In the age of digital, where screens have become the dominant feature of our lives, the charm of tangible printed products hasn't decreased. It doesn't matter if it's for educational reasons such as creative projects or simply to add an individual touch to the home, printables for free are now a vital source. In this article, we'll dive deeper into "Input Tax Credit," exploring what they are, how to find them, and how they can be used to enhance different aspects of your life.

Get Latest Input Tax Credit Below

Input Tax Credit

Input Tax Credit -

Input Tax Credit fiscal deficit Demonetization harshad mehta scam NACH National Automated Clearing House Income Niti Aayog E Banking Electronic Banking BPL Below Poverty Line Bureaucracy Industrialisation Amalgamation India VIX Representative assessee Investing Personal Finance Economy Financial Advisor

1 ITC cannot be claimed if it is restricted in GSTR 2B available under Section 38 2 Time limit to claim ITC on invoices or debit notes of a financial year is revised to earlier of two dates Firstly 30th November of the following year or secondly the date of

Input Tax Credit offer a wide variety of printable, downloadable material that is available online at no cost. These resources come in various designs, including worksheets coloring pages, templates and more. The benefit of Input Tax Credit is their flexibility and accessibility.

More of Input Tax Credit

An In Depth Look At Input Tax Credit Under Gst Razorpay Business Www

An In Depth Look At Input Tax Credit Under Gst Razorpay Business Www

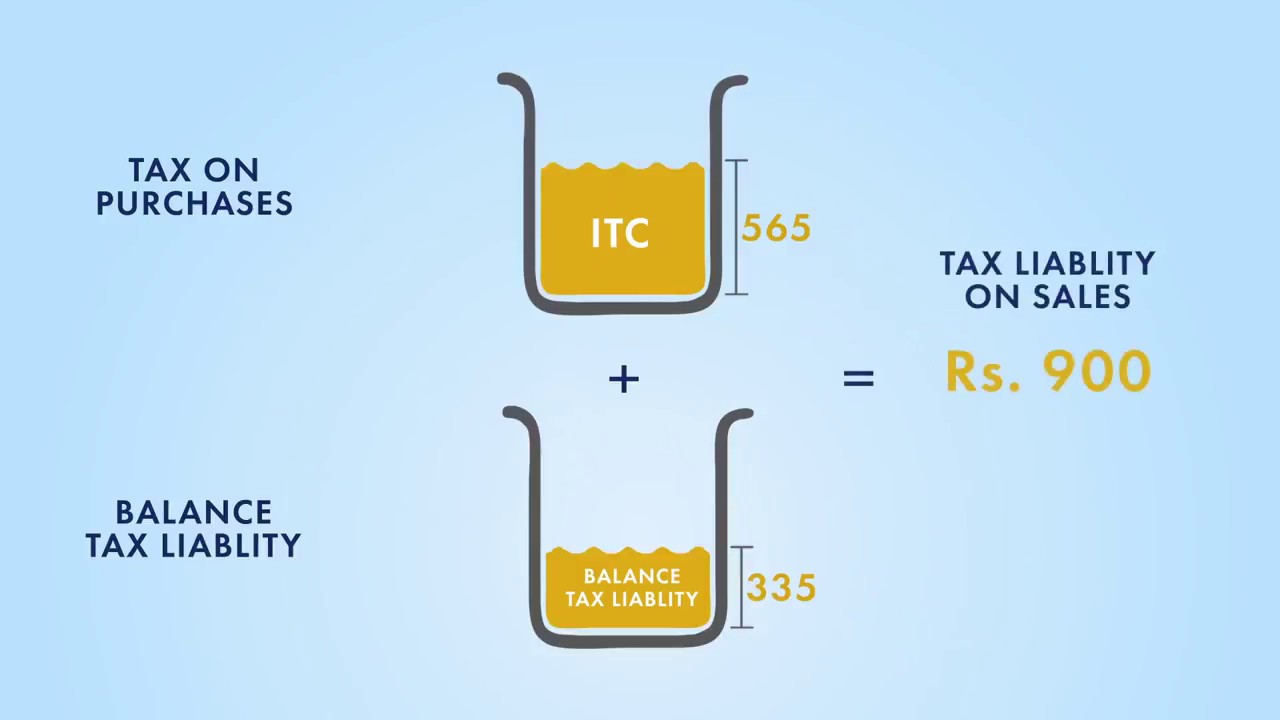

Conclusion FAQs The Importance of Input Tax Credit Input Tax Credit ITC is a critical feature in modern tax systems offering a mechanism for businesses to deduct the taxes they ve incurred on inputs from the taxes they collect on sales or service output

Input tax credits On this page Overview Find out if you are eligible to claim ITCs How to calculate ITCs How to claim ITCs Time limits for claiming ITCs Records you need to support your claim Overview

Input Tax Credit have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Flexible: You can tailor printed materials to meet your requirements for invitations, whether that's creating them for your guests, organizing your schedule or even decorating your home.

-

Educational Use: Printables for education that are free offer a wide range of educational content for learners of all ages. This makes them a great device for teachers and parents.

-

Simple: The instant accessibility to many designs and templates is time-saving and saves effort.

Where to Find more Input Tax Credit

What Is Input Tax Credit In GST YourSelfQuotes

What Is Input Tax Credit In GST YourSelfQuotes

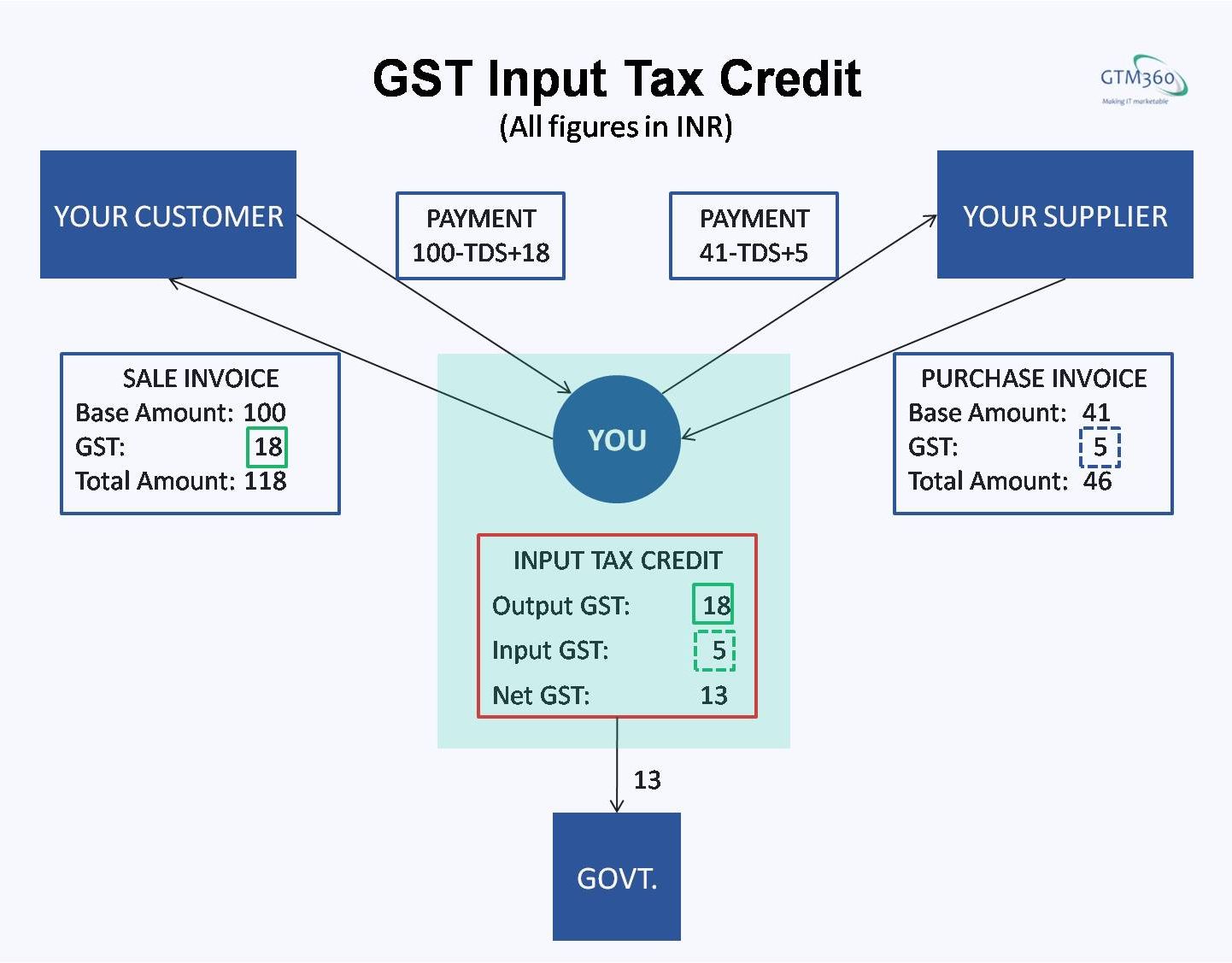

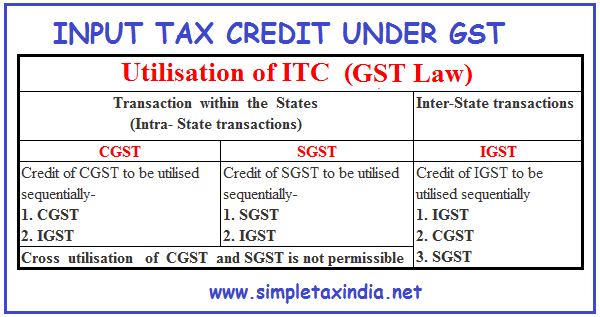

Input Tax Credit ITC One of the fundamental features of GST is the seamless flow of input credit across the chain from the manufacture of goods till it is consumed and across the country Latest Update 1st February 2022 Budget 2022 updates 1

Conditions for taking ITC Input Tax Credit is allowed to a person only if following conditions are satisfied he is in possession of a tax invoice or debit note issued by a supplier registered under GST he has received the goods and or services

We've now piqued your interest in Input Tax Credit Let's see where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Input Tax Credit to suit a variety of needs.

- Explore categories like home decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free with flashcards and other teaching tools.

- Great for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers post their original designs or templates for download.

- The blogs covered cover a wide range of topics, starting from DIY projects to planning a party.

Maximizing Input Tax Credit

Here are some fresh ways to make the most of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use printable worksheets from the internet to build your knowledge at home as well as in the class.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions like weddings and birthdays.

4. Organization

- Be organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Input Tax Credit are a treasure trove of innovative and useful resources that can meet the needs of a variety of people and pursuits. Their access and versatility makes them a great addition to your professional and personal life. Explore the vast world of Input Tax Credit today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really completely free?

- Yes you can! You can print and download these documents for free.

-

Can I use free printables for commercial use?

- It depends on the specific rules of usage. Always check the creator's guidelines before using their printables for commercial projects.

-

Are there any copyright violations with Input Tax Credit?

- Certain printables could be restricted on usage. Check the terms and conditions set forth by the creator.

-

How do I print Input Tax Credit?

- Print them at home with your printer or visit an area print shop for more high-quality prints.

-

What software do I require to open printables free of charge?

- Most PDF-based printables are available in PDF format. They can be opened with free software, such as Adobe Reader.

What GST Input Tax Credit How To Claim It

How GST Input Tax Credit Works YouTube

Check more sample of Input Tax Credit below

Input Tax Credit Under GST How To Claim Calculation Method

Conditions For Availing The Input Tax Credit ITC And Blocked Credit

GST For Normies Part 2 Talk Of Many Things

Input Tax Credit Under GST Time Limit For Input Tax Credit

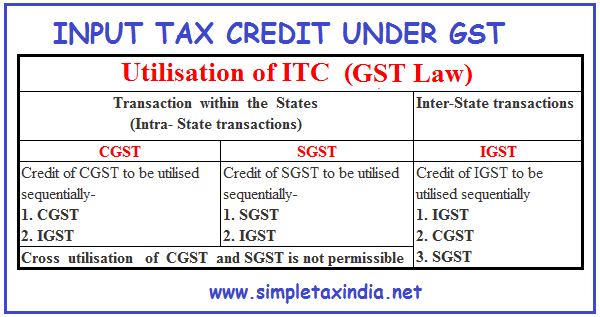

INPUT TAX CREDIT UNDER GST GOODS AND SERVICE TAX SIMPLE TAX INDIA

Input Tax Credit GSTHero Online GST Return Filing E Way Bill

https://cleartax.in/s/gst-input-tax-credit

1 ITC cannot be claimed if it is restricted in GSTR 2B available under Section 38 2 Time limit to claim ITC on invoices or debit notes of a financial year is revised to earlier of two dates Firstly 30th November of the following year or secondly the date of

https://www.embibe.com/exams/input-tax-credit

Q 4 What is ITC credit in GST Ans Input tax credit means claiming the credit of the GST paid on the purchase of products and services used for the furtherance of business The mechanism of the Input tax credit is that the backbone of GST and is one of the foremost important reasons for the introduction of GST Q 5 Can ITC be refunded

1 ITC cannot be claimed if it is restricted in GSTR 2B available under Section 38 2 Time limit to claim ITC on invoices or debit notes of a financial year is revised to earlier of two dates Firstly 30th November of the following year or secondly the date of

Q 4 What is ITC credit in GST Ans Input tax credit means claiming the credit of the GST paid on the purchase of products and services used for the furtherance of business The mechanism of the Input tax credit is that the backbone of GST and is one of the foremost important reasons for the introduction of GST Q 5 Can ITC be refunded

Input Tax Credit Under GST Time Limit For Input Tax Credit

Conditions For Availing The Input Tax Credit ITC And Blocked Credit

INPUT TAX CREDIT UNDER GST GOODS AND SERVICE TAX SIMPLE TAX INDIA

Input Tax Credit GSTHero Online GST Return Filing E Way Bill

Input Tax Credit Under GST Regime Conditions To Claim Credit

Input Tax Credit A New Era A Nightmare

Input Tax Credit A New Era A Nightmare

Learn Accounting Entries Under GST With Journal Entry RCM Meteorio