In this age of electronic devices, when screens dominate our lives The appeal of tangible printed objects isn't diminished. It doesn't matter if it's for educational reasons for creative projects, just adding an extra personal touch to your space, Income Tax Return Exemption are now an essential source. The following article is a dive to the depths of "Income Tax Return Exemption," exploring what they are, where to get them, as well as what they can do to improve different aspects of your daily life.

Get Latest Income Tax Return Exemption Below

Income Tax Return Exemption

Income Tax Return Exemption -

Income Exemption Threshold IET An individual who was resident in Mauritius in the income year ended 30 June 2021 is entitled for the purpose of calculating his chargeable income to claim a deduction in respect of Income Exemption Threshold Category A B C D or E as applicable to him

INCOME TAX RETURN Individual taxpayers have the option to file a Standard tax return or Presumptive tax return or Simplified tax return depending on the types of income and having satisfied certain conditions laid down for each return type All self employed individuals are required to submit an income tax return

Income Tax Return Exemption provide a diverse collection of printable documents that can be downloaded online at no cost. They come in many kinds, including worksheets templates, coloring pages, and more. The appealingness of Income Tax Return Exemption lies in their versatility as well as accessibility.

More of Income Tax Return Exemption

Income Tax Return Exemption For Certain Senior Citizens And NRIs Finds

Income Tax Return Exemption For Certain Senior Citizens And NRIs Finds

Income Tax Returns for individuals An individual who is in receipt of emoluments pension or deriving income from trade business profession agriculture rents and other sources should fill in a return of income if he is registered at the MRA i e has been allocated a Tax Account Number

Find out if you have to file a federal income tax return and why it may pay you to file even if you don t have to

Printables for free have gained immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Customization: Your HTML0 customization options allow you to customize designs to suit your personal needs such as designing invitations planning your schedule or even decorating your home.

-

Educational Benefits: Printing educational materials for no cost can be used by students of all ages, which makes these printables a powerful source for educators and parents.

-

Affordability: Quick access to a plethora of designs and templates cuts down on time and efforts.

Where to Find more Income Tax Return Exemption

The Process Of Filling ITR Will Start Soon

The Process Of Filling ITR Will Start Soon

Certificate of Tax Exemption or CTE is issued to individuals or organizations who are exempt from tax Exemption from taxation as the name suggests is when certain individuals organizations or institutions are free from taxes due to privileges granted by legislative grace

Exempt income Exempt income is income that you don t pay tax on that is it s tax free You may still need to include this income in your tax return for use in other tax calculations Examples of exempt income can include some government pensions and payments including the invalidity pension some education payments

Now that we've ignited your curiosity about Income Tax Return Exemption we'll explore the places you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection in Income Tax Return Exemption for different objectives.

- Explore categories such as decorating your home, education, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free including flashcards, learning tools.

- Perfect for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates free of charge.

- The blogs covered cover a wide range of interests, from DIY projects to party planning.

Maximizing Income Tax Return Exemption

Here are some fresh ways create the maximum value of Income Tax Return Exemption:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print worksheets that are free for reinforcement of learning at home (or in the learning environment).

3. Event Planning

- Design invitations and banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Income Tax Return Exemption are an abundance of practical and imaginative resources catering to different needs and preferences. Their availability and versatility make them an invaluable addition to both professional and personal life. Explore the wide world of Income Tax Return Exemption today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly cost-free?

- Yes you can! You can download and print these free resources for no cost.

-

Are there any free printables in commercial projects?

- It is contingent on the specific usage guidelines. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Are there any copyright issues when you download Income Tax Return Exemption?

- Some printables may have restrictions in use. Be sure to read the terms and conditions set forth by the author.

-

How do I print Income Tax Return Exemption?

- Print them at home using a printer or visit any local print store for premium prints.

-

What program do I need to run printables at no cost?

- The majority of PDF documents are provided as PDF files, which can be opened with free software such as Adobe Reader.

Exemption From The Obligation To Submit An Income Tax Return

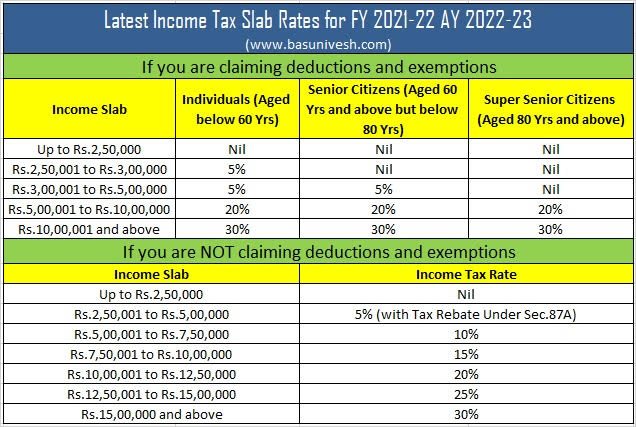

Latest Income Tax Slab Rates For FY 2021 22 AY 2022 23 If You Are

Check more sample of Income Tax Return Exemption below

STEP LATAM 2018 Brook And Cano

Sales Tax Exemption Certificate Wisconsin

2023 Federal Tax Exemption Form ExemptForm

Proper Filing Of Form 10 Manually With Income Tax Return ITAT Grants

Tax Exempt Donation Letter Sample Form Fill Out And Sign Printable

Federal Income Tax Withholding Exemption 2022 Federal Income Tax TaxUni

https://eservices.mra.mu

INCOME TAX RETURN Individual taxpayers have the option to file a Standard tax return or Presumptive tax return or Simplified tax return depending on the types of income and having satisfied certain conditions laid down for each return type All self employed individuals are required to submit an income tax return

https://www.mra.mu/index.php/taxes-duties/corporate-taxation

All companies deriving gross income and exempt income have the legal obligation to file annual returns and pay tax electronically Failure to file electronic returns carries a penalty of 20 of the tax payable maximum Rs 100 000 or Rs 5000 where no tax liability is declared in the return

INCOME TAX RETURN Individual taxpayers have the option to file a Standard tax return or Presumptive tax return or Simplified tax return depending on the types of income and having satisfied certain conditions laid down for each return type All self employed individuals are required to submit an income tax return

All companies deriving gross income and exempt income have the legal obligation to file annual returns and pay tax electronically Failure to file electronic returns carries a penalty of 20 of the tax payable maximum Rs 100 000 or Rs 5000 where no tax liability is declared in the return

Proper Filing Of Form 10 Manually With Income Tax Return ITAT Grants

Sales Tax Exemption Certificate Wisconsin

Tax Exempt Donation Letter Sample Form Fill Out And Sign Printable

Federal Income Tax Withholding Exemption 2022 Federal Income Tax TaxUni

Premium Vector State Government Taxation Calculation Of Tax Return

Tax Return Cover Sheet Megiaaume

Tax Return Cover Sheet Megiaaume

Request Letter For Tax Exemption And Certificate SemiOffice Com