In this digital age, where screens dominate our lives, the charm of tangible, printed materials hasn't diminished. Whether it's for educational purposes and creative work, or just adding a personal touch to your area, Inflation Reduction Act Ev Tax Credit Tesla can be an excellent resource. We'll dive through the vast world of "Inflation Reduction Act Ev Tax Credit Tesla," exploring what they are, where to locate them, and what they can do to improve different aspects of your life.

Get Latest Inflation Reduction Act Ev Tax Credit Tesla Below

Inflation Reduction Act Ev Tax Credit Tesla

Inflation Reduction Act Ev Tax Credit Tesla -

The Inflation Reduction Act focused on expanding availability of tax credits including allowing plug in hybrid models to access the full credit bringing more EV and battery production to the

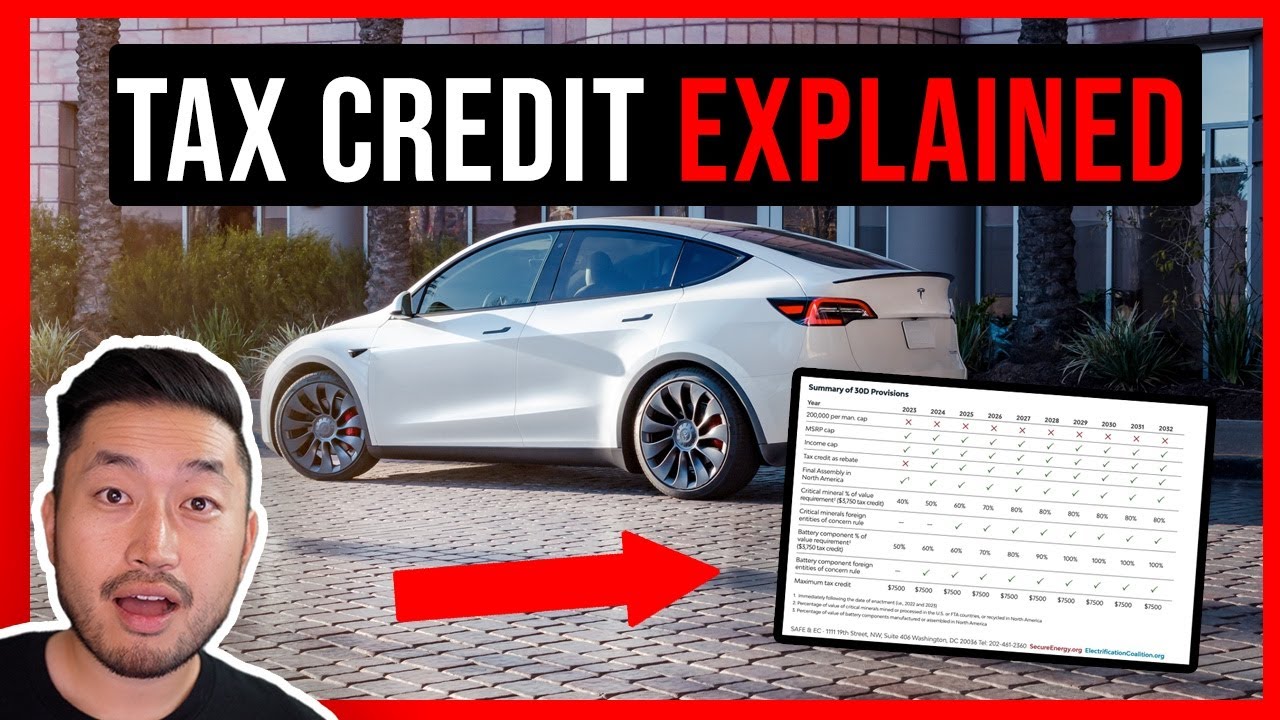

Simply put the Inflation Reduction Act includes a 7 500 tax credit at the point of sale for new EVs and 4 000 for used EVs The new tax credits replace the old incentive

Inflation Reduction Act Ev Tax Credit Tesla offer a wide array of printable content that can be downloaded from the internet at no cost. The resources are offered in a variety formats, such as worksheets, coloring pages, templates and much more. The value of Inflation Reduction Act Ev Tax Credit Tesla is their versatility and accessibility.

More of Inflation Reduction Act Ev Tax Credit Tesla

Inflation Reduction Act How It ll Impact You If You Owe The IRS

Inflation Reduction Act How It ll Impact You If You Owe The IRS

The Inflation Reduction Act allows a maximum credit of 7 500 per new clean vehicle consisting of 3 750 in the case of a new vehicle that meets certain requirements relating to applicable critical minerals and 3 750 in the case of a new vehicle that meets certain requirements relating to battery components

Tesla tax credits and the future of American EV manufacturing Vox Technology Climate Politics The long road ahead for American made electric vehicles The Inflation Reduction

Printables for free have gained immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

Customization: It is possible to tailor the templates to meet your individual needs be it designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Value: Printables for education that are free provide for students of all ages, making them a great tool for parents and educators.

-

The convenience of You have instant access an array of designs and templates cuts down on time and efforts.

Where to Find more Inflation Reduction Act Ev Tax Credit Tesla

Petition Fix The Inflation Reduction Act EV Tax Credit Change

Petition Fix The Inflation Reduction Act EV Tax Credit Change

Changes to the tax credit language took effect Tuesday afternoon when President Joe Biden signed into law the Inflation Reduction Act which includes a number of federal provisions aimed

No If you entered into a written binding contract to purchase a qualifying electric vehicle before the date of enactment of the Inflation Reduction Act August 16 2022 the changes in the Inflation Reduction Act will not impact your tax credit You may claim the credit based on the rules that were in effect before August 16 2022

We hope we've stimulated your interest in printables for free, let's explore where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety and Inflation Reduction Act Ev Tax Credit Tesla for a variety uses.

- Explore categories such as decorating your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing or flashcards as well as learning tools.

- Perfect for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- The blogs are a vast spectrum of interests, ranging from DIY projects to planning a party.

Maximizing Inflation Reduction Act Ev Tax Credit Tesla

Here are some unique ways that you can make use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or decorations for the holidays to beautify your living areas.

2. Education

- Use free printable worksheets to help reinforce your learning at home as well as in the class.

3. Event Planning

- Design invitations, banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Inflation Reduction Act Ev Tax Credit Tesla are an abundance of innovative and useful resources which cater to a wide range of needs and hobbies. Their access and versatility makes them an invaluable addition to both professional and personal life. Explore the world of Inflation Reduction Act Ev Tax Credit Tesla and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Inflation Reduction Act Ev Tax Credit Tesla really absolutely free?

- Yes you can! You can download and print these files for free.

-

Can I utilize free printing templates for commercial purposes?

- It depends on the specific rules of usage. Always read the guidelines of the creator before using any printables on commercial projects.

-

Are there any copyright violations with Inflation Reduction Act Ev Tax Credit Tesla?

- Some printables could have limitations in use. You should read the terms and conditions offered by the creator.

-

How can I print printables for free?

- You can print them at home using printing equipment or visit the local print shops for the highest quality prints.

-

What program do I need to run Inflation Reduction Act Ev Tax Credit Tesla?

- The majority are printed in the format PDF. This is open with no cost programs like Adobe Reader.

Inflation Reduction Act Commercial EV Charging Station Tax Credits

New EV Tax Credits For Tesla In The Inflation Reduction Act

Check more sample of Inflation Reduction Act Ev Tax Credit Tesla below

TESLA EV TAX CREDIT EXPLAINED YouTube

Inflation Reduction Act Cuts EV Tax Credits Boosts Mining

BREAKING DOWN The EV Tax Credit 2022 Inflation Reduction Act 2022

What Does The EV Tax Credit Changes In The Inflation Reduction Act Mean

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

Inflation Reduction Act Of 2022 The Hollander Group

https://www.theverge.com/23310457/inflation

Simply put the Inflation Reduction Act includes a 7 500 tax credit at the point of sale for new EVs and 4 000 for used EVs The new tax credits replace the old incentive

https://www.tesla.com/support/incentives

On January 1 2023 the Inflation Reduction Act of 2022 qualified certain electric vehicles EVs for a tax credit of up to 7 500 for eligible buyers Qualifications include Customers must buy it for their own use not for resale Use the vehicle primarily in the U S Adjusted Gross Income AGI limitations MSRP price caps

Simply put the Inflation Reduction Act includes a 7 500 tax credit at the point of sale for new EVs and 4 000 for used EVs The new tax credits replace the old incentive

On January 1 2023 the Inflation Reduction Act of 2022 qualified certain electric vehicles EVs for a tax credit of up to 7 500 for eligible buyers Qualifications include Customers must buy it for their own use not for resale Use the vehicle primarily in the U S Adjusted Gross Income AGI limitations MSRP price caps

What Does The EV Tax Credit Changes In The Inflation Reduction Act Mean

Inflation Reduction Act Cuts EV Tax Credits Boosts Mining

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

Inflation Reduction Act Of 2022 The Hollander Group

Every EV That Qualifies For The Inflation Reduction Act Tax Credit In

The Inflation Reduction Act And Residential Energy Certasun

The Inflation Reduction Act And Residential Energy Certasun

The Inflation Reduction Act Carves Out An EV Tax Credit For 2023 Does