In this age of electronic devices, in which screens are the norm, the charm of tangible printed objects isn't diminished. If it's to aid in education for creative projects, simply adding an individual touch to your home, printables for free have become a valuable resource. In this article, we'll take a dive to the depths of "Income Tax Rules For Huf," exploring the benefits of them, where they are available, and ways they can help you improve many aspects of your daily life.

Get Latest Income Tax Rules For Huf Below

Income Tax Rules For Huf

Income Tax Rules For Huf -

Surcharge is levied on the amount of income tax at prescribed rates if total income of an assessee exceeds specified limits The enhanced surcharge of 25 37 as

A HUF is taxed separately from its members Therefore it can claim deductions or exemptions allowed under the tax laws separately For example if you and your spouse along with your 2 children decide to create

Income Tax Rules For Huf include a broad collection of printable content that can be downloaded from the internet at no cost. These printables come in different forms, including worksheets, templates, coloring pages and many more. The benefit of Income Tax Rules For Huf lies in their versatility and accessibility.

More of Income Tax Rules For Huf

Pin By TaxGuru On Income Tax EFiling India Huf Family Rules Income Tax

Pin By TaxGuru On Income Tax EFiling India Huf Family Rules Income Tax

The HUF can also claim deductions under Section 80C of the Income Tax Act just like an individual This means that the HUF can invest in things like life insurance premiums

A HUF is a separate entity for taxation under the provisions of S 2 31 of the Income Tax Act 1961 This is in addition to an individual as a separate taxable entity This

Income Tax Rules For Huf have gained a lot of popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Modifications: You can tailor printables to your specific needs, whether it's designing invitations planning your schedule or even decorating your home.

-

Educational Benefits: The free educational worksheets can be used by students from all ages, making the perfect tool for teachers and parents.

-

Convenience: You have instant access the vast array of design and templates is time-saving and saves effort.

Where to Find more Income Tax Rules For Huf

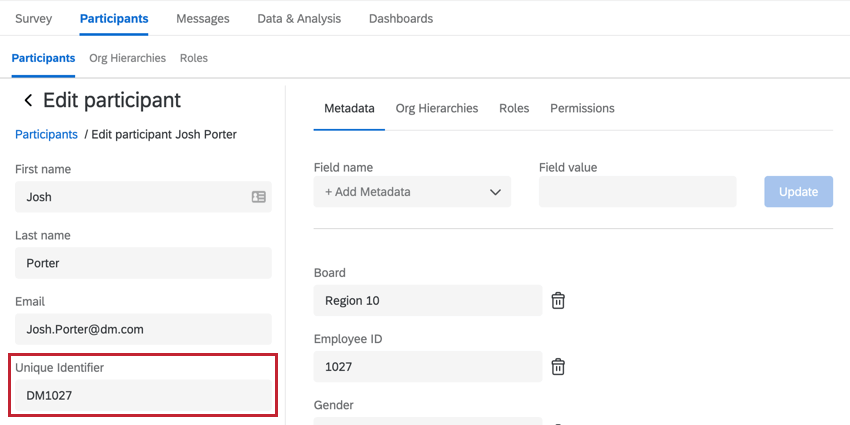

Form Timer Unique Identifier Uniqe Ideas

Form Timer Unique Identifier Uniqe Ideas

The concept of Joint Family under Hindu law as well as the HUF in Income Tax Act 1961 is broadly the same HUF is purely a creature of law and cannot be created by an

A HUF can own a residential house without paying any tax Therefore by registering for HUF you can own more than one residential property without paying taxes

After we've peaked your interest in Income Tax Rules For Huf We'll take a look around to see where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Income Tax Rules For Huf designed for a variety objectives.

- Explore categories such as design, home decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets as well as flashcards and other learning materials.

- Ideal for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates free of charge.

- The blogs covered cover a wide array of topics, ranging starting from DIY projects to party planning.

Maximizing Income Tax Rules For Huf

Here are some fresh ways of making the most use of Income Tax Rules For Huf:

1. Home Decor

- Print and frame gorgeous artwork, quotes as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use these printable worksheets free of charge to help reinforce your learning at home and in class.

3. Event Planning

- Designs invitations, banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars, to-do lists, and meal planners.

Conclusion

Income Tax Rules For Huf are an abundance of innovative and useful resources catering to different needs and passions. Their accessibility and versatility make them a valuable addition to the professional and personal lives of both. Explore the wide world of Income Tax Rules For Huf to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really for free?

- Yes they are! You can download and print these materials for free.

-

Does it allow me to use free printables for commercial use?

- It's based on the terms of use. Always review the terms of use for the creator before utilizing their templates for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Certain printables might have limitations concerning their use. Be sure to check the terms and conditions provided by the author.

-

How do I print printables for free?

- You can print them at home using a printer or visit the local print shops for better quality prints.

-

What program do I require to view printables free of charge?

- The majority of printables are in the format PDF. This can be opened using free software such as Adobe Reader.

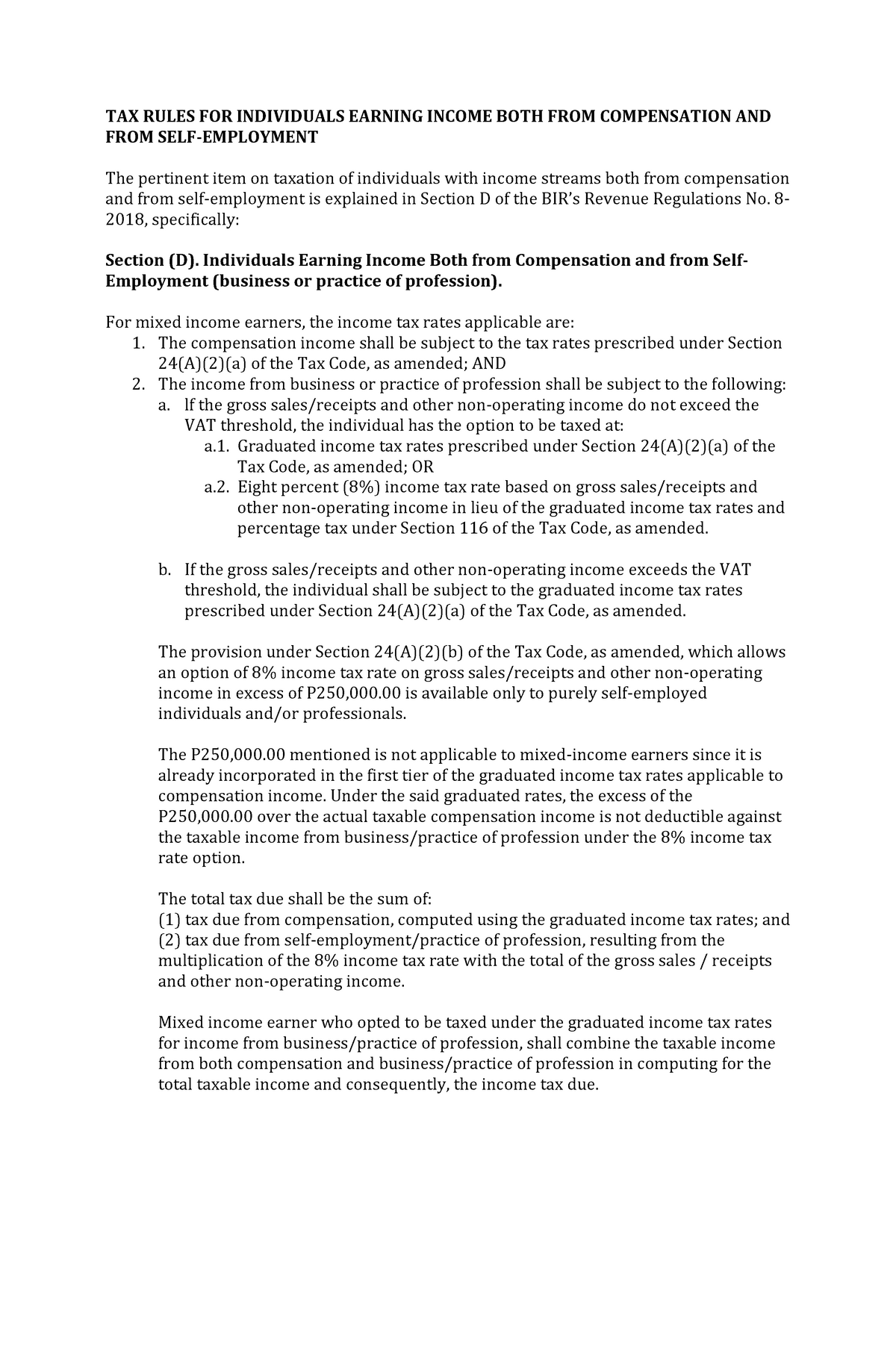

5 Tax Rules For Individuals Earning Income Both From Compensation And

FY 19 20 FY 20 21 Income Tax Rate Slabs For Individual HUF Senior

Check more sample of Income Tax Rules For Huf below

Income Tax Rules For Indian Seafarers Merchant Navy SBNRI

2022 Tax Updates How They ll Impact You Everyday Money

Income Tax 2022 23 Slab Bed Frames Ideas

Tax Rules For Bitcoin Are Based On How It s Being Used As An

Hindu Undivided Family Tax Benefits Documents Required To Start A HUF

Income Tax Rules For Equity Share Trading Archives Ebizfiling

https://cleartax.in › huf-hindu-undivided …

A HUF is taxed separately from its members Therefore it can claim deductions or exemptions allowed under the tax laws separately For example if you and your spouse along with your 2 children decide to create

https://taxguru.in › income-tax › huf-tax…

The income taxable in the hands of an HUF is computed under four heads of income and tax thereon shall be computed as per the tax rates applicable for that previous year The normal income of HUF is taxable as per

A HUF is taxed separately from its members Therefore it can claim deductions or exemptions allowed under the tax laws separately For example if you and your spouse along with your 2 children decide to create

The income taxable in the hands of an HUF is computed under four heads of income and tax thereon shall be computed as per the tax rates applicable for that previous year The normal income of HUF is taxable as per

Tax Rules For Bitcoin Are Based On How It s Being Used As An

2022 Tax Updates How They ll Impact You Everyday Money

Hindu Undivided Family Tax Benefits Documents Required To Start A HUF

Income Tax Rules For Equity Share Trading Archives Ebizfiling

HUF Income Tax Top 5 Tax Benefits For HUF Vakilsearch

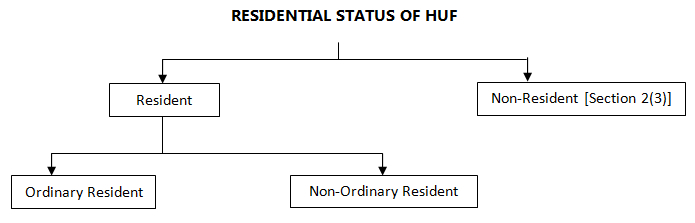

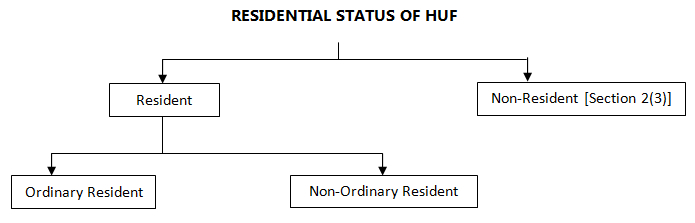

Residential Status Of HUF Hindu Undivided Family Section 6 2

Residential Status Of HUF Hindu Undivided Family Section 6 2

How To Save Tax In Stock Market Income Tax Rules For Stock Market