In this age of technology, where screens rule our lives The appeal of tangible printed material hasn't diminished. No matter whether it's for educational uses in creative or artistic projects, or simply adding some personal flair to your space, Interest Deduction On Loan have become a valuable resource. We'll take a dive into the sphere of "Interest Deduction On Loan," exploring what they are, how to get them, as well as how they can improve various aspects of your life.

Get Latest Interest Deduction On Loan Below

Interest Deduction On Loan

Interest Deduction On Loan -

What Is the Interest Deduction Interest deduction causes a reduction in taxable income If a taxpayer or business pays interest in certain cases the interest may be deducted from income

Interest is an amount you pay for the use of borrowed money Some interest can be claimed as a deduction or as a credit To deduct interest you paid on a debt review each

The Interest Deduction On Loan are a huge variety of printable, downloadable material that is available online at no cost. These resources come in various designs, including worksheets coloring pages, templates and more. The appeal of printables for free is in their versatility and accessibility.

More of Interest Deduction On Loan

Mortgage Interest Tax Deduction 2020 Calculator JunaidKaleah

Mortgage Interest Tax Deduction 2020 Calculator JunaidKaleah

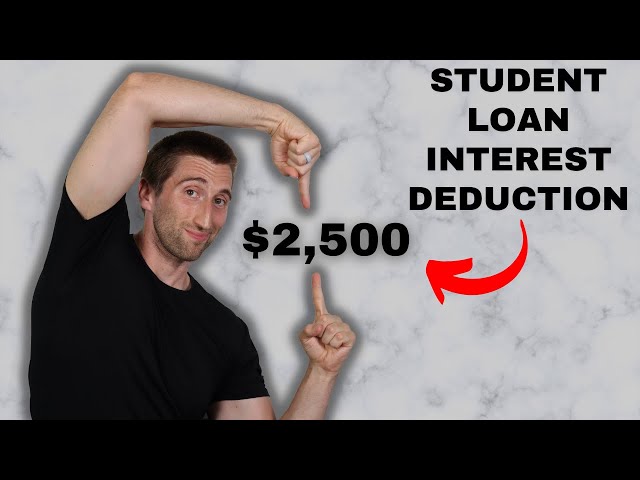

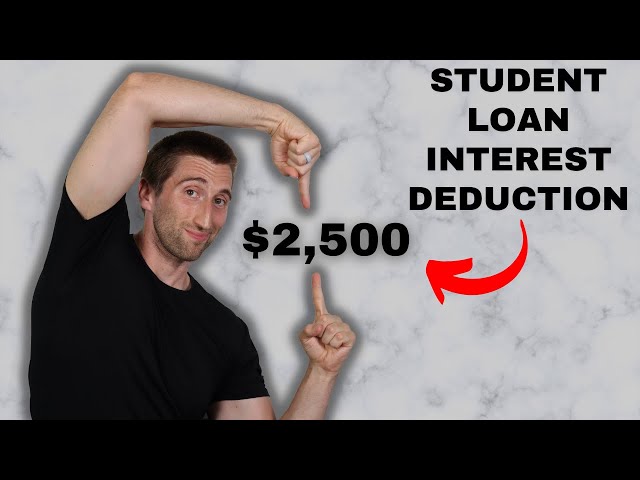

Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You may deduct the lesser of 2 500 or the amount of interest you actually paid during

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a qualified student loan during the

Interest Deduction On Loan have risen to immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

Personalization There is the possibility of tailoring printed materials to meet your requirements such as designing invitations planning your schedule or even decorating your home.

-

Educational Worth: These Interest Deduction On Loan can be used by students of all ages, which makes them a vital device for teachers and parents.

-

The convenience of Access to a myriad of designs as well as templates cuts down on time and efforts.

Where to Find more Interest Deduction On Loan

Good News Bad News On Student Loan Interest Deduction

Good News Bad News On Student Loan Interest Deduction

With the mortgage interest deduction MID you can write off a portion of the interest on your home loan lowering your taxable income and potentially moving you into a lower tax bracket

Eligibility for Student Loan Interest Deduction To be eligible for the maximum student loan interest deduction of 2 500 for tax year 2023 your modified adjusted gross

If we've already piqued your interest in Interest Deduction On Loan and other printables, let's discover where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Interest Deduction On Loan for various reasons.

- Explore categories like design, home decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational tools.

- Ideal for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- These blogs cover a broad variety of topics, ranging from DIY projects to party planning.

Maximizing Interest Deduction On Loan

Here are some ideas that you can make use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes as well as seasonal decorations, to embellish your living areas.

2. Education

- Use free printable worksheets to aid in learning at your home and in class.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Interest Deduction On Loan are an abundance filled with creative and practical information catering to different needs and hobbies. Their accessibility and flexibility make them a great addition to each day life. Explore the many options of Interest Deduction On Loan right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free completely free?

- Yes you can! You can download and print these items for free.

-

Does it allow me to use free printables for commercial use?

- It's based on the usage guidelines. Always verify the guidelines of the creator before utilizing their templates for commercial projects.

-

Do you have any copyright issues when you download Interest Deduction On Loan?

- Certain printables might have limitations in use. Check the terms and condition of use as provided by the designer.

-

How do I print printables for free?

- Print them at home with any printer or head to a print shop in your area for top quality prints.

-

What software do I need to open printables free of charge?

- The majority of printed documents are in the format PDF. This is open with no cost programs like Adobe Reader.

Learn How The Student Loan Interest Deduction Works

How To Claim Your Student Loan Interest Deduction

Check more sample of Interest Deduction On Loan below

Can I Claim Student Loan Interest Deduction College Raptor

How To Get The Interest Deduction On Your Student Loan

2021 Student Loan Interest Deduction

Student Loan Interest Deduction 2013 PriorTax Blog

All About Deduction Of Housing Loan Interest U s 24 b Of The Income

What Is The Student Loan Interest Deduction Commons credit portal

https://www.irs.gov/taxtopics/tc505

Interest is an amount you pay for the use of borrowed money Some interest can be claimed as a deduction or as a credit To deduct interest you paid on a debt review each

https://www.nerdwallet.com/article/taxe…

The mortgage interest deduction allows you to deduct the interest you paid on the first 750 000 of your mortgage debt during the tax year

Interest is an amount you pay for the use of borrowed money Some interest can be claimed as a deduction or as a credit To deduct interest you paid on a debt review each

The mortgage interest deduction allows you to deduct the interest you paid on the first 750 000 of your mortgage debt during the tax year

Student Loan Interest Deduction 2013 PriorTax Blog

How To Get The Interest Deduction On Your Student Loan

All About Deduction Of Housing Loan Interest U s 24 b Of The Income

What Is The Student Loan Interest Deduction Commons credit portal

What Is The Business Loan Interest Tax Deduction

Instead They Can Claim Both The Student Loan Interest Deduction And

Instead They Can Claim Both The Student Loan Interest Deduction And

Student Loan Interest Deduction Los Angeles ORT College