Today, where screens rule our lives and the appeal of physical printed material hasn't diminished. No matter whether it's for educational uses project ideas, artistic or simply adding an individual touch to your home, printables for free have become a valuable source. This article will dive through the vast world of "Input Tax Credit Entitlement," exploring their purpose, where they can be found, and how they can add value to various aspects of your daily life.

Get Latest Input Tax Credit Entitlement Below

Input Tax Credit Entitlement

Input Tax Credit Entitlement -

The article explains how the input tax credit mechanism works under GST recent updates claiming procedures and type of taxes under GST It emphasizes the importance of supplier compliance and rules surrounding claiming input tax credit

You can claim a credit for any GST included in the price you pay for things you use in your business This is called an input tax credit or a GST credit To claim GST credits in your BAS you must be registered for GST You can claim GST credits if

Input Tax Credit Entitlement cover a large selection of printable and downloadable material that is available online at no cost. The resources are offered in a variety styles, from worksheets to templates, coloring pages, and much more. The attraction of printables that are free is in their versatility and accessibility.

More of Input Tax Credit Entitlement

Accounts Finalisation Steps How To Calculate MAT In Income Tax During

Accounts Finalisation Steps How To Calculate MAT In Income Tax During

Through your Business Activity Statement BAS lodgements you will report and pay your GST in pay as you go PAYG instalments However in addition to making GST payments you may also be entitled to claim credits for any GST included in the price you paid This is known as an input tax credit ITC or GST credit

Eligibility for Input Tax Credit Must be a registered taxpayer within the system e g GST VAT Taxes should have been paid on inputs used exclusively for business purposes Inputs should not fall under the list of goods or services that are

Input Tax Credit Entitlement have gained a lot of popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

Flexible: The Customization feature lets you tailor print-ready templates to your specific requirements in designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Value: Downloads of educational content for free can be used by students of all ages, making these printables a powerful resource for educators and parents.

-

An easy way to access HTML0: instant access a myriad of designs as well as templates helps save time and effort.

Where to Find more Input Tax Credit Entitlement

Regarding GSTR 2B Auto drafted Input Tax Credit Statement

Regarding GSTR 2B Auto drafted Input Tax Credit Statement

Understanding what an input tax credit is and why it matters is crucial for small businesses Once your business s turnover reaches A 75 000 or more you must register for goods and services tax GST

How to apportion input tax and claim tax credits on your expenses when filing your GST return

If we've already piqued your curiosity about Input Tax Credit Entitlement and other printables, let's discover where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Input Tax Credit Entitlement suitable for many objectives.

- Explore categories like design, home decor, organization, and crafts.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets with flashcards and other teaching tools.

- This is a great resource for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- The blogs covered cover a wide range of interests, that includes DIY projects to planning a party.

Maximizing Input Tax Credit Entitlement

Here are some ways ensure you get the very most use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations that will adorn your living spaces.

2. Education

- Print worksheets that are free to enhance learning at home (or in the learning environment).

3. Event Planning

- Designs invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Be organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Input Tax Credit Entitlement are a treasure trove with useful and creative ideas which cater to a wide range of needs and desires. Their access and versatility makes them a great addition to each day life. Explore the wide world of Input Tax Credit Entitlement right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly cost-free?

- Yes they are! You can download and print these documents for free.

-

Can I download free printables to make commercial products?

- It's based on the rules of usage. Always read the guidelines of the creator prior to printing printables for commercial projects.

-

Are there any copyright rights issues with Input Tax Credit Entitlement?

- Some printables may come with restrictions on their use. Check the terms and regulations provided by the creator.

-

How can I print printables for free?

- You can print them at home using printing equipment or visit the local print shops for more high-quality prints.

-

What software is required to open Input Tax Credit Entitlement?

- The majority are printed in the PDF format, and can be opened with free programs like Adobe Reader.

GST Input Tax Credit Definitions And Conditions For Claiming GST ITC

GST Input Tax Credit Eligibility Ineligible ITC TAX ROBO

Check more sample of Input Tax Credit Entitlement below

Entitlement To Credit Monitoring

Computation Of Book Profit MAT Credit U S 115JB TAXAJ Corporate

GST Entitlement Of Input Tax Credit Section 16 Of The CGST Act Part 1

Clarification On The Entitlement Of Input Tax Credit Legal Window

DWP Confirm New 1350 Cost Of Living Payments Here Is When You Can

The Section 44 Tax Credit Entitlement To The Tax Credit

https://www.ato.gov.au/.../when-you-can-claim-a-gst-credit

You can claim a credit for any GST included in the price you pay for things you use in your business This is called an input tax credit or a GST credit To claim GST credits in your BAS you must be registered for GST You can claim GST credits if

https://www.easygreenslips.com.au/what-does-input-tax-credit-itc...

Since 2003 customers that use their vehicle as part of a GST registered business have been able to claim back the GST portion of their CTP premium from the Australia Taxation Office as an input tax credit ITC when lodging their business activity statements

You can claim a credit for any GST included in the price you pay for things you use in your business This is called an input tax credit or a GST credit To claim GST credits in your BAS you must be registered for GST You can claim GST credits if

Since 2003 customers that use their vehicle as part of a GST registered business have been able to claim back the GST portion of their CTP premium from the Australia Taxation Office as an input tax credit ITC when lodging their business activity statements

Clarification On The Entitlement Of Input Tax Credit Legal Window

Computation Of Book Profit MAT Credit U S 115JB TAXAJ Corporate

DWP Confirm New 1350 Cost Of Living Payments Here Is When You Can

The Section 44 Tax Credit Entitlement To The Tax Credit

Cost Of Living Payments 2023 Who Is Eligible And How Much Are They

Cost Of Living Payments Check If You Are Eligible For 324 Help And

Cost Of Living Payments Check If You Are Eligible For 324 Help And

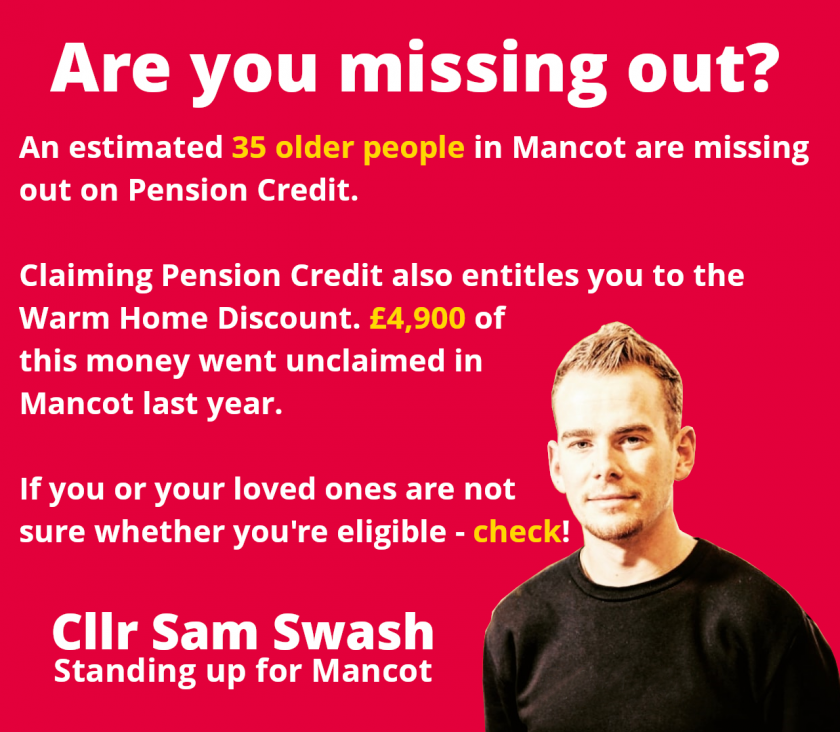

Community Councillor Urges Mancot Residents To Check Pension Credit