In a world where screens have become the dominant feature of our lives it's no wonder that the appeal of tangible printed material hasn't diminished. No matter whether it's for educational uses and creative work, or simply to add an individual touch to the space, Interest On Fixed Deposit Deduction For Senior Citizens have become an invaluable source. This article will take a dive in the world of "Interest On Fixed Deposit Deduction For Senior Citizens," exploring the benefits of them, where to get them, as well as how they can enrich various aspects of your life.

Get Latest Interest On Fixed Deposit Deduction For Senior Citizens Below

Interest On Fixed Deposit Deduction For Senior Citizens

Interest On Fixed Deposit Deduction For Senior Citizens -

Senior citizens or those who are of 60 years or older can get a tax deduction of up to Rs 1 5 lakh under Section 80C of the Income tax Act 1961 Tax

The senior citizen will submit a declaration to the specified bank The bank is a specified bank as notified by the Central Government Such banks will be responsible for the TDS

Interest On Fixed Deposit Deduction For Senior Citizens provide a diverse assortment of printable, downloadable items that are available online at no cost. These materials come in a variety of designs, including worksheets coloring pages, templates and many more. The value of Interest On Fixed Deposit Deduction For Senior Citizens lies in their versatility and accessibility.

More of Interest On Fixed Deposit Deduction For Senior Citizens

10 Tax Deductions For Seniors You Might Not Know About

10 Tax Deductions For Seniors You Might Not Know About

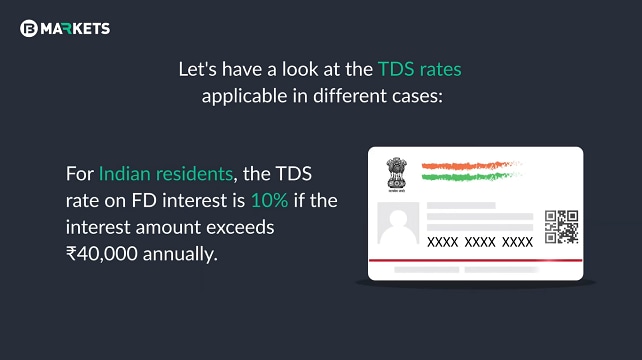

Under section 80TTB a resident senior citizen who is 60 years or above can claim a deduction of up to Rs 50 000 on specified interest income Getty Images 3 5

Section 80TTB of the Income Tax Act provides tax benefits for senior citizens on interest income from deposits allowing a deduction of Rs 50 000 on

Interest On Fixed Deposit Deduction For Senior Citizens have gained immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

The ability to customize: There is the possibility of tailoring the design to meet your needs whether it's making invitations making your schedule, or even decorating your house.

-

Educational Impact: These Interest On Fixed Deposit Deduction For Senior Citizens cater to learners from all ages, making the perfect resource for educators and parents.

-

Easy to use: Access to a variety of designs and templates cuts down on time and efforts.

Where to Find more Interest On Fixed Deposit Deduction For Senior Citizens

80 TTA Deduction For Ay 2022 23 II 80ttb Deduction For Senior Citizens

80 TTA Deduction For Ay 2022 23 II 80ttb Deduction For Senior Citizens

Fixed deposits Tax saving fixed deposits FDs enable senior citizens to avail a tax deduction of up to Rs 1 5 lakh under Section 80C of the Income tax Act 1961 The

Interest on Fixed Deposits Exempt 23 000 Interest From Deposit in a savings account Exempt 3 000 Recurring Deposit Interest Income Exempt 25 500

If we've already piqued your interest in Interest On Fixed Deposit Deduction For Senior Citizens we'll explore the places you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Interest On Fixed Deposit Deduction For Senior Citizens for various goals.

- Explore categories such as decorations for the home, education and management, and craft.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing, flashcards, and learning materials.

- The perfect resource for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- These blogs cover a broad variety of topics, everything from DIY projects to party planning.

Maximizing Interest On Fixed Deposit Deduction For Senior Citizens

Here are some innovative ways to make the most use of Interest On Fixed Deposit Deduction For Senior Citizens:

1. Home Decor

- Print and frame gorgeous artwork, quotes as well as seasonal decorations, to embellish your living areas.

2. Education

- Print free worksheets to enhance learning at home or in the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Be organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Interest On Fixed Deposit Deduction For Senior Citizens are a treasure trove of practical and innovative resources which cater to a wide range of needs and interests. Their accessibility and flexibility make they a beneficial addition to both professional and personal lives. Explore the vast world of Interest On Fixed Deposit Deduction For Senior Citizens now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really completely free?

- Yes, they are! You can download and print these resources at no cost.

-

Can I use free printables for commercial uses?

- It's all dependent on the rules of usage. Always check the creator's guidelines before using their printables for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Some printables could have limitations regarding their use. Check the terms and conditions provided by the author.

-

How do I print printables for free?

- Print them at home using the printer, or go to a local print shop to purchase higher quality prints.

-

What program do I need in order to open printables that are free?

- Many printables are offered with PDF formats, which can be opened using free programs like Adobe Reader.

SBI NRE NRO Senior Citizen Domestic Fixed Deposit Rates March 2013

Can I Get Monthly Interest On Fixed Deposit Koshex Blog

Check more sample of Interest On Fixed Deposit Deduction For Senior Citizens below

Fixed Deposit For Senior Citizens Kannada News Today

Fixed Deposit Rates For Senior Citizens These Banks Offering Over 9 Pc

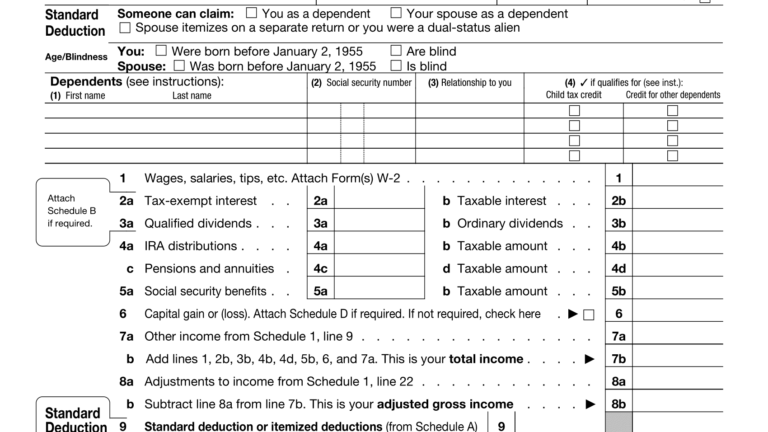

Standard Deduction For Senior Citizens 2020 Standard Deduction 2021

Preventive Check Up 80d Wkcn

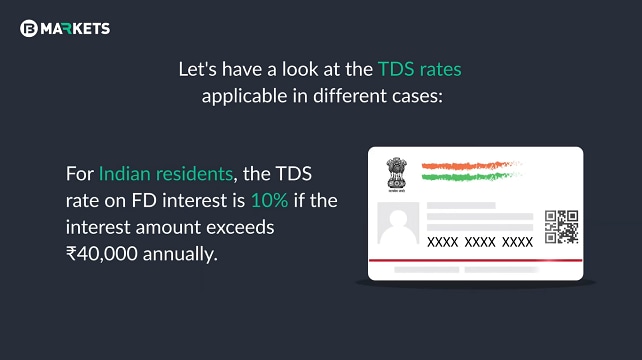

TDS On Fixed Deposit Tax Deduction On FD Interest

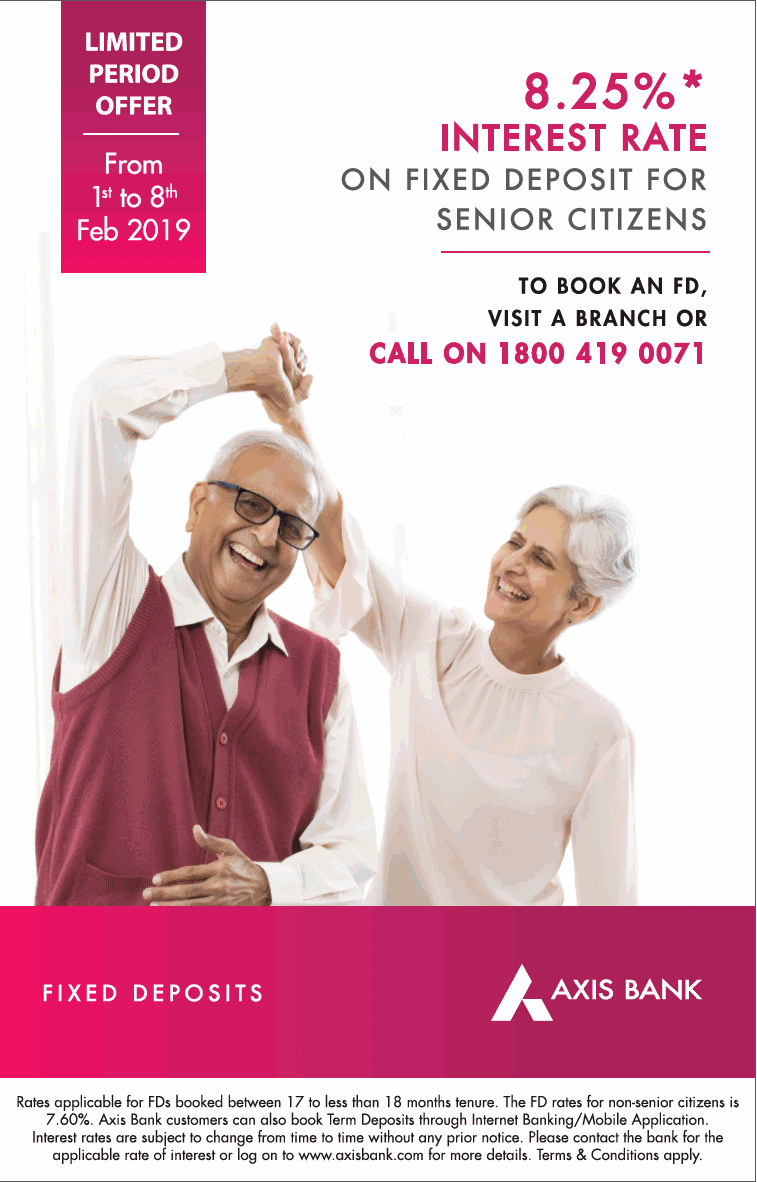

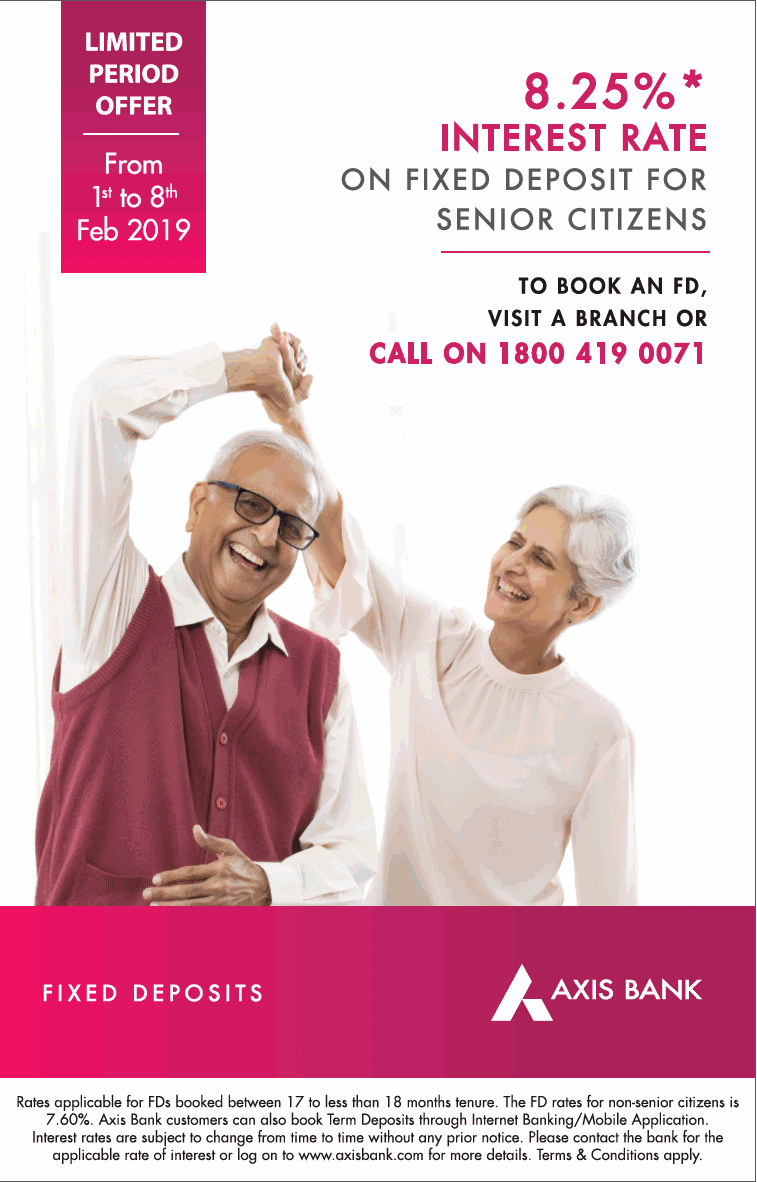

Axis Bank 8 25 Interest Rate On Fixed Deposit For Senior Citizens Ad

https://www.incometax.gov.in/iec/foportal/help/...

The senior citizen will submit a declaration to the specified bank The bank is a specified bank as notified by the Central Government Such banks will be responsible for the TDS

https://m.economictimes.com/wealth/invest/fixed...

Senior citizens or those who are of the age of 60 years or more can claim a deduction of up to Rs 50 000 from their gross total income under Section 80TTB of the

The senior citizen will submit a declaration to the specified bank The bank is a specified bank as notified by the Central Government Such banks will be responsible for the TDS

Senior citizens or those who are of the age of 60 years or more can claim a deduction of up to Rs 50 000 from their gross total income under Section 80TTB of the

Preventive Check Up 80d Wkcn

Fixed Deposit Rates For Senior Citizens These Banks Offering Over 9 Pc

TDS On Fixed Deposit Tax Deduction On FD Interest

Axis Bank 8 25 Interest Rate On Fixed Deposit For Senior Citizens Ad

Every Year When Tax Season Rolls Around Everyone Is Looking To

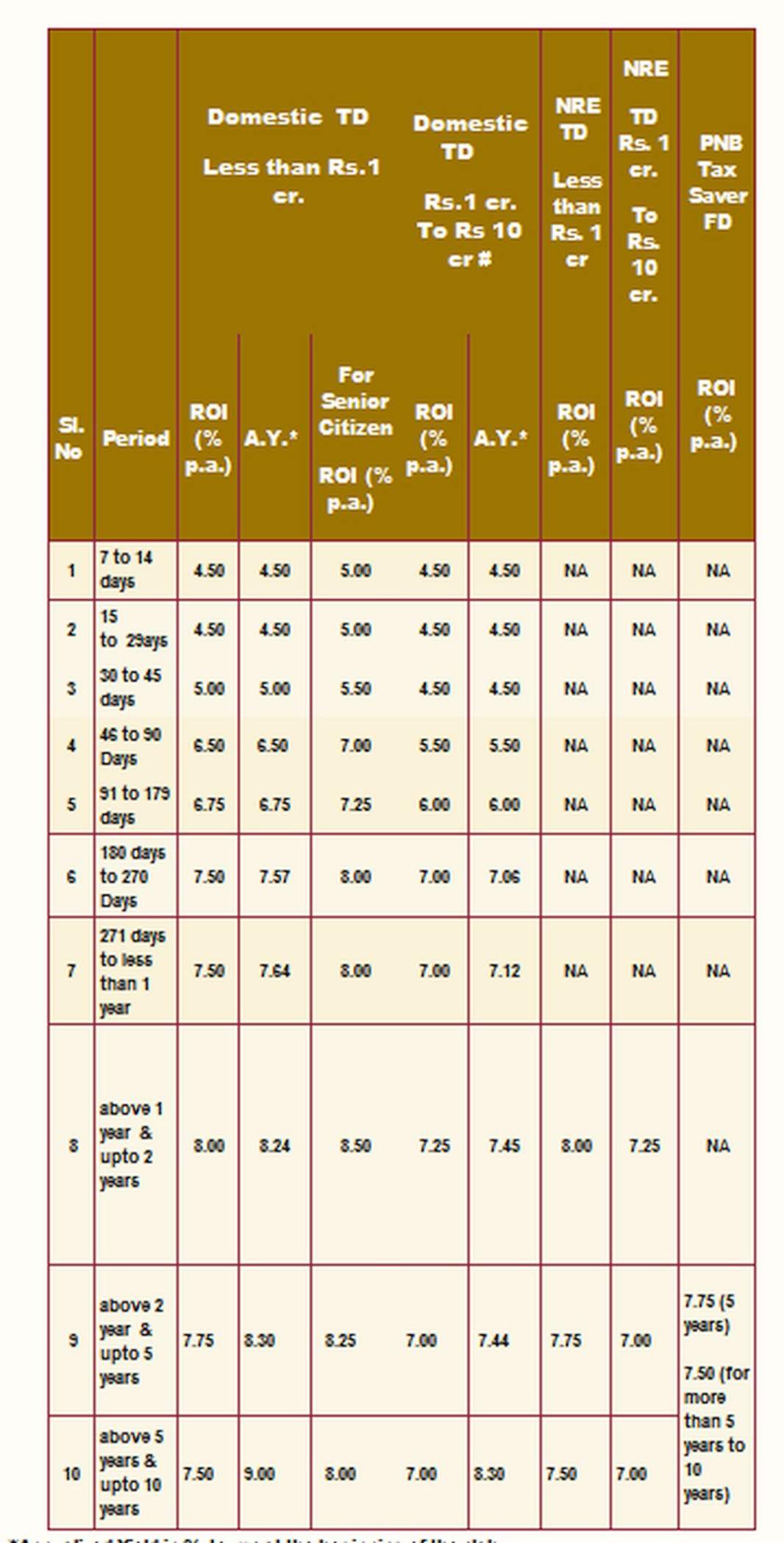

PNB Hikes Fixed Deposit Interest Rates For Senior And Super Senior

PNB Hikes Fixed Deposit Interest Rates For Senior And Super Senior

Fixed Deposit Calculator Banking Tides Cara Pengiraan Bank Rakyat