In the digital age, where screens have become the dominant feature of our lives The appeal of tangible printed objects isn't diminished. In the case of educational materials for creative projects, simply adding an individual touch to your home, printables for free have proven to be a valuable source. In this article, we'll dive into the world of "Income Tax Return For Salaried Person In Pakistan," exploring their purpose, where to locate them, and how they can be used to enhance different aspects of your life.

Get Latest Income Tax Return For Salaried Person In Pakistan Below

Income Tax Return For Salaried Person In Pakistan

Income Tax Return For Salaried Person In Pakistan -

Version 1 0 Income Tax Return IT 2 e Filing Guide for Salaried Taxpayer This guide is intended for use of Salaried Taxpayers only This guide shows step by step procedure for completing the following functions e Enrollment procedure at https e FBR gov pk

Salaried Person Income Tax Return To facilitate salaried person in filing their Income Tax Return Declaration form 114 I has been provided Salaried person would need to complete the Declaration form 114 I in order to successfully submit their

The Income Tax Return For Salaried Person In Pakistan are a huge assortment of printable materials online, at no cost. They come in many types, such as worksheets templates, coloring pages and much more. The appeal of printables for free is in their versatility and accessibility.

More of Income Tax Return For Salaried Person In Pakistan

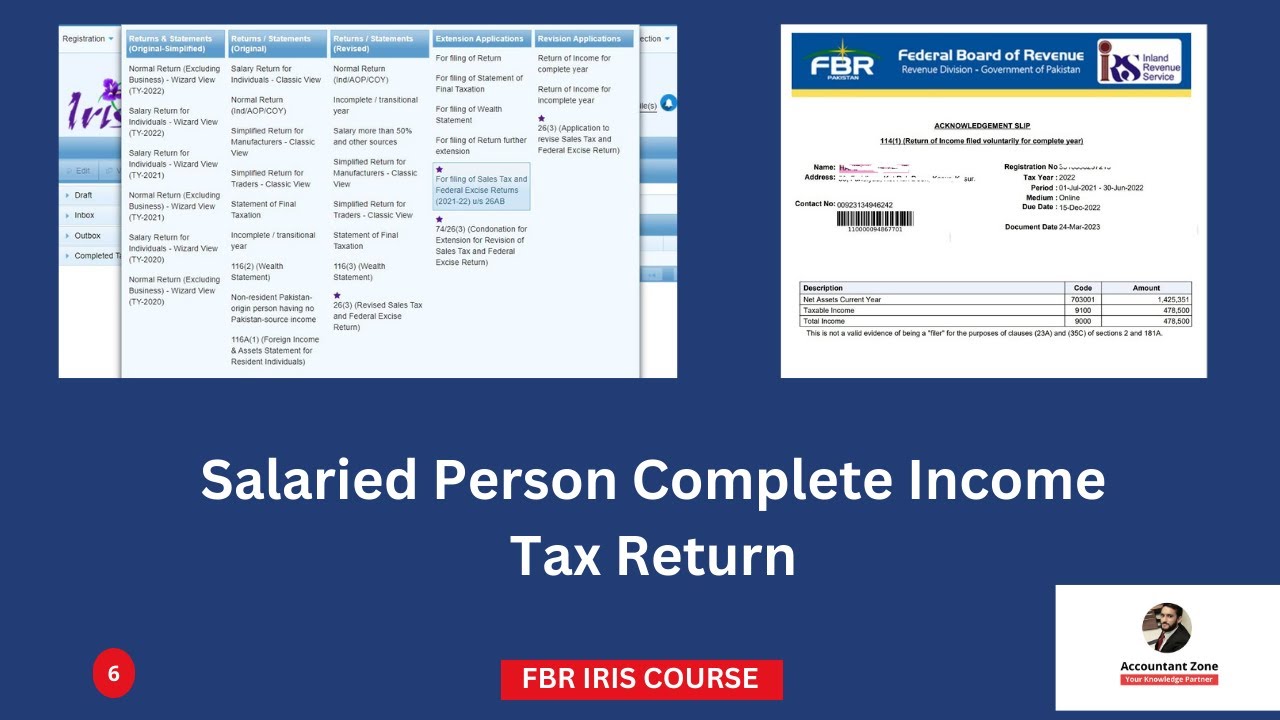

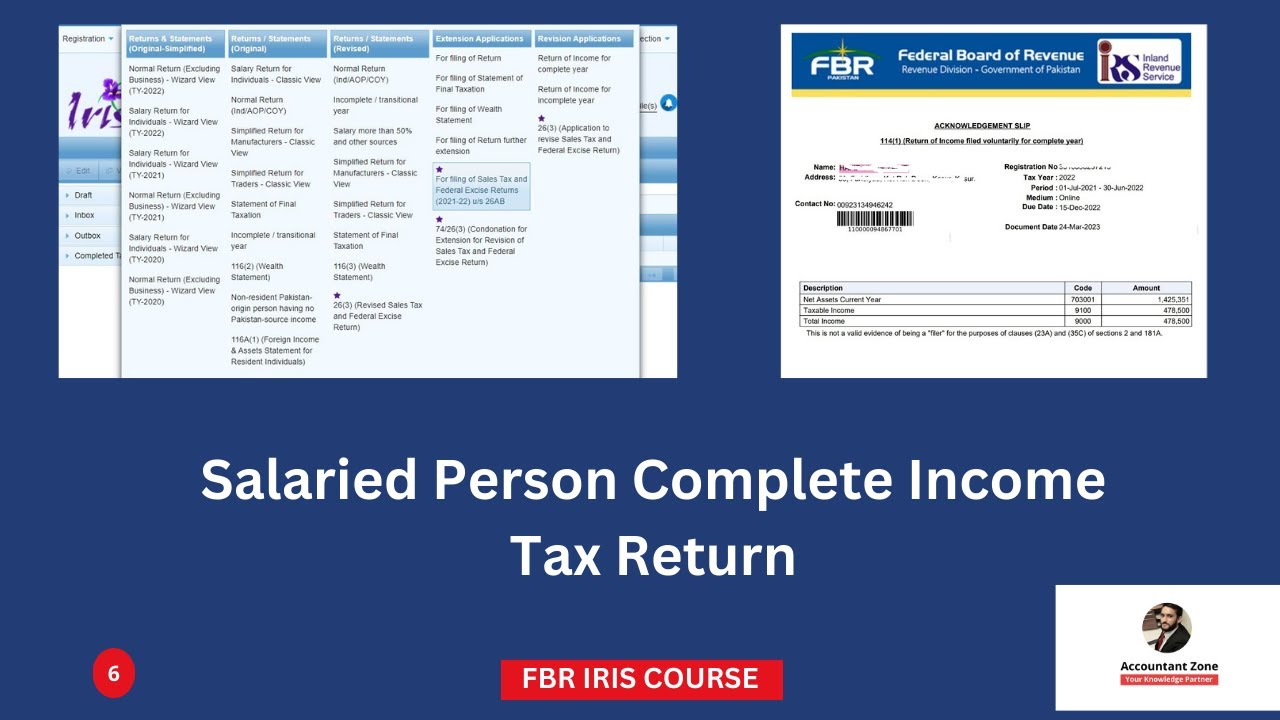

FBR Income Tax Return For Salaried Person File Online Salaried Person

FBR Income Tax Return For Salaried Person File Online Salaried Person

Pakistan levies tax on its residents on their worldwide income A non resident individual is taxed only on Pakistan source income including income received or deemed to be received in Pakistan or deemed to accrue or arise in Pakistan

If your annual income is PKR 400 000 or above you can file your tax returns in Pakistan To facilitate our taxpayers we have compiled a complete guideline for you to file your income tax return

Printables that are free have gained enormous recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Individualization It is possible to tailor printed materials to meet your requirements, whether it's designing invitations to organize your schedule or even decorating your house.

-

Educational Benefits: The free educational worksheets can be used by students from all ages, making them a valuable source for educators and parents.

-

The convenience of Access to an array of designs and templates will save you time and effort.

Where to Find more Income Tax Return For Salaried Person In Pakistan

How To File FBR Income Tax Return For Salaried Person Online In

How To File FBR Income Tax Return For Salaried Person Online In

Calculate monthly income and total payable tax amount on your salary Learn more about tax slabs

An individual is required to file a return of income with the tax authorities on a fiscal year basis 1 July through 30 June Filing of a revised return requires prior approval of the Commissioner subject to certain limitations and conditions

If we've already piqued your curiosity about Income Tax Return For Salaried Person In Pakistan We'll take a look around to see where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Income Tax Return For Salaried Person In Pakistan designed for a variety goals.

- Explore categories such as furniture, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free or flashcards as well as learning tools.

- Perfect for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for no cost.

- These blogs cover a wide range of interests, all the way from DIY projects to party planning.

Maximizing Income Tax Return For Salaried Person In Pakistan

Here are some ideas how you could make the most of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or even seasonal decorations to decorate your living spaces.

2. Education

- Print free worksheets to enhance your learning at home also in the classes.

3. Event Planning

- Make invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Income Tax Return For Salaried Person In Pakistan are a treasure trove of fun and practical tools catering to different needs and preferences. Their availability and versatility make them a great addition to every aspect of your life, both professional and personal. Explore the wide world that is Income Tax Return For Salaried Person In Pakistan today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really cost-free?

- Yes you can! You can download and print these tools for free.

-

Can I download free printables for commercial use?

- It is contingent on the specific terms of use. Always consult the author's guidelines before using any printables on commercial projects.

-

Do you have any copyright concerns with Income Tax Return For Salaried Person In Pakistan?

- Certain printables might have limitations on their use. Be sure to read the terms and conditions provided by the designer.

-

How do I print Income Tax Return For Salaried Person In Pakistan?

- Print them at home with either a printer at home or in an in-store print shop to get top quality prints.

-

What software do I require to view Income Tax Return For Salaried Person In Pakistan?

- The majority are printed in PDF format. They can be opened with free programs like Adobe Reader.

How Salaried Employees Can File Income Tax In Pakistan

File Your Income Tax Return For Salaried Person Pakistan By Umairkhatib

Check more sample of Income Tax Return For Salaried Person In Pakistan below

Income Tax Slab 2020 21 Pakistan Tax Rates For Salaried Non

How To File Income Tax Return Online For Salaried Employees 2022 2023

How To File Income Tax Return For Salaried Person In Pakistan 2019

Income Tax Return For Salaried Person Consult AS

Income Tax Slab 2023 24 Pakistan FOR Salaried Person Educativz

A Complete Guide On How To File Income Tax Return Online For Salaried

https://www.fbr.gov.pk/categ/file-income-tax-return...

Salaried Person Income Tax Return To facilitate salaried person in filing their Income Tax Return Declaration form 114 I has been provided Salaried person would need to complete the Declaration form 114 I in order to successfully submit their

https://www.youtube.com/watch?v=Ea7zqgdetP8

In this video fbr iris fbr federal board of revenue fbr online fbr tax income tax return filing 2022 23 income tax return filing 2022 23 tax return 2

Salaried Person Income Tax Return To facilitate salaried person in filing their Income Tax Return Declaration form 114 I has been provided Salaried person would need to complete the Declaration form 114 I in order to successfully submit their

In this video fbr iris fbr federal board of revenue fbr online fbr tax income tax return filing 2022 23 income tax return filing 2022 23 tax return 2

Income Tax Return For Salaried Person Consult AS

How To File Income Tax Return Online For Salaried Employees 2022 2023

Income Tax Slab 2023 24 Pakistan FOR Salaried Person Educativz

A Complete Guide On How To File Income Tax Return Online For Salaried

ITR For Salaried Person Claim Maximum Deductions Save Taxes With

A Guide To Reducing Your Personal Income Tax For Salaried Person In

A Guide To Reducing Your Personal Income Tax For Salaried Person In

Income Tax Slab Rates For Salaried Class In Pakistan 2023 24