In this age of electronic devices, with screens dominating our lives however, the attraction of tangible printed objects isn't diminished. In the case of educational materials in creative or artistic projects, or simply to add an element of personalization to your home, printables for free can be an excellent resource. This article will take a dive deep into the realm of "Input Tax Credit On Air Conditioner," exploring the different types of printables, where to get them, as well as ways they can help you improve many aspects of your life.

Get Latest Input Tax Credit On Air Conditioner Below

Input Tax Credit On Air Conditioner

Input Tax Credit On Air Conditioner -

Q Is it possible to claim an input tax credit for air conditioners used in office buildings Ans Yes ITC on electronic equipment used in office buildings such as air conditioners and refrigerators is permitted

In re Wago private limited GST AAR Gujarat Input tax credit is not admissible on Air conditioning and Cooling System and Ventilation System as this is blocke

The Input Tax Credit On Air Conditioner are a huge selection of printable and downloadable material that is available online at no cost. They are available in a variety of kinds, including worksheets templates, coloring pages, and much more. The attraction of printables that are free is in their variety and accessibility.

More of Input Tax Credit On Air Conditioner

Input Tax Credit Meaning Conditions To Avail Documents Required

Input Tax Credit Meaning Conditions To Avail Documents Required

Businesses can claim input tax credit on capital goods Latest updates include restrictions on ITC claims and revised time limits Businesses must ensure ITC reflects in GSTR 2B Common credits for both business and

Noted that Input Tax Credit ITC shall not be available on Air Conditioning and Cooling Ventilation System because of the same being covered under blocked credit in Section 17 5 c of the CGST Act

Input Tax Credit On Air Conditioner have gained immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

customization The Customization feature lets you tailor printables to fit your particular needs for invitations, whether that's creating them planning your schedule or even decorating your house.

-

Educational Impact: Downloads of educational content for free are designed to appeal to students of all ages. This makes them a vital tool for parents and educators.

-

Affordability: Instant access to a myriad of designs as well as templates will save you time and effort.

Where to Find more Input Tax Credit On Air Conditioner

Can You Claim Input Tax Credit On Travel

Can You Claim Input Tax Credit On Travel

However section 17 5 of CGST Act 2017 restrict input tax credit on few goods and services ITC on purchase of air conditioner is not restricted u s 17 5 therefore input tax credit can

Input Tax Credit ITC in GST allows taxable persons to claim tax paid on goods services used for business Conditions are essential to claim ITC seen in updated rules and law amendments highlighted Time limits and examples are

If we've already piqued your interest in printables for free and other printables, let's discover where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Input Tax Credit On Air Conditioner for various uses.

- Explore categories like the home, decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free including flashcards, learning tools.

- The perfect resource for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates free of charge.

- The blogs covered cover a wide spectrum of interests, that includes DIY projects to planning a party.

Maximizing Input Tax Credit On Air Conditioner

Here are some innovative ways to make the most use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or festive decorations to decorate your living spaces.

2. Education

- Print out free worksheets and activities for reinforcement of learning at home or in the classroom.

3. Event Planning

- Make invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Stay organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Input Tax Credit On Air Conditioner are an abundance of useful and creative resources that satisfy a wide range of requirements and interest. Their accessibility and flexibility make them a great addition to both personal and professional life. Explore the vast array of Input Tax Credit On Air Conditioner today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Input Tax Credit On Air Conditioner truly cost-free?

- Yes they are! You can print and download the resources for free.

-

Does it allow me to use free printables to make commercial products?

- It's contingent upon the specific terms of use. Always verify the guidelines provided by the creator prior to using the printables in commercial projects.

-

Are there any copyright violations with Input Tax Credit On Air Conditioner?

- Certain printables may be subject to restrictions regarding usage. You should read the terms and conditions offered by the creator.

-

How do I print Input Tax Credit On Air Conditioner?

- You can print them at home with any printer or head to an in-store print shop to get superior prints.

-

What software do I need in order to open printables free of charge?

- Most PDF-based printables are available with PDF formats, which is open with no cost software, such as Adobe Reader.

ITC Not Admissible On Air conditioning Cooling System Ventilation

New GST Input Tax Credit Rules Tally FAQ News Announcements Blog

Check more sample of Input Tax Credit On Air Conditioner below

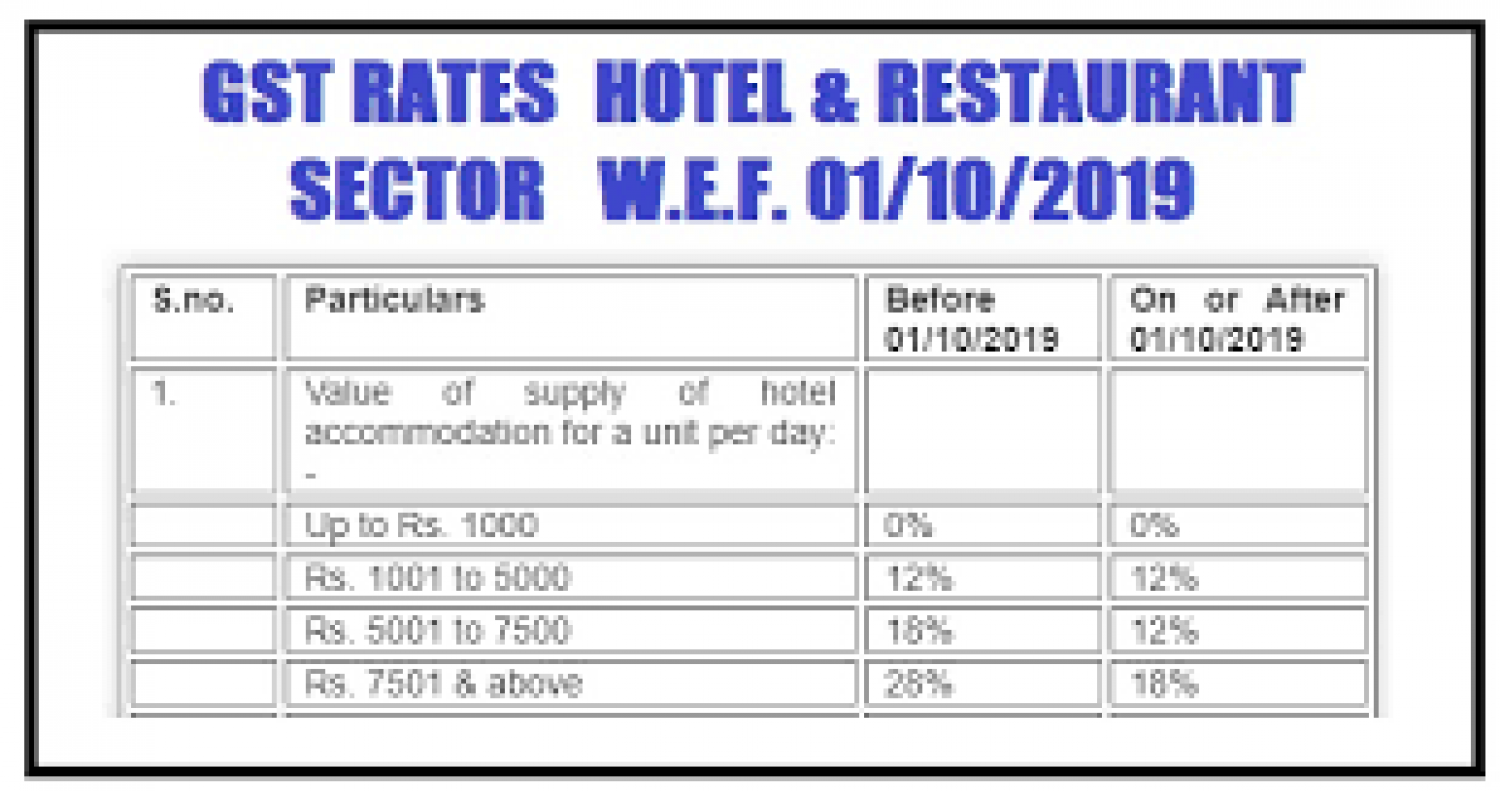

Gst On Hotels Restaurant Industry Gst On Hotel

GST Input Tax Credit On Loyalty Vouchers By Myntra Logitax

Know Whether You Can Claim Input Tax Credit On Food

Input Tax Credit On Iphones Capital Goods

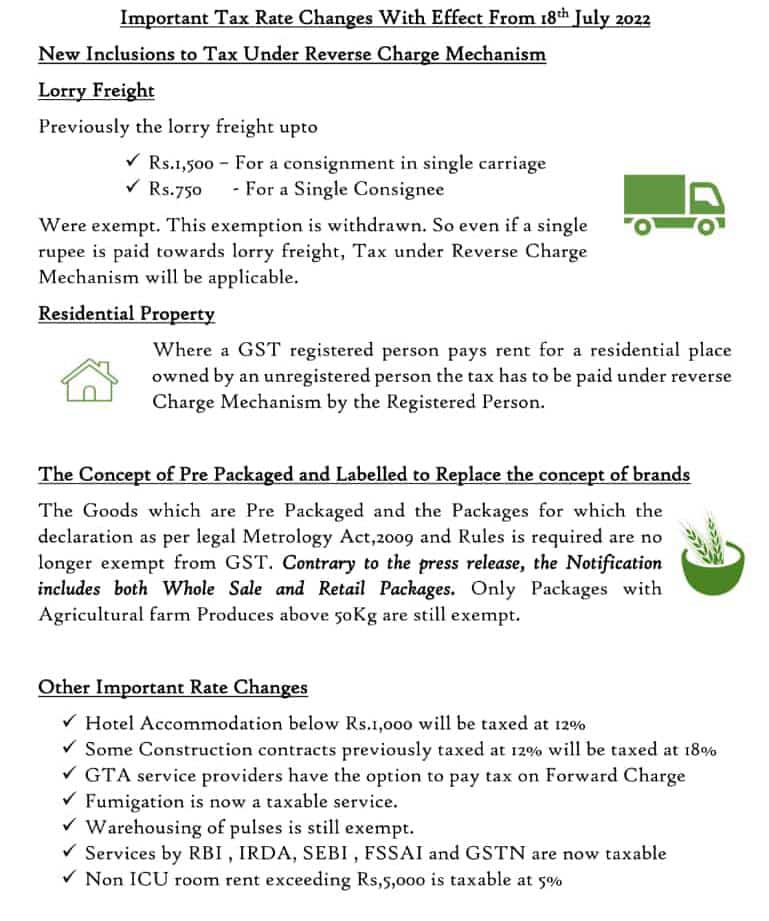

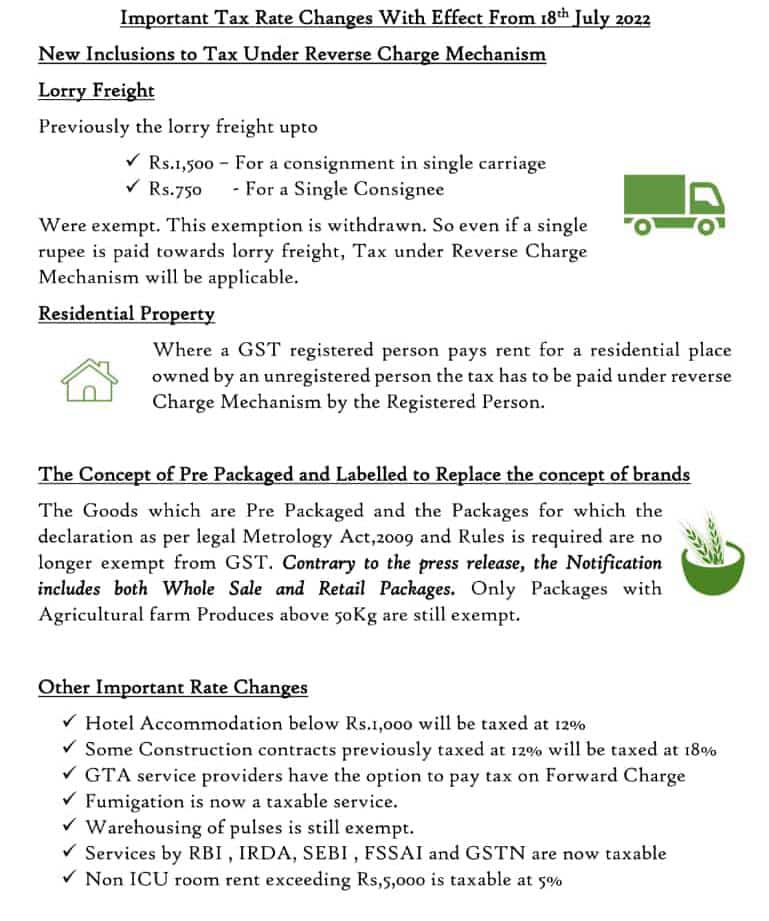

New GST Rate Changes From July 2022 Onwards India Financial Consultancy

Timely Need To Study Circumstances Of Input Tax Credit

https://taxguru.in/goods-and-service-tax…

In re Wago private limited GST AAR Gujarat Input tax credit is not admissible on Air conditioning and Cooling System and Ventilation System as this is blocke

https://taxguru.in/goods-and-service-tax…

Understand the eligibility of Input Tax Credit ITC under GST law for HVAC systems lifts and similar equipment Examine legal provisions and rulings to determine if ITC applies to these immovable property components

In re Wago private limited GST AAR Gujarat Input tax credit is not admissible on Air conditioning and Cooling System and Ventilation System as this is blocke

Understand the eligibility of Input Tax Credit ITC under GST law for HVAC systems lifts and similar equipment Examine legal provisions and rulings to determine if ITC applies to these immovable property components

Input Tax Credit On Iphones Capital Goods

GST Input Tax Credit On Loyalty Vouchers By Myntra Logitax

New GST Rate Changes From July 2022 Onwards India Financial Consultancy

Timely Need To Study Circumstances Of Input Tax Credit

Input Tax Credit Under GST 10 Cases Where You Cannot Claim It

Input Tax Credit GST Input Tax Credit Services In New Delhi

Input Tax Credit GST Input Tax Credit Services In New Delhi

Input Tax Credit On CSR Spending By Companies In Detailed