In the age of digital, with screens dominating our lives however, the attraction of tangible, printed materials hasn't diminished. Be it for educational use or creative projects, or simply to add an extra personal touch to your space, Income Tax Return Child Care Expenses are now a useful resource. This article will dive into the sphere of "Income Tax Return Child Care Expenses," exploring the different types of printables, where to find them and how they can be used to enhance different aspects of your life.

Get Latest Income Tax Return Child Care Expenses Below

Income Tax Return Child Care Expenses

Income Tax Return Child Care Expenses -

What is the child and dependent care tax credit The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care

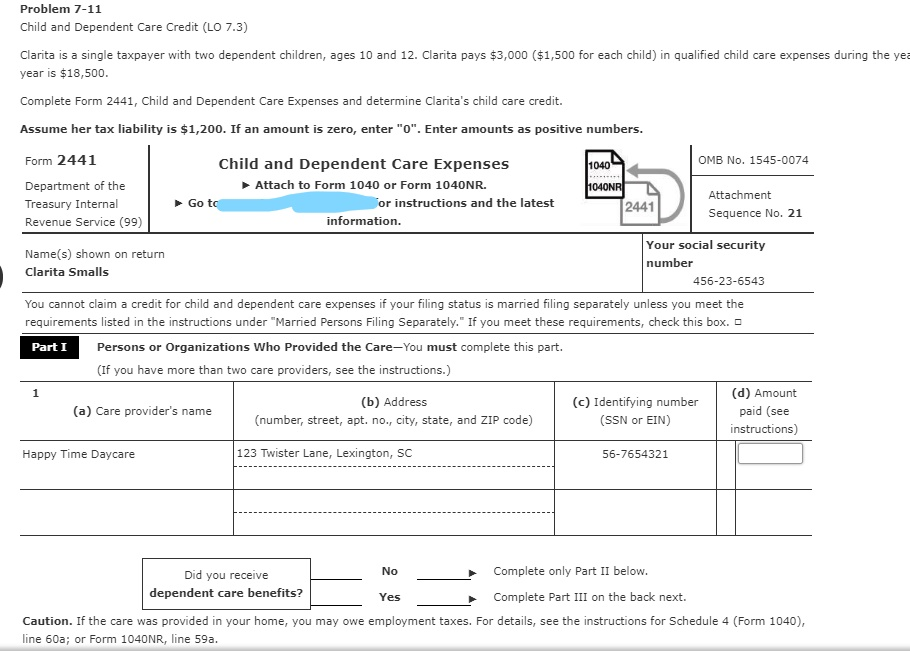

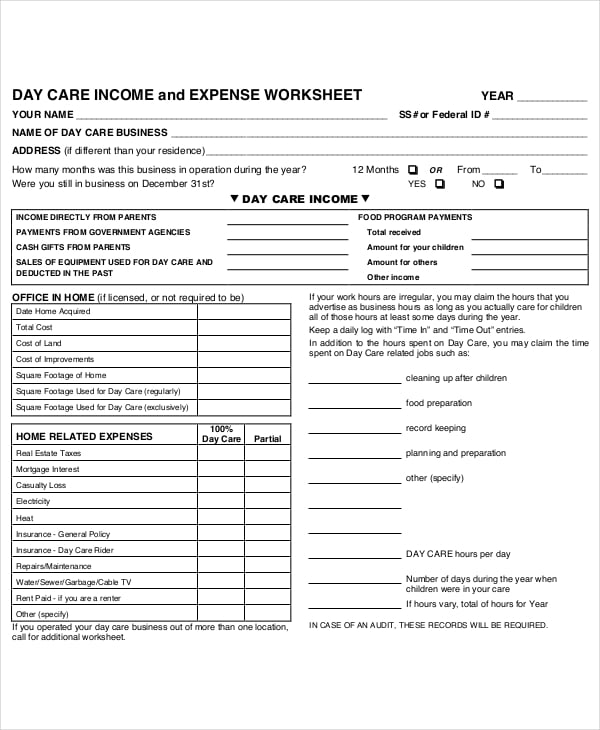

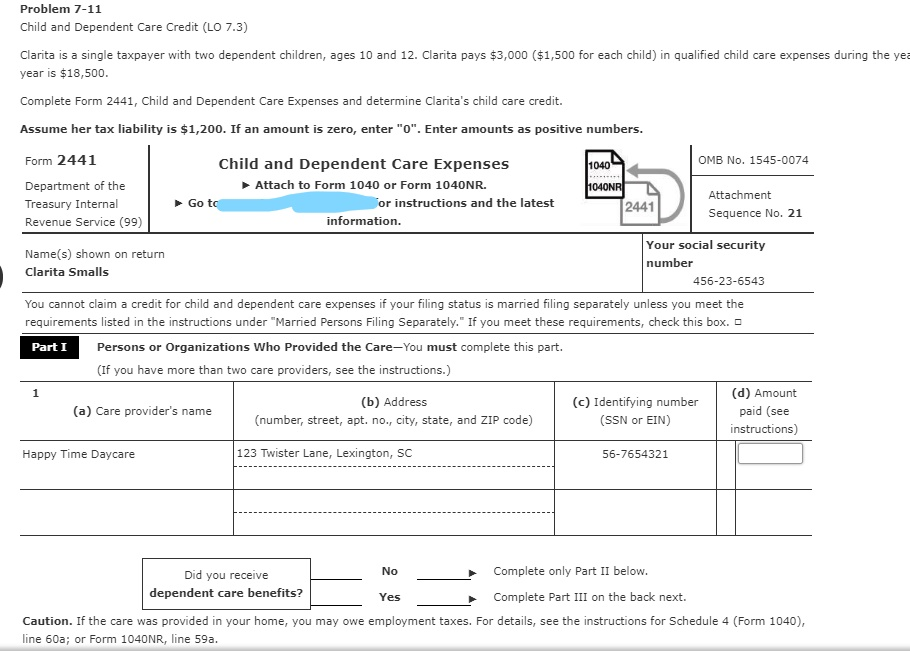

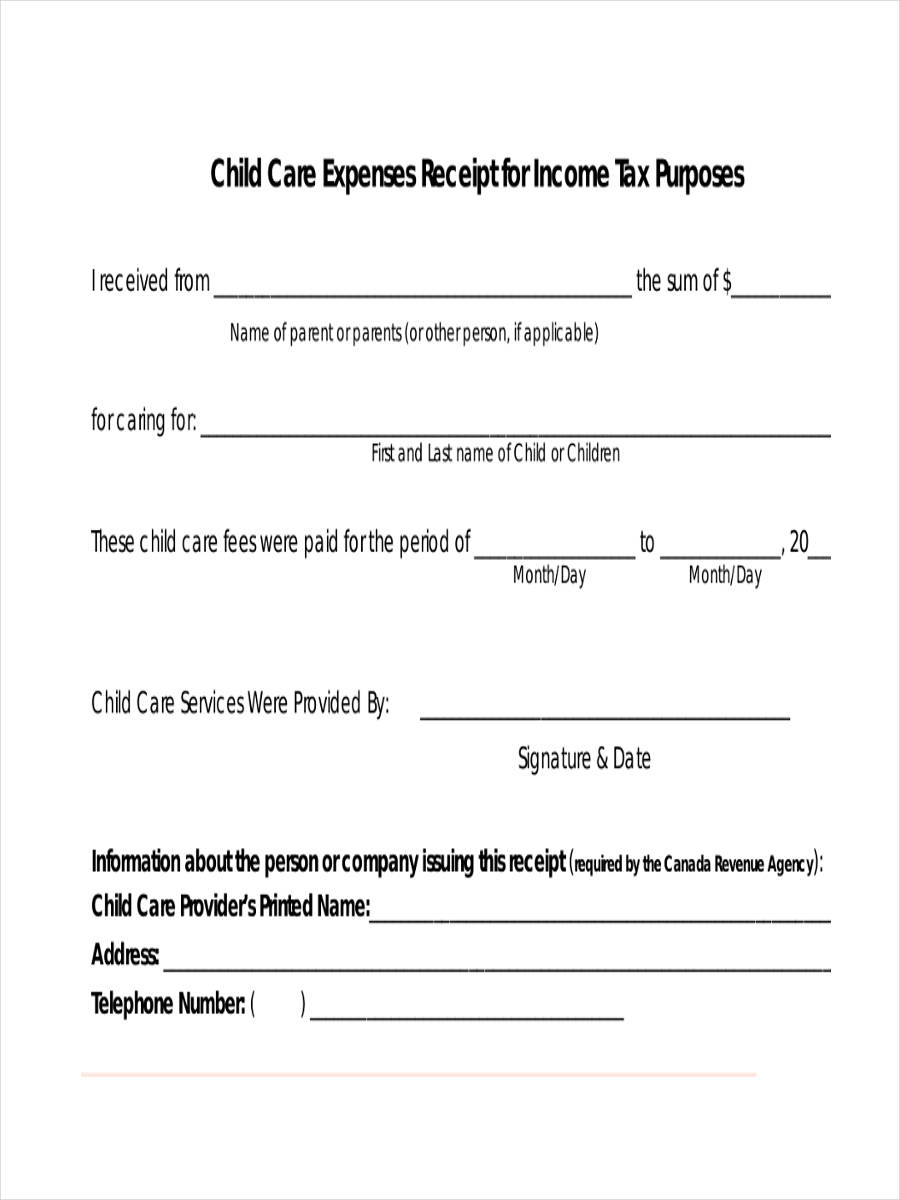

To claim the credit you will need to complete Form 2441 Child and Dependent Care Expenses and include the form when you file your Federal income

Printables for free include a vast range of downloadable, printable materials available online at no cost. These materials come in a variety of formats, such as worksheets, coloring pages, templates and more. The value of Income Tax Return Child Care Expenses is their flexibility and accessibility.

More of Income Tax Return Child Care Expenses

An Affidavit Of Support Is Normally Characterized As A Legal Paper That

An Affidavit Of Support Is Normally Characterized As A Legal Paper That

You can claim from 20 to 35 of your care expenses up to a maximum of 3 000 for one person or 6 000 for two or more people tax year 2023 Benefits of the

3 000 for one qualifying person 6 000 for two or more qualifying persons How much you can claim phases out depending on your income Requirements for the Child Care Tax Credit To claim this valuable tax

Print-friendly freebies have gained tremendous popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Customization: You can tailor printed materials to meet your requirements when it comes to designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Worth: Printables for education that are free can be used by students of all ages. This makes them a valuable tool for parents and teachers.

-

Affordability: Fast access the vast array of design and templates can save you time and energy.

Where to Find more Income Tax Return Child Care Expenses

How Does Paying Or Receiving Child Support Affect My Tax Return LJ

How Does Paying Or Receiving Child Support Affect My Tax Return LJ

Previously taxpayers could claim the Child and Dependent Care Credit for between 20 and 35 percent of their eligible expenses up to 3 000 for one qualifying

Credit for Child and Dependent Care Expenses Introduction This lesson covers the credit for child and dependent care expenses Some taxpayers may not be aware of this

If we've already piqued your interest in printables for free We'll take a look around to see where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Income Tax Return Child Care Expenses designed for a variety needs.

- Explore categories such as home decor, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free, flashcards, and learning tools.

- Ideal for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- These blogs cover a wide range of topics, including DIY projects to planning a party.

Maximizing Income Tax Return Child Care Expenses

Here are some new ways that you can make use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Use free printable worksheets to reinforce learning at home either in the schoolroom or at home.

3. Event Planning

- Invitations, banners and decorations for special events like weddings or birthdays.

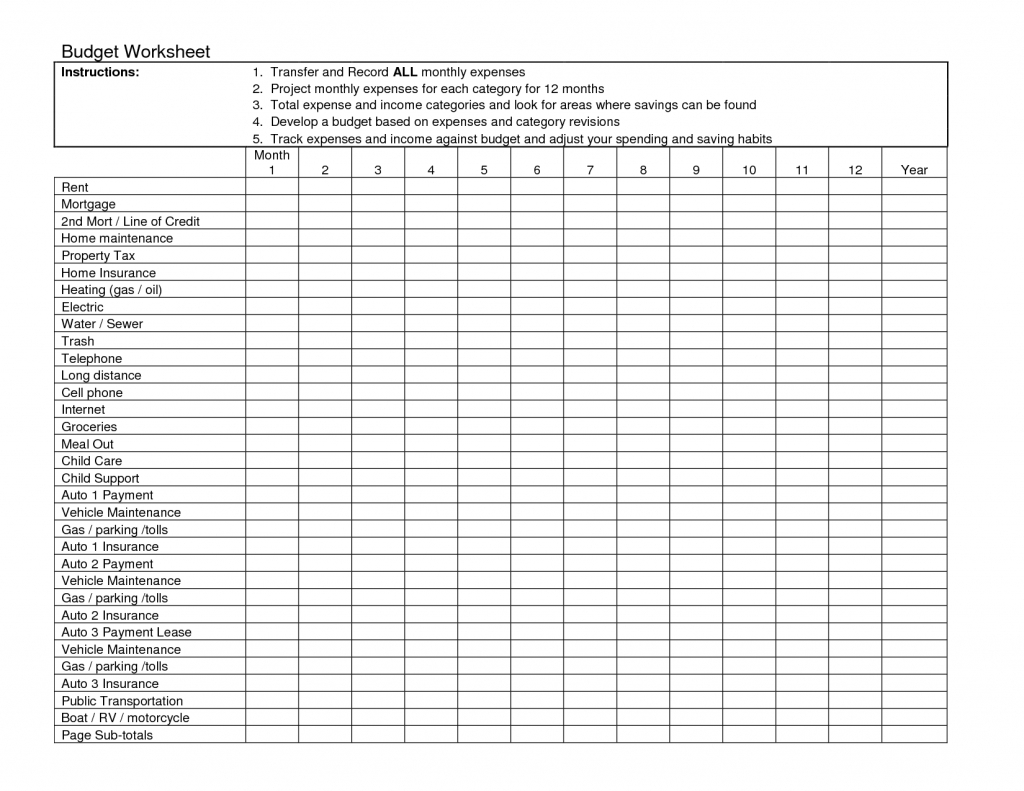

4. Organization

- Make sure you are organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Income Tax Return Child Care Expenses are an abundance of practical and imaginative resources which cater to a wide range of needs and passions. Their accessibility and versatility make them a wonderful addition to every aspect of your life, both professional and personal. Explore the many options of Income Tax Return Child Care Expenses right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free completely free?

- Yes they are! You can print and download these files for free.

-

Can I use the free printables in commercial projects?

- It's dependent on the particular rules of usage. Be sure to read the rules of the creator prior to using the printables in commercial projects.

-

Are there any copyright problems with printables that are free?

- Certain printables might have limitations on their use. Be sure to read the terms and regulations provided by the designer.

-

How can I print printables for free?

- You can print them at home with either a printer or go to the local print shop for higher quality prints.

-

What software do I require to open printables at no cost?

- The majority of PDF documents are provided in PDF format. They can be opened with free software like Adobe Reader.

Credit Limit Worksheet 8839 Free Download Goodimg co

Child Tax Credit Xmas Payment Dates 2021 Kitchen Cabinet

Check more sample of Income Tax Return Child Care Expenses below

Child Care Tax Credit Income Limit

Child Tax Credit 2022 Tax Return 2022 VGH

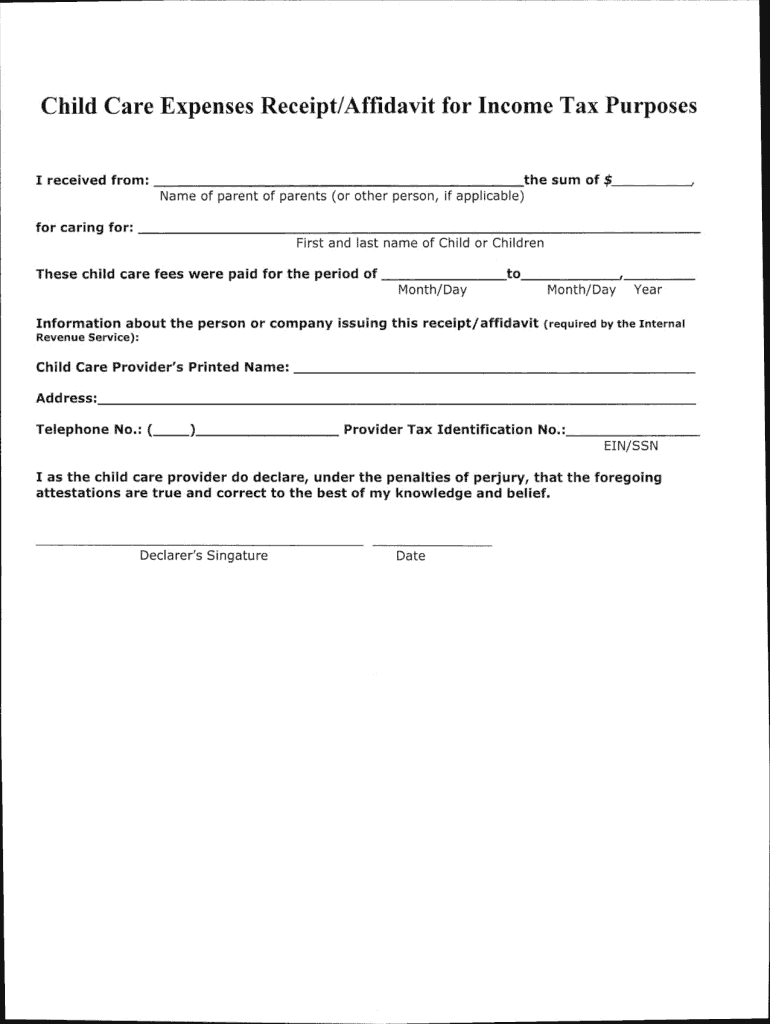

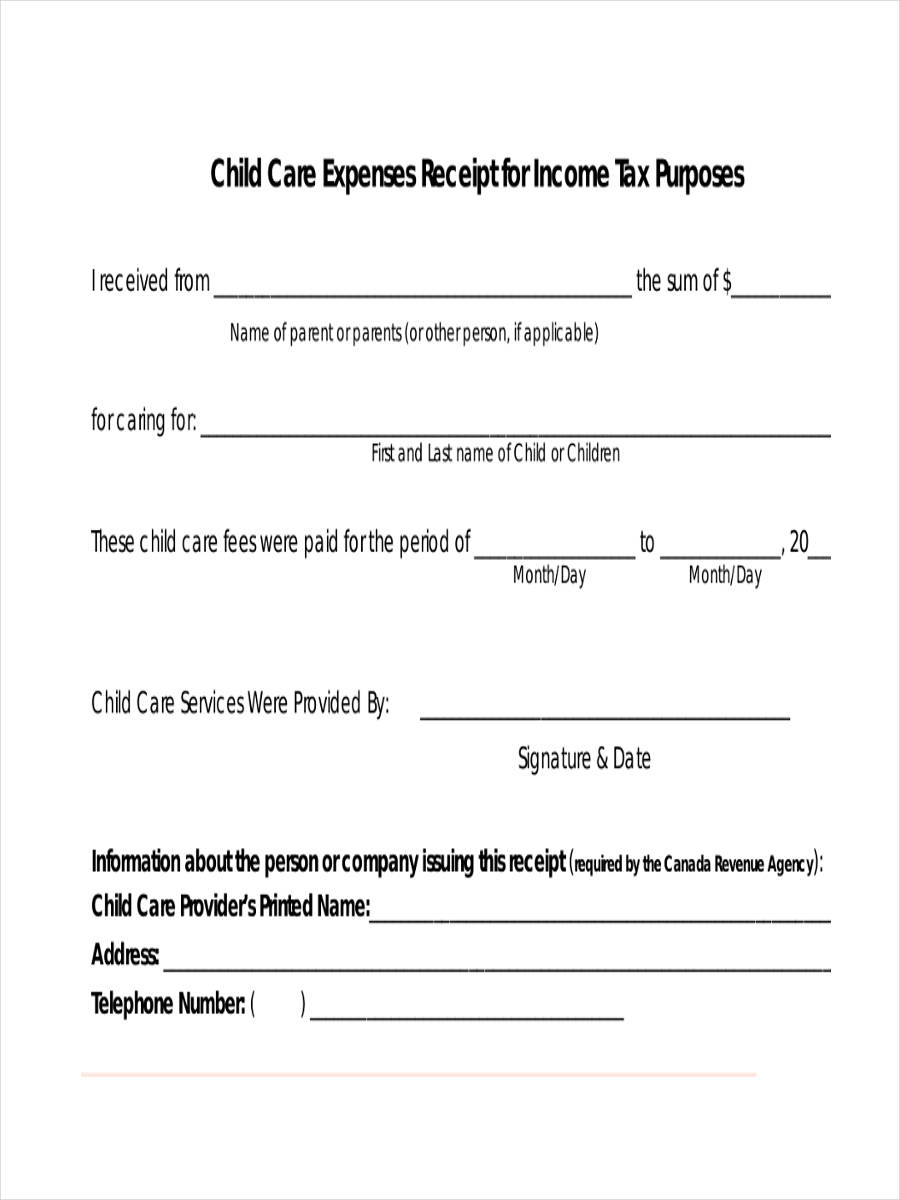

Child Care Receipt Template Canada Form Fill Out And Sign Printable

Problem 7 11 Child And Dependent Care Credit LO 7 3 Chegg

Free Printable Daycare Receipt Printable Word Searches

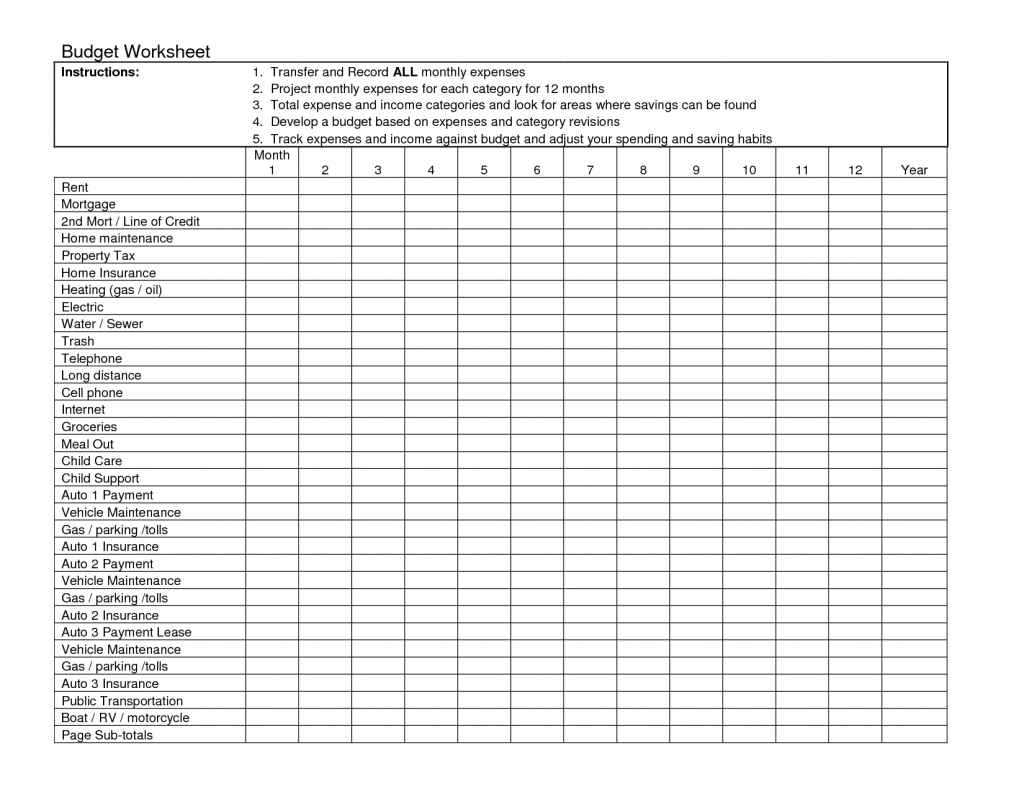

Tax Organizer Worksheet 2015 Free Download Gmbar co

https://www.irs.gov/newsroom/child-and-dependent...

To claim the credit you will need to complete Form 2441 Child and Dependent Care Expenses and include the form when you file your Federal income

https://www.irs.gov/newsroom/understanding-the...

For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or more Depending on their income taxpayers could

To claim the credit you will need to complete Form 2441 Child and Dependent Care Expenses and include the form when you file your Federal income

For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or more Depending on their income taxpayers could

Problem 7 11 Child And Dependent Care Credit LO 7 3 Chegg

Child Tax Credit 2022 Tax Return 2022 VGH

Free Printable Daycare Receipt Printable Word Searches

Tax Organizer Worksheet 2015 Free Download Gmbar co

Tax Return For Child Credit 2020 TAXIRIN

5 Things To Know About Claiming Child Care Expenses This Tax Season

5 Things To Know About Claiming Child Care Expenses This Tax Season

Can I Deduct Nanny Expenses On My Tax Return Taxhub