In this digital age, in which screens are the norm yet the appeal of tangible printed items hasn't gone away. It doesn't matter if it's for educational reasons for creative projects, simply adding some personal flair to your space, Interest Exemption Limit For Senior Citizens are a great resource. Through this post, we'll dive deep into the realm of "Interest Exemption Limit For Senior Citizens," exploring their purpose, where they are available, and ways they can help you improve many aspects of your daily life.

Get Latest Interest Exemption Limit For Senior Citizens Below

Interest Exemption Limit For Senior Citizens

Interest Exemption Limit For Senior Citizens -

The exemption however doesn t apply to retirement plan benefits you receive based on your age length of service or prior contributions to the plan even if you retired because of an occupational sickness or injury

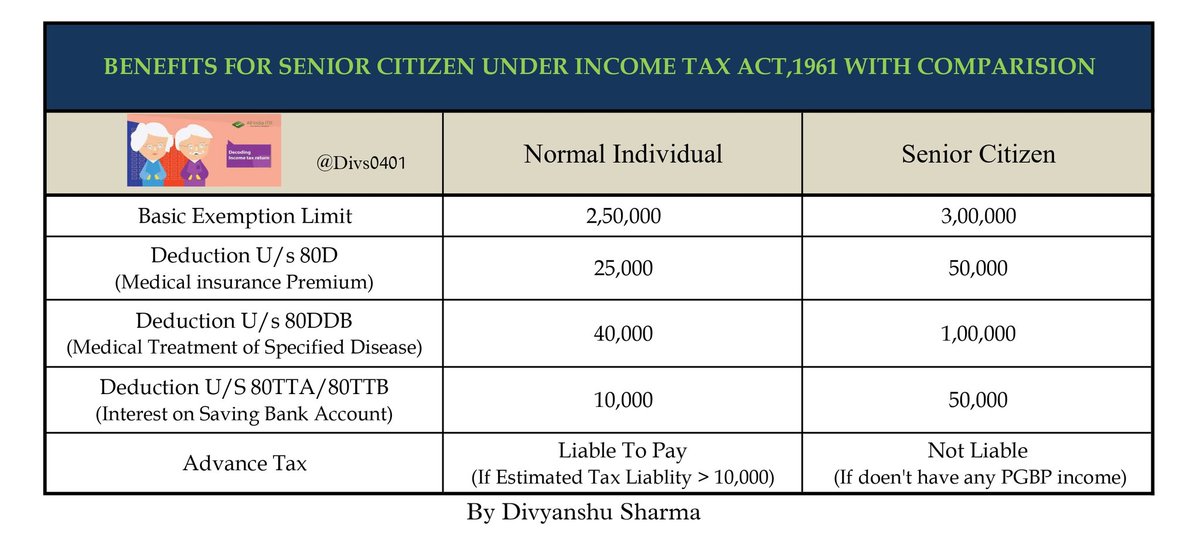

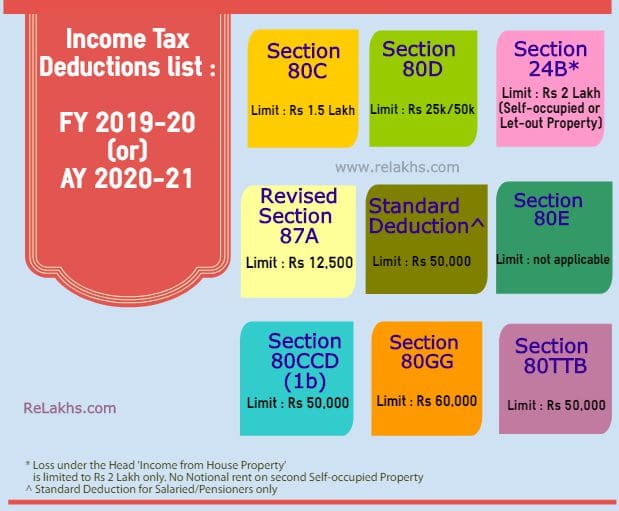

Senior citizens can benefit from Section 80TTB introduced in Finance Budget 2018 allowing a deduction of up to Rs 50 000 on specified interest income The section is applicable for resident senior citizens aged 60 or above from April 1 2018 and excludes interest from other sources like bonds

Printables for free include a vast range of downloadable, printable content that can be downloaded from the internet at no cost. The resources are offered in a variety forms, like worksheets coloring pages, templates and much more. One of the advantages of Interest Exemption Limit For Senior Citizens is their versatility and accessibility.

More of Interest Exemption Limit For Senior Citizens

Home Loan Interest Tax Exemption Limit 2019 20 Home Sweet Home

Home Loan Interest Tax Exemption Limit 2019 20 Home Sweet Home

Section 80TTB is a section that deals with the interest deduction for senior citizens Under this section senior citizens can claim a deduction of upto Rs 50 000 interest on income earned from various types of deposits

In the new regime however both senior and super senior citizens get 2 5 lakh as basic exemption limit just like a regular taxpayer

Printables for free have gained immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Individualization It is possible to tailor designs to suit your personal needs whether you're designing invitations planning your schedule or even decorating your home.

-

Educational Value: Free educational printables are designed to appeal to students of all ages, which makes them a great tool for teachers and parents.

-

Convenience: instant access a plethora of designs and templates can save you time and energy.

Where to Find more Interest Exemption Limit For Senior Citizens

Union Budget 2023

Union Budget 2023

The government raised the ceiling beyond which TDS is applicable on interest income from Rs 10 000 to Rs 50 000 in case of senior citizens This will mean that the bank or the post office will not deduct tax on interest income of up to Rs 50 000 on FDs RDs Post office Schemes like MIS Senior Citizen Savings Scheme KVP NSC etc

In the new tax regime Interest on borrowed capital for Self occupied property is not allowed as a deduction from Income from House property as per the provision of Section 115BAC of the Act 1961

In the event that we've stirred your interest in Interest Exemption Limit For Senior Citizens and other printables, let's discover where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection and Interest Exemption Limit For Senior Citizens for a variety applications.

- Explore categories such as decoration for your home, education, organization, and crafts.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free or flashcards as well as learning tools.

- The perfect resource for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates free of charge.

- The blogs are a vast range of interests, all the way from DIY projects to party planning.

Maximizing Interest Exemption Limit For Senior Citizens

Here are some creative ways ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use printable worksheets for free for teaching at-home also in the classes.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions like weddings and birthdays.

4. Organization

- Get organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Interest Exemption Limit For Senior Citizens are a treasure trove of fun and practical tools catering to different needs and interest. Their accessibility and versatility make them a great addition to your professional and personal life. Explore the endless world that is Interest Exemption Limit For Senior Citizens today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really for free?

- Yes you can! You can print and download these resources at no cost.

-

Can I use the free printables for commercial uses?

- It's based on specific rules of usage. Always check the creator's guidelines before using any printables on commercial projects.

-

Do you have any copyright issues in printables that are free?

- Certain printables could be restricted in their usage. Be sure to check these terms and conditions as set out by the designer.

-

How do I print Interest Exemption Limit For Senior Citizens?

- You can print them at home with either a printer or go to any local print store for more high-quality prints.

-

What program must I use to open Interest Exemption Limit For Senior Citizens?

- The majority are printed in PDF format, which can be opened with free programs like Adobe Reader.

Senior Citizen Tax Exemption Limit Income Tax Slabs Rates And

Tax Exemption Limit Increases For Senior Citizens Financial Freedom

Check more sample of Interest Exemption Limit For Senior Citizens below

People s Friendly Budget Media4achange s Blog

What Is The Tax Exemption Limit For Senior Citizens Archives InstaFiling

Thread Benefits Available For Senior Citizen Under Income Tax ACT

How Senior Citizens Can Claim Tax Exemption And Deduction In ITR

Senior Citizens Get Special Exemption In Income Tax Know 5 Big

ITR Filing For Senior Citizens Tax Benefits Exemption Limit And More

https://cleartax.in/s/section-80ttb

Senior citizens can benefit from Section 80TTB introduced in Finance Budget 2018 allowing a deduction of up to Rs 50 000 on specified interest income The section is applicable for resident senior citizens aged 60 or above from April 1 2018 and excludes interest from other sources like bonds

https://cleartax.in/s/income-tax-slab-for-senior-citizen

Yes the interest earned on Senior Citizen Savings Scheme is eligible for deduction up to Rs 50 000 under Section 80TTB

Senior citizens can benefit from Section 80TTB introduced in Finance Budget 2018 allowing a deduction of up to Rs 50 000 on specified interest income The section is applicable for resident senior citizens aged 60 or above from April 1 2018 and excludes interest from other sources like bonds

Yes the interest earned on Senior Citizen Savings Scheme is eligible for deduction up to Rs 50 000 under Section 80TTB

How Senior Citizens Can Claim Tax Exemption And Deduction In ITR

What Is The Tax Exemption Limit For Senior Citizens Archives InstaFiling

Senior Citizens Get Special Exemption In Income Tax Know 5 Big

ITR Filing For Senior Citizens Tax Benefits Exemption Limit And More

Budget 2016 MPs Want Income Tax Exemption Limit For Individuals To Be

Senior Citizens Exemption Limit For Filing ITR 2023 Online Chartered

Senior Citizens Exemption Limit For Filing ITR 2023 Online Chartered

Income Tax Filing ITR Here s What Senior And Super Senior Citizens