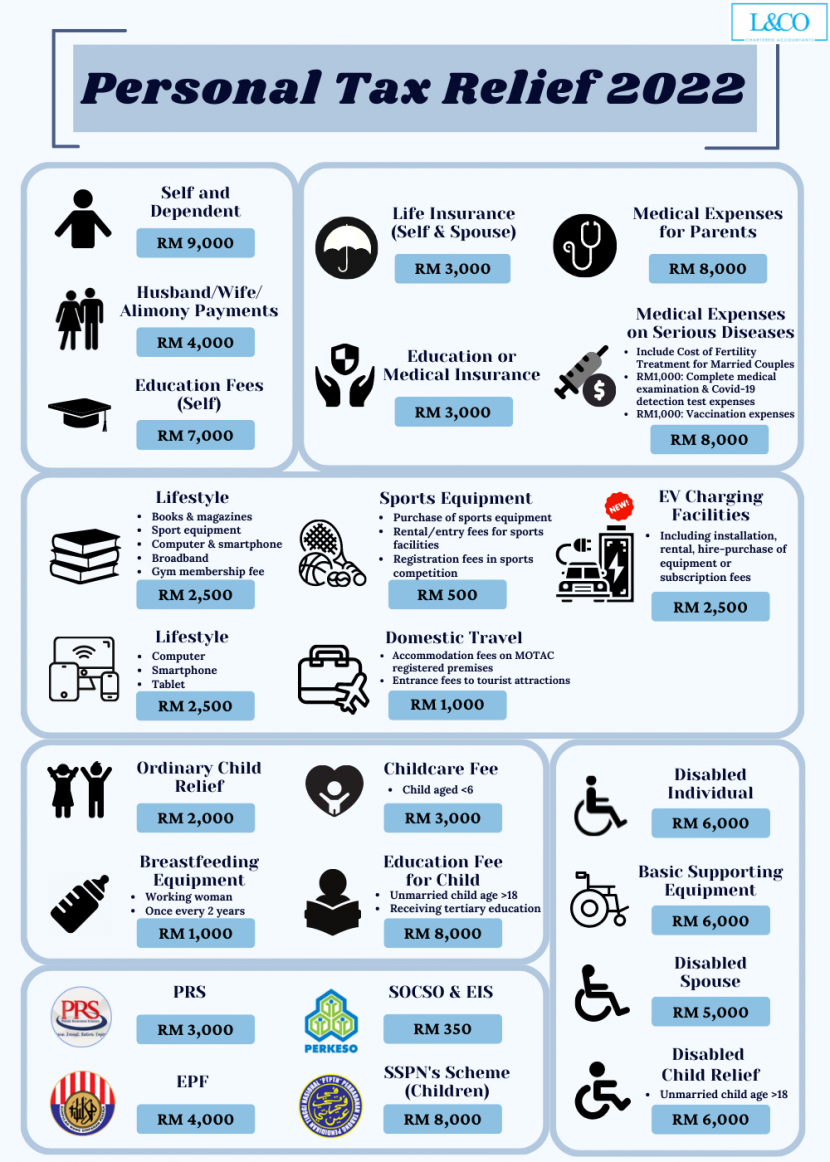

Malaysia Personal Income Tax Relief 2022

Malaysia Personal Income Tax Relief 2022

Who can claim tax benefits on interest paid on an Education Loan Under section 80E of the Income Tax Act only individuals can claim Education Loan income

An education loan tax benefit is a provision that allows individuals to claim a tax deduction on the interest paid on a loan taken for higher education This tax benefit is

In the event that we've stirred your interest in printables for free Let's take a look at where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Income Tax Relief For Education Loan suitable for many uses.

- Explore categories like the home, decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets as well as flashcards and other learning tools.

- Ideal for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their creative designs as well as templates for free.

- These blogs cover a broad range of interests, ranging from DIY projects to party planning.

Maximizing Income Tax Relief For Education Loan

Here are some fresh ways in order to maximize the use of Income Tax Relief For Education Loan:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations to adorn your living areas.

2. Education

- Utilize free printable worksheets to enhance your learning at home or in the classroom.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Income Tax Relief For Education Loan are a treasure trove of innovative and useful resources for a variety of needs and hobbies. Their access and versatility makes them a fantastic addition to both personal and professional life. Explore the vast world of Income Tax Relief For Education Loan now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly are they free?

- Yes you can! You can print and download these documents for free.

-

Can I download free templates for commercial use?

- It's contingent upon the specific terms of use. Make sure you read the guidelines for the creator prior to using the printables in commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Certain printables might have limitations on usage. Check these terms and conditions as set out by the designer.

-

How do I print Income Tax Relief For Education Loan?

- You can print them at home with either a printer or go to the local print shop for more high-quality prints.

-

What program do I need in order to open Income Tax Relief For Education Loan?

- The majority of PDF documents are provided in the PDF format, and is open with no cost software like Adobe Reader.

JasperaxHurst

Check more sample of Income Tax Relief For Education Loan below

List Of Personal Tax Relief And Incentives In Malaysia 2023

Income Tax Relief For Deployed Members Pacific Navy News

Personal Tax Relief 2021 L Co Accountants

Budget 2022 Will The Salaried Class Get Income Tax Relief This Year

List Of LHDN s Income Tax Relief For E Filing 2021 YA 2020

Budget 2022 Increase Standard Deductions And Income Tax Relief For

https://tax2win.in/guide/sec-80e-deducti…

Maximize your tax savings by understanding Section 80E deduction and how it helps you claim tax benefits on the interest paid on

https://www.etmoney.com/learn/income-tax/education...

Section 80E of the Income tax act allows you to claim a deduction for the education loan taken from any financial institution or approved charitable institution

Maximize your tax savings by understanding Section 80E deduction and how it helps you claim tax benefits on the interest paid on

Section 80E of the Income tax act allows you to claim a deduction for the education loan taken from any financial institution or approved charitable institution

Budget 2022 Will The Salaried Class Get Income Tax Relief This Year

Income Tax Relief For Deployed Members Pacific Navy News

List Of LHDN s Income Tax Relief For E Filing 2021 YA 2020

Budget 2022 Increase Standard Deductions And Income Tax Relief For

Best Guide To Maximise Your Malaysian Income Tax Relief 2021

Budget 2022 Income Tax Relief Announced For Differently abled Persons

Budget 2022 Income Tax Relief Announced For Differently abled Persons

Expectations For Budget 2022 Increased Standard Deductions And Income