In this age of electronic devices, where screens dominate our lives and the appeal of physical printed objects isn't diminished. For educational purposes or creative projects, or simply to add an individual touch to your space, Income Tax Rules For Salaried Employees 2022 23 have become an invaluable source. For this piece, we'll dive into the world of "Income Tax Rules For Salaried Employees 2022 23," exploring the different types of printables, where to locate them, and the ways that they can benefit different aspects of your life.

Get Latest Income Tax Rules For Salaried Employees 2022 23 Below

Income Tax Rules For Salaried Employees 2022 23

Income Tax Rules For Salaried Employees 2022 23 -

The Income Tax Act allows deductions like standard deduction for salaried individuals From FY 2024 25 the standard deduction is Rs 75 000 in the new tax regime No supporting documents are needed Old regime s

In this article we will learn about Income Tax Slabs under the old regime Income Tax Slabs under the new regime Comparison of Tax slabs under both the regimes How to calculate income tax under both tax regimes

Income Tax Rules For Salaried Employees 2022 23 cover a large assortment of printable resources available online for download at no cost. They come in many styles, from worksheets to templates, coloring pages and much more. The attraction of printables that are free lies in their versatility and accessibility.

More of Income Tax Rules For Salaried Employees 2022 23

August 2022 Updates To Pennsylvania s Overtime Rules For Salaried

August 2022 Updates To Pennsylvania s Overtime Rules For Salaried

Navigate the New Income Tax Regime for Salaried Employees with insights on regime selection salient features available deductions tax calculator rebate and break even analysis Stay informed for effective tax

If you are a salaried employee in India filing income tax returns is mandatory even if you do not have any tax liability Filing IT returns comes as a proof of income that can provide you

Income Tax Rules For Salaried Employees 2022 23 have gained a lot of popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Individualization There is the possibility of tailoring designs to suit your personal needs in designing invitations planning your schedule or decorating your home.

-

Educational Worth: Educational printables that can be downloaded for free can be used by students of all ages, which makes the perfect device for teachers and parents.

-

The convenience of instant access a myriad of designs as well as templates saves time and effort.

Where to Find more Income Tax Rules For Salaried Employees 2022 23

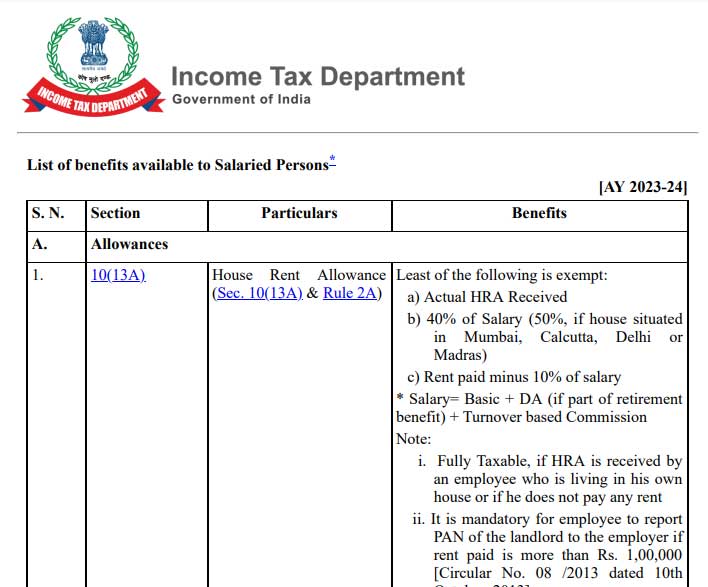

List Of Benefits Available To Salaried Persons For AY 2023 24

List Of Benefits Available To Salaried Persons For AY 2023 24

Current rates and allowances How much Income Tax you pay in each tax year depends on how much of your income is above your Personal Allowance how much of your income falls

Tax Slabs for AY 2024 25 The Finance Act 2023 has amended the provisions of Section 115BAC w e f AY 2024 25 to make new tax regime the default tax regime for the assessee being an

Since we've got your interest in printables for free Let's look into where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Income Tax Rules For Salaried Employees 2022 23 designed for a variety purposes.

- Explore categories like interior decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing, flashcards, and learning materials.

- Ideal for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for free.

- These blogs cover a wide array of topics, ranging from DIY projects to planning a party.

Maximizing Income Tax Rules For Salaried Employees 2022 23

Here are some ideas for you to get the best of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use free printable worksheets to enhance learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Income Tax Rules For Salaried Employees 2022 23 are an abundance filled with creative and practical information that cater to various needs and pursuits. Their availability and versatility make them a fantastic addition to both professional and personal life. Explore the vast array of Income Tax Rules For Salaried Employees 2022 23 today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly cost-free?

- Yes, they are! You can download and print the resources for free.

-

Can I use the free printouts for commercial usage?

- It's determined by the specific conditions of use. Be sure to read the rules of the creator before using their printables for commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Some printables may contain restrictions regarding their use. Make sure to read the terms and conditions offered by the designer.

-

How do I print Income Tax Rules For Salaried Employees 2022 23?

- You can print them at home using a printer or visit an area print shop for the highest quality prints.

-

What program do I require to open printables free of charge?

- Most PDF-based printables are available in the PDF format, and can be opened with free software like Adobe Reader.

How To File Income Tax Return Online For Salaried Employees 2022 2023

Income Tax Allowances For Salaried Employees For F Y 2021 22 A Y 2022 23

Check more sample of Income Tax Rules For Salaried Employees 2022 23 below

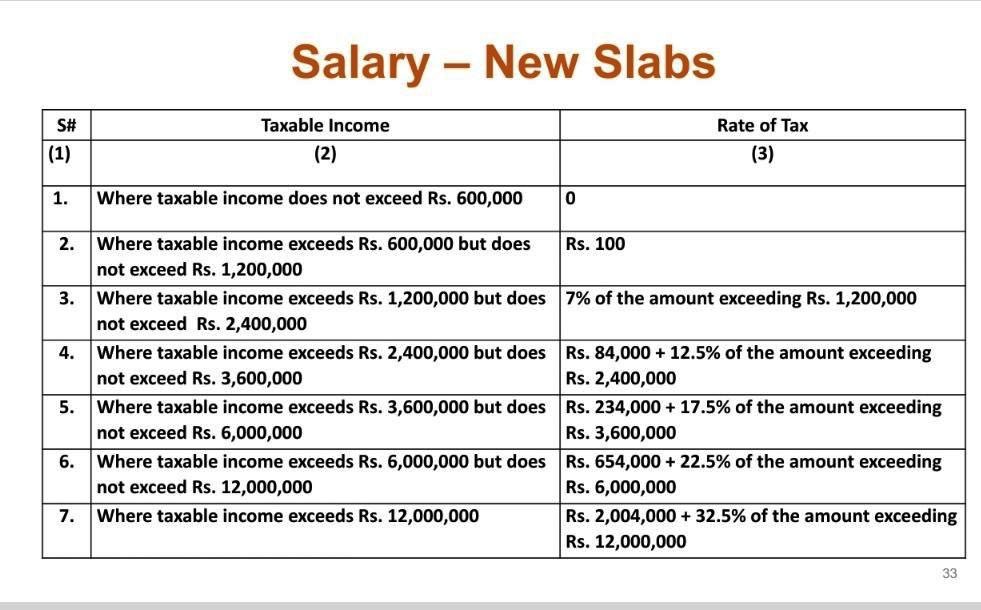

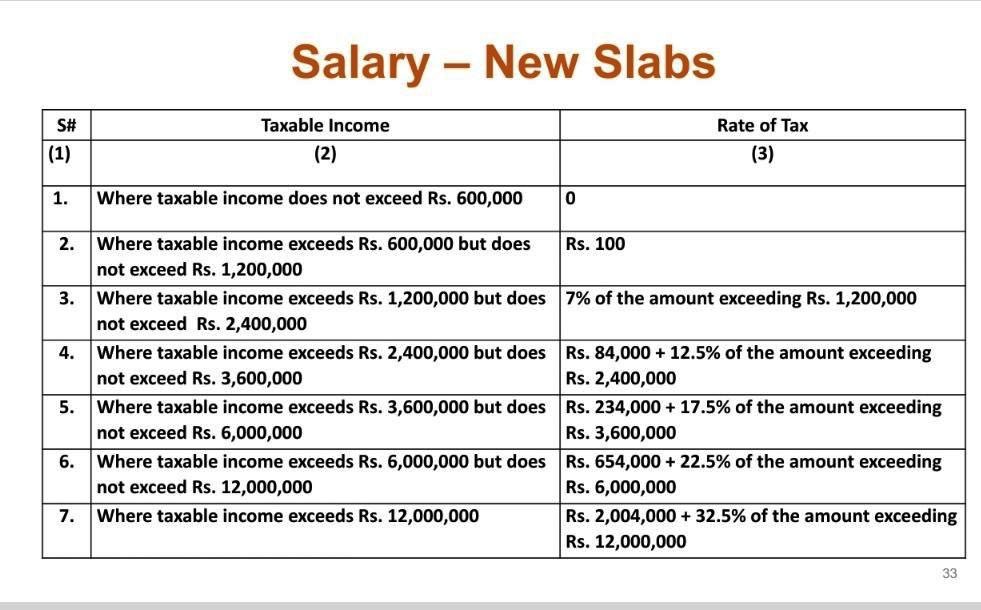

Govt Announced Seven Slabs For Salaried Class In Budget 2022 23

Income Tax Return Filing For Salaried Employees AY 2022 23 Section 80C

NEW OVERTIME RULES FOR SALARIED EMPLOYEES Knowledgeheights

Income Tax Slabs Year 2022 23 Info Ghar Educational News

Income Tax Slab 2020 21 Pakistan Tax Rates For Salaried Non

FY 2022 23 Income Tax Calculation On Salaried Employee CTC

https://cleartax.in/s/income-tax-slabs

In this article we will learn about Income Tax Slabs under the old regime Income Tax Slabs under the new regime Comparison of Tax slabs under both the regimes How to calculate income tax under both tax regimes

https://cleartax.in/s/income-tax-allowan…

Salaried employees have significant income tax deduction opportunities Major deductions include HRA standard deduction LTA books and periodicals and gratuity Other savings avenues include section 80C for

In this article we will learn about Income Tax Slabs under the old regime Income Tax Slabs under the new regime Comparison of Tax slabs under both the regimes How to calculate income tax under both tax regimes

Salaried employees have significant income tax deduction opportunities Major deductions include HRA standard deduction LTA books and periodicals and gratuity Other savings avenues include section 80C for

Income Tax Slabs Year 2022 23 Info Ghar Educational News

Income Tax Return Filing For Salaried Employees AY 2022 23 Section 80C

Income Tax Slab 2020 21 Pakistan Tax Rates For Salaried Non

FY 2022 23 Income Tax Calculation On Salaried Employee CTC

New Overtime Rules Could Result In Loss Of Exempt Status For Salaried

Tax Planning For Salaried Employees

Tax Planning For Salaried Employees

2022 Tax Updates How They ll Impact You Everyday Money