In this age of electronic devices, where screens rule our lives yet the appeal of tangible printed products hasn't decreased. If it's to aid in education such as creative projects or simply to add the personal touch to your space, Income Tax Relief On Salary Arrears have become a valuable source. In this article, we'll take a dive into the world "Income Tax Relief On Salary Arrears," exploring their purpose, where they are, and how they can be used to enhance different aspects of your life.

Get Latest Income Tax Relief On Salary Arrears Below

Income Tax Relief On Salary Arrears

Income Tax Relief On Salary Arrears -

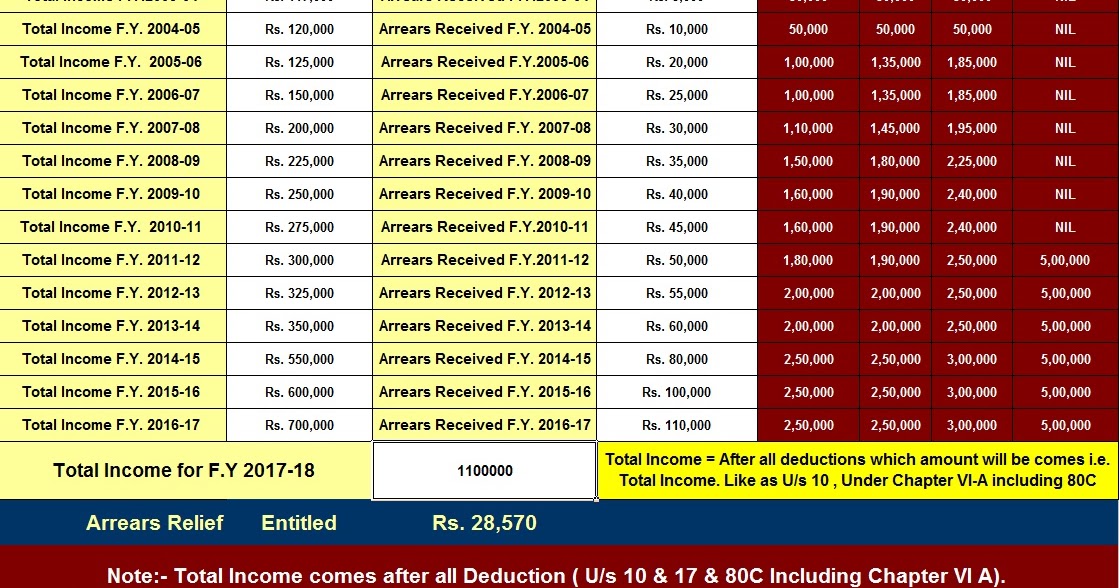

If the assessee has received a potion of his salary in arreas or in advance or received a Family Pension in arrears the Income Tax Act allows you to claim tax relief under section 89 1 Tax liabilities for a taxpayer are calculated from the income earner during that financial year

To save you from add on tax burdens the Income Tax Act offers some relief from salary arrear inclusions under Section 89 1 You can claim relief under this section if you are in a lower tax bracket for the year the dues get credited To claim this tax relief you must fill out Form 10E How to Calculate Tax Relief on Salary Arrears

The Income Tax Relief On Salary Arrears are a huge array of printable resources available online for download at no cost. These resources come in various formats, such as worksheets, templates, coloring pages and more. One of the advantages of Income Tax Relief On Salary Arrears is their flexibility and accessibility.

More of Income Tax Relief On Salary Arrears

Income Tax Relief Under Section 89 1 Read With Rule 21A With

Income Tax Relief Under Section 89 1 Read With Rule 21A With

How to claim tax relief on Salary Arrears under Section 89 1 Arrears or Salary advances are taxable in the year of receipt The income tax department allows tax relief u s 89 of the Income Tax Act to save the taxpayer from the additional tax burden Thus the employer will calculate relief u s 89 and

Here are the steps to calculate relief under section 89 1 of the Income tax Act 1961 Calculate tax payable on total income including arrears in the year in which it is received Calculate tax payable on total income excluding arrears in the year in which it is received Calculate the difference between 1 and 2

Income Tax Relief On Salary Arrears have gained immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

customization: This allows you to modify printables to your specific needs whether you're designing invitations and schedules, or even decorating your house.

-

Educational Benefits: Printables for education that are free provide for students from all ages, making them an essential source for educators and parents.

-

Simple: Quick access to many designs and templates saves time and effort.

Where to Find more Income Tax Relief On Salary Arrears

Claim Income Tax Relief Under Section 89 1 On Salary Arrears YouTube

Claim Income Tax Relief Under Section 89 1 On Salary Arrears YouTube

Section 89 1 provides tax tax relief for delayed salary received in the form of arrears or received a family pension in arrears Who should file Form 10E An individual should file Form 10E if he she has received the following income during the previous financial year Arrears of salary Family pension in arrears

Understand the taxability of arrear salary and the relief provided under Section 89 of the Income Tax Act to effectively manage your tax liability Relief u s 89 An employee may receive any arrear or advance salary or salary for more than 12 months etc then employee might have to pay higher taxes

We've now piqued your interest in printables for free we'll explore the places the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Income Tax Relief On Salary Arrears for various goals.

- Explore categories like decorations for the home, education and management, and craft.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free with flashcards and other teaching tools.

- Great for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for no cost.

- These blogs cover a broad variety of topics, ranging from DIY projects to planning a party.

Maximizing Income Tax Relief On Salary Arrears

Here are some inventive ways of making the most use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Print out free worksheets and activities to enhance your learning at home or in the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Keep your calendars organized by printing printable calendars, to-do lists, and meal planners.

Conclusion

Income Tax Relief On Salary Arrears are an abundance of innovative and useful resources for a variety of needs and desires. Their availability and versatility make them a fantastic addition to each day life. Explore the many options of Income Tax Relief On Salary Arrears and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free cost-free?

- Yes, they are! You can print and download the resources for free.

-

Can I use the free printables in commercial projects?

- It's all dependent on the usage guidelines. Be sure to read the rules of the creator before utilizing their templates for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Certain printables could be restricted on use. Be sure to read these terms and conditions as set out by the author.

-

How do I print printables for free?

- You can print them at home with either a printer at home or in a local print shop for better quality prints.

-

What program do I need to run printables at no cost?

- A majority of printed materials are in the format PDF. This is open with no cost software, such as Adobe Reader.

Relief Under Section 89 1 On Salary Arrears YouTube

Relief Under Section 89 1 On Arrears Of Salary FY 2020 21 Excel

Check more sample of Income Tax Relief On Salary Arrears below

Tamil Nesan Malaysia Kyra Woodbury

Tax Relief On Salary Arrears Sec89 Of IT Act

How To Claim Tax Relief On Salary Arrears Received By You Banking School

How To File Form 10E For Tax Relief On Salary Arrears Under Section 89

TAX RELIEF ON SALARY ARREARS U s 89 1 FORM 10 E ALL ABOUT TAX

Claiming Relief Under Section 89 1 On Salary Arrears

https://fi.money/blog/posts/what-is-arrears-in-salary-and-how-it-works

To save you from add on tax burdens the Income Tax Act offers some relief from salary arrear inclusions under Section 89 1 You can claim relief under this section if you are in a lower tax bracket for the year the dues get credited To claim this tax relief you must fill out Form 10E How to Calculate Tax Relief on Salary Arrears

https://taxguru.in/income-tax/arrears-salary...

Understand the tax implications of arrears of salary and explore relief options under Section 89 1 Learn the calculation process for tax relief and the importance of filing Form 10E to claim relief Stay informed about taxability provisions and steps to ensure a smooth process

To save you from add on tax burdens the Income Tax Act offers some relief from salary arrear inclusions under Section 89 1 You can claim relief under this section if you are in a lower tax bracket for the year the dues get credited To claim this tax relief you must fill out Form 10E How to Calculate Tax Relief on Salary Arrears

Understand the tax implications of arrears of salary and explore relief options under Section 89 1 Learn the calculation process for tax relief and the importance of filing Form 10E to claim relief Stay informed about taxability provisions and steps to ensure a smooth process

How To File Form 10E For Tax Relief On Salary Arrears Under Section 89

Tax Relief On Salary Arrears Sec89 Of IT Act

TAX RELIEF ON SALARY ARREARS U s 89 1 FORM 10 E ALL ABOUT TAX

Claiming Relief Under Section 89 1 On Salary Arrears

Relief Under Section 89 1 For Arrears Of Salary Taxxguru in

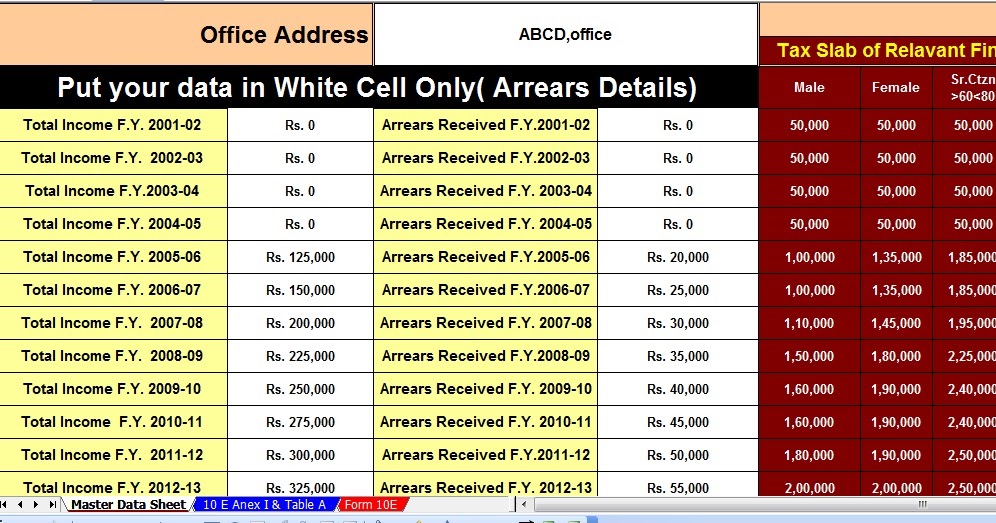

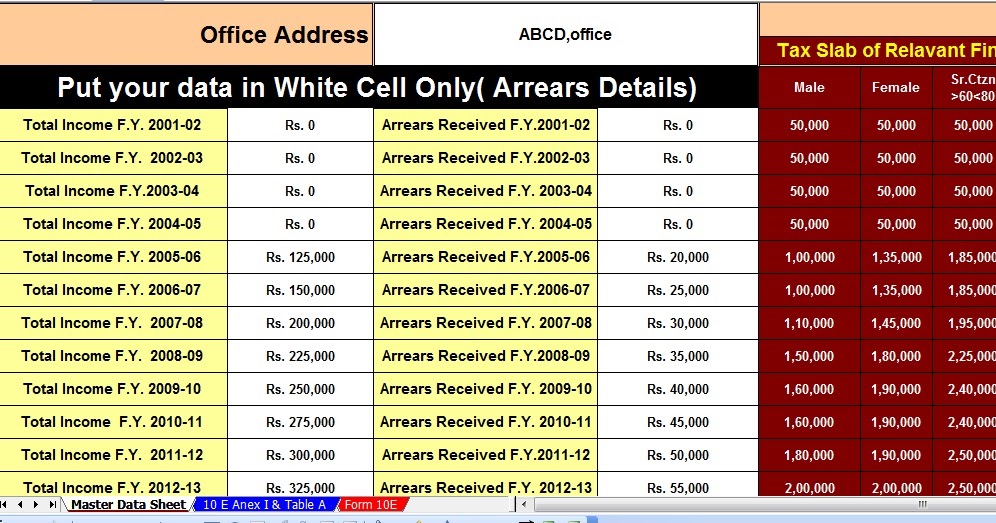

Income Tax Relief Calculator 2016 17 For Arrears Of Salary Income With

Income Tax Relief Calculator 2016 17 For Arrears Of Salary Income With

Tax Relief For Salary Arrears YouTube