In a world with screens dominating our lives it's no wonder that the appeal of tangible, printed materials hasn't diminished. Be it for educational use and creative work, or just adding the personal touch to your area, Input Tax Credit Iras are now an essential resource. The following article is a take a dive deep into the realm of "Input Tax Credit Iras," exploring what they are, where to find them, and how they can be used to enhance different aspects of your daily life.

Get Latest Input Tax Credit Iras Below

Input Tax Credit Iras

Input Tax Credit Iras -

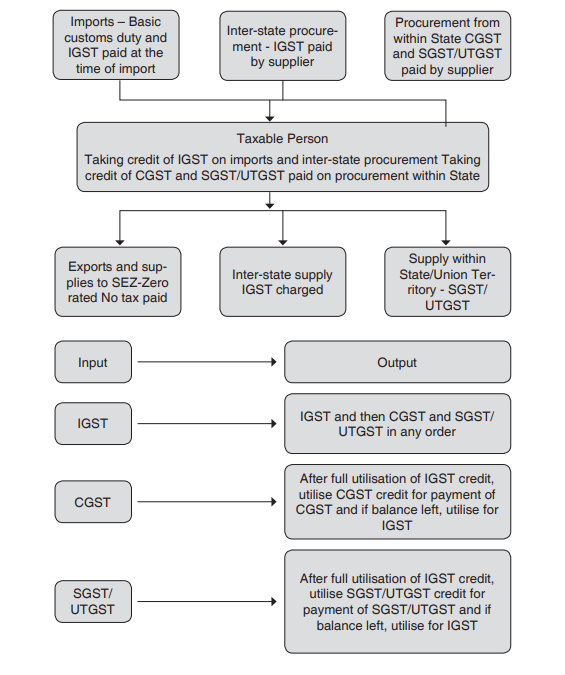

The IRAS has updated the e Tax Guide GST Partial Exemption and Input Tax Recovery on 22 June 2021 to provide clarification on when a supply is considered as occurring infrequently for the purposes of determining whether it can be treated as an incidental exempt supply under the GST Act What is an incidental exempt supply For

Learn about the conditions to claim input tax incurred before you register for GST or incorporate your company Paying Suppliers After Claiming GST Learn what you should do if you do not pay your suppliers after claiming GST

Input Tax Credit Iras encompass a wide selection of printable and downloadable resources available online for download at no cost. They are available in numerous types, like worksheets, templates, coloring pages and more. The great thing about Input Tax Credit Iras lies in their versatility as well as accessibility.

More of Input Tax Credit Iras

Regarding GSTR 2B Auto drafted Input Tax Credit Statement

Regarding GSTR 2B Auto drafted Input Tax Credit Statement

This issue provides a summary of Recent guidance from the IRAS on circumstances where the input tax on expenses incurred in response to the COVID 19 outbreak can be claimed The GST treatment of the COVID 19 support measures for reliefs provided to businesses September 2020 Issue 1 2020 Indirect Tax Alert

IR 2021 53 March 11 2021 WASHINGTON The Internal Revenue Service notes that taxpayers of all ages may be able to claim a deduction on their 2020 tax return for contributions to their Individual Retirement Arrangement IRA made through April 15 2021 There is no longer a maximum age for making IRA contributions

Printables that are free have gained enormous popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Individualization There is the possibility of tailoring printed materials to meet your requirements whether you're designing invitations or arranging your schedule or decorating your home.

-

Educational Impact: Printables for education that are free offer a wide range of educational content for learners of all ages, which makes them a vital tool for parents and educators.

-

Convenience: Access to numerous designs and templates cuts down on time and efforts.

Where to Find more Input Tax Credit Iras

GST Input Tax Credit Eligibility Ineligible ITC TAX ROBO

GST Input Tax Credit Eligibility Ineligible ITC TAX ROBO

2023 12 21 GST HST Find out about input tax credits if you are eligible to claim ITCs how to calculate ITCs how to claim ITCs determine the time limit to claim ITCs and records you need to support your claim

The U S Treasury Department and IRS today released for publication in the Federal Register four guidance documents relating to direct pay and transferable tax credits available under the Inflation Reduction Act of 2022 IRA and the The CHIPS and Science Act of 2022 CHIPS Act

We've now piqued your interest in Input Tax Credit Iras and other printables, let's discover where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection with Input Tax Credit Iras for all motives.

- Explore categories such as decorations for the home, education and management, and craft.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free Flashcards, worksheets, and other educational tools.

- It is ideal for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs with templates and designs for free.

- The blogs are a vast range of topics, from DIY projects to planning a party.

Maximizing Input Tax Credit Iras

Here are some fresh ways for you to get the best of Input Tax Credit Iras:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations that will adorn your living areas.

2. Education

- Use printable worksheets from the internet to build your knowledge at home either in the schoolroom or at home.

3. Event Planning

- Create invitations, banners, and decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars as well as to-do lists and meal planners.

Conclusion

Input Tax Credit Iras are an abundance of practical and imaginative resources catering to different needs and hobbies. Their availability and versatility make them a fantastic addition to each day life. Explore the vast world of Input Tax Credit Iras right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Input Tax Credit Iras truly gratis?

- Yes, they are! You can print and download these tools for free.

-

Can I use free printables for commercial use?

- It's all dependent on the conditions of use. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Some printables could have limitations regarding their use. Make sure you read the terms and conditions provided by the author.

-

How do I print Input Tax Credit Iras?

- Print them at home using either a printer or go to a print shop in your area for premium prints.

-

What program must I use to open Input Tax Credit Iras?

- Most printables come as PDF files, which can be opened using free software like Adobe Reader.

Input Tax Credit Refund For Exports IndiaFilings

IRAS Conditions For Claiming Input Tax 2023

Check more sample of Input Tax Credit Iras below

GET SUPPORT FROM SINGAPORE New

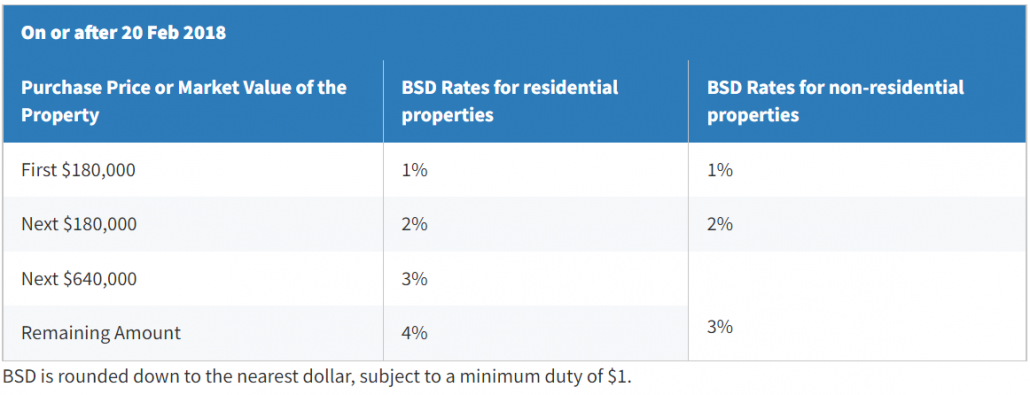

Income Taxes In Singapore You Need To Know About Procosec Asia

Transferring Input Tax Credit To GST IndiaFilings

Scam Email Claims To Be From IRAS Offers Tax Refund And Wants Your

An In Depth Look At Input Tax Credit Under Gst Razorpay Business Www

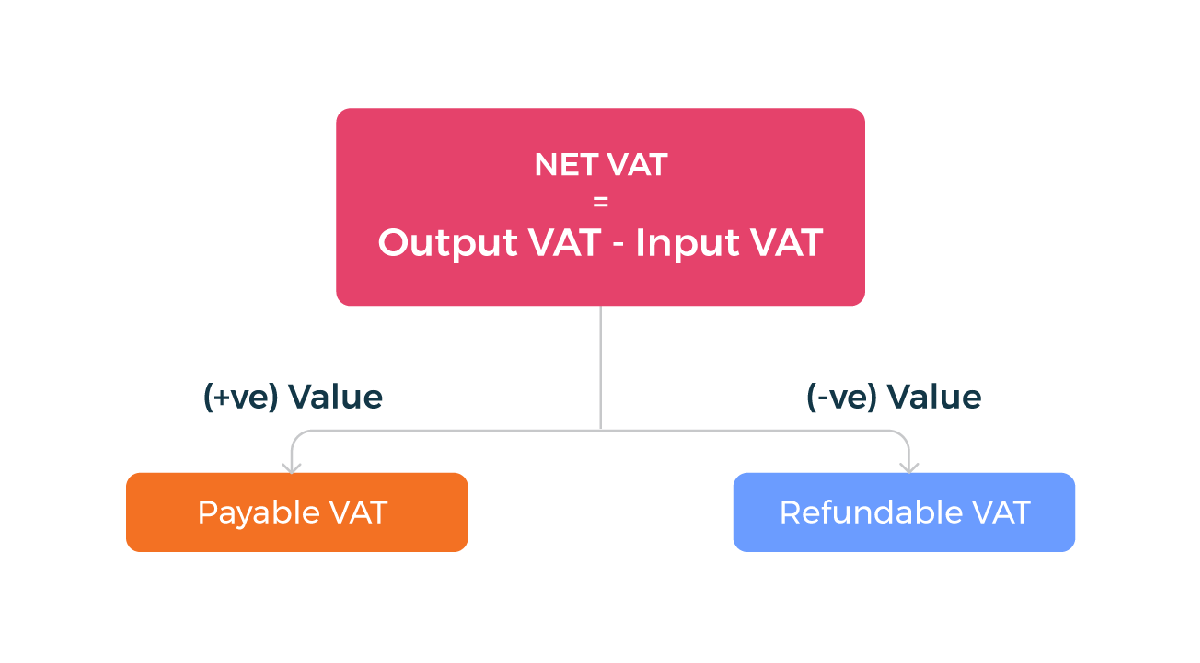

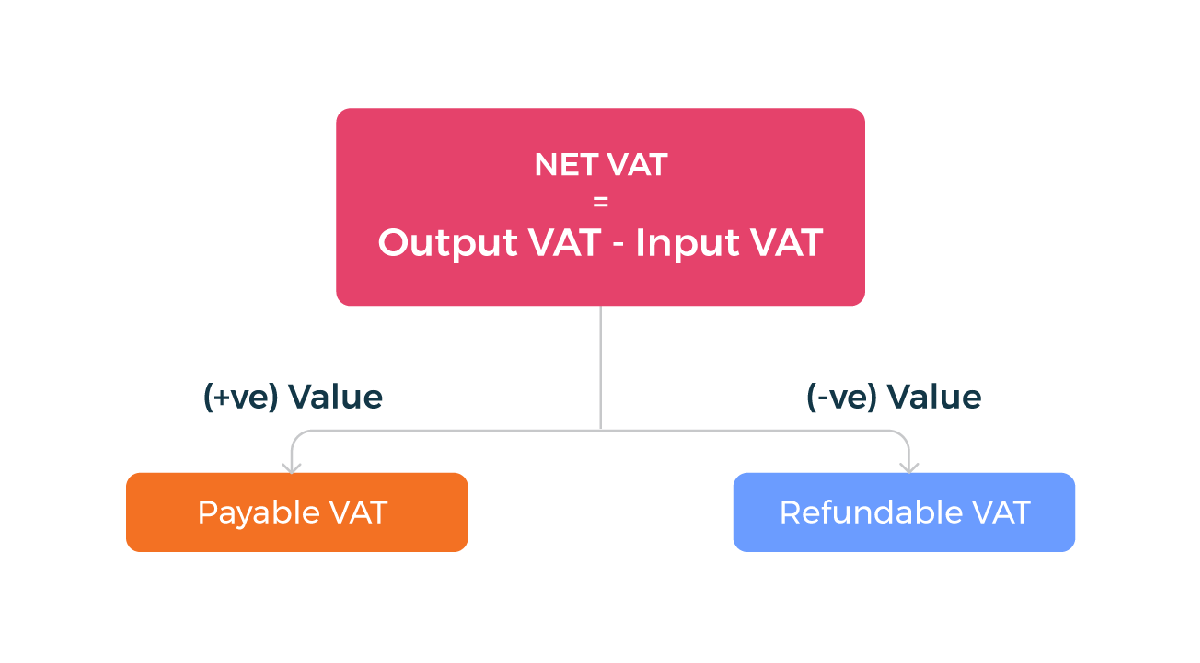

Input Tax Vs Output Tax Nigelctzx

https://www.iras.gov.sg/.../claiming-gst-(input-tax)

Learn about the conditions to claim input tax incurred before you register for GST or incorporate your company Paying Suppliers After Claiming GST Learn what you should do if you do not pay your suppliers after claiming GST

https://assets.kpmg.com/.../08/taxalert-202118.pdf

Taxalert 202118 Tax Alert ISSUE 18 AUGUST 2021 Recent developments in Singapore s GST guidelines The Inland Revenue Authority of Singapore IRAS has recently updated its goods and services tax GST guidelines providing new guidance on eligible GST claims and incidental exempt supplies

Learn about the conditions to claim input tax incurred before you register for GST or incorporate your company Paying Suppliers After Claiming GST Learn what you should do if you do not pay your suppliers after claiming GST

Taxalert 202118 Tax Alert ISSUE 18 AUGUST 2021 Recent developments in Singapore s GST guidelines The Inland Revenue Authority of Singapore IRAS has recently updated its goods and services tax GST guidelines providing new guidance on eligible GST claims and incidental exempt supplies

Scam Email Claims To Be From IRAS Offers Tax Refund And Wants Your

Income Taxes In Singapore You Need To Know About Procosec Asia

An In Depth Look At Input Tax Credit Under Gst Razorpay Business Www

Input Tax Vs Output Tax Nigelctzx

Decoupling What And How It Can Help You Buy A Second Property

PDF Democratic Input Legitimacy Of IRAs Proposing An Assessment

PDF Democratic Input Legitimacy Of IRAs Proposing An Assessment

Goods And Services Tax GST What It Is And How It Works