In this age of electronic devices, where screens rule our lives it's no wonder that the appeal of tangible printed material hasn't diminished. For educational purposes, creative projects, or simply adding an individual touch to the area, Insurance Premium Tax Credit are now a vital resource. With this guide, you'll take a dive to the depths of "Insurance Premium Tax Credit," exploring the benefits of them, where they can be found, and ways they can help you improve many aspects of your life.

Get Latest Insurance Premium Tax Credit Below

Insurance Premium Tax Credit

Insurance Premium Tax Credit -

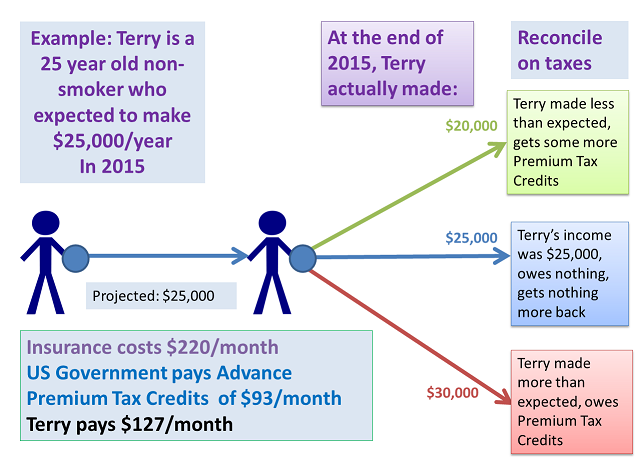

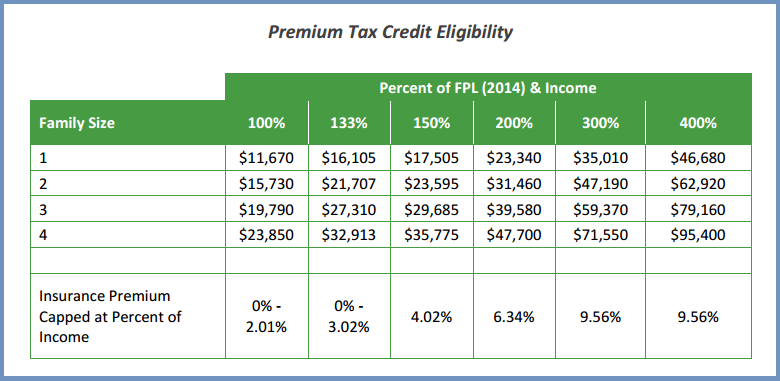

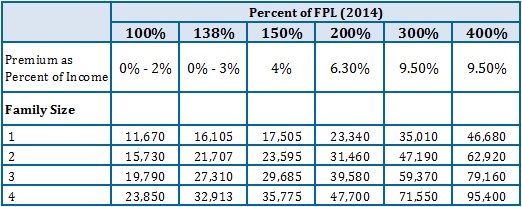

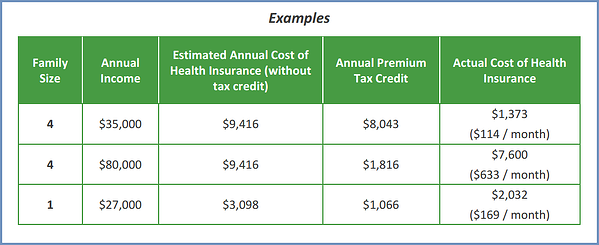

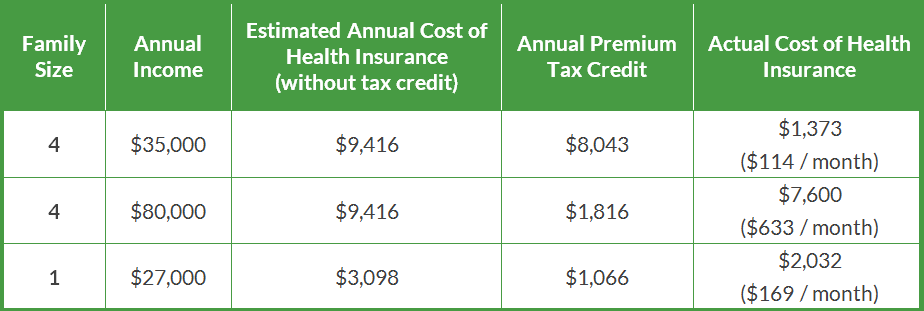

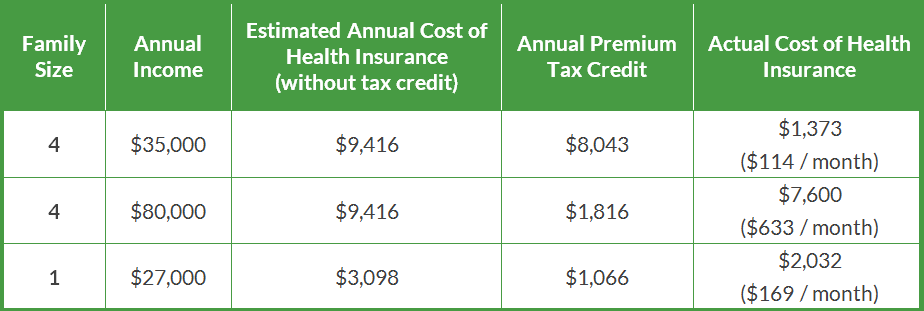

The Premium Tax Credit is a tax credit intended to subsidize the purchase of health plans offered through the federal and state health benefit exchanges The size of your credit will depend

The premium tax credit is a refundable credit that helps some taxpayers afford health insurance premiums The advance PTC lowers the premiums themselves

Insurance Premium Tax Credit cover a large range of printable, free documents that can be downloaded online at no cost. They are available in numerous forms, including worksheets, coloring pages, templates and many more. The appealingness of Insurance Premium Tax Credit lies in their versatility and accessibility.

More of Insurance Premium Tax Credit

Child Tax Credit Dates Elwanda Lemay

Child Tax Credit Dates Elwanda Lemay

Premium tax credit PTC The PTC is a tax credit for certain people who enroll or whose family member enrolls in a qualified health plan offered through a Marketplace The credit provides financial assistance to pay the premiums for the qualified health plan by reducing the amount of tax you owe giving you a refund or increasing your

A tax credit you can use to lower your monthly insurance payment called your premium when you enroll in a plan through the Health Insurance Marketplace Your tax credit is based on the income estimate and household information you put

Printables that are free have gained enormous popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Personalization They can make printed materials to meet your requirements be it designing invitations or arranging your schedule or even decorating your home.

-

Educational Value: Printing educational materials for no cost provide for students of all ages, which makes them an essential source for educators and parents.

-

Accessibility: Fast access a plethora of designs and templates saves time and effort.

Where to Find more Insurance Premium Tax Credit

FAQs Health Insurance Premium Tax Credits

FAQs Health Insurance Premium Tax Credits

A premium tax credit often referred to as a premium subsidy is a tax credit that offsets some or all of the amount that policyholders would otherwise have to pay to purchase individual or family health coverage

The premium tax credit is a refundable tax credit that can help lower your insurance premium costs when you enroll in a health plan through the Health Insurance Marketplace You can receive this credit before you file your return by estimating your expected income for the year when applying for coverage in the Marketplace

In the event that we've stirred your interest in Insurance Premium Tax Credit we'll explore the places you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Insurance Premium Tax Credit designed for a variety motives.

- Explore categories such as the home, decor, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing with flashcards and other teaching tools.

- The perfect resource for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs as well as templates for free.

- The blogs are a vast spectrum of interests, that range from DIY projects to planning a party.

Maximizing Insurance Premium Tax Credit

Here are some new ways how you could make the most of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Utilize free printable worksheets to enhance your learning at home and in class.

3. Event Planning

- Design invitations, banners, and decorations for special events like weddings or birthdays.

4. Organization

- Get organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Insurance Premium Tax Credit are a treasure trove of innovative and useful resources that satisfy a wide range of requirements and pursuits. Their availability and versatility make them an invaluable addition to any professional or personal life. Explore the wide world of Insurance Premium Tax Credit to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually completely free?

- Yes they are! You can download and print these documents for free.

-

Can I make use of free printouts for commercial usage?

- It's dependent on the particular usage guidelines. Always consult the author's guidelines before utilizing their templates for commercial projects.

-

Are there any copyright issues in printables that are free?

- Certain printables might have limitations concerning their use. You should read the terms and conditions provided by the designer.

-

How do I print Insurance Premium Tax Credit?

- Print them at home with an printer, or go to a local print shop to purchase top quality prints.

-

What software is required to open printables for free?

- The majority of printed documents are in the format PDF. This is open with no cost programs like Adobe Reader.

Filing Taxes And Marketplace Health Insurance Form 8962 Healthcare

FAQ Am I Eligible For Premium Tax Credits

Check more sample of Insurance Premium Tax Credit below

FAQs Health Insurance Premium Tax Credits

2019 IRS Health Insurance Premium Tax Credit Reconciliation YouTube

Tax Subsidies For Private Health Insurance II Non Group Coverage

Health Insurance Premium Tax Credit Income Limits What Are They

No More Health Insurance Premium Tax Credit Cliff Diving TaxMedics

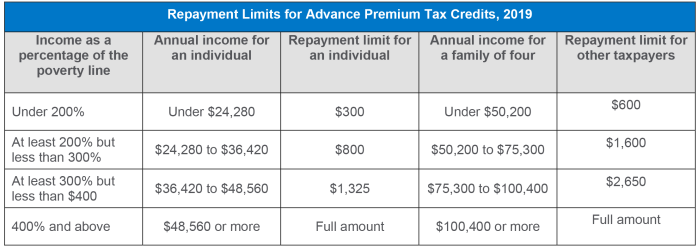

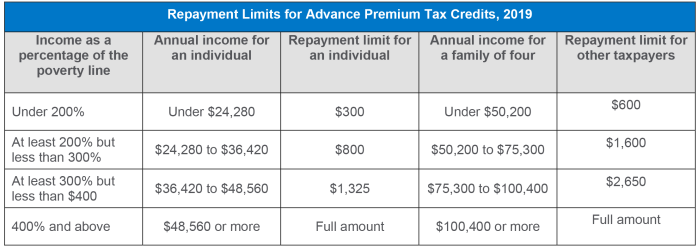

Repayment Limits For Premium Tax Credits 2019 KFF

https://www.nerdwallet.com/article/taxes/premium-tax-credit

The premium tax credit is a refundable credit that helps some taxpayers afford health insurance premiums The advance PTC lowers the premiums themselves

https://www.irs.gov/affordable-care-act/...

The Premium Tax Credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace also known as the Exchange The size of your Premium Tax Credit is based on a sliding scale

The premium tax credit is a refundable credit that helps some taxpayers afford health insurance premiums The advance PTC lowers the premiums themselves

The Premium Tax Credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace also known as the Exchange The size of your Premium Tax Credit is based on a sliding scale

Health Insurance Premium Tax Credit Income Limits What Are They

2019 IRS Health Insurance Premium Tax Credit Reconciliation YouTube

No More Health Insurance Premium Tax Credit Cliff Diving TaxMedics

Repayment Limits For Premium Tax Credits 2019 KFF

Which Is Better Paying Health Insurance Premiums Pre Tax Or Post Tax

Premium Tax Credit Charts 2015

Premium Tax Credit Charts 2015

How To Calculate 300 Of The Federal Poverty Level Reverasite