In a world with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed objects isn't diminished. In the case of educational materials such as creative projects or just adding an element of personalization to your space, Income Tax Rules For 2nd Home Loan are a great resource. For this piece, we'll dive in the world of "Income Tax Rules For 2nd Home Loan," exploring the benefits of them, where they are, and what they can do to improve different aspects of your life.

Get Latest Income Tax Rules For 2nd Home Loan Below

Income Tax Rules For 2nd Home Loan

Income Tax Rules For 2nd Home Loan -

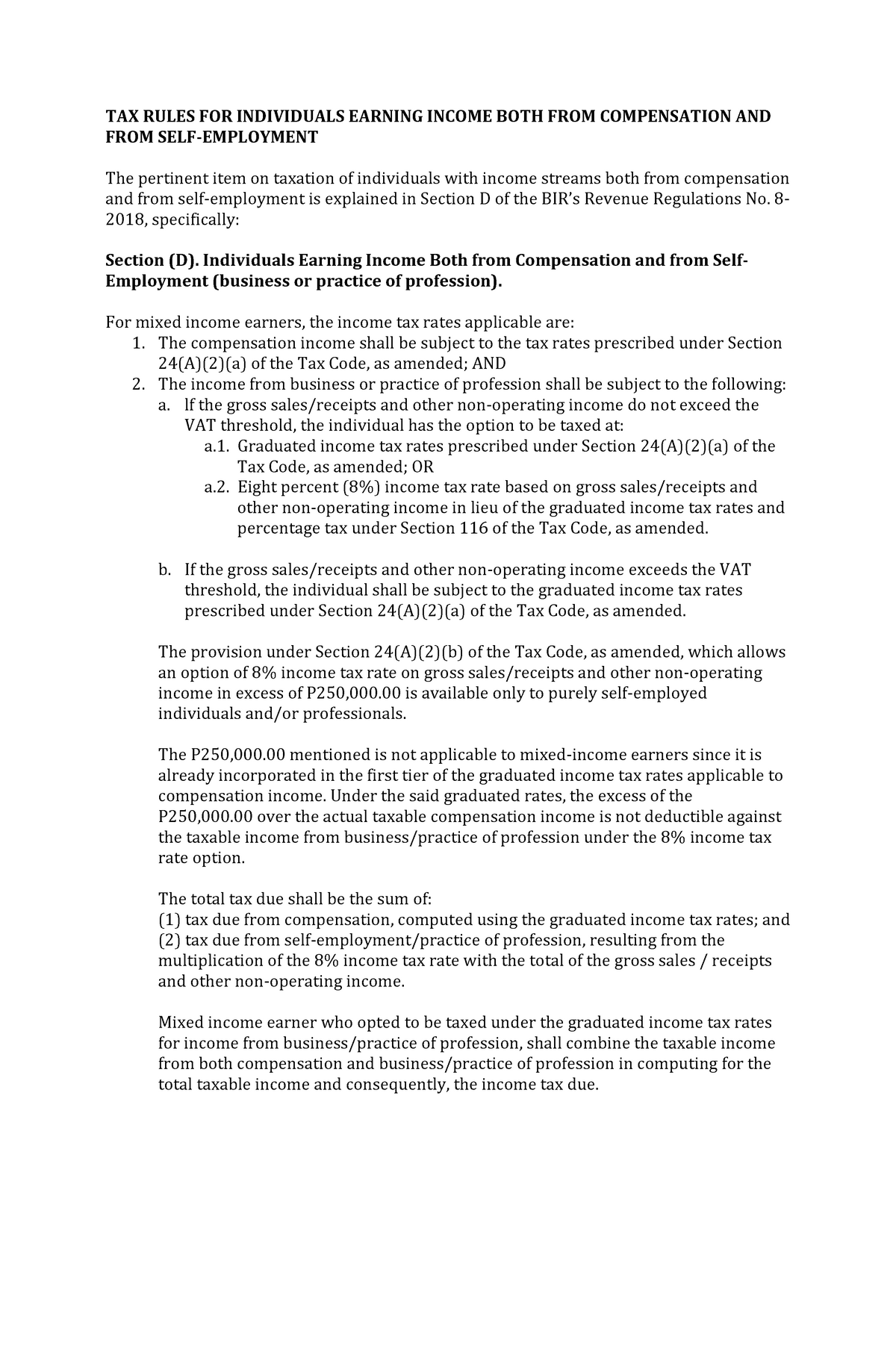

Second home You can t fully deduct in the year paid points you pay on loans secured by your second home You can deduct these points only over the life of the loan

Explains tax benefits on second home loans under Section 80C and 24 of the Income Tax Act Rules differ based on whether properties are rented or self occupied Details calculation procedures and steps to claim tax benefits

Printables for free cover a broad range of downloadable, printable materials available online at no cost. These materials come in a variety of types, such as worksheets templates, coloring pages, and many more. The beauty of Income Tax Rules For 2nd Home Loan lies in their versatility and accessibility.

More of Income Tax Rules For 2nd Home Loan

Tax Implications On A Second Home Loan A Must Read 50 Plus Finance

Tax Implications On A Second Home Loan A Must Read 50 Plus Finance

If the second home is considered a personal residence you must file Form 1040 or 1040 SR and itemize deductions on Schedule A to claim the mortgage interest deduction Additionally the

In general the answer is yes you can However be advised that there are certain terms and conditions that you ll want to know to determine if you re eligible to enjoy such tax deductions as outlined below Is Second Mortgage Interest Deductible

Print-friendly freebies have gained tremendous popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

Flexible: We can customize printables to fit your particular needs such as designing invitations to organize your schedule or decorating your home.

-

Educational Benefits: The free educational worksheets can be used by students of all ages, making them a valuable tool for parents and teachers.

-

Easy to use: Access to numerous designs and templates, which saves time as well as effort.

Where to Find more Income Tax Rules For 2nd Home Loan

Comments Invited On Changes To Income tax Rules Sentinelassam

Comments Invited On Changes To Income tax Rules Sentinelassam

INCOME TAX HOUSE PROPERTY TAX BENEFITS ON HOME LOAN FOR JOINT OWNERS SHARE Tax Benefits on Home Loan for Joint Owners Updated on Mar 29th 2024 10 min read Tax benefits on a joint home loan can be availed by all the joint owners provided certain conditions are met Let s take a look

Homeowners can deduct up to 10 000 total of property taxes per year on federal income taxes including taxes on a second home If you don t rent out your second home it s taxed much

In the event that we've stirred your interest in printables for free, let's explore where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection with Income Tax Rules For 2nd Home Loan for all goals.

- Explore categories such as home decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets for flashcards, lessons, and worksheets. tools.

- Great for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers share their creative designs or templates for download.

- These blogs cover a wide selection of subjects, everything from DIY projects to planning a party.

Maximizing Income Tax Rules For 2nd Home Loan

Here are some unique ways in order to maximize the use of Income Tax Rules For 2nd Home Loan:

1. Home Decor

- Print and frame stunning art, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Print worksheets that are free for reinforcement of learning at home or in the classroom.

3. Event Planning

- Design invitations, banners and decorations for special events like weddings and birthdays.

4. Organization

- Stay organized with printable planners along with lists of tasks, and meal planners.

Conclusion

Income Tax Rules For 2nd Home Loan are an abundance with useful and creative ideas which cater to a wide range of needs and hobbies. Their access and versatility makes these printables a useful addition to each day life. Explore the wide world of Income Tax Rules For 2nd Home Loan today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really available for download?

- Yes they are! You can download and print these documents for free.

-

Can I make use of free printables in commercial projects?

- It's all dependent on the usage guidelines. Always verify the guidelines of the creator before using printables for commercial projects.

-

Are there any copyright issues when you download Income Tax Rules For 2nd Home Loan?

- Some printables may contain restrictions on usage. Make sure to read the terms of service and conditions provided by the author.

-

How do I print printables for free?

- You can print them at home using printing equipment or visit any local print store for more high-quality prints.

-

What software do I need to open printables for free?

- The majority of PDF documents are provided as PDF files, which can be opened using free programs like Adobe Reader.

5 Tax Rules For Individuals Earning Income Both From Compensation And

2nd Home Loan Rochester Hills MI 2nd Home Loan Experts Michigan

Check more sample of Income Tax Rules For 2nd Home Loan below

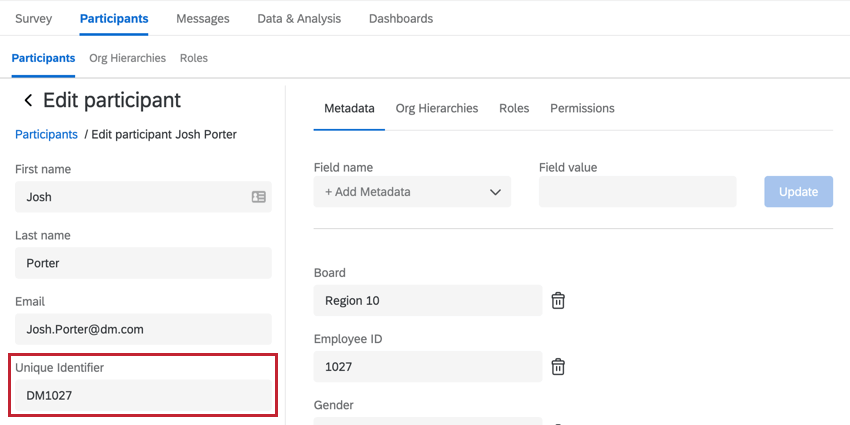

Form Timer Unique Identifier Uniqe Ideas

Income Tax Rules For Indian Seafarers 2018 For F G And Coastal Ships

Second Home Loan Advantages BankBazaar The Definitive Word On

Tax Benefits On Second Home Loans In India Axis Bank

Tax Benefits Of The Second Home Loan LoanDPR

Income Tax Rules For Indian Seafarers Merchant Navy SBNRI

https://cleartax.in/s/how-to-claim-income-tax...

Explains tax benefits on second home loans under Section 80C and 24 of the Income Tax Act Rules differ based on whether properties are rented or self occupied Details calculation procedures and steps to claim tax benefits

https://turbotax.intuit.com/tax-tips/home...

14 or fewer days during the year you can pocket the rental income tax free Even if you re charging 5 000 a day the IRS doesn t want to hear about it The house is considered a personal residence so you deduct mortgage interest and property taxes under the standard rules for a second home

Explains tax benefits on second home loans under Section 80C and 24 of the Income Tax Act Rules differ based on whether properties are rented or self occupied Details calculation procedures and steps to claim tax benefits

14 or fewer days during the year you can pocket the rental income tax free Even if you re charging 5 000 a day the IRS doesn t want to hear about it The house is considered a personal residence so you deduct mortgage interest and property taxes under the standard rules for a second home

Tax Benefits On Second Home Loans In India Axis Bank

Income Tax Rules For Indian Seafarers 2018 For F G And Coastal Ships

Tax Benefits Of The Second Home Loan LoanDPR

Income Tax Rules For Indian Seafarers Merchant Navy SBNRI

Tax Benefit On Second Home Loan Money Doctor Show English EP 160

2022 Tax Updates How They ll Impact You Everyday Money

2022 Tax Updates How They ll Impact You Everyday Money

Tax Benefits On Second Home Loan Tax Exemption On 2nd Home Loan PNB